-

Beijing votes out three generals from political advisory body

Beijing votes out three generals from political advisory body

-

The French village where Ayatollah Khomeini fomented Iran's revolution

-

South Africa, India eye T20 World Cup rematch as semi-finals begin

South Africa, India eye T20 World Cup rematch as semi-finals begin

-

Trump hosts Germany's Merz for talks eclipsed by Mideast war

-

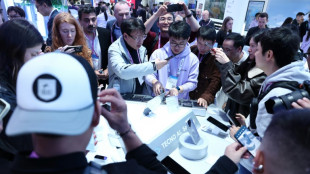

Second-hand phones surf rising green consumer wave

Second-hand phones surf rising green consumer wave

-

Pakistanis at remote border describe scramble to leave Iran

-

China votes to oust three generals from political advisory body

China votes to oust three generals from political advisory body

-

Murray scores 45 as Nuggets hold off Jazz

-

Five things about the 2026 F1 season

Five things about the 2026 F1 season

-

Scrum-half Gibson-Park: Ireland's 'petit general'

-

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

-

Myong hat-trick as North Korea cruise at Women's Asian Cup

-

AI disinformation turns Nepal polls into 'digital battleground'

AI disinformation turns Nepal polls into 'digital battleground'

-

New Israel, Iran attacks across region: Latest developments in Middle East war

-

China's overstretched healthcare looks to AI boom

China's overstretched healthcare looks to AI boom

-

Oil extends gains and stocks drop as Iran conflict spreads

-

Rituals of resilience: how Afghan women stay sane in their 'cage'

Rituals of resilience: how Afghan women stay sane in their 'cage'

-

Strait of Hormuz impasse squeezes world shipping

-

Oscar-nominated Iranian doc offers different vision of leadership

Oscar-nominated Iranian doc offers different vision of leadership

-

Oscar-nominated docs take on hot-button US social issues

-

'I couldn't breathe': The dark side of Bolivia's silver boom

'I couldn't breathe': The dark side of Bolivia's silver boom

-

Underground party scene: Israelis celebrate Purim in air raid shelters

-

Flowers, music, and soldiers at funeral of drug lord

Flowers, music, and soldiers at funeral of drug lord

-

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

-

Trump to attend White House Correspondents' dinner

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 03

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 03

-

New eBook Challenges the Popular Narrative That Manifestation Is Always Positive

-

Trump warns of longer Iran war as violence spreads

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

Rubio, Hezbollah and Qatar: Latest developments in Iran war

-

Rubio says Israel's strike plan triggered US attack on Iran

-

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

-

Bombing Iran, Trump has 'epic fury' but endgame undefined

-

US slaps sanctions on Rwanda military over DR Congo 'violation'

US slaps sanctions on Rwanda military over DR Congo 'violation'

-

US Congress to debate Trump's war powers

-

US appeals court denies Trump bid to delay tariff refund lawsuits

US appeals court denies Trump bid to delay tariff refund lawsuits

-

Trump warns of longer Iran war

-

Fire-damaged Six nations trophy to be replaced

Fire-damaged Six nations trophy to be replaced

-

Trump mulls ground troops: latest developments in US-Iran war

-

Middle East war puts shipping firms in tight insurance spot

Middle East war puts shipping firms in tight insurance spot

-

Qatar downs Iran jets as Tehran targets oil and gas in spiralling Gulf crisis

-

UK PM says US will not use British bases in Cyprus

UK PM says US will not use British bases in Cyprus

-

Can Anthropic survive taking on Trump's Pentagon?

-

Real Madrid superstar Mbappe in Paris for treatment on knee injury

Real Madrid superstar Mbappe in Paris for treatment on knee injury

-

Mideast war risks sending global economy into stagflation

SCI Engineered Materials, Inc. Reports 2024 Fourth Quarter and Year-to-Date Results

COLUMBUS, OH / ACCESS Newswire / February 14, 2025 / SCI Engineered Materials, Inc. ("SCI") (OTCQB:SCIA), today reported financial results for the three months and twelve months ended December 31, 2024.

Jeremy Young, President and Chief Executive Officer, said "We continued to implement our growth strategy throughout 2024, despite signs of slower economic activity during the second half of the year. Specific initiatives currently being implemented include targeted digital online marketing campaigns, active participation in industry trade shows and maintaining close customer contact through in-person visits. These activities are increasing SCI's brand recognition and have resulted in additional cross-selling opportunities with existing customers and the addition of new customers, especially for toll manufacturing services. We plan to launch new products in 2025 which further leverage SCI's manufacturing capabilities and offer customers innovative solutions for their markets."

