-

Extensive destruction in Beirut's southern suburbs following Israeli strikes

Extensive destruction in Beirut's southern suburbs following Israeli strikes

-

'Super special' Allen can light up big occasion for New Zealand

-

'Genie' Bumrah: India's yorker king who carries a billion hopes

'Genie' Bumrah: India's yorker king who carries a billion hopes

-

'There will be nerves': India face New Zealand for T20 World Cup glory

-

Lufthansa warns of heightened 'uncertainty' from Mideast war

Lufthansa warns of heightened 'uncertainty' from Mideast war

-

Mideast war enters 'next phase' as strikes hit Iran, Lebanon

-

Sri Lanka denounces war deaths, houses Iran sailors

Sri Lanka denounces war deaths, houses Iran sailors

-

Inoue primed for 'historic' Nakatani clash in Tokyo

-

Italy challenges EU over key climate tool

Italy challenges EU over key climate tool

-

Home hero Piastri edges Antonelli in second Australian GP practice

-

Australia forces porn sites to block under-18s from Monday

Australia forces porn sites to block under-18s from Monday

-

Ukraine accuses Hungary of taking 'hostage' bank staff carrying $40 mn

-

Aston Martin chief Newey says no quick fix to vibration problems

Aston Martin chief Newey says no quick fix to vibration problems

-

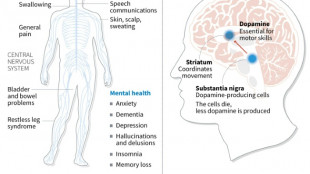

Japan approves stem-cell treatment for Parkinson's in world first

-

Heavy attacks hit Tehran as Israel says war in 'new phase'

Heavy attacks hit Tehran as Israel says war in 'new phase'

-

North Korea thrash Bangladesh in Women's Asian Cup warning

-

Hong Kong mogul Jimmy Lai will not appeal national security conviction: lawyer

Hong Kong mogul Jimmy Lai will not appeal national security conviction: lawyer

-

Eight dead, four missing in Brazil seniors home collapse

-

Paralympics brace for tense opening as Russia comes in from the cold

Paralympics brace for tense opening as Russia comes in from the cold

-

Leclerc edges Hamilton to go fastest in first Australian GP practice

-

Equities mostly drop as Mideast crisis rages, though oil dips

Equities mostly drop as Mideast crisis rages, though oil dips

-

Nepal counts votes after key post-uprising election

-

Italy half-backs can make difference against England: ex-coach Mallett

Italy half-backs can make difference against England: ex-coach Mallett

-

Scotland coach Townsend hails 'instinctive' France ahead of key Six Nations game

-

French starlet Seixas to take on Pogacar at Strade Bianche

French starlet Seixas to take on Pogacar at Strade Bianche

-

Brazil's Petrobras sees profit soar on record output

-

Arsenal, Chelsea aim to avoid FA Cup upsets

Arsenal, Chelsea aim to avoid FA Cup upsets

-

US, Venezuela restore ties as Washington pushes for minerals access

-

Middle East war enters seventh day as Israel strikes Beirut

Middle East war enters seventh day as Israel strikes Beirut

-

Qualifier Parry ends Venus's desert dream

-

Iran missile barrage sparks explosions over Tel Aviv

Iran missile barrage sparks explosions over Tel Aviv

-

Avio Signed $65m Contract for New Solid Rocket Motor Development Project in the USA

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 06

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 06

-

US says Venezuela to protect mining firms as diplomatic ties restored

-

Trump honors Messi and MLS Cup champion Miami teammates

Trump honors Messi and MLS Cup champion Miami teammates

-

Dismal Spurs can still avoid relegation vows Tudor

-

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

-

Morocco part company with coach Regragui as World Cup looms

-

Lens beat Lyon on penalties to reach French Cup semis

Lens beat Lyon on penalties to reach French Cup semis

-

El Salvador's Bukele holding dozens of political prisoners: rights group

-

With Iran war, US goes it alone like never before

With Iran war, US goes it alone like never before

-

Spurs slip deeper into relegation trouble after loss to Palace

-

Pete Hegseth: Trump's Iran war attack dog

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

CSPi Reports Fiscal Fourth Quarter and Full Year 2024 Results; Recurring Sales Continue to Rise as Percentage of Total Revenue; AZT PROTECT Market Momentum Builds; Cash Position of More Than $30 Million as of September 30, 2024

Board Declares $0.03 per Share Quarterly Dividend

Board Declares $0.03 per Share Quarterly Dividend

CSP Inc. (NASDAQ:CSPI), an award-winning provider of security and packet capture products, managed IT and professional services and technology solutions, today announced results for the fiscal fourth quarter and year ended September 30, 2024. The Company also announced that the Board of Directors declared a quarterly dividend of $0.03 per share payable January 15, 2025, to shareholders of record at the close of business on December 27, 2024.

