-

In Iran attack, Trump seeks what he foreswore -- regime change

In Iran attack, Trump seeks what he foreswore -- regime change

-

Climate change forces facelift for Michelangelo masterpiece

-

Trump says US aims to destroy Iran's military, topple government

Trump says US aims to destroy Iran's military, topple government

-

Acosta wins season-opening MotoGP sprint after Marquez penalty

-

US and Israel launch strikes against Iran

US and Israel launch strikes against Iran

-

Afghanistan says Pakistan fighter jet down as cross-border strikes flare

-

Kerr says only '85 percent' fit for Women's Asian Cup

Kerr says only '85 percent' fit for Women's Asian Cup

-

Messi's Inter Miami to visit White House: US media

-

Thunder beat Nuggets in overtime on Gilgeous-Alexander's return

Thunder beat Nuggets in overtime on Gilgeous-Alexander's return

-

'It's surreal': Zimbabwe superfans revel in unexpected ride to India

-

New 'Wuthering Heights' film unleashes fresh wave of Bronte-mania

New 'Wuthering Heights' film unleashes fresh wave of Bronte-mania

-

US backs Pakistan's 'right to defend itself' after strikes on Afghanistan

-

Bezzecchi beats Marquez to pole at season-opening Thailand MotoGP

Bezzecchi beats Marquez to pole at season-opening Thailand MotoGP

-

OpenAI strikes Pentagon deal with 'safeguards' as Trump dumps Anthropic

-

Oscar-nominated 'F1' sound engineers recreate roar of racetrack

Oscar-nominated 'F1' sound engineers recreate roar of racetrack

-

15 dead as cash-packed military plane crashes in Bolivia

-

Costa Rica's Grynspan pledges reform in bid for UN chief job

Costa Rica's Grynspan pledges reform in bid for UN chief job

-

Former All Black Bridge hailed for influence at Western Force

-

'Sinners' vampires inspired by animals, says Oscar hopeful makeup artist

'Sinners' vampires inspired by animals, says Oscar hopeful makeup artist

-

For Oscar nominee Stellan Skarsgard, good cinema is like slow food

-

'Brilliant industry' sees Reds down Highlanders in Super Rugby

'Brilliant industry' sees Reds down Highlanders in Super Rugby

-

Neil Sedaka, US singer and songwriter, dies age 86

-

Paramount acquires Warner Bros. in $110 bn mega-merger

Paramount acquires Warner Bros. in $110 bn mega-merger

-

Rosenior eyes extended stay to stabilise Chelsea

-

Spurs struggling physically admits Tudor

Spurs struggling physically admits Tudor

-

Lens held by Strasbourg in blow to Ligue 1 title chances

-

NFL salary cap passes $300 mn for first time

NFL salary cap passes $300 mn for first time

-

Wolves secure rare win to dent Villa's bid for Champions League place

-

Oil prices jump on Iran attack fears while US stocks fall

Oil prices jump on Iran attack fears while US stocks fall

-

Two dead, dozens injured as tram derails in Milan

-

Trump tells US govt to 'immediately' stop using Anthropic AI tech

Trump tells US govt to 'immediately' stop using Anthropic AI tech

-

Court orders Greenpeace to pay $345 mn to US oil pipeline company

-

IAEA stresses 'urgency' to verify Iran's nuclear material

IAEA stresses 'urgency' to verify Iran's nuclear material

-

UN urges action to prevent full civil war in South Sudan

-

Hackers steal medical details of 15 million in France

Hackers steal medical details of 15 million in France

-

Susan Sarandon praises Spain’s stance on Gaza

-

Murray adamant size isn't everything despite losing Wales place

Murray adamant size isn't everything despite losing Wales place

-

Messi knocked down by fan in Puerto Rico pitch invasion

-

Two killed, dozens injured as tram derails in Milan

Two killed, dozens injured as tram derails in Milan

-

O'Neill taken aback by Rangers boss Rohl's comments on Celtic

-

Ukrainian, Slovak leaders hold call amid energy spat

Ukrainian, Slovak leaders hold call amid energy spat

-

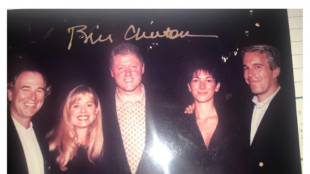

French hard-left firebrand sparks row with 'antisemitic' Epstein jibe

-

Ahmed, Jacks blast England to thrilling win over New Zealand

Ahmed, Jacks blast England to thrilling win over New Zealand

-

UK police arrest man after Churchill statue sprayed with graffiti

-

Bill Clinton denies wrongdoing at grilling on Epstein ties

Bill Clinton denies wrongdoing at grilling on Epstein ties

-

Red Cross urges Afghanistan-Pakistan 'de-escalation'

-

Coup role revelations revive calls for return of Spain's ex king

Coup role revelations revive calls for return of Spain's ex king

-

Oil prices jump on Iran attack fears, Wall Street slips on AI

-

TikTok disinformation: the other weapon in Mexico violence

TikTok disinformation: the other weapon in Mexico violence

-

Carmaker BMW to trial humanoid robots at German factory

SonicStrategy Approaches 15M Sonic Tokens Staked and Delegated, with 3.7 BTC Held in Treasury

