-

Judge homers as USA cruise past Brazil in World Baseball Classic

Judge homers as USA cruise past Brazil in World Baseball Classic

-

Russian strike on Kharkiv appartment block kills three

-

Grabbing the bull by the tail: Venezuela's cowboy sport

Grabbing the bull by the tail: Venezuela's cowboy sport

-

Russell tops final practice in Melbourne as Antonelli crashes heavily

-

Vibes war? Trump pitches Iran conflict on 'feeling'

Vibes war? Trump pitches Iran conflict on 'feeling'

-

Nepal's rapper-turned-politician looks set for landslide win

-

Tatum's 'emotional' return sparks Celtics over Mavs

Tatum's 'emotional' return sparks Celtics over Mavs

-

Rising US fuel prices risk sparking domestic wildfire for Trump

-

Questions over AI capability as tech guides Iran strikes

Questions over AI capability as tech guides Iran strikes

-

Trump convenes Latin American leaders to curb crime, immigration

-

Venezuela inflation hit 475% in 2025, the world's highest level

Venezuela inflation hit 475% in 2025, the world's highest level

-

Only Iran's 'unconditional surrender' can end war: Trump

-

Former 100m champion Kerley banned two years over whereabouts failures

Former 100m champion Kerley banned two years over whereabouts failures

-

Sabalenka opens Indian Wells bid with dominant win

-

Doris relieved Ireland's slim title hopes intact after 'scrappy' win over Welsh

Doris relieved Ireland's slim title hopes intact after 'scrappy' win over Welsh

-

Man City aren't a 'complete team' admits Guardiola

-

Arteta warns Arsenal to preserve reputation in Mansfield clash

Arteta warns Arsenal to preserve reputation in Mansfield clash

-

Timothee Chalamet taken to task over opera, ballet dig

-

Ireland keep title hopes alive in thrilling win over Wales

Ireland keep title hopes alive in thrilling win over Wales

-

Hungary has not returned cash seized from bank workers, Kyiv says

-

Napoli secure first Serie A home win since January

Napoli secure first Serie A home win since January

-

Valverde strikes late as Real Madrid beat Celta Vigo

-

PSG beaten by Monaco ahead of Chelsea Champions League showdown

PSG beaten by Monaco ahead of Chelsea Champions League showdown

-

Liverpool tame Wolves to reach FA Cup quarter-finals

-

Kane-less Bayern brush aside Gladbach to continue title march

Kane-less Bayern brush aside Gladbach to continue title march

-

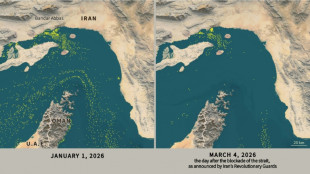

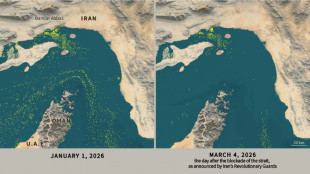

Only nine commercial ships detected crossing Hormuz Strait since Monday

-

Berger extends lead midway through Arnold Palmer Invitational

Berger extends lead midway through Arnold Palmer Invitational

-

Paralympics open with Russian athletes booed in ceremony

-

Cuba 'next' on agenda, after Iran: Trump

Cuba 'next' on agenda, after Iran: Trump

-

Zverev leads way into Indian Wells third round

-

NASA defense test kicked asteroid off course -- and changed its orbit around the sun

NASA defense test kicked asteroid off course -- and changed its orbit around the sun

