-

Veteran Fickou returns for France against Australia

Veteran Fickou returns for France against Australia

-

Spain court orders Meta to compensate media for 'unfair competition'

-

Australia's Smith takes pre-Ashes swipe at 'Mastermind' Panesar

Australia's Smith takes pre-Ashes swipe at 'Mastermind' Panesar

-

Deaves to debut for Wales against New Zealand

-

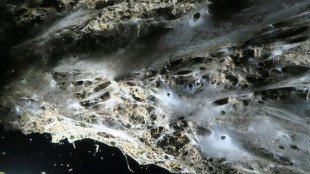

Giant spider web found in Greek-Albanian border cave: study

Giant spider web found in Greek-Albanian border cave: study

-

Chinese woman who faked nationality to become Philippine mayor jailed for trafficking

-

New Zealand ring changes for Wales Test

New Zealand ring changes for Wales Test

-

Most markets rise as Nvidia earnings override Fed rate concern

-

Vietnam flooding submerges homes, kills 16, after relentless rain

Vietnam flooding submerges homes, kills 16, after relentless rain

-

The case of Africa's 'vanishing' carbon deals

-

Stokes tells England to 'write our own history' in Ashes

Stokes tells England to 'write our own history' in Ashes

-

Young Nepalis drive a new wave of voters and candidates

-

Bangladesh's Mushfiqur joins elite club with ton in 100th Test

Bangladesh's Mushfiqur joins elite club with ton in 100th Test

-

Memory chip crunch set to drive up smartphone prices

-

Vietnam flooding death toll rises to 16

Vietnam flooding death toll rises to 16

-

Pacific islands rue lost chance to host COP climate summit

-

Australia's Weatherald and Doggett to debut in first Ashes Test

Australia's Weatherald and Doggett to debut in first Ashes Test

-

Sengun powers Rockets over Cavs as Thunder reach 15-1

-

Chinese woman who faked nationality to become Philippines mayor jailed for trafficking

Chinese woman who faked nationality to become Philippines mayor jailed for trafficking

-

Norris eyeing big step towards maiden world title in Vegas

-

Bangladesh police hope new uniform repairs broken image

Bangladesh police hope new uniform repairs broken image

-

Stocks rally as bumber Nvidia report offsets Fed rate concern

-

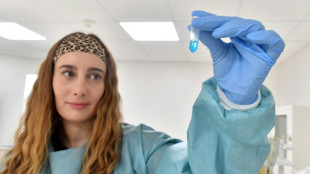

French scientists probe mRNA's potential to fight cancer

French scientists probe mRNA's potential to fight cancer

-

South Korea ferry runs aground after officer distracted by phone: coast guard

-

Nigeria searches for abducted schoolgirls as gunmen attack church

Nigeria searches for abducted schoolgirls as gunmen attack church

-

South Africa chase history in India as Gambhir feels the heat

-

Brazil's planned railway to Amazon draws fire on margins of COP30

Brazil's planned railway to Amazon draws fire on margins of COP30

-

Grieving family blames false US shooting accusations for death of NFL fan

-

Unequal South Africa seeks to tackle inequality as its G20 'legacy'

Unequal South Africa seeks to tackle inequality as its G20 'legacy'

-

Something for moi? Miss Piggy's shoes go under the hammer

-

'Beggars belief': Londoners baffled by bizarre Christmas mural

'Beggars belief': Londoners baffled by bizarre Christmas mural

-

Australia yields to Turkey in standoff over next climate summit

-

Lula pushes fossil fuel 'roadmap' back to center of COP30

Lula pushes fossil fuel 'roadmap' back to center of COP30

-

Nvidia reports 'off the charts' demand for AI chips

-

GenesisEdge Society Presents ΣClipse AI as Richard Schmidt Advances a Smarter Cognitive Framework for ESG Transparency

GenesisEdge Society Presents ΣClipse AI as Richard Schmidt Advances a Smarter Cognitive Framework for ESG Transparency

-

Eramls Investment Alliance shaped by Nolan Mercer Debuts Documentary on Its Responsibility-Driven Identity

-

BioNxt Secures Final Patent Grant from the Eurasian Patent Organization for Sublingual Cladribine Platform

BioNxt Secures Final Patent Grant from the Eurasian Patent Organization for Sublingual Cladribine Platform

-

Gang-wracked Haiti unites, goes wild over World Cup qualification

-

Meta to remove under-16 Australians from Facebook, Instagram on December 4

Meta to remove under-16 Australians from Facebook, Instagram on December 4

-

MLB returns to Field of Dreams in 2026 with Twins and Phillies

-

LPGA's 2026 schedule has 33 events, record $132 million

LPGA's 2026 schedule has 33 events, record $132 million

-

Arsenal beat Real Madrid as Man Utd lose in Women's Champions League

-

Trump vows to end Sudan war, in sudden pivot

Trump vows to end Sudan war, in sudden pivot

-

US presses Ukraine to cede land as Russian strikes kill 26

-

Argentine court orders $500 mn forfeiture in ex-pres. Kirchner graft case

Argentine court orders $500 mn forfeiture in ex-pres. Kirchner graft case

-

Many US Fed members inclined against December cut: minutes

-

Man Utd lose as Lyon snatch draw in Women's Champions League

Man Utd lose as Lyon snatch draw in Women's Champions League

-

PSG's Hakimi voted African player of the year

-

Trump vows to end Sudan 'atrocities,' in sudden pivot

Trump vows to end Sudan 'atrocities,' in sudden pivot

-

Argentine court orders assets worth $500 mn seized in ex-president Kirchner's graft case

