-

Arms makers see record revenues as tensions fuel demand: report

Arms makers see record revenues as tensions fuel demand: report

-

Trump optimistic after Ukraine talks as Rubio says 'more work' needed

-

Real Madrid title hopes dented at Girona in third straight draw

Real Madrid title hopes dented at Girona in third straight draw

-

Pau beat La Rochelle as Hastoy sent off after 34 seconds

-

Real Madrid drop points at Girona in third straight Liga draw

Real Madrid drop points at Girona in third straight Liga draw

-

Napoli beat rivals Roma to join Milan at Serie A summit

-

Shiffrin bags 104th World Cup win with Copper Mountain slalom victory

Shiffrin bags 104th World Cup win with Copper Mountain slalom victory

-

Disney's 'Zootopia 2' rules Thanksgiving at N. American box office

-

Arteta takes heart from Arsenal escape in Chelsea battle

Arteta takes heart from Arsenal escape in Chelsea battle

-

Duplantis and McLaughlin-Levrone crowned 'Athletes of the Year'

-

Rubio says 'more work' required after US-Ukraine talks in Florida

Rubio says 'more work' required after US-Ukraine talks in Florida

-

McLaren boss admits team made strategy blunder

-

West Ham's red-carded Paqueta slams FA for lack of support

West Ham's red-carded Paqueta slams FA for lack of support

-

Ramaphosa labels US attacks on S.Africa 'misinformation'

-

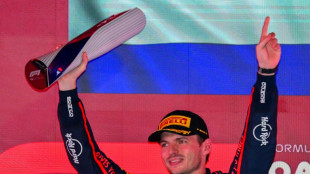

Relaxed Verstappen set for another title showdown

Relaxed Verstappen set for another title showdown

-

Van Graan compares Bath match-winner Arundell to Springbok great Habana

-

Arsenal held by 10-man Chelsea, Isak end drought to fire Liverpool

Arsenal held by 10-man Chelsea, Isak end drought to fire Liverpool

-

Slot hails 'important' Isak goal as Liverpool beat West Ham

-

Merino strikes to give Arsenal bruising draw at 10-man Chelsea

Merino strikes to give Arsenal bruising draw at 10-man Chelsea

-

Thauvin double sends Lens top of Ligue 1 for 1st time in 21 years

-

Pope urges Lebanese to embrace reconciliation, stay in crisis-hit country

Pope urges Lebanese to embrace reconciliation, stay in crisis-hit country

-

Arundell stars as Bath top Prem table with comeback win over Saracens

-

Villarreal edge Real Sociedad, Betis win fiery derby

Villarreal edge Real Sociedad, Betis win fiery derby

-

Israel's Netanyahu seeks pardon in corruption cases

-

Verstappen wins Qatar GP to set up final race title showdown

Verstappen wins Qatar GP to set up final race title showdown

-

Afghan suspect in Washington shooting likely radicalized in US: security official

