-

Russell tops final practice in Melbourne as Antonelli crashes heavily

Russell tops final practice in Melbourne as Antonelli crashes heavily

-

Vibes war? Trump pitches Iran conflict on 'feeling'

-

Nepal's rapper-turned-politician looks set for landslide win

Nepal's rapper-turned-politician looks set for landslide win

-

Tatum's 'emotional' return sparks Celtics over Mavs

-

Rising US fuel prices risk sparking domestic wildfire for Trump

Rising US fuel prices risk sparking domestic wildfire for Trump

-

Questions over AI capability as tech guides Iran strikes

-

Trump convenes Latin American leaders to curb crime, immigration

Trump convenes Latin American leaders to curb crime, immigration

-

Venezuela inflation hit 475% in 2025, the world's highest level

-

Only Iran's 'unconditional surrender' can end war: Trump

Only Iran's 'unconditional surrender' can end war: Trump

-

Former 100m champion Kerley banned two years over whereabouts failures

-

Sabalenka opens Indian Wells bid with dominant win

Sabalenka opens Indian Wells bid with dominant win

-

Doris relieved Ireland's slim title hopes intact after 'scrappy' win over Welsh

-

Man City aren't a 'complete team' admits Guardiola

Man City aren't a 'complete team' admits Guardiola

-

Arteta warns Arsenal to preserve reputation in Mansfield clash

-

Timothee Chalamet taken to task over opera, ballet dig

Timothee Chalamet taken to task over opera, ballet dig

-

Ireland keep title hopes alive in thrilling win over Wales

-

Hungary has not returned cash seized from bank workers, Kyiv says

Hungary has not returned cash seized from bank workers, Kyiv says

-

Napoli secure first Serie A home win since January

-

Valverde strikes late as Real Madrid beat Celta Vigo

Valverde strikes late as Real Madrid beat Celta Vigo

-

PSG beaten by Monaco ahead of Chelsea Champions League showdown

-

Liverpool tame Wolves to reach FA Cup quarter-finals

Liverpool tame Wolves to reach FA Cup quarter-finals

-

Kane-less Bayern brush aside Gladbach to continue title march

-

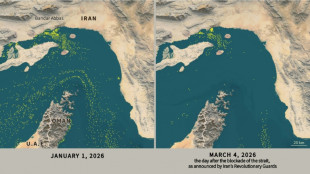

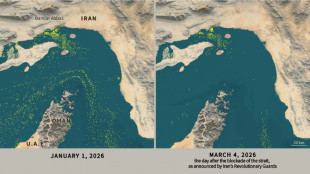

Only nine commercial ships detected crossing Hormuz Strait since Monday

Only nine commercial ships detected crossing Hormuz Strait since Monday

-

Berger extends lead midway through Arnold Palmer Invitational

-

Paralympics open with Russian athletes booed in ceremony

Paralympics open with Russian athletes booed in ceremony

-

Cuba 'next' on agenda, after Iran: Trump

-

Zverev leads way into Indian Wells third round

Zverev leads way into Indian Wells third round

-

NASA defense test kicked asteroid off course -- and changed its orbit around the sun