Recent Achievements and Operating Highlights

Cloud-based business remains strong with over 10 new customers signed in the fourth quarter.

Recurring revenue increases to approximately 17% of total revenue.

Strong relationship with Rockwell Automation generates over 100 new business leads for AZT PROTECT™ at recent conference.

Cruise line business bookings and pipeline positioned for strong fiscal year 2025.

Record cash level of $30.6 million as of September 30, 2024 allows the company to implement near and long-term business initiatives to generate sustained growth and profitability.

"Our results for the fiscal fourth quarter and full year were in-line with our internal projections as we completed a sales force transition and built market interest in our AZT PROTECT™ product line," commented Victor Dellovo, Chief Executive Officer. "Our business activity towards the end of the quarter was above normal and allowed us to sign several new customers during fiscal 2025 first quarter for both our Technology Solutions (TS) and High Performance Products (HPP) businesses. We believe this momentum increases our growth prospects during fiscal 2025, which is anticipated to be led by continued growth of Managed Services, an increase in our cruise line business, and new AZT PROTECT™ customers. Our partnership with Rockwell Automation is building and has substantially increased our active AZT PROTECT™ leads. We have aligned our sales strategy to maximize AZT PROTECT™ market adoption by focusing on working with partners and distributors. These activities also complement our strategy of focusing on higher margin products and services, which has enabled us to grow the recurring business to 17% of fiscal 2024 sales compared to under 5% of sales just two years ago - with additional growth expected for fiscal 2025."

Fiscal 2024 Fourth Quarter Results

Revenue for the fiscal fourth quarter ended September 30, 2024, was $13.0 million compared to revenue of $15.3 million for the fiscal fourth quarter ended September 30, 2023. Services revenue represented $4.0 million of overall sales compared to the year-ago services revenue of $4.3 million. Gross profit for the three months ended September 30, 2024, was $3.7 million, or 28.4% of sales, compared to $5.2 million, or 33.8% of sales. The Company reported a net loss of $(1.7) million, or $(0.18) per diluted common share for the fiscal fourth quarter ended September 30, 2024, compared to net income of $1.4 million, or $0.15 per diluted common share for the fiscal fourth quarter ended September 30, 2023.

The Company had cash and cash equivalents of $30.6 million as of September 30, 2024. The robust balance sheet ensures the Company has the resources to implement the AZT PROTECT™ product offering and other growth strategies. During the fiscal fourth quarter 2024, the Company repurchased 2,800 shares for a total cost of $34 thousand.

Fiscal Year 2024 Full Year Results

Revenue for the fiscal year ended September 30, 2024, was $55.2 million compared with revenue of $64.6 million in the same prior year period. Gross profit for the fiscal year ended September 30, 2024, was $18.9 million, or 34.1% of sales compared with $21.9 million, or 33.9% of sales. The decline in gross profit was largely due to product mix. The Company reported a net loss of $(0.3) million, or $(0.04) per diluted common share in the fiscal year ended September 30, 2024, compared with net income of $5.2 million, or $0.55 per diluted common share for the fiscal year ended September 30, 2023.

Conference Call Details

CSPi Chief Executive Officer Victor Dellovo and Chief Financial Officer Gary W. Levine will host a conference call at 10:00 a.m. (ET) today to review CSPi's financial results and provide a business update. To listen to a live webcast of the call, the event link https://www.webcaster4.com/Webcast/Page/2912/51805. Individuals also may listen to the call via telephone, by dialing 888-506-0062 or 973-528-0011 and use the Participant Access Code: 221929 when greeted by the live operator when greeted by the live operator. For interested parties unable to participate in the live call, an archived version of the webcast will be available for approximately one year on CSPi's website.

About CSPi

CSPi (NASDAQ:CSPI) operates two divisions, each with unique expertise in designing and implementing technology solutions to help customers use technology to success. The High Performance Product division, including ARIA Cybersecurity Solutions, recognizes that better, stronger, more effective cybersecurity starts with a smarter approach. ARIA's solutions provide new ways for organizations to protect their most critical assets-they can shield their critical applications from cyberattack with the AZT solution, while monitoring internal traffic, device-level logs, and alert output with our ARIA ADR solution to substantially improve threat detection and surgically disrupt cyberattacks and data exfiltration. Rounding out the portfolio, Aria's AZT Gateway Software allows us to interrogate network packets at 100mbps line-rate to enforce forwarding and capture policies on the fly. Customers in a range of industries rely on our solutions to accelerate incident response, automate breach detection, and protect their most critical assets and applications-no matter where they are stored, used, or accessed.

