-

Rapper-turned-politician looks set for landslide Nepal election win

Rapper-turned-politician looks set for landslide Nepal election win

-

Russian strike on Kharkiv apartment block kills three

-

Judge homers as USA cruise past Brazil in World Baseball Classic

Judge homers as USA cruise past Brazil in World Baseball Classic

-

Russian strike on Kharkiv appartment block kills three

-

Grabbing the bull by the tail: Venezuela's cowboy sport

Grabbing the bull by the tail: Venezuela's cowboy sport

-

Russell tops final practice in Melbourne as Antonelli crashes heavily

-

Vibes war? Trump pitches Iran conflict on 'feeling'

Vibes war? Trump pitches Iran conflict on 'feeling'

-

Nepal's rapper-turned-politician looks set for landslide win

-

Tatum's 'emotional' return sparks Celtics over Mavs

Tatum's 'emotional' return sparks Celtics over Mavs

-

Rising US fuel prices risk sparking domestic wildfire for Trump

-

Questions over AI capability as tech guides Iran strikes

Questions over AI capability as tech guides Iran strikes

-

Trump convenes Latin American leaders to curb crime, immigration

-

Venezuela inflation hit 475% in 2025, the world's highest level

Venezuela inflation hit 475% in 2025, the world's highest level

-

Only Iran's 'unconditional surrender' can end war: Trump

-

Former 100m champion Kerley banned two years over whereabouts failures

Former 100m champion Kerley banned two years over whereabouts failures

-

Sabalenka opens Indian Wells bid with dominant win

-

Doris relieved Ireland's slim title hopes intact after 'scrappy' win over Welsh

Doris relieved Ireland's slim title hopes intact after 'scrappy' win over Welsh

-

Man City aren't a 'complete team' admits Guardiola

-

Arteta warns Arsenal to preserve reputation in Mansfield clash

Arteta warns Arsenal to preserve reputation in Mansfield clash

-

Timothee Chalamet taken to task over opera, ballet dig

-

Ireland keep title hopes alive in thrilling win over Wales

Ireland keep title hopes alive in thrilling win over Wales

-

Hungary has not returned cash seized from bank workers, Kyiv says

-

Napoli secure first Serie A home win since January

Napoli secure first Serie A home win since January

-

Valverde strikes late as Real Madrid beat Celta Vigo

-

PSG beaten by Monaco ahead of Chelsea Champions League showdown

PSG beaten by Monaco ahead of Chelsea Champions League showdown

-

Liverpool tame Wolves to reach FA Cup quarter-finals

-

Kane-less Bayern brush aside Gladbach to continue title march

Kane-less Bayern brush aside Gladbach to continue title march

-

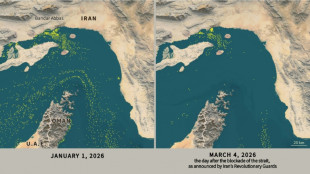

Only nine commercial ships detected crossing Hormuz Strait since Monday

-

Berger extends lead midway through Arnold Palmer Invitational

Berger extends lead midway through Arnold Palmer Invitational

-

Paralympics open with Russian athletes booed in ceremony

-

Cuba 'next' on agenda, after Iran: Trump

Cuba 'next' on agenda, after Iran: Trump

-

Zverev leads way into Indian Wells third round

-

NASA defense test kicked asteroid off course -- and changed its orbit around the sun

NASA defense test kicked asteroid off course -- and changed its orbit around the sun

-

Anthropic vows court fight in Pentagon row

-

'Harder path': Obama attacks Trump at Jesse Jackson memorial

'Harder path': Obama attacks Trump at Jesse Jackson memorial

-

Amber Glenn says will not visit White House to celebrate Olympic gold

-

Russian athletes booed as they parade under own flag at Paralympics opening

Russian athletes booed as they parade under own flag at Paralympics opening

-

Trump to attend return of six US troops killed in Iran war

-

Tom Brady flag football event moved from Saudi to Los Angeles: reports

Tom Brady flag football event moved from Saudi to Los Angeles: reports

-

UN chief slams 'unlawful attacks', says Mideast could spiral out of control

-

Middle East war a new shock for financial markets

Middle East war a new shock for financial markets

-

Only nine commercial ships detected crossing the Hormuz Strait since Monday

-

Mexico unveils 100,000-strong security deployment for World Cup

Mexico unveils 100,000-strong security deployment for World Cup

-

Trump's Iran war violates international law, experts say

-

Swiss eyeing fewer F-35 fighters, reshaping defence set-up

Swiss eyeing fewer F-35 fighters, reshaping defence set-up

-

UK police question three women in Al-Fayed probe

-

Oil prices surge as Mideast war rages, stocks fall on US jobs

Oil prices surge as Mideast war rages, stocks fall on US jobs

-

Dupont says France must forget Six Nations title talk against Scotland

-

Voices from Iran: protests, fear and scarcity

Voices from Iran: protests, fear and scarcity

-

Champions League ambitions encourage Barca gamble in Bilbao

New Survey Highlights Emotional Toll of Auto Total Loss Claims on Policyholders

Survey Finds Communication Crucial in Reducing Stress and Improving Satisfaction During Claims Process