-

Anthropic vows court fight in Pentagon row

Anthropic vows court fight in Pentagon row

-

'Harder path': Obama attacks Trump at Jesse Jackson memorial

-

Amber Glenn says will not visit White House to celebrate Olympic gold

Amber Glenn says will not visit White House to celebrate Olympic gold

-

Russian athletes booed as they parade under own flag at Paralympics opening

-

Trump to attend return of six US troops killed in Iran war

Trump to attend return of six US troops killed in Iran war

-

Tom Brady flag football event moved from Saudi to Los Angeles: reports

-

UN chief slams 'unlawful attacks', says Mideast could spiral out of control

UN chief slams 'unlawful attacks', says Mideast could spiral out of control

-

Middle East war a new shock for financial markets

-

Only nine commercial ships detected crossing the Hormuz Strait since Monday

Only nine commercial ships detected crossing the Hormuz Strait since Monday

-

Mexico unveils 100,000-strong security deployment for World Cup

-

Trump's Iran war violates international law, experts say

Trump's Iran war violates international law, experts say

-

Swiss eyeing fewer F-35 fighters, reshaping defence set-up

-

UK police question three women in Al-Fayed probe

UK police question three women in Al-Fayed probe

-

Oil prices surge as Mideast war rages, stocks fall on US jobs

-

Dupont says France must forget Six Nations title talk against Scotland

Dupont says France must forget Six Nations title talk against Scotland

-

Voices from Iran: protests, fear and scarcity

-

Champions League ambitions encourage Barca gamble in Bilbao

Champions League ambitions encourage Barca gamble in Bilbao

-

This is how Ukraine has countered Russia's Iran-designed drones

-

Dybala out for six weeks as Roma battle for top-four spot

Dybala out for six weeks as Roma battle for top-four spot

-

Sleepless Iranians count cost of war as damage mounts

-

Itoje tells faltering England to 'take the game to Italy' in Six Nations

Itoje tells faltering England to 'take the game to Italy' in Six Nations

-

Leading satellite firm to hold back Gulf state images

First Abu Dhabi Bank and Libre Capital Sign MoU to Explore RWA Collateralised Lending

First Abu Dhabi Bank (FAB) has signed a Memorandum of Understanding (MoU) with Libre Capital, a technology firm specialising in blockchain-based investment infrastructure and backed by Further Ventures, to explore innovative approaches to collateralised lending using public blockchains and tokenised RWAs.

The collaboration will combine Libre's onchain primary issuance infrastructure and lending capabilities with FAB's financial expertise and liquidity to create a fully automated, transparent, and efficient lending ecosystem. By using high-quality tokenised fund assets as collateral, the initiative aims to redefine Net Asset Value (NAV) financing, thereby unlocking new opportunities for accredited and institutional borrowers on public blockchain networks.

This MOU sets the foundation for a multi-phased approach to onchain collateralised lending, with the potential to transform traditional lending paradigms. The initial phase will pilot a credit line for stablecoin lending, backed by tokenised money market funds created by globally recognised asset managers. The system will leverage blockchain technology for automated collateral management, real-time NAV updates via oracles, and smart contract-enabled loan monitoring.

With daily liquidity, seamless fund disbursements, and automated risk management, this initiative positions both organisations as leaders in blockchain-enabled NAV financing. It also paves the way for institutional participation in compliant tokenised markets, thereby bridging the gap between traditional finance and decentralised ecosystems, while ensuring adherence to regulatory requirements across all jurisdictions.

Libre's technology ushers in a new era of frictionless finance by allowing institutional or accredited investors to borrow against their holdings in tokenised financial assets. These assets are pledged to platform lenders and securely locked in smart contract vaults for the loan duration. This innovative lending format delivers unmatched efficiencies, including faster loan disbursement, cost-effectiveness, and complete onchain transparency.

Speaking at the signing, Sameh Al Qubaisi, Group Head of Global Markets, highlighted, "FAB's involvement in this initiative underscores our commitment to drive innovation in the UAE's financial landscape. Through this initiative, FAB aims to enable secure credit facilities backed by tokenised assets, with automated processes ensuring robust risk management and complete regulatory compliance. This venture aligns seamlessly with the UAE's vision to become a global hub for financial and technological excellence."

Dr. Avtar Sehra, founder and CEO of Libre, emphasised, "This partnership epitomises the transformative power of blockchain and RWAs in reimagining capital markets. Together with FAB, we are laying the foundation for a future where access to liquidity is seamless, secure, and globally interconnected."

Faisal Al Hammadi, Managing Partner of Further Ventures, added "At Further Ventures, we strongly believe in the transformative impact that tokenisation will have in reshaping the delivery of financial services. Through this partnership, we demonstrate how the UAE can continue to be a leader in digital asset adoption across institutional use cases."

Early shareholders in Libre include Nomura's Laser Digital and WebN Group.

PR Contact:

Libre Capital

[email protected]

SOURCE: Libre Capital

L.Durand--AMWN