-

New German leader Merz stumbles out of the blocks

New German leader Merz stumbles out of the blocks

-

'Wagatha Christie': Vardy and Rooney settle on legal costs

-

Defending Rome champion Zverev blames burn out on poor run of form

Defending Rome champion Zverev blames burn out on poor run of form

-

No signs of US recession, Treasury Secretary says

-

Israel pummels Yemen airport in reprisal against Huthis

Israel pummels Yemen airport in reprisal against Huthis

-

Swiatek struggling with 'perfectionism' ahead of Rome

-

Germany's Merz elected chancellor after surprise setback

Germany's Merz elected chancellor after surprise setback

-

Ukraine fires drones on Moscow days before WWII parade

-

EU proposes ending all Russian gas imports by 2027

EU proposes ending all Russian gas imports by 2027

-

UK, India strike trade deal amid US tariff blitz

-

Move over Met Ball. For fashion wow head to the Vatican

Move over Met Ball. For fashion wow head to the Vatican

-

Stocks retreat as traders cautious before Fed rates call

-

EDF complaint blocks Czech-Korean nuclear deal

EDF complaint blocks Czech-Korean nuclear deal

-

Germany's Merz faces new vote for chancellor after surprise loss

-

US trade deficit hit fresh record before new Trump tariffs

US trade deficit hit fresh record before new Trump tariffs

-

US Fed starts rate meeting under cloud of tariff uncertainty

-

Trump's Aberdeen course to host revived Scottish Championship

Trump's Aberdeen course to host revived Scottish Championship

-

Argentina's 1978 World Cup winner Galvan dies

-

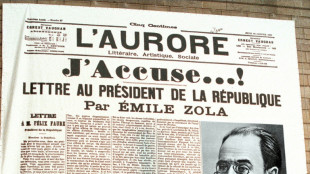

French lawmakers want Dreyfus promoted 130 years after scandal

French lawmakers want Dreyfus promoted 130 years after scandal

-

AFP Gaza photographers shortlisted for Pulitzer Prize

-

Cristiano Ronaldo's eldest son called up by Portugal Under-15s

Cristiano Ronaldo's eldest son called up by Portugal Under-15s

-

Stocks diverge as traders await Fed rates meeting

-

Tesla sales fall again in Germany as drivers steer clear of Musk

Tesla sales fall again in Germany as drivers steer clear of Musk

-

Radiohead's Jonny Greenwood says shows cancelled after 'credible threats'

-

Hamas says Gaza truce talks pointless as Israel wages 'hunger war'

Hamas says Gaza truce talks pointless as Israel wages 'hunger war'

-

Aussie cycling star Ewan announces shock retirement

-

Blow for Germany's Merz as he loses first-round vote for chancellor

Blow for Germany's Merz as he loses first-round vote for chancellor

-

EU to lay out plan to cut last Russian gas supplies

-

Food delivery app DoorDash agrees to buy peer Deliveroo

Food delivery app DoorDash agrees to buy peer Deliveroo

-

Zhao's world championship win will take snooker to 'another level': sport's chief

