-

Spurs win 10th straight, Pistons silence Thunder in battle of NBA's best

Spurs win 10th straight, Pistons silence Thunder in battle of NBA's best

-

Germany's Merz visits China AI hub hoping for business deals

-

Post-uprising polls won't shake Nepal's delicate India-China balance

Post-uprising polls won't shake Nepal's delicate India-China balance

-

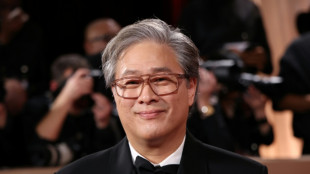

S.Korea's Park Chan-wook to head Cannes festival jury

-

Australian ex-PM says 'more important than ever' to ditch UK monarchy

Australian ex-PM says 'more important than ever' to ditch UK monarchy

-

Dressed for succession? Kim Jong Un, daughter fuel speculation with matching coats

-

US-Ukraine talks to open in Geneva after overnight Russian strikes

US-Ukraine talks to open in Geneva after overnight Russian strikes

-

Export ban sparks rush to process lithium in Zimbabwe

-

Pakistani sculptor turns scrap into colossal metal artworks

Pakistani sculptor turns scrap into colossal metal artworks

-

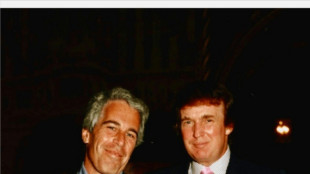

Epstein files reveal links to cash, women, power in Africa

-

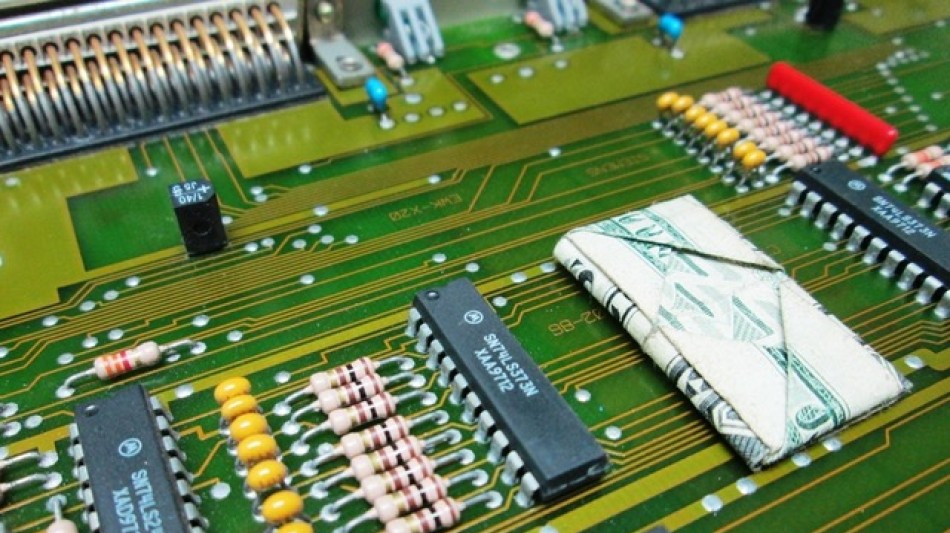

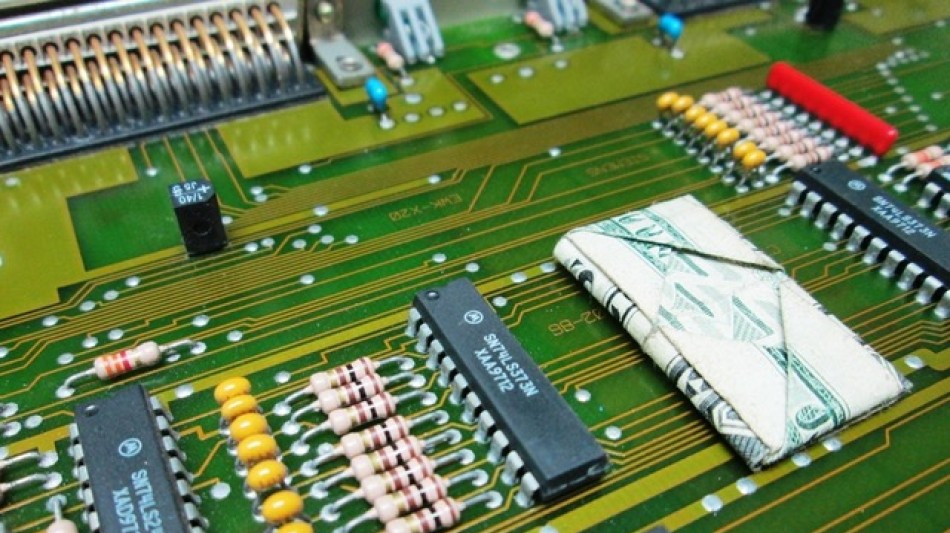

Where are Southeast Asia's data centres?

Where are Southeast Asia's data centres?

-

Where AI lives: Southeast Asia's data centre boom

-

Seoul hits fresh record on mixed day for Asia markets

Seoul hits fresh record on mixed day for Asia markets

-

Kyiv residents pool together for solar panels and batteries amid Russian strikes

-

North Korea's Kim says could 'get along' with US but shuns South

North Korea's Kim says could 'get along' with US but shuns South

-

Cuba kills four on US-registered speedboat trying to 'infiltrate'

-

UK Labour party threatened by hard-right, leftists in heartland

