-

With new ships, Canada aims to be 'icebreaking superpower'

With new ships, Canada aims to be 'icebreaking superpower'

-

Brazil's Recife basks in success of 'The Secret Agent' before Oscars

-

Casting directors finally get their due at Oscars

Casting directors finally get their due at Oscars

-

Fantastic Mr Stowaway: fox sails from Britain to New York port

-

Five share lead at US PGA Players Championship

Five share lead at US PGA Players Championship

-

Trump says Iran shouldn't come to World Cup for 'own life and safety'

-

US jury to begin deliberations in social media addiction trial

US jury to begin deliberations in social media addiction trial

-

Venezuela leader's first foreign trip abruptly canceled

-

Forest stunned by Midtjylland, Villa beat Lille in Europa League

Forest stunned by Midtjylland, Villa beat Lille in Europa League

-

Sinner rolls into Indian Wells semi-final clash with Zverev

-

Iran says will make US regret war as oil prices soar

Iran says will make US regret war as oil prices soar

-

Trump says Iran war moving 'very rapidly'

-

NASA says 'on track' for Artemis 2 launch as soon as April 1

NASA says 'on track' for Artemis 2 launch as soon as April 1

-

Valentino mixes 80s and Baroque splendour on Rome return

-

Italian prosecutors seek trial for Amazon over tax evasion

Italian prosecutors seek trial for Amazon over tax evasion

-

Polish president vetoes 40-bn-euro EU defence funding plan

-

Duplantis clears 6.31m to set 15th pole vault world record

Duplantis clears 6.31m to set 15th pole vault world record

-

Dating app Tinder dabbles with AI matchmaking

-

Sabalenka out-guns Mboko to reach Indian Wells semi-finals

Sabalenka out-guns Mboko to reach Indian Wells semi-finals

-

Watkins ends drought as Villa snatch Europa last 16 advantage over Lille

-

'Say a prayer and send it': Paralympic alpine skiers tackle fear

'Say a prayer and send it': Paralympic alpine skiers tackle fear

-

Israel renews Beirut strikes after threatening to expand Lebanon operations

-

Assailant dead after ramming vehicle into Michigan synagogue

Assailant dead after ramming vehicle into Michigan synagogue

-

The Chinese cable that could trip up Chile's new leader

-

Assailant dead after ramming car into Michigan synagogue

Assailant dead after ramming car into Michigan synagogue

-

World in 'new dark age' of abuse: UN rights expert

-

Morikawa pulls out of Players Championship with back trouble

Morikawa pulls out of Players Championship with back trouble

-

Scavenging ravens memorize vast tracts of wolf hunting grounds: study

-

In Iran, shut shops, joblessness and a dash for cash

In Iran, shut shops, joblessness and a dash for cash

-

Polish bishops announce 'independent' probe of child sexual abuse

-

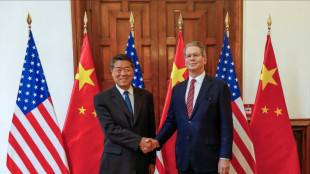

Top US, China economy officials to meet for talks in Paris

Top US, China economy officials to meet for talks in Paris

-

Israel strikes Beirut after threatening to expand Lebanon operations

-

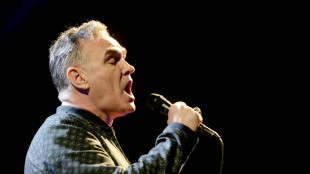

Out with a bang: Morrissey cancels Spain concert over noise

Out with a bang: Morrissey cancels Spain concert over noise

-

Vingegaard soloes to victory in Paris-Nice fifth stage

-

Poland reels from row over EU loans to fend off Russia

Poland reels from row over EU loans to fend off Russia

-

Spurs extend season ticket deadline as relegation fears grow

-

Laundry fire on giant US aircraft carrier injures two: US military

Laundry fire on giant US aircraft carrier injures two: US military

-

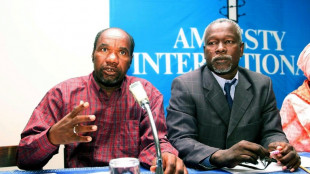

Mauritanian anti-slavery stalwart Boubacar Ould Messaoud dead

-

Behind Cambodian border casino, Thai military shows off a scam hub

Behind Cambodian border casino, Thai military shows off a scam hub

-

Chile's Smiljan Radic Clarke wins Pritzker architecture prize

-

Scotland boss Townsend says Six Nations title 'out of our hands'

Scotland boss Townsend says Six Nations title 'out of our hands'

