-

Google gives CEO new pay deal worth up to $692 million

Google gives CEO new pay deal worth up to $692 million

-

Thousands of Taiwan fans turn Tokyo blue at World Baseball Classic

-

Verstappen baffled by crash in Australian Grand Prix qualifying

Verstappen baffled by crash in Australian Grand Prix qualifying

-

Russell leads Mercedes 1-2 for Australian GP as Verstappen crashes

-

'Grateful' Osaka returns to action with Indian Wells win

'Grateful' Osaka returns to action with Indian Wells win

-

Israel fires 'broad-scale' strikes on Tehran as war hits 2nd week

-

Rapper-turned-politician looks set for landslide Nepal election win

Rapper-turned-politician looks set for landslide Nepal election win

-

Russian strike on Kharkiv apartment block kills three

-

Judge homers as USA cruise past Brazil in World Baseball Classic

Judge homers as USA cruise past Brazil in World Baseball Classic

-

Russian strike on Kharkiv appartment block kills three

-

Grabbing the bull by the tail: Venezuela's cowboy sport

Grabbing the bull by the tail: Venezuela's cowboy sport

-

Russell tops final practice in Melbourne as Antonelli crashes heavily

-

Vibes war? Trump pitches Iran conflict on 'feeling'

Vibes war? Trump pitches Iran conflict on 'feeling'

-

Nepal's rapper-turned-politician looks set for landslide win

-

Tatum's 'emotional' return sparks Celtics over Mavs

Tatum's 'emotional' return sparks Celtics over Mavs

-

Rising US fuel prices risk sparking domestic wildfire for Trump

-

Questions over AI capability as tech guides Iran strikes

Questions over AI capability as tech guides Iran strikes

-

Trump convenes Latin American leaders to curb crime, immigration

-

Venezuela inflation hit 475% in 2025, the world's highest level

Venezuela inflation hit 475% in 2025, the world's highest level

-

Only Iran's 'unconditional surrender' can end war: Trump

-

Former 100m champion Kerley banned two years over whereabouts failures

Former 100m champion Kerley banned two years over whereabouts failures

-

Sabalenka opens Indian Wells bid with dominant win

-

Doris relieved Ireland's slim title hopes intact after 'scrappy' win over Welsh

Doris relieved Ireland's slim title hopes intact after 'scrappy' win over Welsh

-

Man City aren't a 'complete team' admits Guardiola

-

Arteta warns Arsenal to preserve reputation in Mansfield clash

Arteta warns Arsenal to preserve reputation in Mansfield clash

-

Timothee Chalamet taken to task over opera, ballet dig

-

Ireland keep title hopes alive in thrilling win over Wales

Ireland keep title hopes alive in thrilling win over Wales

-

Hungary has not returned cash seized from bank workers, Kyiv says

-

Napoli secure first Serie A home win since January

Napoli secure first Serie A home win since January

-

Valverde strikes late as Real Madrid beat Celta Vigo

-

PSG beaten by Monaco ahead of Chelsea Champions League showdown

PSG beaten by Monaco ahead of Chelsea Champions League showdown

-

Liverpool tame Wolves to reach FA Cup quarter-finals

-

Kane-less Bayern brush aside Gladbach to continue title march

Kane-less Bayern brush aside Gladbach to continue title march

-

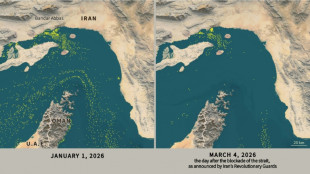

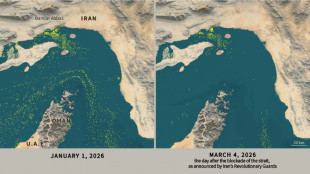

Only nine commercial ships detected crossing Hormuz Strait since Monday

-

Berger extends lead midway through Arnold Palmer Invitational

Berger extends lead midway through Arnold Palmer Invitational

-

Paralympics open with Russian athletes booed in ceremony

-

Cuba 'next' on agenda, after Iran: Trump

Cuba 'next' on agenda, after Iran: Trump

-

Zverev leads way into Indian Wells third round

-

NASA defense test kicked asteroid off course -- and changed its orbit around the sun

NASA defense test kicked asteroid off course -- and changed its orbit around the sun