UK Labour party threatened by hard-right, leftists in heartland

-

Australian PM sorry after saying sexual assault survivor 'difficult'

-

Kim Jong Un spurns olive branch from 'hostile' South Korea

Kim Jong Un spurns olive branch from 'hostile' South Korea

-

DR Congo sanctuary resists bloody forest sell-off

-

North Korea looking to replicate youth success at Women's Asian Cup

North Korea looking to replicate youth success at Women's Asian Cup

-

Deal or no deal: What's the state of Trump's tariffs?

-

Hillary Clinton to testify in US House panel's Epstein probe

Hillary Clinton to testify in US House panel's Epstein probe

-

African migrants won legal protections - then Trump deported them

-

US women's ice hockey captain responds to 'distasteful' Trump remark

US women's ice hockey captain responds to 'distasteful' Trump remark

-

US presses missile issue as new Iran talks to open in Geneva

-

US government accused of major 'cover-up' over Trump sex abuse claims

US government accused of major 'cover-up' over Trump sex abuse claims

-

US eases Cuba oil embargo but demands 'dramatic' change

-

IMF urges US to work with partners to ease trade restrictions

IMF urges US to work with partners to ease trade restrictions

-

Brumbies not getting carried away by emphatic Super Rugby start

-

Cuba coast guard kills four on US-registered speedboat

Cuba coast guard kills four on US-registered speedboat

-

Juve lick wounds after painful Champions League exit

-

Real Madrid victory for 'everyone against racism': Tchouameni

Real Madrid victory for 'everyone against racism': Tchouameni

-

Wallabies skipper Wilson back from injury in clash of heavyweight coaches

-

PSG coach Luis Enrique calls on team to raise their game in Champions League last 16

PSG coach Luis Enrique calls on team to raise their game in Champions League last 16