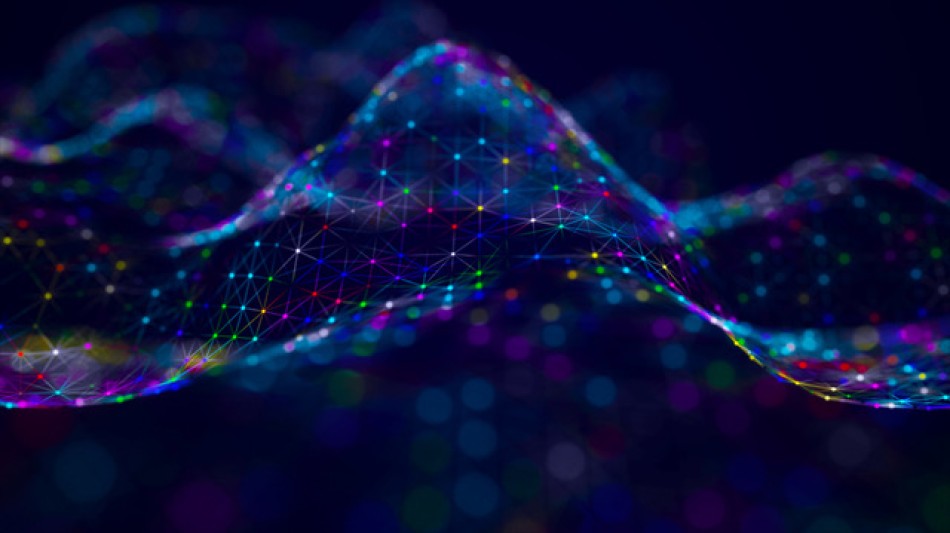

TORONTO, ON / ACCESS Newswire / June 25, 2025 / SonicStrategy Inc., the blockchain infrastructure subsidiary of Spetz Inc. (CSE:SPTZ)(OTC:DBKSF), is pleased to announce further expansion of its digital asset position within the Sonic blockchain ecosystem.

The Company has acquired an additional 1,000,000 Sonic (S) tokens on the open market at an average cost of approximately $0.3724 CAD ($0.2711 USD) per token, representing a total investment of $373,000 CAD. This acquisition brings the Company's direct holdings to over 8,200,000 S tokens, reflecting its conviction in Sonic as a next-generation Layer 1 blockchain.

The Company's institutional-grade validator continues to see growing adoption, with total delegated tokens now exceeding 6,740,000 S, up from 3,700,000 just a few days prior (see figure 1 below). Independent Sonic holders continue to delegate to SonicStrategy's validator infrastructure, trusting in its security, uptime, and performance to generate and distribute staking rewards efficiently.

Taken together, SonicStrategy now has exposure to nearly 15,000,000 S tokens, combining direct holdings and third-party validator delegations. This level of engagement underscores the Company's commitment to building sustainable economic infrastructure within the Sonic ecosystem while generating long-term yield for stakeholders.

The Company also continues to hold 3.7 BTC as part of its broader digital asset treasury strategy, and approximately $3,000,000 CAD.

Figure 1 - Screenshot from Sonic Labs Validator Portal showing SonicStrategy's institutional-grade validator (ID #45), with 500,000 S tokens self-staked and 6,741,069.789 S tokens delegated by third-party token holders.

The Company also announces that it has entered into a market making agreement, effective June 5th, 2025, with Independent Trading Group (ITG) Inc., a CIRO member firm based in Toronto, to provide market making services for its common shares traded on the Canadian Securities Exchange with the objective of maintaining a reasonable market and improving the liquidity of the Company's shares. Under the terms of the agreement, Spetz Inc. will pay a monthly service fee of $5,000 CAD. There are no performance obligations contained in the agreement and ITG will not receive shares, options or any other form of equity in the Company as compensation. The agreement is renewable monthly and may be terminated by either party with 30 days' notice. ITG and the Company are arm's-length parties, and ITG and its principals do not currently own or have any interest, directly or indirectly, in the securities of the Company, however, ITG and its clients may acquire an interest in the securities of the Company in the future.

Further updates will be provided as SonicStrategy executes additional capital deployment and staking strategies across the network.

For more information, visit:

SonicStrategy: www.sonicstrategy.io

About Spetz Inc. (dba SonicStrategy)

Spetz Inc. (dba SonicStrategy) (CSE:SPTZ)(OTC PINK:DBKSF) is the parent company of SonicStrategy Inc., a public-market gateway to the Sonic blockchain ecosystem. Spetz provides investors with compliant exposure to staking infrastructure and DeFi strategies across the Sonic network.

Company Contacts:

Investor Relations

Email: [email protected]

Mitchell Demeter

Email: [email protected]

Phone: 345-936-9555

NEITHER THE CANADIAN SECURITIES EXCHANGE, NOR THEIR REGULATION SERVICES PROVIDERS HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Note Regarding Forward-looking Statements

Certain information herein constitutes "forward-looking information" under Canadian securities laws, reflecting management's expectations regarding objectives, plans, strategies, future growth, results of operations, and business prospects of the Company. Words such as "may", "plans," "expects," "intends," "anticipates," "believes," and similar expressions identify forward-looking statements, which are qualified by the inherent risks and uncertainties surrounding future expectations.

Forward-looking statements are based on a number of estimates and assumptions that, while considered reasonable by management, are subject to business, economic, and competitive uncertainties and contingencies. The Company cautions readers not to place undue reliance on these statements, as forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from projected outcomes. Factors influencing these outcomes include economic conditions, regulatory developments, competition, capital availability, and business execution risks. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur.

The forward-looking information contained in this press release represents Spetz's expectations as of the date of this release and is subject to change. Spetz does not undertake any obligation to update forward-looking statements, except as required by law.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, and shall not constitute an offer, solicitation or sale in any state, province, territory or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state, province, territory or jurisdiction. None of the securities issued in the Private Placement will be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), and none of them may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act.

We seek Safe Harbor.

SOURCE: Spetz Inc

View the original press release on ACCESS Newswire

G.Stevens--AMWN