-

Anthropic vows court fight in Pentagon row

-

'Harder path': Obama attacks Trump at Jesse Jackson memorial

'Harder path': Obama attacks Trump at Jesse Jackson memorial

-

Amber Glenn says will not visit White House to celebrate Olympic gold

-

Russian athletes booed as they parade under own flag at Paralympics opening

Russian athletes booed as they parade under own flag at Paralympics opening

-

Trump to attend return of six US troops killed in Iran war

-

Tom Brady flag football event moved from Saudi to Los Angeles: reports

Tom Brady flag football event moved from Saudi to Los Angeles: reports

-

UN chief slams 'unlawful attacks', says Mideast could spiral out of control

-

Middle East war a new shock for financial markets

Middle East war a new shock for financial markets

-

Only nine commercial ships detected crossing the Hormuz Strait since Monday

-

Mexico unveils 100,000-strong security deployment for World Cup

Mexico unveils 100,000-strong security deployment for World Cup

-

Trump's Iran war violates international law, experts say

TaxBandits Is Now Accepting ACA 1095 Forms For The 2024 Tax Year

With the 2024 tax year underway, ALEs and employers must be prepared for ACA compliance.

TaxBandits, the leading IRS-authorized e-file provider, is pleased to announce that it now accepts ACA Form 1095 filings for the 2024 tax year. This service allows businesses, ALEs, and tax professionals to stay ahead of ACA compliance requirements, meeting both IRS and state-specific ACA reporting obligations accurately and efficiently.

Get Ahead on 2024 ACA 1095 Forms with TaxBandits

All applicable large employers (those with 50 or more full-time equivalent employees) must provide minimum essential coverage to their full-time employees, file Form 1095-C to report that information to the IRS and provide a copy of the return to their employees.

TaxBandits streamlines the ACA 1095 filing process, enabling employers to get a head start on their 2024 filings efficiently and accurately. With TaxBandits, clients can start preparing the filings of ACA Forms 1095-B and 1095-C, meeting federal and state requirements well before deadlines.

By preparing ACA forms now, employers can avoid last-minute stress and ensure compliance with the ACA regulations. TaxBandits' pre-filing solution allows the ACA forms to be transmitted to the IRS on January 10, 2025, when the IRS/SSA processing window opens.

Key Features for Efficient ACA Filing for This Season

TaxBandits offers time-saving features to streamline the filing process for ACA 1095 forms for this tax season. With a user-friendly application and dedicated support team, TaxBandits ensures that businesses can efficiently manage their ACA compliance requirements.

Easy Preparation and Filing: TaxBandits offers an intuitive platform for preparing, editing, and filing Forms 1095-B and 1095-C.

Bulk Data Upload: Streamlines the filing process with their 1095 Excel templates for bulk data import, eliminating manual data entry and saving time.

State-Only Filing Support: TaxBandits supports ACA state-only ACA filing for California, New Jersey, the District of Columbia, Rhode Island, and Massachusetts, so employers can meet state requirements without federal filings if needed.

Employee Copy Distribution: TaxBandits ensures that copies of ACA forms are securely distributed to employees via postal mail or a secure online portal.

ACA Corrections: Clients caneasily file ACA corrections with TaxBandits to ensure accurate reporting and compliance with IRS requirements.

Businesses, tax professionals, and service providers can start their year-end tax filings at TaxBandits.com by signing up for a free account today.

About TaxBandits

TaxBandits is a SOC 2 Certified, IRS-authorized e-file provider of Form 1099, Form W-2, Form 1095-C, Form 1095-B, Form 940, Form 941, and Form W-9. Serving businesses, service providers, or tax professionals of every shape and size, TaxBandits offers a complete solution that fulfills all filing needs.

In addition to tax filing services, TaxBandits offers a comprehensive solution for business and tax professionals to meet their FinCEN Beneficial Ownership Information BOIR requirements.

Software providers and other high-volume filers can take advantage of TaxBandits API. The integration allows them to add client value and expand monetization efforts. TaxBandits API enables seamless preparation and e-filing of 1099, W-2, 941, 940, and ACA 1095 forms. Software providers can also use the developer-friendly 1099 API to request W-9s and automate 1099 filings efficiently.

About SPAN Enterprises

Headquartered in Rock Hill, South Carolina, SPAN Enterprises has created cutting-edge software solutions for e-filing and business management for over ten years.

SPAN Enterprises portfolio of products includes TaxBandits, Tax990, ACAwise, ExpressExtension, 123PayStubs, and TruckLogics.

Please direct all media inquiries to Stephanie Glanville, Marketing Manager, at [email protected].

SOURCE: TaxBandits

O.M.Souza--AMWN