-

Nvidia smashes forecasts with record quarter as AI boom rolls on

-

Vinicius seals Real Champions League progress as PSG edge out Monaco

Vinicius seals Real Champions League progress as PSG edge out Monaco

-

Galatasaray survive Juve scare to squeeze into Champions League last 16

-

PSG survive Monaco scare to reach Champions League last 16

PSG survive Monaco scare to reach Champions League last 16

-

Vinicius hits winner as Real Madrid eliminate Benfica after racism row

-

Harden fractures thumb in blow to in-form Cavaliers

Harden fractures thumb in blow to in-form Cavaliers

-

Hope fades in search for missing after Brazil rains kill 46

-

Trump, Zelensky speak before Ukraine-US talks in Geneva

Trump, Zelensky speak before Ukraine-US talks in Geneva

-

Scam centres 'destroying' Cambodia's economy, PM tells AFP

-

Last-gasp Atalanta eliminate Dortmund to reach Champions League last 16

Last-gasp Atalanta eliminate Dortmund to reach Champions League last 16

-

Iran negotiators arrive in Geneva for high-stakes US talks

-

Antonio Tejero, leader of Spain's failed 1981 coup, dies at 93

Antonio Tejero, leader of Spain's failed 1981 coup, dies at 93

-

Hakimi, set to face trial for rape, in PSG team for Champions League game

-

Eleven men lured into Russia war returned to South Africa

Eleven men lured into Russia war returned to South Africa

-

Brazil politicians convicted for ordering murder of black activist councilor

Peraso Announces Second Quarter 2025 Results

mmWave product revenue increased 45% sequentially and over 200% year-over-year

SAN JOSE, CALIFORNIA / ACCESS Newswire / August 11, 2025 / Peraso Inc. (NASDAQ:PRSO) ("Peraso" or the "Company"), a pioneer in mmWave wireless technology solutions, today announced financial results for the second quarter ended June 30, 2025.

Management Commentary

"Second quarter shipments reflected increased demand, as we continued to ramp shipments of our mmWave products," commented Ron Glibbery, CEO of Peraso. "Highlighting the sustained market leadership of our 60 GHz solutions, we recently achieved a significant milestone having surpassed two million cumulative shipments of our mmWave devices.

"Also notable during the quarter, a leading partner, Tachyon Networks, selected Peraso's mmWave module to power its latest 60 GHz fixed wireless solution for cost-effective deployments of fiber-class broadband in both urban and rural markets. Additionally, we delivered our first production shipments of advanced 60 GHz wireless solutions for a mission-critical defense application to our lead customer in the tactical communications market. We also demonstrated progress toward broadening our market reach, as we shipped a production order in support of a customer's wireless video system for classroom environments, expanding our served addressable market into education applications.

"Looking ahead, we are focused on continuing to ramp production shipments in support of an expanding customer base for our mmWave solutions, while also maintaining disciplined expense management. Based on our existing pipeline of customer engagements, as well as growing order backlog, we anticipate continued sequential growth and record revenue contribution from our mmWave products in the third quarter of 2025."

Second Quarter 2025 Financial Results

Total net revenue for the second quarter of 2025 was $2.2 million, compared with $3.9 million in the prior quarter and $4.2 million in the same quarter a year ago. Product revenue for the second quarter of 2025 was $2.2 million, compared with $3.8 million in the prior quarter and $4.1 million in the same quarter a year ago. The decrease in total revenue was primarily attributable to the completion of end-of-life shipments of memory IC products during the quarter ended March 31, 2025, partially offset by growth in shipments of mmWave products.

GAAP gross margin for the second quarter of 2025 was 48.3%, compared with 69.3% in the prior quarter and 55.5% in the same quarter a year ago. On a non-GAAP basis, gross margin for the second quarter of 2025 was also 48.3%, compared with 69.3% in the prior quarter and 68.8% in the same quarter a year ago. The decrease in GAAP gross margin for the second quarter of 2025 compared with the prior periods was primarily attributable to revenue mix being comprised entirely of mmWave products and solutions.