-

Pastor, bride among 26 kidnapped as Nigeria reels from raids

Pastor, bride among 26 kidnapped as Nigeria reels from raids

-

Trump officials host crucial Ukraine talks in Florida

-

OPEC+ reaffirms planned pause on oil output hikes until March

OPEC+ reaffirms planned pause on oil output hikes until March

-

Kohli stars as India beat South Africa in first ODI

-

Long-lost Rubens 'masterpiece' sells for almost 3 mn euros

Long-lost Rubens 'masterpiece' sells for almost 3 mn euros

-

Set-piece theft pays off for Man Utd: Amorim

-

Isak scores first Premier League goal for Liverpool to sink West Ham

Isak scores first Premier League goal for Liverpool to sink West Ham

-

Death toll from Sri Lanka floods, landslides rises to 334: disaster agency

-

Martinez double at Pisa keeps Inter on heels of Serie A leaders AC Milan

Martinez double at Pisa keeps Inter on heels of Serie A leaders AC Milan

-

Swiss reject compulsory civic duty, climate tax for super-rich

-

Moleiro snatches Villarreal late winner at Real Sociedad

Moleiro snatches Villarreal late winner at Real Sociedad

-

Pope arrives in Lebanon with message of peace for crisis-hit country

-

Celtic close on Scottish leaders Hearts after beating Hibs

Celtic close on Scottish leaders Hearts after beating Hibs

-

Swiss right-to-die group says founder dies by assisted suicide

-

Zirkzee ends goal drought to inspire Man Utd victory at Palace

Zirkzee ends goal drought to inspire Man Utd victory at Palace

-

Trump threats dominate as Hondurans vote for president

-

Hong Kong in mourning as fire death toll climbs to 146

Hong Kong in mourning as fire death toll climbs to 146

-

West Ham legend Bonds dies aged 79

-

Swiss reject compulsory civic duty, climate tax for super-rich: projections

Swiss reject compulsory civic duty, climate tax for super-rich: projections

-

Kohli's 135 powers India to 349-8 in first South Africa ODI

-

Indonesia, Thailand race to find missing as flooding toll tops 600

Indonesia, Thailand race to find missing as flooding toll tops 600

-

After call for Christian unity, pope leaves Turkey for Lebanon

-

Floods hit Sri Lanka's capital as cyclone deaths top 200

Floods hit Sri Lanka's capital as cyclone deaths top 200

-

Netanyahu submits pardon request in Israel corruption cases

Most equity markets build on week's rally

Most markets squeezed out gains Friday at the end of a strong week for equities fuelled by growing expectations that the Federal Reserve will cut interest rates again next month.

Traders took silence from New York's Thanksgiving break as a reason to have a breather and take stock of a healthy rebound from November's swoon that was sparked by AI bubble fears.

But while there is much debate on whether valuations in the tech sector are overstretched, focus this week has been firmly on the prospect of more rate cuts.

A string of top Fed officials have lined up to back a third straight reduction, mostly saying that worries over a weakening labour market trumped still elevated inflation.

Attention now turns to a range of data releases over the next week or so that could play a role in the bank's final decision, with private hiring, services activity and personal consumption expenditure -- the Fed's preferred gauge of inflation.

With the government shutdown postponing or cancelling the release of some key data, closely watched non-farm payrolls figures are now due in mid-December, after the Fed's policy decision.

"This delay places much greater scrutiny on the latest November ADP (private) payrolls report," wrote Market Insights' Michael Hewson. He said there would likely be a Thanksgiving-linked spike in hiring "that is not entirely representative of recent slower trends in the US labour market".

"While a big jump in payrolls in November could be construed as a positive signal for the US labour market it might not be enough to stop the Fed from cutting rates again with another close decision expected on 10th December," he added.

Markets see around an 85 percent chance of a cut next month and three more in 2026.

With no catalyst from New York, Asian investor excitement was limited but most markets managed to rise.

Tokyo, Shanghai, Singapore, Wellington, Taipei, Manila, Mumbai and Bangkok all advanced, though Hong Kong, Sydney, Seoul and Jakarta reversed.

London, Paris and Frankfurt rose at the open.

The yen swung against the dollar after data showed inflation in Tokyo, seen as a bellwether for Japan, came in a little higher than expected, reigniting talk on whether the central bank will hike interest rates in the coming months.

The Japanese unit remains under pressure against the greenback amid concerns about Japan's fiscal outlook and pledges for more borrowing, but it has pulled back from the levels near 158 per dollar seen earlier this week.

- Key figures at around 0815 GMT -

Tokyo - Nikkei 225: UP 0.2 percent at 50,253.91 (close)

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 25,858.89 (close)

Shanghai - Composite: UP 0.3 percent at 3888.60 (close)

London - FTSE 100: UP 0.2 percent at 9,715.84

Euro/dollar: DOWN at $1.1583 from $1.1602 on Thursday

Pound/dollar: DOWN at $1.3215 from $1.3252

Dollar/yen: UP at 156.35 yen from 156.30 yen

Euro/pound: UP at 87.64 pence from 87.56 pence

West Texas Intermediate: UP 0.7 percent at $59.08 per barrel

Brent North Sea Crude: UP 0.3 percent at $63.52 per barrel

New York - Dow: Closed for a public holiday

A.Malone--AMWN