| CMSC | 0.34% | 23.67 | $ | |

| SCS | 0.45% | 15.73 | $ | |

| CMSD | -0.49% | 23.753 | $ | |

| BTI | -0.22% | 54.74 | $ | |

| RIO | -0.45% | 69.43 | $ | |

| AZN | -0.63% | 88.99 | $ | |

| BCC | 1.71% | 67.22 | $ | |

| NGG | -1.89% | 76.09 | $ | |

| GSK | -2.22% | 46.34 | $ | |

| RYCEF | -1.23% | 13.79 | $ | |

| BP | -2.06% | 35.95 | $ | |

| JRI | -0.15% | 13.25 | $ | |

| BCE | -1.01% | 22.79 | $ | |

| RBGPF | 2.47% | 79.04 | $ | |

| VOD | -2% | 12.01 | $ | |

| RELX | -1.18% | 39.8 | $ |

Most markets rise as Nvidia earnings override Fed rate concern

Most Asian markets rallied on Thursday after blowout earnings from chip powerhouse Nvidia cooled worries over an AI bubble and overshadowed a Federal Reserve report that dealt a blow to hopes for a December interest rate cut.

Global equities have struggled of late owing to warnings that valuations -- particularly in the tech sector -- have been overdone and are due a pullback, and possibly a sharp correction, following a record-breaking rally this year.

Wednesday's report from Nvidia -- one of the torchbearers of the AI revolution -- was therefore seen as a bellwether on the industry.

And it topped expectations on fierce demand for its sophisticated chips, with chief executive Jensen Huang brushing off the recent concerns.

"There's been a lot of talk about an AI bubble," he told an earnings call. "From our vantage point, we see something very different."

Shares in the firm -- which last month became the world's first $5 trillion stock -- rose more than five percent in post-market trade, while S&P 500 and Nasdaq futures also soared.

Tech firms led the gains in Asia. South Korea's Samsung and SK hynix, Taiwan's TSMC and Japanese investment giant SoftBank all enjoyed a strong day.

Among broader markets, Tokyo, Seoul and Taipei were up between 1.9 percent and 3.2 percent.

Sydney, Singapore, Wellington, Mumbai, Bangkok and Jakarta were also well up, though Hong Kong and Shanghai reversed their morning gains.

However, SPI Asset Management's Stephen Innes said: "Nvidia's latest forecast has, for now, dulled the sharpest edges of the AI-bubble anxiety that had gripped global markets.

"But make no mistake: this is still a market balancing on a wire stretched between AI euphoria and debt-filled reality.

"Nvidia's results may have bought the tape a reprieve, but they haven't rewritten the script -- they've simply reminded traders why they still cling to the idea that one last Santa-rally can be extracted from the AI supercycle."

The reading helped offset minutes from the Fed's October policy meeting suggesting officials are against cutting rates for the third time in a row next month.

Bets on a string of reductions going into 2026 have been part of the driver of this year's stocks rally -- helped by a softening labour market -- but the persistence of big price gains has started to take a toll.

"Many participants suggested that, under their economic outlooks, it would likely be appropriate to keep the target range unchanged for the rest of the year," the minutes said.

Fed boss Jerome Powell said after last month's decision that a December move was "not a foregone conclusion".

Thursday is expected to see the release of US jobs data for September, which was delayed by the government shutdown. However, the Bureau of Labor Statistics said it would not publish its October figures, instead rolling them into November's full report on December 16.

Rodrigo Catril at National Australia Bank said: "The question that follows is whether there will be enough information in December for Fed officials to make a decision."

He said the removal of the October report "leaves policymakers without a key piece of evidence for the December (policy meeting), prompting traders to sharply scale back expectations for a rate cut next month" to just 28 percent.

The pullback in US rate cut expectations saw the dollar rally to 157.73 yen, its strongest since January, spurring talk of an intervention by Japanese authorities.

Top government spokesman Minoru Kihara told reporters officials were "currently observing one-sided and rapid movements in the foreign exchange market, and we are concerned about it".

The yen was already under pressure from concerns about Japan's fiscal outlook before the expected release of a stimulus package by Prime Minister Sanae Takaichi.

Worries that she will push for more borrowing have hit the currency and sent bond yields to record highs.

- Key figures at around 0705 GMT -

Tokyo - Nikkei 225: UP 2.7 percent at 49,823.94 (close)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 25,736.84

Shanghai - Composite: DOWN 0.4 percent at 3,931.05 (close)

Dollar/yen: UP at 157.60 yen from 157.01 yen on Wednesday

Euro/dollar: DOWN at $1.1522 from $1.1526

Pound/dollar: UP at $1.3063 from $1.3048

Euro/pound: DOWN at 88.19 from 88.33 pence

West Texas Intermediate: UP 0.4 percent at $59.66 per barrel

Brent North Sea Crude: UP 0.2 percent at $63.66 per barrel

New York - Dow: UP 0.1 percent at 46,138.77 (close)

London - FTSE 100: DOWN 0.5 percent at 9,507.41 (close)

L.Davis--AMWN