Revenue

The Company's revenue for the twelve months ended December 31, 2024, was $22,870,192 compared to $27,984,083 the prior year. Fourth quarter 2024 revenue was $5,051,150 versus $7,029,123 for the same period in 2023. Lower cost of a key raw material was the primary factor concerning the revenue decrease in 2024 versus 2023. Product mix and a slight decrease in volume also contributed to lower revenue for the full-year and fourth quarter of 2024. Order backlog was $2.5 million on December 31, 2024, compared to $3.0 million at September 30, 2024.

Gross profit

Gross profit was $5,068,301 for the year 2024 compared to $5,251,633 in 2023. The Company's gross profit for the fourth quarter of 2024 was $1,184,953 versus $1,286,763 the prior year. Lower raw material costs were the key factor contributing to the decrease in gross profit. Gross profit margin for both periods in 2024 benefited from lower raw material costs and product mix compared to a year ago.

Operating expenses

Operating expenses (general and administrative, research & development (R&D), and marketing and sales) for the twelve months ended December 31, 2024, increased approximately 10% to $3,023,535 from $2,757,385 a year ago. Higher compensation and benefit expenses, which included increased staff, and additional R&D materials and supplies, were partially offset by lower consulting and travel expenses. The Company's operating expenses for the fourth quarter of 2024 decreased 5% to $702,764 from $741,768 in 2023. Lower R&D and marketing and sales expenses offset slightly higher general and administrative expense.

Net interest income

Net interest income was $393,441 for the year 2024 versus $286,361 in 2023, an increase of 37%. The Company's net interest income increased to $102,533 for the fourth quarter of 2024 from $92,218 a year ago. Both periods in 2024 benefited from higher cash and cash equivalents and increased investments in marketable securities compared to the same periods of the prior year.

Income taxes

Income tax expense decreased slightly to $576,818 for the year 2024 from $586,710 in 2023. The Company's effective tax rate was 23.6% for the twelve months ended December 31, 2024, compared to 21.1% in 2023.

Net income

Net income was $1,861,389, or $0.41 per diluted share, for the twelve months ended December 31, 2024, compared to $2,193,899, or $0.48 per diluted share, in 2023. For the year 2024, increased net interest income partially offset lower gross profit and higher operating expenses. The Company's 2024 fourth quarter net income was $428,981, or $0.09 per diluted share, compared to $565,736, or $0.12 per diluted share, the prior year. Net income for the fourth quarter of 2024 benefited from lower operating expenses and higher net interest income, which partially offset lower gross profit.

Cash and cash equivalents

Cash and cash equivalents were $6,753,403 at December 31, 2024, versus $5,673,994 on the same date a year ago, an increase of 19%. There were $2,758,478 and $1,994,478 of investments in marketable securities at December 31, 2024 and 2023, respectively. The Company's 2024 year-end cash and cash equivalents benefited from increased net cash provided by operating activities, partially offset by the purchase of $750,000 of marketable securities and approximately $500,000 for the acquisition of production equipment during the year.

Debt outstanding

The Company had no debt outstanding at December 31, 2024, compared to $49,149 a year ago. A final lease payment was made during the third quarter of 2024.

About SCI Engineered Materials, Inc.

SCI Engineered Materials is a global supplier and manufacturer of advanced materials for PVD thin film applications who works closely with end users and OEMs to develop innovative, customized solutions. Additional information is available at www.sciengineeredmaterials.com or follow SCI Engineered Materials, Inc. at:

https://www.linkedin.com/company/sci-engineered-materials.-inc

https://www.facebook.com/sciengineeredmaterials/

https://x.com/SciMaterials

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created thereby. Those statements include, but are not limited to, all statements regarding intent, beliefs, expectations, projections, customer guidance, forecasts, plans of the Company and its management. These forward-looking statements involve numerous risks and uncertainties, including without limitation, other risks and uncertainties detailed from time to time in the Company's Securities and Exchange Commission filings, including the Company's Annual Report on Form 10-K for the year ended December 31, 2024. One or more of these factors have affected and could affect the Company's projections in the future. Therefore, there can be no assurances that the forward-looking statements included in this press release will prove to be accurate. Due to the significant uncertainties in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company, or any other persons, that the objectives and plans of the Company will be achieved. All forward-looking statements made in this press release are based on information presently available to the management of the Company. The Company assumes no obligation to update any forward-looking statements.

Contact: Robert Lentz

(614) 439-6006

SCI ENGINEERED MATERIALS, INC.

