-

'Bitter end' for Real Madrid magician Modric

'Bitter end' for Real Madrid magician Modric

-

Sabalenka targets Wimbledon final as Swiatek showdown looms

-

Hopes for migrant deal as Macron wraps up UK state visit

Hopes for migrant deal as Macron wraps up UK state visit

-

London hits record as trade deal hopes fan rally on markets

-

France make 10 changes to starting side for second All Blacks Test

France make 10 changes to starting side for second All Blacks Test

-

Wave of Russian drones, missiles kill two in Kyiv

-

Most stocks rise on trade deal optimism

Most stocks rise on trade deal optimism

-

Sherratt says 'grieving' Wales ready to end 18-game losing run

-

'Monster' Inoue to face Akhmadaliev in Japan

'Monster' Inoue to face Akhmadaliev in Japan

-

Humanoid robot says not aiming to 'replace human artists'

-

Hippo birthday: Thai internet sensation Moo Deng is a year old

Hippo birthday: Thai internet sensation Moo Deng is a year old

-

Havili, Salakaia-Loto to lead Australia-New Zealand against Lions

-

Mexico barred from sending cattle to US over flesh-eating pest

Mexico barred from sending cattle to US over flesh-eating pest

-

China heatwaves boost ice factory sales

-

Russian strikes on Kyiv kill at least two

Russian strikes on Kyiv kill at least two

-

Fly-half Edwards to make first start for Wales against Japan

-

In Indonesia, a start-up captures coolants to stop global warming

In Indonesia, a start-up captures coolants to stop global warming

-

Japan's sticky problem with Trump, tariffs and rice

-

European court to rule in Semenya sports gender case

European court to rule in Semenya sports gender case

-

Finns flock to 'shepherd weeks' to disconnect on holiday

-

Jones urges Japan to 'create history' against Wales

Jones urges Japan to 'create history' against Wales

-

EU chief von der Leyen faces no confidence vote

-

Stocks mostly rise on trade deal optimism

Stocks mostly rise on trade deal optimism

-

Alonso looks forward to 'starting from scratch' with Real Madrid

-

Huawei probe blunder sparks EU parliament rules change

Huawei probe blunder sparks EU parliament rules change

-

Israel's Bedouin communities use solar energy to stake claim to land

-

Search for missing cockfighters begins at Philippine lake

Search for missing cockfighters begins at Philippine lake

-

Jewish Australians feel 'very unsafe' after rise in attacks: envoy

-

'Hippo Birthday': Thailand's Moo Deng marks one year old

'Hippo Birthday': Thailand's Moo Deng marks one year old

-

Macron wraps up UK state visit with defence pact 'reboot'

-

India electoral roll revision sparks fear and fury

India electoral roll revision sparks fear and fury

-

Robertson keeps faith with All Blacks for second France Test

-

Jewish Australians feel unsafe after rise in attacks: antisemitism envoy

Jewish Australians feel unsafe after rise in attacks: antisemitism envoy

-

S Korea's disgraced ex-president Yoon detained, again, over martial law

-

Trump hits Brazil with 50% tariff, sets date for copper levy

Trump hits Brazil with 50% tariff, sets date for copper levy

-

Rubio to meet Russia's Lavrov as strikes pound Kyiv

-

Trump taps transport chief to be interim NASA administrator

Trump taps transport chief to be interim NASA administrator

-

Mexican fishermen join fight to save extraordinary amphibian

-

Rubio to meet with Russia's Lavrov, ASEAN allies in Malaysia

Rubio to meet with Russia's Lavrov, ASEAN allies in Malaysia

-

Justice Dept sues California over transgender athletes

-

Apex Critical Metals Prepares for 1,500 Metre Drill Program at Cap Project, British Columbia

Apex Critical Metals Prepares for 1,500 Metre Drill Program at Cap Project, British Columbia

-

Star Copper Advances Investigation of Indata Project Robust Copper Values of "at least" 5km Breadth

