-

Why is bitcoin plunging?

Why is bitcoin plunging?

-

LeBron debuts in NBA record 23rd season as Pistons win streak hits 11

-

Curacao seal World Cup fairytale as Haiti, Panama qualify

Curacao seal World Cup fairytale as Haiti, Panama qualify

-

South Africa to host G20 summit boycotted by US

-

Confident Japan eye World Cup history after impressive year

Confident Japan eye World Cup history after impressive year

-

England face daunting task to break Ashes drought in Australia

-

Asian markets bounce as Nvidia takes centre stage amid AI bubble fears

Asian markets bounce as Nvidia takes centre stage amid AI bubble fears

-

Ireland's data centres power digital age, drain the grid

-

Under pressure, EU to scale back digital rules

Under pressure, EU to scale back digital rules

-

India's Bollywood battles paid reviews and fake sale claims

-

Ronaldo and Musk attend Trump's dinner with Saudi prince

Ronaldo and Musk attend Trump's dinner with Saudi prince

-

USA thrash Uruguay 5-1 in friendly rout

-

Belgian climate case pits farmer against TotalEnergies

Belgian climate case pits farmer against TotalEnergies

-

Auction of famed CIA cipher shaken after archive reveals code

-

UK spy agency warns MPs over Chinese 'headhunters'

UK spy agency warns MPs over Chinese 'headhunters'

-

Nuts and beer: booze-free bar offers Saudis a pub vibe

-

Klimt portrait becomes second most expensive artwork sold at auction

Klimt portrait becomes second most expensive artwork sold at auction

-

In blow to Trump, US court tosses redrawn Texas congressional map

-

Ultra-processed foods a rising threat to health: researchers

Ultra-processed foods a rising threat to health: researchers

-

'Piggy.' 'Terrible.' Trump lashes out at female reporters

-

Trump says Saudi prince 'knew nothing' about journalist's murder

Trump says Saudi prince 'knew nothing' about journalist's murder

-

Scotland reach 2026 World Cup with stunning late show, Spain, Switzerland qualify

-

No.1 Jeeno seeks repeat win at LPGA Tour Championship

No.1 Jeeno seeks repeat win at LPGA Tour Championship

-

Sensational Scotland reach first World Cup since 1998

-

Sensational Scotland strike late to seal World Cup place

Sensational Scotland strike late to seal World Cup place

-

Scotland strike late to book World Cup place

-

Unbeaten Spain qualify for 2026 World Cup with Turkey draw

Unbeaten Spain qualify for 2026 World Cup with Turkey draw

-

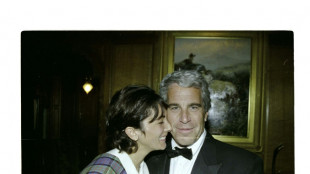

What are the 'Epstein Files?'

-

Brazil held to friendly draw by Tunisia despite Estevao goal

Brazil held to friendly draw by Tunisia despite Estevao goal

-

Patagonian blizzard kills 5 foreign tourists in Chile

-

Nicki Minaj stands with Trump on Nigeria religious persecution

Nicki Minaj stands with Trump on Nigeria religious persecution

-

LeBron rules out 2028 Olympic return, Curry doubtful

-

Trump threatens ABC News in Oval Office meltdown

Trump threatens ABC News in Oval Office meltdown

-

Trump defends Saudi prince over journalist Khashoggi's murder

-

Lula to return to COP30 as nations under pressure to land deal

Lula to return to COP30 as nations under pressure to land deal

-

Nvidia, Microsoft invest $15 billion in AI startup Anthropic

-

Belgium beat France to reach last four of Davis Cup following Alcaraz withdrawal

Belgium beat France to reach last four of Davis Cup following Alcaraz withdrawal

-

Meta wins major antitrust case as US judge rules no monopoly

-

Lula says Germany's Merz should have 'gone dancing', after Belem criticism

Lula says Germany's Merz should have 'gone dancing', after Belem criticism

-

Two Mexicans killed, seven visitors missing in Chilean Patagonia blizzard: officials

-

Germany hopes new data centre can help bring 'digital sovereignty'

Germany hopes new data centre can help bring 'digital sovereignty'

-

French court says Perrier can keep marketing as 'natural mineral water'

