-

Pro-Iran protesters try to storm US missions in Pakistan, Iraq

Pro-Iran protesters try to storm US missions in Pakistan, Iraq

-

8 killed in pro-Iran protest at US consulate in Pakistan's Karachi

-

Latest developments after US, Israeli strikes kill Iran's Khamenei

Latest developments after US, Israeli strikes kill Iran's Khamenei

-

Before dawn, ancient drum rite wakes Istanbul faithful to fast

-

Music, mourning as Iran's Khamenei is killed

Music, mourning as Iran's Khamenei is killed

-

Pakistan cricket's lack of T20 evolution exposed by World Cup exit

-

Cobolli downs Tiafoe to claim Mexican Open

Cobolli downs Tiafoe to claim Mexican Open

-

Takele defends Tokyo Marathon title after sprint finish

-

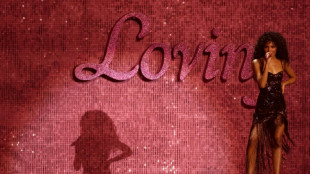

Hollywood's finest gather for guild's Actor Awards

Hollywood's finest gather for guild's Actor Awards

-

Iran prepare for Women's Asian Cup as bombs drop on homeland

-

Doncic shines as Lakers cruise past depleted Warriors

Doncic shines as Lakers cruise past depleted Warriors

-

3D tool Unreal Engine makes real impact in creative industries

-

OPEC+ mulls oil production increase in shadow of war

OPEC+ mulls oil production increase in shadow of war

-

Putin, Russia's eternal leader defined by war and power

-

Explosion, gunfire as Afghan forces shoot at aircraft over Kabul

Explosion, gunfire as Afghan forces shoot at aircraft over Kabul

-

Iranians across North America rally for -- and against -- strikes

-

Shakespeare would have shunned streaming, 'Hamnet' team says

Shakespeare would have shunned streaming, 'Hamnet' team says

-

Will Oscars be 17th time lucky for songwriter Diane Warren?

-

Sympathy for the bedeviled: the likable conspiracy theorist of 'Bugonia'

Sympathy for the bedeviled: the likable conspiracy theorist of 'Bugonia'

-

Texas port humming as Trump ramps up Venezuela oil

-

76ers' center Embiid to miss at least three games with oblique strain

76ers' center Embiid to miss at least three games with oblique strain

-

US, Israel defend strikes at UN as Iran alleges 'war crime'

-

Brumbies' 'mental resolve' keeps them unbeaten in Super Rugby

Brumbies' 'mental resolve' keeps them unbeaten in Super Rugby

-

Iran attacks rock Dubai's Palm, Burj Al Arab, airport

-

JP Anderson Signs Landmark MOU with Vaama Village to Advance Rare Earth Mineral Development in Bonthe District

JP Anderson Signs Landmark MOU with Vaama Village to Advance Rare Earth Mineral Development in Bonthe District

