-

Trump threatens to escalate bombing as Iran vows no surrender

Trump threatens to escalate bombing as Iran vows no surrender

-

Russian strikes kill 11 across Ukraine

-

Nepal's rapper politician who took on the old guard and won

Nepal's rapper politician who took on the old guard and won

-

Pirovano doubles up with second Val di Fassa downhill win

-

Rapper-turned-politician Shah unseats former Nepal PM in own constituency

Rapper-turned-politician Shah unseats former Nepal PM in own constituency

-

Beating Italy is not a 'God-given right', says Wales coach Tandy

-

Sri Lanka to treat Iranian sailors according to 'international law'

Sri Lanka to treat Iranian sailors according to 'international law'

-

New Zealand want to 'break a few hearts' in World Cup final

-

Farrell welcomes bonus-point win over 'tough' Welsh

Farrell welcomes bonus-point win over 'tough' Welsh

-

Iran vows no surrender as air strikes hit Tehran airport

-

Hamilton says 'not where we wanted or expected' for Australian GP

Hamilton says 'not where we wanted or expected' for Australian GP

-

Pole-sitter Russell says his Mercedes more go-kart than 'bouncing bus'

-

Google gives CEO new pay deal worth up to $692 million

Google gives CEO new pay deal worth up to $692 million

-

Thousands of Taiwan fans turn Tokyo blue at World Baseball Classic

-

Verstappen baffled by crash in Australian Grand Prix qualifying

Verstappen baffled by crash in Australian Grand Prix qualifying

-

Russell leads Mercedes 1-2 for Australian GP as Verstappen crashes

-

'Grateful' Osaka returns to action with Indian Wells win

'Grateful' Osaka returns to action with Indian Wells win

-

Israel fires 'broad-scale' strikes on Tehran as war hits 2nd week

-

Rapper-turned-politician looks set for landslide Nepal election win

Rapper-turned-politician looks set for landslide Nepal election win

-

Russian strike on Kharkiv apartment block kills three

-

Judge homers as USA cruise past Brazil in World Baseball Classic

Judge homers as USA cruise past Brazil in World Baseball Classic

-

Russian strike on Kharkiv appartment block kills three

-

Grabbing the bull by the tail: Venezuela's cowboy sport

Grabbing the bull by the tail: Venezuela's cowboy sport

-

Russell tops final practice in Melbourne as Antonelli crashes heavily

-

Vibes war? Trump pitches Iran conflict on 'feeling'

Vibes war? Trump pitches Iran conflict on 'feeling'

-

Nepal's rapper-turned-politician looks set for landslide win

-

Tatum's 'emotional' return sparks Celtics over Mavs

Tatum's 'emotional' return sparks Celtics over Mavs

-

Rising US fuel prices risk sparking domestic wildfire for Trump

-

Questions over AI capability as tech guides Iran strikes

Questions over AI capability as tech guides Iran strikes

-

Trump convenes Latin American leaders to curb crime, immigration

-

Dipylon Medical Expands Access to Clinical Microbiology Equipment for Modern Diagnostic Laboratories

Dipylon Medical Expands Access to Clinical Microbiology Equipment for Modern Diagnostic Laboratories

-

Bestday Safaris Launches Affordable Tanzania Safari Tours for International Travelers

