-

Sixties screen siren Claudia Cardinale dies aged 87

Sixties screen siren Claudia Cardinale dies aged 87

-

Kane 'welcome' to make Spurs return: Frank

-

Trump says Ukraine can win back all territory, in sudden shift

Trump says Ukraine can win back all territory, in sudden shift

-

Real Madrid thrash Levante as Mbappe hits brace

-

Isak scores first Liverpool goal in League Cup win, Chelsea survive scare

Isak scores first Liverpool goal in League Cup win, Chelsea survive scare

-

US stocks retreat from records as tech giants fall

-

Escalatorgate: White House urges probe into Trump UN malfunctions

Escalatorgate: White House urges probe into Trump UN malfunctions

-

Zelensky says China could force Russia to stop Ukraine war

-

Claudia Cardinale: single mother who survived rape to be a screen queen

Claudia Cardinale: single mother who survived rape to be a screen queen

-

With smiles and daggers at UN, Lula and Trump agree to meet

-

Iran meets Europeans but no breakthrough as Tehran pushes back

Iran meets Europeans but no breakthrough as Tehran pushes back

-

Trump says Kyiv can win back 'all of Ukraine' in major shift

-

US veterans confident in four Ryder Cup rookies

US veterans confident in four Ryder Cup rookies

-

Ecuador's president claims narco gang behind fuel price protests

-

Qatar's ruler says to keep efforts to broker Gaza truce despite strike

Qatar's ruler says to keep efforts to broker Gaza truce despite strike

-

Pakistan stay alive in Asia Cup with win over Sri Lanka

-

S.Korea leader at UN vows to end 'vicious cycle' with North

S.Korea leader at UN vows to end 'vicious cycle' with North

-

Four years in prison for woman who plotted to sell Elvis's Graceland

-

'Greatest con job ever': Trump trashes climate science at UN

'Greatest con job ever': Trump trashes climate science at UN

-

Schools shut, flights axed as Typhoon Ragasa nears Hong Kong, south China

-

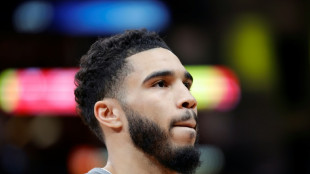

Celtics star Tatum doesn't rule out playing this NBA season

Celtics star Tatum doesn't rule out playing this NBA season

-

Trump says NATO nations should shoot down Russian jets breaching airspace

-

Trump says at Milei talks that Argentina does not 'need' bailout

Trump says at Milei talks that Argentina does not 'need' bailout

-

Iran meets Europeans but no sign of sanctions breakthrough

-

NBA icon Jordan's insights help Europe's Donald at Ryder Cup

NBA icon Jordan's insights help Europe's Donald at Ryder Cup

-

Powell warns of inflation risks if US Fed cuts rates 'too aggressively'

-

Arteta slams 'handbrake' criticism as Arsenal boss defends tactics

Arteta slams 'handbrake' criticism as Arsenal boss defends tactics

-

Jimmy Kimmel back on the air, but faces partial boycott

-

Triumphant Kenyan athletes receive raucous welcome home from Tokyo worlds

Triumphant Kenyan athletes receive raucous welcome home from Tokyo worlds

-

NASA says on track to send astronauts around the Moon in 2026

-

Stokes 'on track' for Ashes as England name squad

Stokes 'on track' for Ashes as England name squad

-

Djokovic to play Shanghai Masters in October

-

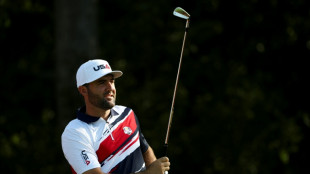

In US Ryder Cup pay spat, Schauffele and Cantlay giving all to charity

In US Ryder Cup pay spat, Schauffele and Cantlay giving all to charity

-

Congo's Nobel winner Mukwege pins hopes on new film

-

Scheffler expects Trump visit to boost USA at Ryder Cup

Scheffler expects Trump visit to boost USA at Ryder Cup

-

Top Madrid museum opens Gaza photo exhibition

-

Frank unfazed by trophy expectations at Spurs

Frank unfazed by trophy expectations at Spurs

-

US says dismantled telecoms shutdown threat during UN summit

-

Turkey facing worst drought in over 50 years

Turkey facing worst drought in over 50 years

-

Cities face risk of water shortages in coming decades: study

-

Trump mocks UN on peace and migration in blistering return

Trump mocks UN on peace and migration in blistering return

-

Stokes named as England captain for Ashes tour

-

Does taking paracetamol while pregnant cause autism? No, experts say

Does taking paracetamol while pregnant cause autism? No, experts say

-

We can build fighter jet without Germany: France's Dassault

-

Atletico owners negotiating with US firm Apollo over majority stake sale - reports

