-

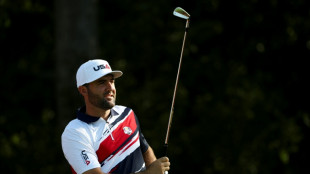

In US Ryder Cup pay spat, Schauffele and Cantlay giving all to charity

In US Ryder Cup pay spat, Schauffele and Cantlay giving all to charity

-

Congo's Nobel winner Mukwege pins hopes on new film

-

Scheffler expects Trump visit to boost USA at Ryder Cup

Scheffler expects Trump visit to boost USA at Ryder Cup

-

Top Madrid museum opens Gaza photo exhibition

-

Frank unfazed by trophy expectations at Spurs

Frank unfazed by trophy expectations at Spurs

-

US says dismantled telecoms shutdown threat during UN summit

-

Turkey facing worst drought in over 50 years

Turkey facing worst drought in over 50 years

-

Cities face risk of water shortages in coming decades: study

-

Trump mocks UN on peace and migration in blistering return

Trump mocks UN on peace and migration in blistering return

-

Stokes named as England captain for Ashes tour

-

Does taking paracetamol while pregnant cause autism? No, experts say

Does taking paracetamol while pregnant cause autism? No, experts say

-

We can build fighter jet without Germany: France's Dassault

-

Atletico owners negotiating with US firm Apollo over majority stake sale - reports

Atletico owners negotiating with US firm Apollo over majority stake sale - reports

-

Stocks mark time with eyes on key economic data

-

Tabilo stuns Musetti for Chengdu title, Bublik wins in Hangzhou

Tabilo stuns Musetti for Chengdu title, Bublik wins in Hangzhou

-

Trump returns to UN to attack 'globalist' agenda

-

No.1 Scheffler plays down great expectations at Ryder Cup

No.1 Scheffler plays down great expectations at Ryder Cup

-

WHO sees no autism links to Tylenol, vaccines

-

US Fed official urges proactive approach on rates to boost jobs market

US Fed official urges proactive approach on rates to boost jobs market

-

Nearly 100 buffaloes die in Namibia stampede

-

UN chief warns 'aid cuts are wreaking havoc' amid slashed budgets

UN chief warns 'aid cuts are wreaking havoc' amid slashed budgets

-

Schools shut, flights axed as Typhoon Ragasa nears Hong Kong, southern China

-

Hundreds trapped as typhoon triggers barrier lake burst in Taiwan

Hundreds trapped as typhoon triggers barrier lake burst in Taiwan

-

EU proposes new delay to anti-deforestation rules

-

Man City have 'recovered many things': Guardiola

Man City have 'recovered many things': Guardiola

-

Thailand to 'clarify misunderstandings' after SEA Games petanque ban

-

Denmark brands mystery drone flights 'serious' attack

Denmark brands mystery drone flights 'serious' attack

-

Iran executed at least 1,000 this year in prison 'mass killing': NGO

-

France's Dassault says can build European fighter jet without Germany

France's Dassault says can build European fighter jet without Germany

-

Former umpire 'Dickie' Bird dies aged 92

-

Ghana deports at least six west Africans expelled by US to Togo

Ghana deports at least six west Africans expelled by US to Togo

-

Bradley admits thoughts linger about having played in Ryder Cup

-

EU queries Apple, Google, Microsoft over financial scams

EU queries Apple, Google, Microsoft over financial scams

-

OECD raises world growth outlook as tariffs contained, for now

-

Former umpire Harold 'Dickie' Bird dies aged 92

Former umpire Harold 'Dickie' Bird dies aged 92

-

Cycling worlds bring pride to African riders despite disadvantages

-

Stocks diverge with eyes on key economic data

Stocks diverge with eyes on key economic data

-

German business groups pressure Merz over ailing economy

-

Drone flights 'most serious attack' on Danish infrastructure, PM says

Drone flights 'most serious attack' on Danish infrastructure, PM says

-

Indonesia, EU sign long-awaited trade deal

-

Howe confident Newcastle will find 'X factor'

Howe confident Newcastle will find 'X factor'