-

Iran leader Khamenei killed in massive US and Israeli attack, Trump says

-

UK pop-soul star Olivia Dean sweeps Brit Awards

UK pop-soul star Olivia Dean sweeps Brit Awards

-

Iranians across North America take to the streets for - and against - strikes

-

'Turning point' as Crusaders notch first Super Rugby win

'Turning point' as Crusaders notch first Super Rugby win

-

White House releases photos of Trump, Vance during Iran ops

-

PSG win to extend lead over Lens at top of Ligue 1

PSG win to extend lead over Lens at top of Ligue 1

-

Barca's Yamal nets hat-trick in Villarreal romp, Atletico go third

-

Trump says Khamenei is dead after Israel, US attack Iran

Trump says Khamenei is dead after Israel, US attack Iran

-

Iran's Khamenei: ruthless revolutionary atop Islamic republic

-

Inter continue Scudetto march after Champions League humbling

Inter continue Scudetto march after Champions League humbling

-

Questions cloud Trump's case for war against Iran

-

Latest developments in US, Israel strikes on Iran

Latest developments in US, Israel strikes on Iran

-

Fears of Mideast war as US-Iran conflict flares

-

Guardiola expects short absence for injured Haaland

Guardiola expects short absence for injured Haaland

-

Liverpool's set play transformation a return to 'normal' for Slot

-

Man City win to close on Arsenal as Liverpool hit five

Man City win to close on Arsenal as Liverpool hit five

-

Kane bags brace as Bayern end Dortmund's title hopes

-

Semenyo sinks Leeds as Man City close gap on Arsenal

Semenyo sinks Leeds as Man City close gap on Arsenal

-

Last-gasp Lukaku saves Napoli's blushes at rock-bottom Verona

-

Could the US-Israel war on Iran drag on?

Could the US-Israel war on Iran drag on?

-

Iranians abroad jittery but jubilant at US, Israeli strikes

-

Pakistan 'have underperformed' says Agha after T20 World Cup exit

Pakistan 'have underperformed' says Agha after T20 World Cup exit

-

Under-strength Toulouse overpower Montauban in Top 14

-

Vietnam AI law takes effect, first in Southeast Asia

Vietnam AI law takes effect, first in Southeast Asia

-

Brazil's Lula visits flood zone as death toll from landslides hits 70

Loar Announces Launch of Secondary Public Offering

WHITE PLAINS, NY / ACCESS Newswire / May 13, 2025 / Loar Holdings Inc. (NYSE:LOAR) ("Loar") announced today the launch of a secondary underwritten public offering of 9,000,000 shares of its common stock by certain of its stockholders. In addition, such selling stockholders expect to grant the underwriters a 30-day option to purchase up to 1,350,000 additional shares of common stock at the public offering price, less underwriting discounts and commissions.

Such selling stockholders will receive all of the proceeds from this offering. Loar is not selling any shares of common stock in this offering and will not receive any proceeds from this offering.

Jefferies and Morgan Stanley are acting as lead book runners for the proposed offering. Blackstone is acting as co-manager.

An automatic shelf registration statement (including a base prospectus) relating to this offering of common stock was filed by Loar with the Securities and Exchange Commission (the "SEC") on May 1, 2025 and became effective upon filing. The proposed offering of these shares will be made only by means of a prospectus supplement and accompanying base prospectus related to the offering filed with the SEC. A copy of the preliminary prospectus supplement and accompanying base prospectus may be obtained by contacting Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison Avenue, New York, NY 10022, by telephone at (877) 821-7388 or by email at [email protected]; and Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, New York 10014.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The offering is subject to market conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering.

About Loar

Loar Holdings Inc. is a diversified manufacturer and supplier of niche aerospace and defense components that are essential for today's aircraft and aerospace and defense systems. Loar has established relationships across leading aerospace and defense original equipment manufacturers and Tier Ones worldwide.

Forward-Looking Statements

This press release contains forward-looking statements, including statements regarding the public offering. These statements are not historical facts but rather are based on Loar's current expectations and projections regarding its business, operations and other factors relating thereto. Words such as "may," "will," "could," "would," "should," "anticipate," "predict," "potential," "continue," "expects," "intends," "plans," "projects," "believes," "estimates" and similar expressions are used to identify these forward-looking statements. Such forward-looking statements include, but are not limited to, statements relating to the proposed public offering, including the size and timing of such offering. These statements are only predictions and as such are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, uncertainties related to market conditions, volatility in the price of Loar's common stock, and other factors relating to Loar's business described in the prospectus included in Loar's Registration Statement on Form S-3, as it may be amended from time to time, and a related preliminary prospectus supplement related to the offering filed with the SEC, including Loar's latest Annual Report on Form 10-K, including under the caption "Risk Factors," and Loar's subsequent filings with the SEC incorporated by reference therein. Any forward-looking statement in this press release speaks only as of the date of this release. Loar undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable laws.

CONTACT:

Ian McKillop

Loar Holdings Investor Relations

[email protected]

SOURCE: Loar Group Inc.

View the original press release on ACCESS Newswire

D.Sawyer--AMWN