Total operating expenses on a GAAP basis for the second quarter of 2025 were $2.9 million, compared with $3.2 million in the prior quarter and $6.8 million in the same quarter a year ago. Operating expenses on a non-GAAP basis for the second quarter of 2025, which excluded stock-based compensation and severance expenses and amortization of intangible assets, were $2.7 million compared with $3.1 million in the prior quarter and $5.0 million in the same quarter a year ago. Operating expenses on both a GAAP and non-GAAP basis for the second quarter of 2024 included $1.6 million of charges for software license obligations. The sequential decrease in second quarter 2025 operating expenses on a GAAP basis was primarily attributable to reduced stock-based compensation expense and amortization expense related to intangible assets fully amortized as of December 31, 2024. The year-over-year decrease in second quarter 2025 operating expenses on a GAAP basis was primarily attributable to the software license obligations recorded in 2024, reduced stock-based compensation expense and amortization expense related to intangible assets fully amortized as of December 31, 2024.

GAAP net loss for the second quarter of 2025 was $1.8 million, or ($0.31) per share, compared with a net loss of $0.5 million, or ($0.08) per share, in the prior quarter and a net loss of $4.4 million, or ($1.88) per share, in the second quarter 0f 2024. Non-GAAP net loss, which also excludes the change in fair value of warrant liabilities, for the second quarter of 2025 was $1.7 million, or ($0.28) per share, compared with a net loss of $0.4 million, or ($0.07) per share, in the prior quarter and a net loss of $2.1 million, or ($0.88) per share, in the second quarter of 2024.

Adjusted EBITDA for the second quarter of 2025 was negative $1.6 million, compared with negative $0.3 million in the prior quarter and negative $1.9 million in the same quarter last year.

A reconciliation of GAAP to non-GAAP results and GAAP net loss to Adjusted EBITDA is provided in the financial statement tables following the text of this press release.

Business Outlook

The Company expects total net revenue for the third quarter of 2025 to be in the range of $2.8 million to $3.1 million.

Earnings Conference Call and Webcast Information

Ron Glibbery, CEO, and Jim Sullivan, CFO, will host a conference call and webcast with slides today, August 11, at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time).

Date: Monday, August 11, 2025

Time: 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time)

Conference Call Number: 1-888-506-0062

International Call Number: +1-973-528-0011

Participant Access Code: 367678

Webcast and Slides: Click Here

For those unable to listen to the live Web broadcast, it will be archived on the Company's website, and can be accessed by visiting the Company's investor page at https://investors.perasoinc.com/events-presentations. A replay of the conference call will also be available through August 18, 2025, and can be accessed by calling 1-877-481-4010, and using passcode 52752. International callers should dial 1-919-882-2331 and enter the same passcode at the prompt. Any supporting materials referenced during the live broadcast will be made available in the Investor Relations section of the Company's website following the conclusion of the conference call.

Use of Non-GAAP Financial Measures

To supplement Peraso's consolidated financial statements presented in accordance with GAAP, Peraso uses non-GAAP financial measures that exclude from the statement of operations the effects of stock-based compensation,amortization of reported intangible assets, severance costs, and the change in fair value of warrant liabilities. Peraso's management believes that the presentation of these non-GAAP financial measures is useful to investors and other interested persons because they are one of the primary indicators that Peraso's management uses for planning and forecasting future performance. The press release also makes reference to and reconciles GAAP net income (loss) and adjusted EBITDA, which the Company defines as GAAP net income (loss) before interest expense, the income tax provision, and depreciation and amortization, as well as stock-based compensation, amortization of reported intangible assets, severance costs, and the change in fair value of warrant liabilities. Management believes that the presentation of non-GAAP financial measures that exclude these items is useful to investors because management does not consider these charges part of the day-to-day business or reflective of the core operational activities of the Company that are within the control of management or that would be used to evaluate management's operating performance.

Investors are encouraged to review the reconciliations of these non-GAAP financial measures to the comparable GAAP results, which are provided in tables below the Condensed Consolidated Statements of Operations. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements should be carefully evaluated. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. For additional information regarding these non-GAAP financial measures, and management's explanation of why it considers such measures to be useful, refer to the Current Report on Form 8-K dated August 11, 2025, that the Company filed with the Securities and Exchange Commission.