BALANCE SHEETS

ASSETS | ||||

DECEMBER 31, | DECEMBER 31, | |||

2024 | 2023 | |||

Current Assets | ||||

Cash and cash equivalents | $ | 6,753,403 | $ | 5,673,994 |

Investments - marketable securities, short term | 509,478 | 1,000,000 | ||

Accounts receivable, less allowance for doubtful accounts | 775,288 | 910,647 | ||

Inventories | 1,432,914 | 4,654,398 | ||

Prepaid purchase orders and expenses | 238,834 | 1,338,438 | ||

Total current assets | 9,709,917 | 13,577,477 | ||

Property and Equipment, at cost | 9,904,028 | 9,603,316 | ||

Less accumulated depreciation | (7,632,946 | ) | (7,359,310 | ) |

Property and equipment, net | 2,271,082 | 2,244,006 | ||

Investments, net - marketable securities, long term | 2,249,000 | 994,478 | ||

Right of use asset, net | 1,236,572 | 592,170 | ||

Other assets | 66,394 | 78,289 | ||

Total other assets | 3,551,966 | 1,664,937 | ||

TOTAL ASSETS | $ | 15,532,965 | $ | 17,486,420 |

LIABILITIES AND SHAREHOLDERS' EQUITY | ||||

Current Liabilities | ||||

Short term debt | $ | - | $ | 49,149 |

Operating lease, short term | 174,863 | 111,193 | ||

Accounts payable | 419,209 | 385,489 | ||

Customer deposits | 337,873 | 4,871,035 | ||

Accrued expenses | 532,260 | 527,595 | ||

Total current liabilities | 1,464,205 | 5,944,461 | ||

Deferred tax liability | 121,649 | 69,846 | ||

Operating lease, long term | 1,061,709 | 492,080 | ||

Total liabilities | 2,647,563 | 6,506,387 | ||

Total Shareholders' Equity | 12,885,402 | 10,980,033 | ||

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 15,532,965 | $ | 17,486,420 |

SCI ENGINEERED MATERIALS, INC.

STATEMENTS OF INCOME

THREE MONTHS ENDED | YEAR ENDED | ||||||||||

2024 | 2023 | 2024 | 2023 | ||||||||

Revenue | $ | 5,051,150 | $ | 7,029,123 | $ | 22,870,192 | $ | 27,984,083 | |||

Cost of revenue | 3,866,197 | 5,742,360 | 17,801,891 | 22,732,450 | |||||||

Gross profit | 1,184,953 | 1,286,763 | 5,068,301 | 5,251,633 | |||||||

General and administrative expense | 513,489 | 486,111 | 1,939,895 | 1,771,263 | |||||||

Research and development expense | 74,697 | 129,530 | 564,576 | 501,937 | |||||||

Marketing and sales expense | 114,578 | 126,127 | 519,064 | 484,185 | |||||||

Income from operations | 482,189 | 544,995 | 2,044,766 | 2,494,248 | |||||||

Interest income, net | 102,533 | 92,218 | 393,441 | 286,361 | |||||||

Income before provision for income taxes | 584,722 | 637,213 | 2,438,207 | 2,780,609 | |||||||

Income tax expense | 155,741 | 71,477 | 576,818 | 586,710 | |||||||

NET INCOME | $ | 428,981 | $ | 565,736 | $ | 1,861,389 | $ | 2,193,899 | |||

Earnings per share - basic and diluted | |||||||||||

Income per common share | |||||||||||

Basic | $ | 0.09 | $ | 0.12 | $ | 0.41 | $ | 0.48 | |||

Diluted | $ | 0.09 | $ | 0.12 | $ | 0.41 | $ | 0.48 | |||

Weighted average shares outstanding | |||||||||||

Basic | 4,568,127 | 4,530,207 | 4,551,763 | 4,528,948 | |||||||

Diluted | 4,572,555 | 4,561,481 | 4,556,285 | 4,559,786 | |||||||

SCI ENGINEERED MATERIALS, INC.

CONDENSED STATEMENTS OF CASH FLOWS

FOR THE TWELVE MONTHS ENDED DECEMBER 31,

2024 | 2023 | |||

CASH PROVIDED BY (USED IN): | ||||

Operating activities | $ | 2,369,815 | $ | 2,281,279 |

Investing activities | (1,241,257 | ) | (457,884 | ) |

Financing activities | (49,149 | ) | (97,367 | ) |

NET INCREASE IN CASH | 1,079,409 | 1,726,028 | ||

CASH - Beginning of period | 5,673,994 | 3,947,966 | ||

CASH - End of period | $ | 6,753,403 | $ | 5,673,994 |

SOURCE: SCI Engineered Materials, Inc.

View the original press release on ACCESS Newswire

B.Finley--AMWN