-

All Home Care Matters Takes Over Leadership Role of AlzAuthors

All Home Care Matters Takes Over Leadership Role of AlzAuthors

-

Venezuela inflation hit 475% in 2025, the world's highest level

-

Only Iran's 'unconditional surrender' can end war: Trump

Only Iran's 'unconditional surrender' can end war: Trump

-

Former 100m champion Kerley banned two years over whereabouts failures

-

Sabalenka opens Indian Wells bid with dominant win

Sabalenka opens Indian Wells bid with dominant win

-

Doris relieved Ireland's slim title hopes intact after 'scrappy' win over Welsh

-

Man City aren't a 'complete team' admits Guardiola

Man City aren't a 'complete team' admits Guardiola

-

Arteta warns Arsenal to preserve reputation in Mansfield clash

-

Timothee Chalamet taken to task over opera, ballet dig

Timothee Chalamet taken to task over opera, ballet dig

-

Ireland keep title hopes alive in thrilling win over Wales

-

Hungary has not returned cash seized from bank workers, Kyiv says

Hungary has not returned cash seized from bank workers, Kyiv says

-

Napoli secure first Serie A home win since January

-

Valverde strikes late as Real Madrid beat Celta Vigo

Valverde strikes late as Real Madrid beat Celta Vigo

-

PSG beaten by Monaco ahead of Chelsea Champions League showdown

-

Liverpool tame Wolves to reach FA Cup quarter-finals

Liverpool tame Wolves to reach FA Cup quarter-finals

-

Kane-less Bayern brush aside Gladbach to continue title march

-

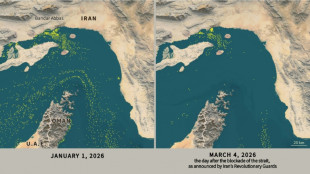

Only nine commercial ships detected crossing Hormuz Strait since Monday

Only nine commercial ships detected crossing Hormuz Strait since Monday

-

Berger extends lead midway through Arnold Palmer Invitational

Infrax Systems, Inc (OTC: IFXY) / US Standard Capital Completes Acquisition of Cornerstone Rock LLC

Infrax Systems, Inc. (OTC PINK:IFXY) dba US Standard Capital (the "Company") announced today that it has completed its acquisition of Cornerstone Rock LLC, a Houston-based residential construction company specializing in home remodeling renovations and new construction projects. The acquisition brings together the construction and remodeling capabilities of Cornerstone Rock and the real estate investment capabilities of the previously acquired JP Developers of Texas under the Infrax / US Standard Capital name.

As previously reported, the Company has completed the audits for 2022 and 2023 and is currently working on its audit for its 2024 fiscal year that ended on June 30, 2024. The Company is concurrently working with its attorneys to prepare the text of its S-1 registration statement and plans to file it with the SEC once the 2024 audit is complete.

The Company will now pause its acquisition activity to complete the 2024 audit of the combined entities so it can file its S-1 registration statement as soon as possible. The Company has identified several other potential acquisition targets and will revisit the viability of these acquisitions once the S-1 is effective. The Company also plans to file a name and ticker symbol change request with FINRA to officially change the Company's name to US Standard Capital at that time.

About Infrax Systems, Inc. / US Standard Capital

Infrax Systems, Inc. is focused on acquiring assets and companies in the real estate sector, including housing development, construction, remodeling, and financing. The Company also provides products and services that address the various challenges faced by Latin American immigrants.

Contact Information:

https://twitter.com/jpineda100

https://www.usstandardcapital.com/

https://www.jpdevelopersoftexas.com/

https://www.cornerstonehtx.com

Shareholder/Investor inquiries for Infrax Systems, Inc.:

Infrax Systems, Inc.

1-888-204-4134

[email protected]

Safe Harbor Statement: In addition to historical information, this press release may contain statements that constitute forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. Forward-looking statements contained in this press release include the intent, belief, or expectations of the Company and members of its management team with respect to the Company's future business operations and the assumptions upon which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance, and involve risks and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements. Factors that could cause these differences include, but are not limited to, failure to complete anticipated sales under negotiations, lack of revenue growth, client discontinuances, failure to realize improvements in performance, efficiency and profitability, and adverse developments with respect to litigation or increased litigation costs, the operation or performance of the Company's business units or the market price of its common stock. Additional factors that would cause actual results to differ materially from those contemplated within this press release can also be found on the Company's website. The Company disclaims any responsibility to update any forward-looking statements.

Contact Information

Jose Pineda

CEO

[email protected]

786-583-6642

SOURCE: Infrax Systems, Inc.

P.Stevenson--AMWN