Forward-Looking Statements

This press release may contain forward-looking statements about the Company, including, without limitation, the Company's expectations regarding growth prospects for the Company's products and the Company's 2025 revenue and gross margin trends. Forward-looking statements are based on certain assumptions and expectations of future events that are subject to risks and uncertainties. Actual results and trends may differ materially from historical results or those projected in any such forward-looking statements depending on a variety of factors. These factors include, but are not limited, to the following:

the Company's ability to continue as a going concern;

the Company's ability to raise additional capital to fund its operations;

the Company's ability to maintain compliance with the continued listing requirements and standards of the Nasdaq Stock Market;

risks related to the process of reviewing and exploring potential strategic alternatives, which may be time-consuming, distracting, and disruptive to the Company's business operations;

annual expense savings expected from the Company's cost reduction initiatives;

the timing of customer orders and product shipments;

risks related to pandemics, wars and terrorist activities that may have an adverse impact on the Company's business and financial results and result in component shortages and increased lead times that may negatively impact the Company's ability to ship its products;

inflationary and tariff risks;

customer concentrations and length of billing and collection cycles, which may be impacted in the event of a global recession or economic downturn;

lengthy sales cycle;

ability to enhance the Company's existing proprietary technologies and develop new technologies;

achieving additional design wins for the Company's products through the acceptance and adoption of its technology by potential customers and their suppliers;

difficulties and delays in the production, testing and marketing of the Company's products;

reliance on manufacturing partners to assist successfully with the fabrication of and production of the Company's products;

impacts of the end-of-life of the Company's memory products;

availability of quantities of the Company's products supplied by its manufacturing partners at a competitive cost;

level of intellectual property protection provided by the Company's patents, the expenses and other consequences of litigation, including intellectual property infringement litigation, to which the Company may be or may become a party from time to time;

vigor and growth of markets served by the Company's customers and its operations; and

other risks identified in the Company's public filings it makes with the Securities and Exchange Commission.

Peraso does not intend to update publicly any forward-looking statement for any reason, except as required by law, even as new information becomes available or other events occur in the future.

About Peraso Inc.

Peraso Inc. (NASDAQ: PRSO) is a pioneer in high-performance 60 GHz unlicensed and 5G mmWave wireless technology, offering chipsets, antenna modules, software and IP. Peraso supports a variety of applications, including fixed wireless access, immersive video and factory automation. For additional information, please visit www.perasoinc.com.

Company Contact:

Jim Sullivan, CFO

Peraso Inc.

P: 408-418-7500

E: [email protected]

Investor Relations Contacts:

Shelton Group

Brett L. Perry | Leanne K. Sievers

P: 214-272-0070

E: [email protected]

PERASO INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts; unaudited)

Three Months Ended | Six Months Ended | |||||||||||

June 30, | June 30, | |||||||||||

2025 | 2024 | 2025 | 2024 | |||||||||

Net Revenue | ||||||||||||

Product | $ | 2,218 | $ | 4,109 | $ | 6,018 | $ | 6,785 | ||||

Royalty and other | 2 | 129 | 71 | 269 | ||||||||

Total net revenue | 2,220 | 4,238 | 6,089 | 7,054 | ||||||||

Cost of Net Revenue | 1,147 | 1,887 | 2,336 | 3,397 | ||||||||

Gross Profit | 1,073 | 2,351 | 3,753 | 3,657 | ||||||||

Operating Expenses | ||||||||||||

Research and development | 1,662 | 2,644 | 3,245 | 5,457 | ||||||||

Selling, general and administrative | 1,411 | 2,141 | 3,022 | 4,243 | ||||||||

Severance and software license obligations | (223 | ) | 2,041 | (223 | ) | 2,063 | ||||||

