-

Hope fades in search for missing after Brazil rains kill 46

Hope fades in search for missing after Brazil rains kill 46

-

Trump, Zelensky speak before Ukraine-US talks in Geneva

-

Scam centres 'destroying' Cambodia's economy, PM tells AFP

Scam centres 'destroying' Cambodia's economy, PM tells AFP

-

Last-gasp Atalanta eliminate Dortmund to reach Champions League last 16

-

Iran negotiators arrive in Geneva for high-stakes US talks

Iran negotiators arrive in Geneva for high-stakes US talks

-

Antonio Tejero, leader of Spain's failed 1981 coup, dies at 93

-

Hakimi, set to face trial for rape, in PSG team for Champions League game

Hakimi, set to face trial for rape, in PSG team for Champions League game

-

Eleven men lured into Russia war returned to South Africa

-

Brazil politicians convicted for ordering murder of black activist councilor

Brazil politicians convicted for ordering murder of black activist councilor

-

Ex-US Treasury chief Summers quits Harvard over Epstein ties

-

Modi says India stands 'firmly' with Israel during visit

Modi says India stands 'firmly' with Israel during visit

-

New Zealand knock sorry Sri Lanka out of T20 World Cup

-

Berlinale meet called over film director's anti-Israel speech

Berlinale meet called over film director's anti-Israel speech

-

Van der Poel to make season bow at Omloop Het Nieuwsblad

-

Maria Grazia Chiuri's Fendi homecoming feted in Milan

Maria Grazia Chiuri's Fendi homecoming feted in Milan

-

Norway's King Harald to stay in hospital to treat infection: doctor

-

Mbappe season on ice ahead of silverware sprint, World Cup

Mbappe season on ice ahead of silverware sprint, World Cup

-

New Zealand produce late flurry to reach 168-7 against Sri Lanka

-

France appoints new Louvre chief after jewellery heist

France appoints new Louvre chief after jewellery heist

-

No Ahmedabad advantage for South Africa against West Indies: Maharaj

-

Scotland fans skirt World Cup rules for kilt bags

Scotland fans skirt World Cup rules for kilt bags

-

18 Egyptians missing after deadly boat capsize near Greece

-

Stock markets strike record highs as AI concerns ease

Stock markets strike record highs as AI concerns ease

-

Hong Kong finance chief tips up to 3.5% growth this year

-

Arctic underdogs Bodo/Glimt topple Champions League giants in 'fairytale'

Arctic underdogs Bodo/Glimt topple Champions League giants in 'fairytale'

-

Bill Gates admits affairs but denies involvement in Epstein crimes

-

Hope fades in search for missing after deadly Brazil rains

Hope fades in search for missing after deadly Brazil rains

-

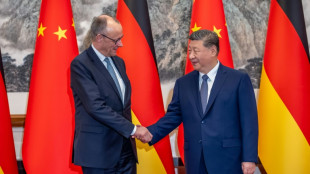

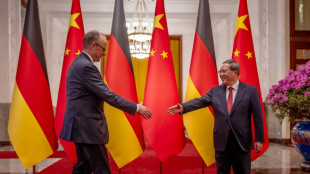

Germany's Merz meets Xi, announces Chinese Airbus order

-

Hakimi, set to face trial for rape, in PSG Champions League matchday squad

Hakimi, set to face trial for rape, in PSG Champions League matchday squad

-

Man Utd financial results show profit increase after job cuts

-

Guinness maker Diageo cuts outlook on weak US, China demand

Guinness maker Diageo cuts outlook on weak US, China demand

-

Swiss-EU deals package to be signed next week

-

Ice melt threatens emperor penguins during annual moult: researchers

Ice melt threatens emperor penguins during annual moult: researchers

-

Pope lines up trips to Central Africa, Algeria, Spain, Monaco

-

Stock markets hit record highs on easing AI concerns

Stock markets hit record highs on easing AI concerns

-

Samson in India's mix for high-stakes clash against Zimbabwe

-

Turkey's Erdogan dismisses secular critics of Ramadan school plan

Turkey's Erdogan dismisses secular critics of Ramadan school plan

-

Ferguson inspiring Hearts' bid for Scottish title history

-

Snoop Dogg's Swansea party showcases Championship glow-up

Snoop Dogg's Swansea party showcases Championship glow-up

-

France appoints new president at Louvre after jewellery heist

-

Germany's Merz meets Xi in China, seeking closer ties

Germany's Merz meets Xi in China, seeking closer ties

-

Aston Martin slashes staff as US tariffs hit carmakers

-

Chief executive of 2030 Olympic Games becomes latest director to quit

Chief executive of 2030 Olympic Games becomes latest director to quit

-

Rubio meets Caribbean leaders as US raises pressure on Cuba

-

Head of France's Versailles Palace to take over Louvre: source to AFP

Head of France's Versailles Palace to take over Louvre: source to AFP

-

England's Brook gains redemption after 'hardest winter of my life'

-

Iran dismisses missile, nuclear claims after Trump alleges 'sinister ambitions'

Iran dismisses missile, nuclear claims after Trump alleges 'sinister ambitions'

-

Inside the Mexican resort that was the final hideout of 'El Mencho'

-

Somaliland pins hopes on critical mineral gold rush

Somaliland pins hopes on critical mineral gold rush

-

Bejart Ballet's iconic Bolero ignites Istanbul

NuRAN Closes Private Placement of Shares While it Continues Negotiations to Replace or Restructure its Current Debt