-

Trump returns to UN podium and Zelensky talks

-

Tech migrants 'key' for US growth, warns OECD chief economist

Tech migrants 'key' for US growth, warns OECD chief economist

-

East Timor to become ASEAN bloc's 11th member in October

-

OECD ups world economic outlook as tariffs contained, for now

OECD ups world economic outlook as tariffs contained, for now

-

India bids tearful farewell to maverick musician

-

Sunset for Windows 10 updates leaves users in a bind

Sunset for Windows 10 updates leaves users in a bind

-

Hopes of Western refuge sink for Afghans in Pakistan

-

'Real' Greek farmers fume over EU subsidies scandal

'Real' Greek farmers fume over EU subsidies scandal

-

Trump to see Zelensky and lay out dark vision of UN

| CMSC | -0.62% | 24.1 | $ | |

| SCS | 0.24% | 16.94 | $ | |

| RIO | -0.31% | 63.451 | $ | |

| BCE | 0.11% | 23.095 | $ | |

| BCC | -0.62% | 78.95 | $ | |

| CMSD | -0.45% | 24.35 | $ | |

| RYCEF | 0.63% | 15.75 | $ | |

| NGG | -0.04% | 70.93 | $ | |

| RBGPF | 0% | 76.6 | $ | |

| JRI | 0.43% | 14.06 | $ | |

| BTI | -1.98% | 52.825 | $ | |

| VOD | -0.35% | 11.35 | $ | |

| GSK | -1.02% | 40.495 | $ | |

| RELX | -1.25% | 46.5 | $ | |

| AZN | -1.84% | 76.1 | $ | |

| BP | 1.88% | 35.03 | $ |

Asian markets track Wall St rally on Fed rate cut bets

Stock markets rose Tuesday as investors grow increasingly confident the Federal Reserve will cut interest rates next month, despite concerns about the US economy and Donald Trump's tariffs.

The gains tracked a rally on Wall Street, where traders rediscovered their mojo following Friday's sell-off that was fuelled by news that fewer-than-expected American jobs were created in July, while the previous two months' figures were revised down sharply.

The reading raised concerns the world's biggest economy was in worse shape than expected, though it also fanned bets the Fed will slash in September, with markets pricing the chance of a 25-basis-point reduction at about 95 percent, according to Bloomberg.

There is also talk that bank officials could go for twice as much as that.

"The narrative flipped fast: soft jobs equals soft Fed, and soft Fed equals risk-on," said Stephen Innes at SPI Asset Management.

But he warned that "if cuts are coming because the labour market is slipping from 'cooling' to 'cracking', then we're skating closer to the edge than we care to admit".

He added: "That dichotomy -- between rate cuts as stimulus and rate cuts as warning flare -- is now front and center.

"If the Fed moves proactively to shield markets from the tariff storm and weak labour, the equity rally has legs. But if policymakers are reacting to a sharper downturn that is in full swing, the runway shortens quickly."

In early trade, Tokyo, Hong Kong, Shanghai, Sydney, Seoul, Singapore, Taipei, Manila and Jakarta were all in the green.

However, while there is a broad expectation that the Fed will cut rates, Lazard chief market strategist Ronald Temple remained sceptical.

"I continue to believe the Fed will not reduce rates at all this year given rising inflation caused by tariffs and a relatively stable unemployment rate," he wrote.

"I would align with the majority of the FOMC members who believe it is more appropriate to hold policy constant until there is greater clarity in terms of the effects of tariffs and stricter immigration enforcement on inflation and employment."

Traders were keeping an eye on trade talks between Washington and dozens of its trade partners after Trump imposed tariffs of between 10 and 41 percent on them.

Among those to strike a deal is India, which Trump on Monday threatened to hit with "substantially" higher rates over its purchases of Russian oil.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.6 percent at 40,544.99 (break)

Hong Kong - Hang Seng Index: UP 0.1 percent at 24,747.97

Shanghai - Composite: UP 0.5 percent at 3,600.02

Dollar/yen: UP at 147.11 yen from 147.08 yen on Monday

Euro/dollar: DOWN at $1.1562 from $1.1573

Pound/dollar: UP at $1.3287 from $1.3285

Euro/pound: DOWN at 87.01 pence from 87.11 pence

West Texas Intermediate: DOWN 0.1 percent at $66.24 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $68.70 per barrel

New York - Dow: UP 1.3 percent at 44,173.64 (close)

London - FTSE 100: UP 0.7 percent at 9,128.30 (close)

F.Schneider--AMWN