Total operating expenses | 2,850 | 6,826 | 6,044 | 11,763 | ||||||||

Loss from operations | (1,777 | ) | (4,475 | ) | (2,291 | ) | (8,106 | ) | ||||

Change in fair value of warrant liabilities | (29 | ) | 54 | 6 | 1,645 | |||||||

Other income (expenses), net | (23 | ) | (4 | ) | (15 | ) | 5 | |||||

Net loss | $ | (1,829 | ) | $ | (4,425 | ) | $ | (2,300 | ) | $ | (6,456 | ) |

Net loss per share | ||||||||||||

Basic and diluted | $ | (0.31 | ) | $ | (1.88 | ) | $ | (0.39 | ) | $ | (2.75 | ) |

Shares used in computing net loss per share | ||||||||||||

Basic and diluted | 5,977 | 2,358 | 5,862 | 2,345 | ||||||||

PERASO INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, unaudited)

June 30, | December 31, | |||

2025 | 2024 | |||

Assets | ||||

Current assets: | ||||

Cash and cash equivalents | $ | 1,761 | $ | 3,344 |

Accounts receivable, net | 1,003 | 682 | ||

Inventories | 1,296 | 2,079 | ||

Prepaid expenses and other | 736 | 188 | ||

Total current assets | 4,796 | 6,293 | ||

Property and equipment, net | 432 | 512 | ||

Right-of-use lease assets | 194 | 267 | ||

Other | 109 | 134 | ||

Total assets | $ | 5,531 | $ | 7,206 |

Liabilities and Stockholders' Equity | ||||

Current liabilities: | ||||

Accounts payable | $ | 1,278 | $ | 1,036 |

Deferred revenue | 24 | 341 | ||

Short-term lease liabilities | 99 | 139 | ||

Accrued expenses and other | 962 | 1,987 | ||

Total current liabilities | 2,363 | 3,503 | ||

Long-term lease liabilities | 132 | 182 | ||

Warrant liabilities | 49 | 55 | ||

Total liabilities | 2,544 | 3,740 | ||

Stockholders' equity | 2,987 | 3,466 | ||

Total liabilities and stockholders' equity | $ | 5,531 | $ | 7,206 |

PERASO INC.

Reconciliation of GAAP to Non-GAAP Net Loss and Net Loss Per Share

(In thousands, except per share amounts; unaudited)

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | June 30, | |||||||||||||||

2025 | 2024 | 2025 | 2024 | |||||||||||||

GAAP net loss | $ | (1,829 | ) | $ | (4,425 | ) | $ | (2,300 | ) | $ | (6,456 | ) | ||||

Stock-based compensation expense | ||||||||||||||||

- Research and development | 81 | 652 | 146 | 1,357 | ||||||||||||

- Selling, general and administrative | 60 | 503 | 120 | 1,020 | ||||||||||||

Total stock-based compensation expense | 141 | 1,155 | 266 | 2,377 | ||||||||||||

Amortization of intangibles (1) | ||||||||||||||||

- Cost of net revenue | - | 564 | - | 1,127 | ||||||||||||

- Selling, general and administrative | - | 251 | - | 503 | ||||||||||||

Total amortization of intangible assets | - | 815 | - | 1,630 | ||||||||||||

Severance costs | ||||||||||||||||

- Research and development | - | 419 | - | 441 | ||||||||||||

- Selling, general and administrative | - | 5 | - | 5 | ||||||||||||

Total severance costs | - | 424 | - | 446 | ||||||||||||

Change in fair value of warrant liabilities | 29 | (54 | ) | (6 | ) | (1,645 | ) | |||||||||

Non-GAAP net loss | $ | (1,659 | ) | $ | (2,085 | ) | $ | (2,040 | ) | $ | (3,648 | ) | ||||

GAAP net loss per share | $ | (0.31 | ) | $ | (1.88 | ) | $ | (0.39 | ) | $ | (2.75 | ) | ||||