CSPi's Technology Solutions division helps clients achieve their business goals and accelerate time to market through innovative IT solutions and professional services by partnering with best-in-class technology providers. For organizations that want the benefits of an IT department without the cost, we offer a robust catalog of Managed IT Services providing 24×365 proactive support. Our team of engineers have expertise across major industries supporting five key technology areas: Advanced Security; Communication and Collaboration; Data Center; Networking; and Wireless & Mobility.

Safe Harbor

The Company wishes to take advantage of the "Safe Harbor" provisions of the Private Securities Litigation Reform Act of 1995 with respect to statements that may be deemed to be forward-looking under the Act. Such forward-looking statements may include but are not limited to, projections or guidance concerning business performance, revenue, earnings, cash flow, the current economic environment, liquidity, strategic decisions and actions, and other financial and operational measures.

The Company cautions that numerous factors could cause actual results to differ materially from forward-looking statements made by the Company. Such risks include general economic conditions, market factors, competitive factors and pricing pressures, and others described in the Company's filings with the Securities and Exchange Commission ("SEC"). Please refer to the section on forward-looking statements included in the Company's filings with the SEC.

CONTACT:

CSP Inc.

Gary Levine, 978-954-5040

Chief Financial Officer

CSP INC. AND SUBSIDIARIES

CONDENSED UNAUDITED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

September 30, 2024 | September 30, 2023 | |||

Assets | ||||

Current assets: | ||||

Cash and cash equivalents | $ | 30,585 | $ | 25,217 |

Accounts receivable, net | 14,494 | 12,955 | ||

Financing receivables, net | 4,384 | 7,171 | ||

Inventories | 2,293 | 2,542 | ||

Other current assets | 3,093 | 2,479 | ||

Total current assets | 54,849 | 50,364 | ||

Financing receivables due after one year, net | 2,922 | 4,224 | ||

Cash surrender value of life insurance | 5,589 | 5,356 | ||

Other assets | 6,076 | 5,960 | ||

Total assets | $ | 69,436 | $ | 65,904 |

Liabilities and Shareholders' Equity | ||||

Current liabilities | $ | 18,682 | $ | 15,659 |

Pension and retirement plans | 1,306 | 1,251 | ||

Other non-current liabilities | 2,178 | 2,846 | ||

Shareholders' equity | 47,270 | 46,148 | ||

Total liabilities and shareholders' equity | $ | 69,436 | $ | 65,904 |

CSP INC. AND SUBSIDIARIES

CONDENSED UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except per share data )

Three months ended | Year ended | ||||||||||

September 30, | September 30, | September 30, | September 30, | ||||||||

2024 | 2023 | 2024 | 2023 | ||||||||

Sales: | |||||||||||

Product | $ | 9,083 | $ | 11,006 | $ | 36,793 | $ | 47,149 | |||

Services | 3,950 | 4,320 | 18,426 | 17,498 | |||||||

Total sales | 13,033 | 15,326 | 55,219 | 64,647 | |||||||

Cost of sales: | |||||||||||

Product | 7,633 | 8,213 | 28,800 | 35,524 | |||||||

Services | 1,700 | 1,927 | 7,564 | 7,203 | |||||||

Total cost of sales | 9,333 | 10,140 | 36,364 | 42,727 | |||||||

Gross profit | 3,700 | 5,186 | 18,855 | 21,920 | |||||||

Operating expenses: | |||||||||||

Engineering and development | 793 | 705 | 2,956 | 3,140 | |||||||

Selling, general and administrative | 4,950 | 4,787 | 17,771 | 16,910 | |||||||

Total operating expenses | 5,743 | 5,492 | 20,727 | 20,050 | |||||||

Operating (loss) income | (2,043 | ) | (306 | ) | (1,872 | ) | 1,870 | ||||

Other income (expense), net | 221 | 2,733 | 1,453 | 2,865 | |||||||

(Loss) income before income taxes | (1,822 | ) | 2,427 | (419 | ) | 4,735 | |||||

Income tax (benefit) expense | (166 | ) | 1,019 | (93 | ) | (469 | ) | ||||

Net (loss) income | $ | (1,656 | ) | $ | 1,408 | $ | (326 | ) | $ | 5,204 | |

Net (loss) income attributable to common shareholders | $ | (1,656 | ) | $ | 1,320 | $ | (326 | ) | $ | 4,884 | |

Net (loss) income per common share - basic | $ | (0.18 | ) | $ | 0.15 | $ | (0.04 | ) | $ | 0.56 | |

Weighted average shares outstanding - basic | 9,121 | 8,853 | 9,041 | 8,762 | |||||||

Net (loss) income per common share - diluted | $ | (0.18 | ) | $ | 0.15 | $ | (0.04 | ) | $ | 0.55 | |

Weighted average shares outstanding net income - diluted | 9,121 | 9,053 | 9,041 | 8,941 | |||||||

SOURCE: CSP Inc.

P.Mathewson--AMWN