Survey Finds Communication Crucial in Reducing Stress and Improving Satisfaction During Claims Process

A new survey of US policyholders who have had a car declared a total loss found that how carriers communicate with policyholders significantly impacts their emotional state and overall satisfaction with their insurance carrier. Auto total loss events are inherently stressful and time-consuming, with 49 percent reporting feeling frustrated and sad when they learned their vehicle was totaled. Then, as the insured navigated through the claim process, more than half (55 percent) of respondents felt they could have been better informed of their claim's progress.

Further complicating the process, 60 percent of those surveyed reported interacting with two or three people on their claim, and almost 50 percent had to repeat basic details of the incident between two and three times. Fourteen percent noted they had to repeat themselves more than four times.

Hi Marley, an SMS-driven conversational platform built for P&C insurance, commissioned the survey to examine policyholders' experience and sentiment around total loss claims. Hi Marley surveyed 800 policyholders nationwide who had reported a total loss claim in the past three years. The survey prompted respondents to provide information about their recent experience filing an insurance claim, including the need for support as they navigated the complex and emotional journey of total auto loss.

The survey revealed an essential takeaway for carriers: more than half of respondents cited their most significant pain points had to do with a lack of understanding and clarity throughout the claim, including not knowing the claim status (11 percent), process, responsibilities, or next steps (27 percent), or even knowing who to work with or speak to (13 percent). These results highlight communication breakdowns and showcase how carriers can leverage asynchronous single-thread communications throughout the total loss process to drive clarity and keep the policyholder informed while improving the customer experience and reducing total lost cycle time.

Balancing cost containment with improved customer experience is a longstanding challenge for P&C insurers. The challenge is magnified in auto total loss, which traditionally has the lengthiest cycle time of all claim types and requires multiple touchpoints with policyholders who may be distressed during the process. In fact, according to Hi Marley's survey, 40 percent of respondents said their time-to-resolution took a month or longer. These claimants were more likely to experience frustration (68 percent), anger (37 percent), and confusion (37 percent) compared to those who saw faster time-to-resolution. Also, due to the complex nature of these claims, more than 41 percent of respondents said they would have appreciated additional support or guidance during the total loss claims process.

"We understand the complexities that contribute to the time it takes for carriers to resolve a total loss claim, but this survey highlights the importance of an empathy-first approach throughout the process, especially when claims take longer than expected," said Hugh Allen, Principal Product Strategist at Hi Marley. "This presents an opportunity for carriers to streamline communication channels and improve efficiencies. Keeping customers informed and supported positively impacts the claimant's emotional state during a tumultuous time."

Earlier this year, Hi Marley, in collaboration with Copart, Inc., released Total Loss Assist to address these pain points for policyholders and offer benefits such as:

One trusted, unified conversation thread between the policyholder and other relevant parties.

Automated workflows that guide the policyholder through their auto total loss process and set expectations about next steps.

Real-time customized notifications from Copart to adjusters in Hi Marley for clear, next actions.

Personalized, automated text messages through Hi Marley to customers based on Copart alert triggers.

Increased automation in key areas of the total loss process.

For more information about Hi Marley's Total Loss Assist, visit https://www.himarley.com/totalloss.

About Hi Marley

Hi Marley is the first intelligent conversational platform built for P&C insurance and powered by SMS. Designed by insurance professionals, Hi Marley enables lovable, convenient conversations across the entire ecosystem, saving carriers money and time while building customer loyalty through delightful interactions. Hi Marley's industry-leading collaboration, coaching, and analytics capabilities deliver crucial insights that streamline carrier operations while enabling a frictionless customer engagement experience. The solution is made for the enterprise; it's fast to deploy, easy to use, and seamlessly integrates with core insurance systems. Through its advanced conversational technology, Hi Marley reduces friction and empowers innovative carriers to reinvent the customer and employee experience. Learn more at www.himarley.com.

Media Contact

Escalate PR

[email protected]

SOURCE: Hi Marley

F.Bennett--AMWN