Atletico owners negotiating with US firm Apollo over majority stake sale - reports

-

Stocks mark time with eyes on key economic data

-

Tabilo stuns Musetti for Chengdu title, Bublik wins in Hangzhou

Tabilo stuns Musetti for Chengdu title, Bublik wins in Hangzhou

-

Trump returns to UN to attack 'globalist' agenda

-

No.1 Scheffler plays down great expectations at Ryder Cup

No.1 Scheffler plays down great expectations at Ryder Cup

-

WHO sees no autism links to Tylenol, vaccines

Global stocks fall sharply on weak US job data, Trump tariffs

Stock markets dived Friday following weak US jobs data that raised doubts about the world's biggest economy as President Donald Trump moves forward with additional tariffs.

Major US indices finished down 1.2 percent or more after spending the entire day in the red. Major indices in Asia and Europe also fell, with Paris and Frankfurt losing nearly three percent.

The dollar fell sharply against other key currencies while oil prices plunged on fears that a weakening US economy would sap demand.

The Labor Department said the US economy added just 73,000 jobs in July, while the unemployment rate rose to 4.2 percent from 4.1 percent. The department also cut the job gains from June and May by nearly 260,000 jobs.

"Investors are getting a bit worried that this economy is softening more rapidly than we earlier thought," said Sam Stovall of CFRA Research.

The report comes at a moment when investors had been questioning whether the market was overvalued following a series of records in recent weeks.

"There's a lot of excuses to do some selling. The primary one today is the payrolls data," said Briefing.com analyst Patrick O'Hare.

Following the jobs data, yields on US Treasury bonds fell sharply as markets price in a weaker US growth outlook and expected cuts in Federal Reserve interest rates.

"The market thinks the Fed needs to cut rates and will cut rates in September because of the data," said O'Hare, who also pointed to "disappointing price action" in the market following generally strong earnings from large tech companies.

The jobs data came as Trump's long-telegraphed August 1 tariff deadline arrived.

Trump announced late Thursday that dozens of economies, including the European Union, will face new tariff rates of between 10 and 41 percent.

However, implementation will be on August 7 rather than Friday as previously announced, the White House said. This gives governments a window to rush to strike bilateral deals with Washington setting more favorable conditions.

"The US payrolls data has eclipsed news about the latest tariff rates applied to the world's economies by Donald Trump, and is now dominating markets," said Kathleen Brooks, research director at XTB trading group.

Some trading partners have reached deals with the United States -- including Britain, the European Union, Japan and South Korea.

China remains in talks with Washington to extend a fragile truce in place since May that is due to expire on August 12.

- Key figures at around 2045 GMT -

New York - Dow: DOWN 1.2 percent at 43,588.58 (close)

New York - S&P 500: DOWN 1.6 percent at 6,238.01 (close)

New York - Nasdaq: DOWN 2.2 percent at 20,650.13 (close)

London - FTSE 100: DOWN 0.7 percent at 9,068.58 (close)

Paris - CAC 40: DOWN 2.9 percent at 7,546.16 (close)

Frankfurt - DAX: DOWN 2.7 percent at 23,425.97 (close)

Tokyo - Nikkei 225: DOWN 0.7 percent at 40,799.60 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 24,507.81 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,559.95 (close)

Euro/dollar: UP at $1.1586 from $1.1415 on Thursday

Pound/dollar: UP at $1.3276 from $1.3207

Dollar/yen: DOWN at 147.427 yen from 150.75 yen

Euro/pound: UP at 87.25pence from 86.42 pence

West Texas Intermediate: DOWN 2.8 percent at $67.33 per barrel

Brent North Sea Crude: DOWN 2.8 percent at $69.67 per barrel

L.Durand--AMWN