Reconciling items | ||||||||||||||||

- Stock-based compensation expense | 0.02 | 0.49 | 0.04 | 1.01 | ||||||||||||

- Amortization of intangible assets (1) | - | 0.35 | - | 0.69 | ||||||||||||

- Severance costs | - | 0.18 | - | 0.19 | ||||||||||||

- Change in fair value of warrant liabilities | 0.01 | (0.02 | ) | - | (0.70 | ) | ||||||||||

Non-GAAP net loss per share | $ | (0.28 | ) | $ | (0.88 | ) | $ | (0.35 | ) | $ | (1.56 | ) | ||||

Shares used in computing non-GAAP net loss per share | ||||||||||||||||

Basic and diluted | 5,977 | 2,358 | 5,862 | 2,345 | ||||||||||||

(1) Non-cash charges for amortization of intangibles arising from acquired assets. These charges are included in cost of net revenue and selling, general and administrative expenses. | ||||||||||||||||

PERASO INC.

Reconciliation of GAAP Gross Profit to Non-GAAP Gross Profit

(In thousands, except percentages; unaudited)

Three Months Ended | Six Months Ended | |||||||

June 30, 2025 | June 30, 2025 | |||||||

GAAP gross profit | $ | 1,073 | 48.3 | % | $ | 3,753 | 61.6 | % |

Reconciling items: | ||||||||

- Amortization of intangibles | - | 0.0 | % | - | 0.0 | % | ||

Non-GAAP gross profit | $ | 1,073 | 48.3 | % | $ | 3,753 | 61.6 | % |

Three Months Ended | Six Months Ended | |||||||

June 30, 2024 | June 30, 2024 | |||||||

GAAP gross profit | $ | 2,351 | 55.5 | % | $ | 3,657 | 51.8 | % |

Reconciling items: | ||||||||

- Amortization of intangibles | 564 | 13.3 | % | 1,127 | 16.0 | % | ||

Non-GAAP gross profit | $ | 2,915 | 68.8 | % | $ | 4,784 | 67.8 | % |

PERASO INC.

Reconciliation of GAAP and Non-GAAP Financial Information

(In thousands; unaudited)

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | June 30, | |||||||||||||||

2025 | 2024 | 2025 | 2024 | |||||||||||||

Reconciliation of GAAP net loss and adjusted EBITDA | ||||||||||||||||

GAAP net loss | $ | (1,829 | ) | $ | (4,425 | ) | $ | (2,300 | ) | $ | (6,456 | ) | ||||

Stock-based compensation expense | ||||||||||||||||

- Research and development | 81 | 652 | 146 | 1,357 | ||||||||||||

- Selling, general and administrative | 60 | 503 | 120 | 1,020 | ||||||||||||

Stock-based compensation expense | 141 | 1,155 | 266 | 2,377 | ||||||||||||

Amortization of intangibles (1) | - | 815 | - | 1,630 | ||||||||||||

Severance costs | - | 424 | - | 446 | ||||||||||||

Change in fair value of warrant liabilities | 29 | (54 | ) | (6 | ) | (1,645 | ) | |||||||||

Non-GAAP net loss | (1,659 | ) | (2,085 | ) | (2,040 | ) | (3,648 | ) | ||||||||

EBITDA adjustments: | ||||||||||||||||

- Depreciation and amortization | 62 | 176 | 129 | 353 | ||||||||||||

- Interest expense | - | 3 | 1 | 7 | ||||||||||||

Adjusted EBITDA | $ | (1,597 | ) | $ | (1,906 | ) | $ | (1,910 | ) | $ | (3,288 | ) | ||||

(1) Non-cash charges for amortization of intangibles arising from acquired assets. These charges are included in cost of net revenue and selling, general and administrative expenses. | ||||||||||||||||

SOURCE: Peraso Inc.

View the original press release on ACCESS Newswire

L.Harper--AMWN