-

Iranian in possible prisoner exchange faces 'terrorism' verdict in France

Iranian in possible prisoner exchange faces 'terrorism' verdict in France

-

'Street-smart' New Zealand can topple England to make T20 semis: coach

-

Iran-US talks begin in push to avert war

Iran-US talks begin in push to avert war

-

Merz says Germany, China must overcome trade gaps 'together'

-

Automaker Stellantis posts massive loss, pivots from EV

Automaker Stellantis posts massive loss, pivots from EV

-

US, Ukraine to meet in Geneva after overnight Russian strikes

-

Snake-like robot unveiled for Fukushima debris removal

Snake-like robot unveiled for Fukushima debris removal

-

'Public lynching': Senegal cracks down on LGBTQ+ community

-

Hong Kong sentences father of wanted activist to 8 months in jail

Hong Kong sentences father of wanted activist to 8 months in jail

-

The woman fighting to reclaim her face from Albania's 'AI minister'

-

Bulgaria ski station becomes refuge for digital nomads

Bulgaria ski station becomes refuge for digital nomads

-

Thai runner-up party seeks criminal case against election officials

-

North Korea's Kim shuns South but could 'get along' with US

North Korea's Kim shuns South but could 'get along' with US

-

Spurs win 10th straight, Pistons silence Thunder in battle of NBA's best

-

Germany's Merz visits China AI hub hoping for business deals

Germany's Merz visits China AI hub hoping for business deals

-

Post-uprising polls won't shake Nepal's delicate India-China balance

-

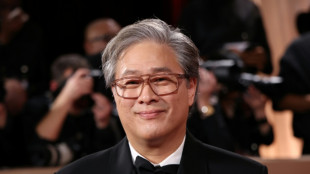

S.Korea's Park Chan-wook to head Cannes festival jury

S.Korea's Park Chan-wook to head Cannes festival jury

-

Australian ex-PM says 'more important than ever' to ditch UK monarchy

-

Dressed for succession? Kim Jong Un, daughter fuel speculation with matching coats

Dressed for succession? Kim Jong Un, daughter fuel speculation with matching coats

-

US-Ukraine talks to open in Geneva after overnight Russian strikes

-

Export ban sparks rush to process lithium in Zimbabwe

Export ban sparks rush to process lithium in Zimbabwe

-

Pakistani sculptor turns scrap into colossal metal artworks

-

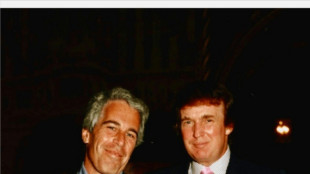

Epstein files reveal links to cash, women, power in Africa

Epstein files reveal links to cash, women, power in Africa

-

Where are Southeast Asia's data centres?

-

Where AI lives: Southeast Asia's data centre boom

Where AI lives: Southeast Asia's data centre boom

-

Seoul hits fresh record on mixed day for Asia markets

-

Kyiv residents pool together for solar panels and batteries amid Russian strikes

Kyiv residents pool together for solar panels and batteries amid Russian strikes

-

North Korea's Kim says could 'get along' with US but shuns South

-

Cuba kills four on US-registered speedboat trying to 'infiltrate'

Cuba kills four on US-registered speedboat trying to 'infiltrate'

-

UK Labour party threatened by hard-right, leftists in heartland

-

Australian PM sorry after saying sexual assault survivor 'difficult'

Australian PM sorry after saying sexual assault survivor 'difficult'

-

Kim Jong Un spurns olive branch from 'hostile' South Korea

-

DR Congo sanctuary resists bloody forest sell-off

DR Congo sanctuary resists bloody forest sell-off

-

North Korea looking to replicate youth success at Women's Asian Cup

-

Deal or no deal: What's the state of Trump's tariffs?

Deal or no deal: What's the state of Trump's tariffs?

-

Hillary Clinton to testify in US House panel's Epstein probe

-

African migrants won legal protections - then Trump deported them

African migrants won legal protections - then Trump deported them

-

US women's ice hockey captain responds to 'distasteful' Trump remark

-

US presses missile issue as new Iran talks to open in Geneva

US presses missile issue as new Iran talks to open in Geneva

-

US government accused of major 'cover-up' over Trump sex abuse claims

-

US eases Cuba oil embargo but demands 'dramatic' change

US eases Cuba oil embargo but demands 'dramatic' change

-

IMF urges US to work with partners to ease trade restrictions

-

Brumbies not getting carried away by emphatic Super Rugby start

Brumbies not getting carried away by emphatic Super Rugby start

-

Dr. Angela Zeng's TEDx Talk on Supporting Children's Mental Health Without Medication Goes Live

