-

Sri Lanka denounces war deaths, houses Iran sailors

Sri Lanka denounces war deaths, houses Iran sailors

-

Inoue primed for 'historic' Nakatani clash in Tokyo

-

Italy challenges EU over key climate tool

Italy challenges EU over key climate tool

-

Home hero Piastri edges Antonelli in second Australian GP practice

-

Australia forces porn sites to block under-18s from Monday

Australia forces porn sites to block under-18s from Monday

-

Ukraine accuses Hungary of taking 'hostage' bank staff carrying $40 mn

-

Aston Martin chief Newey says no quick fix to vibration problems

Aston Martin chief Newey says no quick fix to vibration problems

-

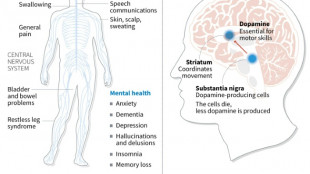

Japan approves stem-cell treatment for Parkinson's in world first

-

Heavy attacks hit Tehran as Israel says war in 'new phase'

Heavy attacks hit Tehran as Israel says war in 'new phase'

-

North Korea thrash Bangladesh in Women's Asian Cup warning

-

Hong Kong mogul Jimmy Lai will not appeal national security conviction: lawyer

Hong Kong mogul Jimmy Lai will not appeal national security conviction: lawyer

-

Eight dead, four missing in Brazil seniors home collapse

-

Paralympics brace for tense opening as Russia comes in from the cold

Paralympics brace for tense opening as Russia comes in from the cold

-

Leclerc edges Hamilton to go fastest in first Australian GP practice

-

Equities mostly drop as Mideast crisis rages, though oil dips

Equities mostly drop as Mideast crisis rages, though oil dips

-

Nepal counts votes after key post-uprising election

-

Italy half-backs can make difference against England: ex-coach Mallett

Italy half-backs can make difference against England: ex-coach Mallett

-

Scotland coach Townsend hails 'instinctive' France ahead of key Six Nations game

-

French starlet Seixas to take on Pogacar at Strade Bianche

French starlet Seixas to take on Pogacar at Strade Bianche

-

Brazil's Petrobras sees profit soar on record output

-

Arsenal, Chelsea aim to avoid FA Cup upsets

Arsenal, Chelsea aim to avoid FA Cup upsets

-

US, Venezuela restore ties as Washington pushes for minerals access

-

Middle East war enters seventh day as Israel strikes Beirut

Middle East war enters seventh day as Israel strikes Beirut

-

Qualifier Parry ends Venus's desert dream

-

Iran missile barrage sparks explosions over Tel Aviv

Iran missile barrage sparks explosions over Tel Aviv

-

US says Venezuela to protect mining firms as diplomatic ties restored

-

Trump honors Messi and MLS Cup champion Miami teammates

Trump honors Messi and MLS Cup champion Miami teammates

-

Dismal Spurs can still avoid relegation vows Tudor

-

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

-

Morocco part company with coach Regragui as World Cup looms

-

Lens beat Lyon on penalties to reach French Cup semis

Lens beat Lyon on penalties to reach French Cup semis

-

El Salvador's Bukele holding dozens of political prisoners: rights group

-

With Iran war, US goes it alone like never before

With Iran war, US goes it alone like never before

-

Spurs slip deeper into relegation trouble after loss to Palace

-

Pete Hegseth: Trump's Iran war attack dog

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

Kick Off the 2024 Tax Season with TaxBandits: Solutions to E-file Forms 1099, W-2, 94x, 1095, and Manage W-9

Tax season has arrived, and TaxBandits is prepared to simplify year-end filings for businesses, accountants, and tax professionals nationwide. As a trusted IRS-authorized e-file provider, TaxBandits offers a user-friendly platform and dedicated customer support, making it easier to manage W-9 forms and file essential IRS forms such as 1099s, W-2s, 94x, ACA 1095, etc.

As year-end deadlines approach, it is crucial for businesses and tax professionals to stay ahead of their tax reporting. TaxBandits offers all the essential tools to ensure tax forms are filed securely and accurately by the January 31, 2025, deadline.

TaxBandits: The Go-To Solution for Secure E-filing

With a comprehensive platform, TaxBandits serves as an all-in-one solution that caters to the unique needs of businesses, tax professionals, and service providers. Here are some of the advantages of choosing TaxBandits:

Smart Solutions to Meet 1099/W-2 Filing Requirements

Supports Federal and State Filing: TaxBandits supports both federal and state filing of 1099, W-2, and other forms, ensuring seamless filing that meets all the required deadlines. TaxBandits helps to comply with state-specific reporting by supporting required reconciliation forms.

