-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

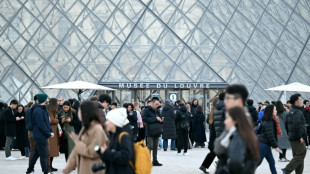

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

Bondi Beach gunmen had possible Islamic State links, says ABC

-

Lakers fend off Suns fightback, Hawks edge Sixers

-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

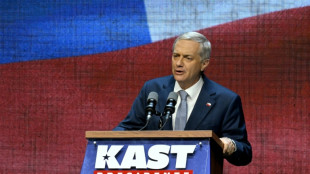

Far-right Kast wins Chile election landslide

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

-

Iran's women bikers take the road despite legal, social obstacles

Iran's women bikers take the road despite legal, social obstacles

-

Civilians venture home after militia seizes DR Congo town

-

Countdown to disclosure: Epstein deadline tests US transparency

Countdown to disclosure: Epstein deadline tests US transparency

-

Desperate England looking for Ashes miracle in Adelaide

-

Far-right Kast wins Chile election in landslide

Far-right Kast wins Chile election in landslide

-

What we know about Australia's Bondi Beach attack

-

Witnesses tell of courage, panic in wake of Bondi Beach shootings

Witnesses tell of courage, panic in wake of Bondi Beach shootings

-

Chiefs out of playoffs after decade as Mahomes hurts knee

-

Chilean hard right victory stirs memories of dictatorship

Chilean hard right victory stirs memories of dictatorship

-

Volunteers patrol Thai villages as artillery rains at Cambodia border

Asian stocks drop, dollar holds rally as US jobs report looms

Asian markets fell and the dollar held an advance as the optimism that coursed through trading floors earlier this week gave way to nervousness ahead of a massive US jobs report later Friday that could determine Federal Reserve rate hike plans.

Soft economic data out of Washington sent equities surging at the start of the week and dragged the greenback on hopes that the readings could allow the US central bank to pivot and slow down its strict monetary tightening programme.

However, the uncertainty that has characterised the year so far has slowly returned and Wall Street's three main indexes ended Thursday with fresh losses, with sights firmly on the non-farm payrolls (NFP) figures.

Analysts expect the monthly report to show 250,000 posts were created in September, which would be the weakest since late 2020 but still a healthy figure suggesting a strong labour market.

There is a fear that a result higher than expectations could spark another sell-off across risk markets as investors bet on more bumper rate hikes.

Fed officials have consistently warned that they are determined to ramp up borrowing costs to fight four-decade-high inflation, even at the expense of a recession -- feeding worries among traders that the world economy is heading for such a scenario.

"The pivot party gang dialled down their new-found enthusiasm overnight after hawkish central bankers expressed concerns over sticky inflation," said SPI Asset Management's Stephen Innes.

He pointed out that other central banks, including in Europe and Canada, had also flagged further tough measures.

Still, OANDA's Edward Moya added that a consumer price index report next week was also coming on traders' radars.

"Economists are not expecting a significant drop in pricing pressures, but many traders think that a cool report could happen and that will force the Fed to change their tune next week," he said in a note.

"Fed messaging has been consistent and it will likely stay that way post-NFP. Rate hike and cut bets will likely have significant swings after next Thursday’s inflation report."

Asian markets extended the New York retreat, with downbeat earnings from chipmakers -- and a warning from South Korean titan Samsung -- raising worries about the upcoming corporate earnings season.

Tokyo, Hong Kong, Sydney, Seoul, Wellington, Taipei, Manila and Jakarta were all in negative territory.

Adding to the unease was a warning from US President Joe Biden that the world faced nuclear "Armageddon" for the first time since the 1962 Cuban missile crisis and that he is trying to find Russian counterpart Vladimir Putin's "off-ramp"

He told a Democratic Party fundraiser in New York that Putin was "not joking" when he threatened to use nuclear weapons as his army faces a series of defeats in eastern Ukraine following his invasion in February.

The risk-off mood saw the dollar bounce Thursday after days of losses caused by traders lowering their rate expectations, and it held the advance in early Asian business.

The standout was sterling, which remained wedged below $1.12 and continued a rollercoaster that saw it hit a record low last week before recovering thanks to a Bank of England lifeline.

However, observers warned of more volatility in the pound as the government presses ahead with a debt-funded tax-cutting mini-budget, while the promised support from the BoE is due to end soon.

Oil prices edged down but are set for their biggest weekly gain since March after OPEC and other major producers led by Russia agreed to slash output by two million barrels, leading some analysts to predict a return to $100 a barrel by the end of the year.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.6 percent at 27,149.76 (break)

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 17,836.92

Shanghai - Composite: Closed for a holiday

Pound/dollar: UP at $1.1164 from $1.1161 on Thursday

Euro/dollar: UP at $0.9797 from $0.9794

Euro/pound: UP at 87.77 pence from 87.74 pence

Dollar/yen: DOWN at 145.04 yen from 145.11 yen

West Texas Intermediate: DOWN 0.1 percent at $88.40 per barrel

Brent North Sea crude: DOWN 0.2 percent at $94.28 per barrel

New York - Dow: DOWN 1.2 percent at 29,926.94 (close)

London - FTSE 100: DOWN 0.8 percent at 6,997.27 (close)

P.Santos--AMWN