-

Truly Good Foods Unveils Golden Hour(TM) Snack Bars

Truly Good Foods Unveils Golden Hour(TM) Snack Bars

-

Renee Is Transforming AI Therapy, And It's Just Getting Started

-

Eagle Plains Increases Saskatchewan Gold Royalty Portfolio

Eagle Plains Increases Saskatchewan Gold Royalty Portfolio

-

Innovation Holds Key to Future Growth, New Research from Ipsos, Alchemy-RX and Market Logic Finds

-

Forecast Change for The 2025/2026 Fiscal Year

Forecast Change for The 2025/2026 Fiscal Year

-

Banyan Gold Continues to Intersect Visible Gold and High-Grade Mineralization in Powerline, Yukon, Canada

Security First International Holdings, Inc. Forges Groundbreaking Joint Venture with BTCx Developers to Establish Shareholder-Backed, Non-Custodial Bitcoin Treasury Reserve

FORT LAUDERDALE, FL / ACCESS Newswire / August 4, 2025 / Security First International Holdings, Inc. (OTC:SCFR), a diversified holding company with a focus on innovative financial solutions, today announced a strategic joint venture with the BTCx Developer Team, the creators of BTCx, a leading Bitcoin derivative token. This partnership aims to pioneer a revolutionary model for corporate treasury management, allowing Security First to integrate Bitcoin exposure into its balance sheet while empowering its shareholders with a unique non-custodial backing mechanism.

This groundbreaking initiative will enable Security First International Holdings, Inc. to utilize BTCx as a core component of its corporate treasury reserves. What sets this venture apart is the innovative "shareholder-backed derivative reserve" model, designed to align the company's digital asset strategy with the principles of decentralization and individual asset control.

Under this model, participating Security First shareholders will have the unprecedented opportunity to voluntarily contribute their native Bitcoin (BTC) to a highly secure, transparent, and auditable multi-party computation (MPC) vault or a decentralized proof-of-reserve protocol managed by the BTCx developers. Crucially, these shareholders will retain ultimate control over their private keys through advanced cryptographic techniques, ensuring they never relinquish sole custody of their underlying Bitcoin. In return for their participation, these shareholders will receive newly minted BTCx tokens directly to their personal wallets, maintaining a verifiable 1:1 peg with their locked BTC.

Security First's corporate treasury will then acquire BTCx tokens, which are directly backed by this collective, shareholder-controlled Bitcoin reserve. This innovative structure provides Security First with Bitcoin price exposure and the flexibility of a tokenized asset, while offering unparalleled transparency and aligning directly with the self-custody ethos valued by the crypto community.

"This joint venture with the BTCx Developer Team represents a monumental leap forward for corporate treasury management and shareholder empowerment," said Brian Fowler, CEO of Security First International Holdings, Inc. "We are not just adding Bitcoin to our balance sheet; we are doing so in a way that respects the foundational principles of decentralization and individual ownership. By allowing our shareholders to non-custodially back our BTCx reserves, we are building a treasury strategy that is both secure and deeply aligned with our investor base, setting a new standard for public companies embracing digital assets."

The BTCx Developer Team brings robust blockchain infrastructure and expertise in maintaining the integrity and peg of the BTCx token. This collaboration will ensure the highest levels of security, transparency, and auditability for the underlying Bitcoin reserves.

Lead Developer for the BTCx Team, commented, "We are thrilled to partner with Security First International Holdings, Inc. on this visionary project. Their commitment to a non-custodial, shareholder-aligned treasury model perfectly showcases the power and flexibility of BTCx. This initiative will not only bolster Security First's financial strategy but also serve as a powerful testament to the utility and trustworthiness of tokenized Bitcoin in institutional settings."

The joint venture is expected to provide Security First with enhanced liquidity for its digital asset holdings, potential for yield generation through DeFi integrations enabled by BTCx, and a clear, auditable pathway for Bitcoin adoption. For shareholders, it offers a unique opportunity to support the company's growth while maintaining direct control over their Bitcoin.

About Security First International Holdings, Inc.:

Security First International Holdings, Inc. (OTC:SCFR) is a diversified holding company focused on identifying and developing innovative solutions across various sectors. With a commitment to security, transparency, and technological advancement, SCFR seeks to create long-term value for its shareholders through strategic investments and groundbreaking partnerships.

Contact:

Brian Fowler

CEO

[email protected]

https://yieldtether.com

SOURCE: Security First International Holdings, Inc.

View the original press release on ACCESS Newswire

A.Rodriguezv--AMWN