-

Sheehan and van der Flier recalled for Triple Crown decider with Scots

-

Chelsea's Neto faces UEFA punishment for pushing ball boy

Chelsea's Neto faces UEFA punishment for pushing ball boy

-

Engraved tombs help keep memories alive in Pakistan

-

IPL-linked Sunrisers sign Pakistan's Ahmed for Hundred

IPL-linked Sunrisers sign Pakistan's Ahmed for Hundred

-

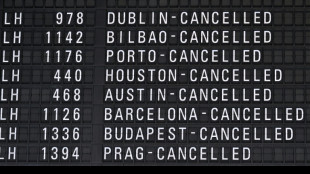

Lufthansa flights axed as pilots walk out

-

Turkey talking to US, Iran in bid to end war: minister

Turkey talking to US, Iran in bid to end war: minister

-

Oil tops $100 as fresh Iran attacks offset stockpiles release

-

Fears grow for French loans at Louvre Abu Dhabi as war rages

Fears grow for French loans at Louvre Abu Dhabi as war rages

-

US military 'not ready' to escort tankers through Hormuz Strait: energy secretary

Two weeks of banking turbulence

After three US regional lenders collapsed and UBS swooped to buyout troubled Credit Suisse to avoid a wider crisis, AFP looks back at the last two weeks of banking turbulence:

- Silvergate Bank -

The turmoil begins the night of March 8 with a liquidation announcement from Silvergate Bank, a US regional lender and favourite among the cryptocurrency crowd.

The California business had been swept up in several crypto mishaps, particularly the implosion of exchange platform FTX, before facing a wave of sudden withdrawals.

On March 10 the crypto banking giant says it plans to close.

- Silicon Valley Bank -

On the same night of March 8, Silicon Valley Bank announces it is facing a huge run of unexpected withdrawals.

In an attempt to raise cash, the bank loses $1.8 billion in the sale of a bond portfolio whose value dropped following interest rate hikes by the US Federal Reserve.

SVB, a key lender to startups across the US since the 1980s and the country's 16th-largest bank by assets, had been hit by the tech sector slowdown as cash-hungry companies rushed to get their hands on their money.

The announcement by SVB spooks investors and clients, and sparks a run on deposits.

On March 10 the bank collapses -- the biggest US banking failure since the 2008 financial crisis -- prompting regulators to seize control the same day.

The Federal Deposit Insurance Corporation (FDIC) takes over the bank and says it will protect insured deposits -- those up to $250,000 per client.

In a statement on March 12, the Federal Reserve, the Treasury Department and the FDIC step in, announcing that SVB depositors will have access to "all of their money" starting Monday March 13, and American taxpayers will not have to foot the bill.

So far regulators have been unable to find a buyer for SVB and are now considering breaking up the bank, according to Bloomberg.

- Signature Bank -

The March 12 statement also reveals that Signature Bank, the 21st-largest in the United States, has been automatically closed and its customers will benefit from the same measures as those at SVB.

On March 19 the FDIC says it has struck a deal to sell most of the assets of Signature Bank to Flagstar Bank, a subsidiary of New York Community Bancorp.

Signature Bank held deposits of $88.6 billion as of December 31, the FDIC statement says, adding that the bank's 40 branches will open under Flagstar on Monday.

- First Republic Bank -

San Francisco-based First Republic Bank -- the 14th largest US bank by assets -- sees its stock market valuation plunge as of March 9 and its shares tumble over the next week.

On March 16, Wall Street titans including JP Morgan, Bank of America and Citigroup pledge to deposit $30 billion into the lender.

But despite the rescue package, on Sunday ratings agency Standard & Poor's (S&P) downgrades First Republic's long-term issuer credit rating from BB+ to B+.

The agency warns it could further lower the bank's rating if there is no progress in stabilising deposits.

First Republic Bank makes assurances that with the $30 billion injection the lender is "well positioned to manage short-term deposit activity."

- Credit Suisse -

On March 15 the shares of Credit Suisse, Switzerland's second-largest bank and considered the "weakest link" in the Swiss banking sector, go into freefall.

In a bid to calm the markets, Credit Suisse announces it will borrow 50 billion francs ($54 billion) from the Swiss central bank to reinforce the group.

After recovering some ground on March 16, Credit Suisse shares close down eight percent the next day at 1.86 Swiss francs as the Zurich-based lender struggles to regain investors confidence.

In a crunch weekend, UBS -- Switzerland's biggest bank -- says Sunday it will buy Credit Suisse for $3.25 billion in hopes of stopping a wider international banking crisis.

The takeover will create a banking giant unprecedented in the history of Switzerland, where banking is a core part of the national identity.

burs-eab/jmy/lth

F.Bennett--AMWN