Recipient Copy Distribution: TaxBandits provides flexible options for recipient copy distribution, including postal mail, online access, or a combination of both. These options ensure timely and secure delivery, giving recipients multiple ways to access their form copies conveniently.

Advanced Bulk Upload Options: TaxBandits allows clients to upload W-2,1099-NEC, 1099-MISC, and other 1099 form data using the standard CSV template or by mapping data directly from their own files. Additional features, such as the 'Copy and Paste' option and integrations with popular accounting software (QuickBooks, Xero, ZohoBooks, and FreshBooks), further simplify the filing process.

TaxBandits and Sage Intacct Partnership: The ongoing partnership between TaxBandits and Sage Intacct enables seamless automation of 1099 e-filing with both the IRS and state agencies, helping clients save time and ensure compliance.

Corrections: TaxBandits supports corrections for previously filed forms such as 1099s and W-2s. For W-2 forms, clients can file corrections even if the original form was filed through another e-file service provider.

Free Retransmission: TaxBandits offers a seamless solution for handling rejected 1099 and W-2 forms. If a federal or state agency rejects the forms due to errors, quickly correct the errors and retransmit the returns at no additional cost.

W-9 Manager: TaxBandits' W-9 Manager is a comprehensive solution designed to simplify the entire process of handling Form W-9. This feature enables businesses and tax professionals to efficiently collect, manage, and organize W-9 forms from their clients within a user-friendly platform.

TIN Matching: This feature allows businesses and tax professionals to validate the TINs provided by recipients through Form W-9 using the IRS database. This ensures that the TINs are accurate and compliant with IRS regulations.

Comprehensive 94x Filing Features

TaxBandits simplifies quarterly and annual payroll tax reporting with robust features for 94x forms:

Zero Reporting: Businesses with no wages or taxes to report can use the zero-wage reporting option to file Form 941 quickly and accurately.

Copy Return: Reuse data from previously filed 94x returns to save time and reduce errors.

941-X Filing: Correct errors in previously filed 941 forms by electronically filing 941-X with ease.

Balance Due Payment Options: Conveniently pay balances for 94x forms using credit/debit cards, EFW, or EFTPS.

941 Schedule B: Include the necessary Schedule B at no additional cost for employers following a semi-weekly deposit schedule.

Advanced Features for Tax Professionals

BanditConnect (Client Portal): TaxBandits is the first to offer a secure, branded client portal for CPAs and tax professionals. BanditConnect eliminates insecure communication channels, enabling professionals to collaborate with clients seamlessly while sharing sensitive tax documents securely.

BanditCollab (Team Management): Designed for efficient workflow management, BanditCollab allows account admins to invite team members, assign specific clients, and organize groups with controlled access levels. This feature ensures effective task delegation and secure collaboration on a unified platform.

Multi E-sign: For 94x forms, tax pros can easily send multiple e-sign requests to the clients and sign multiple returns at once using Form 8453-EMP and Form 8879-EMP.

When asked about TaxBandits' role in the upcoming tax season, Naga Palanisamy, President and Co-Founder of SPAN Enterprises, the parent company of TaxBandits, shared:

"TaxBandits provides a powerful e-file solution designed to meet the needs of every business. Its easy filing process and affordable pricing make it an excellent choice for small business owners. With built-in client and staff management tools, as well as integrations with popular accounting software like QuickBooks, Sage Intacct, and Xero, it's also an ideal solution for tax professionals and large enterprises."

Businesses, tax professionals, and service providers can e-file 1099-NEC, W-2, and other year-end tax filings at TaxBandits.com by signing up for a free account today.

About TaxBandits

TaxBandits is a SOC 2 Certified, IRS-authorized e-file provider specializing in various tax forms such as Form 941, Form 940, Form 1099, Form W-2, Form 1095-C, Form 1095-B, and Form W-9. Serving businesses, service providers, or tax professionals of every shape and size, TaxBandits offers a complete solution that fulfills all filing needs.

TaxBandits provides another advantage for high-volume filers and software providers. TaxBandits API enables seamless preparation and e-filing of 1099, W-2, 941, 940, and ACA 1095 forms and BOI reporting. Use the developer filing 1099 API to request W-9 and automate the filing efficiently.

About SPAN Enterprises

Headquartered in Rock Hill, South Carolina, SPAN Enterprises has created cutting-edge software solutions for e-filing and business management for over ten years. The suite of products includes TaxBandits, Tax990, TaxExemptBonds, ACAwise, ExpressExtension, 123PayStubs, and TruckLogics.

Please direct all media inquiries to Stephanie Glanville, Marketing Manager, at [email protected].

SOURCE: TaxBandits

M.Thompson--AMWN