QUEBEC, QC / ACCESS Newswire / August 26, 2025 / NuRAN Wireless Inc. ("NuRAN" or the "Company") (CSE:NUR)(OTC:NRRWF)(FSE:1RN), a leading supplier of mobile and broadband wireless infrastructure solutions, is pleased to announce it has closed a non-brokered private placement financing for gross proceeds of CAD$1,500,000 (the "Private Placement") through the issuance of 30,000,000 common shares of the Company (each a "Share") at a price of $0.05 per Share. The proceeds raised from the Private Placement will be used by the Company for working capital purposes and payment of all outstanding short-term promissory notes issued from April to August 2025. The cash flow from the company's African operations is allocated to site maintenance, upgrades, and deployments. Additionally, due to delays in accessing funds from its US$5 million facility, this private placement addresses the company's short-term financial requirements. The Common Shares issued under the Private Placement are subject to a statutory hold period expiring December 26, 2025.

Further to the Company's news release dated July 18, 2025, the Company is negotiating with its current debt holders and with new potential institutional investors and lenders to raise additional operating funds to potentially restructure or replace much of its outstanding current debt instruments with better terms and provide the Company with additional working capital. The Company is pursuing two main tracks broadly to include either 1) replacing the existing debt with longer term, non-convertible or hybrid instruments or 2) a debt for equity swap which would replace debt with equity on the Company's balance sheet.

The Company's negotiations with the new potential institutional lenders and investors are ongoing and include governmental agencies that require sufficient time to complete their process. This first option might also include other private lenders and investors who know the Company well and are working in parallel.

Current debt holders are an integral part of the process and terms of potential repayment, conversion and write-off, or a combination of these, is being discussed. The second option includes a potential restructuring of most of their outstanding current debt instruments with significantly better terms which to allow the Company to reduce their interest obligations and clean up its balance sheet.

Both proposals would include additional tranches of the Private Placement to raise cash and achieve a more streamlined capital structure suited to future fund-raising and value creation. The Company decided to close this Private Placement at this time to ensure that it has sufficient working capital for the duration of the discussions. Any elements of the proposals that require shareholder approval will be included in the Company's information circular for its the annual general and special shareholders meeting to be held on September 30, 2025, which will be mailed in the coming days. The Company will provide an update if and when terms have been settled.

About NuRAN Wireless:

NuRAN Wireless is a leading rural telecommunications company that meets the growing demand for wireless network coverage in remote and rural regions around the globe. With its affordable and innovative scalable solutions of 2G, 3G, and 4G technologies, NuRAN Wireless offers a new possibility for more than one billion people to communicate effectively over long distances efficiently and affordably. "Bridging the Digital Divide, One Connection at a Time."

Additional Information:

For further information about NuRAN Wireless: www.nuranwireless.com

Francis Létourneau,

Director and CEO

[email protected]

Tel: (418) 264-1337

Frank Candido

Investor relations

[email protected]

Tel: (514) 969-5530

Forward Looking Statements

This news release contains forward-looking statements. Forward-looking statements can be identified by the use of words such as, "expects", "is expected", "anticipates", "intends", "believes", or variations of such words and phrases or state that certain actions, events or results "may" or "will" be taken, occur or be achieved. Forward-looking statements include those relating to the Company being able to receive funding from the new potential institutional lenders to refinance and replace most of its outstanding current debt instruments with significantly better terms; the Company's current debt holders potentially restructuring most of their outstanding current debt instruments with significantly better terms; and the Company having sufficient working capital for the duration of the institutional lenders' process. Forward-looking statements are not a guarantee of future performance and are subject to risks and uncertainties that could cause actual results to differ materially from the results projected, expressed or implied by these forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements, such as the uncertainties regarding include risks such as risks relating to NuRAN's business and the economy generally; NuRAN's ability to refinance its long term debt that is currently in default; NuRAN's ability to adequately restructure its operations with respect to its new model of NaaS service contracts; our ability to collect fees from our telecommunication providers and reliance on the network of our telecommunications providers, the capacity of the Company to deliver in a technical capacity and to import inventory to Africa at a reasonable cost; NuRAN's ability to obtain project financing for the proposed site build out under its NaaS agreements with Orange, MTN and other telecommunication providers, the loss of one or more significant suppliers or a reduction in significant volume from such suppliers; NuRAN's ability to meet or exceed customers' demand and expectations; significant current competition and the introduction of new competitors or other disruptive entrants in the Company's industry; effects of the global supply shortage affecting parts needed for NuRAN's sites and site installations; NuRAN's ability to retain key employees and protect its intellectual property; compliance with local laws and regulations and ability to obtain all required permits for our operations, access to the credit and capital markets, changes in applicable telecommunications laws or regulations or changes in license and regulatory fees, downturns in customers' business cycles; and insurance prices and insurance coverage availability, the Company's ability to effectively maintain or update information and technology systems; our ability to implement and maintain measures to protect against cyberattacks and comply with applicable privacy and data security requirements; the Company's ability to successfully implement its business strategies or realize expected cost savings and revenue enhancements; business development activities, including acquisitions and integration of acquired businesses; the Company's expansion into markets outside of Canada and the operational, competitive and regulatory risks facing the Company's non-Canadian based operations. Accordingly, readers should not place undue reliance on forward looking information. Other factors which could materially affect such forward-looking information are described in the risk factors in the Company's most recent annual management's discussion and analysis that is available on the Company's profile on SEDAR+ at www.sedarplus.ca.

SOURCE: NuRAN Wireless Inc.

View the original press release on ACCESS Newswire

L.Davis--AMWN