-

Anthropic vows court fight in Pentagon row

-

'Harder path': Obama attacks Trump at Jesse Jackson memorial

'Harder path': Obama attacks Trump at Jesse Jackson memorial

-

Amber Glenn says will not visit White House to celebrate Olympic gold

-

Russian athletes booed as they parade under own flag at Paralympics opening

Russian athletes booed as they parade under own flag at Paralympics opening

-

Trump to attend return of six US troops killed in Iran war

-

Tom Brady flag football event moved from Saudi to Los Angeles: reports

Tom Brady flag football event moved from Saudi to Los Angeles: reports

-

UN chief slams 'unlawful attacks', says Mideast could spiral out of control

-

Middle East war a new shock for financial markets

Middle East war a new shock for financial markets

-

Only nine commercial ships detected crossing the Hormuz Strait since Monday

-

Mexico unveils 100,000-strong security deployment for World Cup

Mexico unveils 100,000-strong security deployment for World Cup

-

Trump's Iran war violates international law, experts say

-

Swiss eyeing fewer F-35 fighters, reshaping defence set-up

Swiss eyeing fewer F-35 fighters, reshaping defence set-up

-

UK police question three women in Al-Fayed probe

-

Oil prices surge as Mideast war rages, stocks fall on US jobs

Oil prices surge as Mideast war rages, stocks fall on US jobs

-

Dupont says France must forget Six Nations title talk against Scotland

-

Voices from Iran: protests, fear and scarcity

Voices from Iran: protests, fear and scarcity

-

Champions League ambitions encourage Barca gamble in Bilbao

-

This is how Ukraine has countered Russia's Iran-designed drones

This is how Ukraine has countered Russia's Iran-designed drones

-

Dybala out for six weeks as Roma battle for top-four spot

Loar Announces Pricing of Upsized Public Offering

Loar Holdings Inc. (NYSE:LOAR) ("Loar"), announced today the pricing of its upsized public offering of 5,750,000 shares of its common stock, including 1,897,500 shares offered by certain stockholders and 3,852,500 shares offered by Loar at $85.00 per share. The selling stockholders have granted the underwriters a 30-day option to purchase up to an additional 862,500 shares of common stock at the public offering price, less underwriting discounts and commissions. The offering is expected to close on December 12, 2024, subject to customary closing conditions.

Loar intends to use the net proceeds from this offering for repayment of borrowings outstanding under its credit agreement and, to the extent of any remaining proceeds, for general corporate purposes, including working capital. Loar will not receive any of the proceeds from the sale of common stock offered by the selling stockholders, including any common stock sold pursuant to any exercise by the underwriters of their option to purchase additional shares.

Jefferies and Morgan Stanley are acting as lead book runners for the offering and Moelis is acting as joint book runner. Citigroup and RBC Capital Markets are additionally acting as book runners. Blackstone is acting as co-manager.

A registration statement relating to these securities has been filed with, and declared effective by, the Securities and Exchange Commission ("SEC"). This offering is being made only by means of a prospectus. When available, copies of the prospectus relating to the offering may be obtained by contacting Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison Avenue, New York, NY 10022, by telephone at (877) 821-7388 or by email at [email protected]; Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, New York 10014; and Moelis & Company LLC, Attention: Melissa Mariaschin, Managing Director and Head of Distribution, Capital Markets, 399 Park Avenue, 5th Floor, New York, NY 10022.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Loar

Loar Holdings Inc. is a diversified manufacturer and supplier of niche aerospace and defense components that are essential for today's aircraft and aerospace and defense systems. Loar has established relationships across leading aerospace and defense original equipment manufacturers and Tier Ones worldwide.

Forward-Looking Statements

This press release contains forward-looking statements, including statements regarding the public offering. These statements are not historical facts but rather are based on Loar's current expectations and projections regarding its business, operations and other factors relating thereto. Words such as "may," "will," "could," "would," "should," "anticipate," "predict," "potential," "continue," "expects," "intends," "plans," "projects," "believes," "estimates" and similar expressions are used to identify these forward-looking statements. Such forward-looking statements include, but are not limited to, statements relating to the proposed public offering, including the completion, size and timing of such offering, and the expected use of proceeds from the offering. These statements are only predictions and as such are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, uncertainties related to market conditions, volatility in the price of Loar's common stock, and other factors relating to Loar's business described in the prospectus included in Loar's Registration Statement on Form S-1, as it may be amended from time to time, and Loar's latest Quarterly Report on Form 10-Q, including under the caption "Risk Factors," and Loar's subsequent filings with the SEC. Any forward-looking statement in this press release speaks only as of the date of this release. Loar undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable laws.

Contact:

Ian McKillop

Loar Holdings Investor Relations

[email protected]

SOURCE: Loar Group Inc.

Y.Kobayashi--AMWN