-

Argentine judge fired after causing mistrial of Maradona medical team

Argentine judge fired after causing mistrial of Maradona medical team

-

Sahel nations must unite to contain raging violence: UN chief

-

IMF gold sales among measures to tackle debt, says report for G20

IMF gold sales among measures to tackle debt, says report for G20

-

Global stocks in red over worries about tech and Nvidia

-

Venezuelan opposition leader looks to 'new era' without Maduro

Venezuelan opposition leader looks to 'new era' without Maduro

-

'That place': Merz offends Brazil with comments about COP30 city

-

Cloudflare bug takes chunk of web offline

Cloudflare bug takes chunk of web offline

-

Lula to return to COP30 as first draft climate deal lands

| RBGPF | -0.17% | 77.09 | $ | |

| CMSC | -0.21% | 23.59 | $ | |

| SCS | 0.96% | 15.66 | $ | |

| AZN | 0.17% | 89.55 | $ | |

| GSK | -0.34% | 47.37 | $ | |

| BTI | 0.27% | 54.86 | $ | |

| CMSD | 0.04% | 23.87 | $ | |

| RIO | -1.08% | 69.74 | $ | |

| RELX | -0.27% | 40.27 | $ | |

| NGG | -0.53% | 77.53 | $ | |

| RYCEF | -1% | 13.96 | $ | |

| JRI | -1.28% | 13.27 | $ | |

| BCE | -0.09% | 23.02 | $ | |

| VOD | 0.33% | 12.25 | $ | |

| BP | 0.52% | 36.69 | $ | |

| BCC | -0.88% | 66.07 | $ |

Asian markets bounce as Nvidia takes centre stage amid AI bubble fears

Asian investors battled Wednesday to kickstart a recovery in equities following the latest stagger across world markets that has been caused by worries over an AI-fuelled bubble and uncertainty over US interest rates.

Stocks have endured a tough November as speculation has grown that the tech-led rally this year may have gone too far, and valuations have become frothy enough to warrant a stiff correction.

With the Magnificent Seven, including Amazon, Meta, Alphabet and Apple, accounting for the majority of the rally to record highs for Wall Street's three main indexes, there are worries that any problems with them could have huge ripple effects on markets.

And so the spotlight Wednesday turns on the earnings report from the biggest of the bunch: chip giant Nvidia, which this month became the first $5 trillion company.

Investors are nervous that any sign of weakness could be the pin that pops the AI bubble, having spent months fearing that the hundreds of billions invested may have been excessive.

"The AI complex, once the undisputed locomotive of 2025's rally, now sounds like an engine with sand in the gears," said Stephen Innes at SPI Asset Management.

"This isn't a crash, or a panic, or even a proper correction; it's the unmistakeable sensation of a market trading at altitude with borrowed oxygen, suddenly aware of how thin the air has become."

He added that four days of losses in Wall Street's S&P 500, the VIX "fear index" hitting 25 -- a level that causes traders concern -- and a tone shift were "all signs that investors are finally blinking at the speed and scale of the AI capex boom".

Meanwhile, a Bank of America survey of fund managers found that more than half thought AI stocks were already in a bubble and 45 percent thought that that was the biggest "tail risk" to markets, more so than inflation.

That came after the BBC released an interview with the head of Google's parent company Alphabet -- Sundar Pichai -- who warned every company would be impacted if the AI bubble were to burst.

Still, after a tough run in recent sessions, Asia enjoyed a little stability as markets fluctuated between gains and losses.

Tokyo edged up but was anchored by simmering China tensions as well as questions over Japan's fiscal state ahead of an economic stimulus package that has pushed government bond yields to record highs.

Hong Kong, Shanghai, Sydney, Singapore, Taipei and Manila rose, but Seoul, Wellington and Jakarta fell.

Also in sight this week is the planned release of key US data, particularly on jobs creation, which will be closely read over for an idea about the Fed's plans for interest rates.

Investors have scaled back their bets on a third successive cut next month -- weighing on markets of late -- after a string of decision makers, including bank boss Jerome Powell, questioned the need for another as inflation remains stubbornly high.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.8 percent at 49,077.49 (break)

Hong Kong - Hang Seng Index: UP 0.1 percent at 25,943.80

Shanghai - Composite: UP 0.2 percent at 3,947.68

Dollar/yen: DOWN at 155.52 yen from 155.53 yen on Tuesday

Euro/dollar: DOWN at $1.1577 from $1.1580

Pound/dollar: DOWN at $1.3134 from $1.3146

Euro/pound: UP at 88.15 from 88.09 pence

West Texas Intermediate: DOWN 0.3 percent at $60.58 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $64.67 per barrel

New York - Dow: DOWN 1.1 percent at 46,091.74 (close)

London - FTSE 100: DOWN 1.3 percent at 9,552.30 (close)

Ch.Havering--AMWN