-

'Stuck in limbo': Over 90% of X's Community Notes unpublished, study says

'Stuck in limbo': Over 90% of X's Community Notes unpublished, study says

-

Luis Enrique eyes more history for PSG after reaching Club World Cup final

-

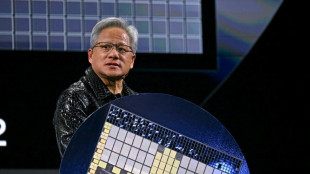

AI giant Nvidia becomes first company to reach $4 tn in value

AI giant Nvidia becomes first company to reach $4 tn in value

-

Global stocks mostly up despite new Trump tariffs, Nasdaq at record

-

Trump praises Liberian leader on English - his native tongue

Trump praises Liberian leader on English - his native tongue

-

Brazil, Trump up the ante in row over Bolsonaro coup trial

-

S.Korean court orders new arrest of disgraced ex-president Yoon

S.Korean court orders new arrest of disgraced ex-president Yoon

-

Djokovic ready to go the distance in Sinner showdown

Stocks mostly rise on trade deal optimism

Asian markets mostly rose Thursday on optimism that governments will hammer out deals to avoid the worst of US President Donald Trump's tariffs even after he broadened his range of measures.

Negotiators from around the world have tried to reach agreements with Washington since Trump in April unveiled his "Liberation Day" tariff bombshell, with a July 9 deadline recently pushed back to August 1.

Letters have been sent in recent days to more than 20 trading partners -- including Japan and South Korea -- setting out new tolls, with some higher and some lower than the initial levels.

The US president also said this week he would put a 50 percent tariff on copper imports, while considering a 200 percent charge for pharmaceuticals.

However, analysts said the threats are largely being seen as negotiating tools, and investors have increasingly taken them in their stride, with the S&P 500 and Nasdaq hitting all-time highs in New York.

And David Chao, global market strategist for Asia Pacific at Invesco, painted a positive picture even in light of the threatened levies.

"Should the US ultimately impose higher tariffs on Asian countries, the region appears better positioned to withstand the resulting headwinds," he wrote.

"A softer dollar should give Asian central banks greater flexibility to ease policy to support their domestic economies without heightened concerns over currency depreciation."

Asian stocks mostly advanced after a healthy lead from Wall Street, where the Nasdaq hit another peak thanks to a surge in Nvidia that pushed the firm to a $4 trillion valuation at one point.

Hong Kong, Shanghai, Sydney, Singapore, Seoul, Taipei, Manila and Jakarta all rose, though Tokyo edged down with Wellington.

The broadly upbeat mood helped push bitcoin above $112,000 for the first time.

There was also little reaction to news that Trump had hit Brazil with a 50 percent tariff as he blasted the trial of the country's ex-president Jair Bolsonaro.

In a letter addressed to Brazilian President Luiz Inacio Lula da Silva, he called the treatment of his right-wing ally an "international disgrace". Bolsonaro is on trial over accusations he plotted a coup after his 2022 election loss to Lula.

Lula said he will impose reciprocal levies on the United States.

Brazil had not been among those threatened with these higher duties previously, with the United States running a goods trade surplus instead with the South American giant.

Traders were given few guides on the Federal Reserve's interest rate plans after minutes from its June policy meeting showed officials divided on the best way forward.

Boss Jerome Powell's patient approach to lowering borrowing costs has drawn the ire of Trump, who on Wednesday said they were "at least" three points too high.

While the board sees the president's tariffs as inflationary, the minutes said there remained "considerable uncertainty" on the timing, size and duration of the effects.

Companies might choose not to raise consumer prices until they depleted their product stockpiles, for example, but supply chain disruptions caused by the levies could trigger larger price hikes.

"While a few participants noted that tariffs would lead to a one-time increase in prices and would not affect longer-term inflation expectations, most participants noted the risk that tariffs could have more persistent effects on inflation," the report said.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.5 percent at 39,610.61 (break)

Hong Kong - Hang Seng Index: UP 0.2 percent at 23,938.07

Shanghai - Composite: UP 0.3 percent at 3,503.13

Euro/dollar: UP at $1.1741 from $1.1719 on Wednesday

Pound/dollar: UP at $1.3608 from $1.3590

Dollar/yen: DOWN at 145.95 yen from 146.30 yen

Euro/pound: UP at 86.28 pence from 86.21 pence

West Texas Intermediate: DOWN 0.2 percent at $68.28 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $70.15 per barrel

New York - Dow: UP 0.5 percent at 44,458.30 (close)

London - FTSE 100: UP 0.2 percent at 8,867.02 (close)

L.Miller--AMWN