-

Ukraine fires drones on Moscow days before Red Square parade

Ukraine fires drones on Moscow days before Red Square parade

-

Blow for Merz as he misses majority in first vote for chancellor

-

Putin gears up for 'grandest' Victory Day amid Ukraine conflict

Putin gears up for 'grandest' Victory Day amid Ukraine conflict

-

Cardinals to move into Vatican on eve of conclave

-

Romania names interim premier as turmoil deepens

Romania names interim premier as turmoil deepens

-

DoorDash agrees £2.9 billion takeover of Deliveroo

-

Dollar recovers some losses, stocks mixed as traders eye tariff deals

Dollar recovers some losses, stocks mixed as traders eye tariff deals

-

Hamas says no point in further Gaza truce talks

-

'Aussiewood' courts Hollywood as Trump film tariffs loom

'Aussiewood' courts Hollywood as Trump film tariffs loom

-

How a privately owned city in Kenya took on corrupt officials

-

Ozempic slimming craze sweeps Kosovo despite side effects

Ozempic slimming craze sweeps Kosovo despite side effects

-

Drone strikes rock Port Sudan in third day of attacks

-

US President Trump and Canada's Carney set for high-stakes meeting

US President Trump and Canada's Carney set for high-stakes meeting

-

Philips turns in a profit but China, tariffs weigh

-

Drones hit Port Sudan airport in third day of attacks

Drones hit Port Sudan airport in third day of attacks

-

Australian mushroom murder suspect rejected help preparing meal: witness

-

Jokic-inspired Nuggets stun Thunder, Knicks down Celtics

Jokic-inspired Nuggets stun Thunder, Knicks down Celtics

-

India's woman fighter pilot trailblazer eyes space

-

'Shared dream': China celebrates Zhao's world snooker breakthrough

'Shared dream': China celebrates Zhao's world snooker breakthrough

-

Wait for Vatican white smoke fires up social media

Trump insists he could fire independent Fed Chair Powell

US President Donald Trump on Thursday insisted that he could force out the head of the independent Federal Reserve, lashing out after Jerome Powell warned of tariffs-fueled inflation.

Speaking to reporters at the White House, Trump said Powell would "leave if I ask him to."

He added: "I'm not happy with him. I let him know it and if I want him out, he'll be out of there real fast, believe me."

Earlier, in a scathing post on Truth Social, Trump repeated a demand for Powell to lower interest rates, saying his "termination... cannot come fast enough."

Sources also told the Wall Street Journal that Trump has privately discussed firing Powell for months but has not made a final decision, and raised it during private meetings at Mar-a-Lago with former Fed Governor Kevin Warsh.

The US president does not have direct authority to fire Federal Reserve governors, but Trump could initiate a lengthy process to attempt to unseat Powell by proving there was "cause" to do so.

Powell warned Wednesday that Trump's sweeping tariffs on virtually every trade partner could put the Fed in the unenviable position of having to choose between tackling inflation and unemployment.

Trump's stop-start tariff policy has unnerved investors and governments around the world, leaving them unsure about his long-term strategy and what it might mean for international trade.

The US central bank has adopted a wait-and-see attitude to cutting rates, holding them steady at 4.25 to 4.5 percent since the start of this year.

Trump has frequently criticized the Fed chairman, whom he originally nominated during his first term, accusing Powell of playing politics.

Trump's earlier post suggested Powell's decisions were "Too Late" and that he should have followed the European Central Bank's lead, which on Thursday lowered its benchmark deposit rate by a quarter point.

ECB chief Christine Lagarde expressed her confidence in Powell following Trump's remarks, saying she had "a lot of respect for my friend and esteemed colleague."

On the campaign trail in August, Trump suggested the White House should have a "say" in setting monetary policy.

Democrats, however, have defended the independence of the institution.

"An independent Fed is vital for a healthy economy -- something that Trump has proved is not a priority for him," senior Democratic Senator Chuck Schumer said on X in response to Trump's criticism of Powell.

- Powell pledges to stay -

While presidents have a long history of clashing with Fed chiefs, any move to force Powell to leave office would be unprecedented in modern US political history.

Speaking on April 4, Powell insisted he had no plans to step down as Fed chairman before his term ends next year.

"I fully intend to serve all of my term," he said at an event in Virginia.

At the time, Powell also suggested that the Fed was in no rush to cut its benchmark lending rate from its current elevated level.

Financial markets see a roughly two-thirds chance that policymakers will vote to keep rates unchanged again at the next Fed interest rate meeting in May, according to data from CME Group.

Setting key interest rates is one of the primary levers the Fed exercises in its dual mandate of managing inflation and unemployment.

Lowering interest rates serves to make borrowing cheaper and tends to kickstart the economy by encouraging investment, while raising them -- or keeping them steady at higher rates -- can help cool inflation.

US year-on-year consumer inflation slowed to 2.4 percent in March, bringing it closer to the Fed's long-term two-percent target.

That drop was aided by a 6.3 percent fall in gasoline prices, according to official data.

Ch.Kahalev--AMWN