-

Spurs slip deeper into relegation trouble after loss to Palace

Spurs slip deeper into relegation trouble after loss to Palace

-

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

Leagues Cup to hold matches in Mexico for first time

-

India reach T20 World Cup final after England fail in epic chase

-

Conservative Anglicans press opposition to Church's first woman leader

Conservative Anglicans press opposition to Church's first woman leader

-

Sri Lanka takes control of Iranian ship fearing new US sub attack

-

Iran players sing anthem and salute at Women's Asian Cup

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

-

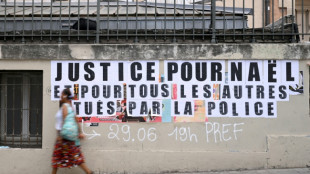

French policeman to be tried over 2023 killing of teen

French policeman to be tried over 2023 killing of teen

-

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Oil prices rise, stocks drop as Middle East war stirs supply concerns

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

Second Iranian ship nears Sri Lanka after submarine attack

-

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

Australia join South Korea in quarters of Women's Asian Cup

-

Stocks, oil climb as Middle East war stirs volatility

-

Kane to miss Bayern game against Gladbach with calf knock

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

India's 'digital arrest' scammers stealing savings

Within five hours while sitting at home in India, retired professor Kamta Prasad Singh handed over his hard-earned savings to online fraudsters impersonating police.

The cybercrime known as "digital arrest" -- where fraudsters pose online as law enforcement officials and order people to transfer huge amounts of money -- has become so rampant that Prime Minister Narendra Modi has issued warnings.

Singh told AFP that money was his life savings.

"Over the years, I have skipped having tea outside, walked to avoid spending on public transport," the 62-year-old said, his voice breaking.

"Only I know how I saved my money."

Police say scammers have exploited the vast gap between the breakneck speed of India's data digitalisation, from personal details to online banking, and the lagging awareness of many of basic internet safety.

Fraudsters are using technology for data breaches, targeting information their victims believe is only available to government authorities, and making otherwise unlikely demands appear credible.

Indians have emptied their bank accounts "out of sheer fear", Modi said in an October radio broadcast, adding fraudsters "create so much psychological pressure on the victim".

- 'Ruined' -

Mobile phones, and especially video calling, have allowed fraudsters to reach straight into people's homes.

India runs the world's largest biometric digital identity programme -- called "Aadhaar", or foundation in Hindi -- a unique card issued to India's more than one billion people, and increasingly required for financial transactions.

Scammers often claim they are police investigating questionable payments, quoting their target's Aadhaar number to appear genuine.

They then request their victim make a "temporary" bank transfer to validate their accounts, before stealing the cash.

Singh, from India's eastern state of Bihar, said the web of lies began when he received a call in December, seemingly from the telecom regulatory authority.

"They said... police were on their way to arrest me," Singh said.

The fraudsters told Singh that his Aadhaar ID was being misused for illegal payments.

Terrified, Singh agreed to prove he had control of his bank account, and after spiralling threats, transferred over $16,100.

"I have lost sleep, don't feel like eating," he said. "I have been ruined."

- 'Rot in proverbial hell' -

The surge of online scams is worrying because of "how valid they make it look and sound", said police officer Sushil Kumar, who handled cybercrimes for half a decade.

The perpetrators range from school dropouts to highly educated individuals.

"They know what to search for on the internet to find out basic details of how government agencies work," Kumar added.

India registered 17,470 cybercrimes in 2022, including 6,491 cases of online bank fraud, according to the latest government data.

Tricks vary. Kaveri, 71, told AFP her story on condition her name was changed.

She said fraudsters posed as officials from the US courier FedEx, claiming she had sent a package containing drugs, passports and credit cards.

They offered her full name and Aadhaar ID details as "proof", followed by well-forged letters from the Central Bank of India and Central Bureau of Investigation, the country's top investigative agency.

"They wanted me to send money, which would be returned in 30 minutes," she said, adding she was convinced when they sent a "properly signed letter".

She transferred savings from a house sale totalling around $120,000 in four instalments over six days before the fraudsters vanished.

Kaveri says those days felt "like a tunnel".

Meeta, 35, a private health professional from Bengaluru who also did not want to be identified, was conned by fake police via a video call.

"It seemed like a proper police station, with walkie-talkie noises," she said.

The scammers told her to prove she controlled her bank account by taking out a 200,000 rupee ($2,300) loan via her bank's phone app, before demanding she make a "temporary" transfer.

Despite making it clear to the bank that she had been scammed, Meeta continues to be asked to pay back the loan.

"My trust in banks has mostly gone," she said, before cursing the thieves.

"I hope they rot in proverbial hell."

P.Mathewson--AMWN