-

Hope fades in search for missing after Brazil rains kill 46

Hope fades in search for missing after Brazil rains kill 46

-

Trump, Zelensky speak before Ukraine-US talks in Geneva

-

Scam centres 'destroying' Cambodia's economy, PM tells AFP

Scam centres 'destroying' Cambodia's economy, PM tells AFP

-

Last-gasp Atalanta eliminate Dortmund to reach Champions League last 16

-

Iran negotiators arrive in Geneva for high-stakes US talks

Iran negotiators arrive in Geneva for high-stakes US talks

-

Antonio Tejero, leader of Spain's failed 1981 coup, dies at 93

-

Hakimi, set to face trial for rape, in PSG team for Champions League game

Hakimi, set to face trial for rape, in PSG team for Champions League game

-

Eleven men lured into Russia war returned to South Africa

-

Brazil politicians convicted for ordering murder of black activist councilor

Brazil politicians convicted for ordering murder of black activist councilor

-

Ex-US Treasury chief Summers quits Harvard over Epstein ties

-

Modi says India stands 'firmly' with Israel during visit

Modi says India stands 'firmly' with Israel during visit

-

New Zealand knock sorry Sri Lanka out of T20 World Cup

-

Berlinale meet called over film director's anti-Israel speech

Berlinale meet called over film director's anti-Israel speech

-

Van der Poel to make season bow at Omloop Het Nieuwsblad

-

Maria Grazia Chiuri's Fendi homecoming feted in Milan

Maria Grazia Chiuri's Fendi homecoming feted in Milan

-

Norway's King Harald to stay in hospital to treat infection: doctor

-

Mbappe season on ice ahead of silverware sprint, World Cup

Mbappe season on ice ahead of silverware sprint, World Cup

-

New Zealand produce late flurry to reach 168-7 against Sri Lanka

-

France appoints new Louvre chief after jewellery heist

France appoints new Louvre chief after jewellery heist

-

No Ahmedabad advantage for South Africa against West Indies: Maharaj

-

Scotland fans skirt World Cup rules for kilt bags

Scotland fans skirt World Cup rules for kilt bags

-

18 Egyptians missing after deadly boat capsize near Greece

-

Stock markets strike record highs as AI concerns ease

Stock markets strike record highs as AI concerns ease

-

Hong Kong finance chief tips up to 3.5% growth this year

-

Arctic underdogs Bodo/Glimt topple Champions League giants in 'fairytale'

Arctic underdogs Bodo/Glimt topple Champions League giants in 'fairytale'

-

Bill Gates admits affairs but denies involvement in Epstein crimes

-

Hope fades in search for missing after deadly Brazil rains

Hope fades in search for missing after deadly Brazil rains

-

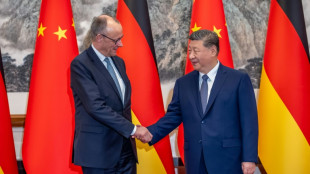

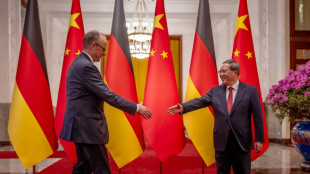

Germany's Merz meets Xi, announces Chinese Airbus order

-

Hakimi, set to face trial for rape, in PSG Champions League matchday squad

Hakimi, set to face trial for rape, in PSG Champions League matchday squad

-

Man Utd financial results show profit increase after job cuts

-

Guinness maker Diageo cuts outlook on weak US, China demand

Guinness maker Diageo cuts outlook on weak US, China demand

-

Swiss-EU deals package to be signed next week

-

Ice melt threatens emperor penguins during annual moult: researchers

Ice melt threatens emperor penguins during annual moult: researchers

-

Pope lines up trips to Central Africa, Algeria, Spain, Monaco

-

Stock markets hit record highs on easing AI concerns

Stock markets hit record highs on easing AI concerns

-

Samson in India's mix for high-stakes clash against Zimbabwe

-

Turkey's Erdogan dismisses secular critics of Ramadan school plan

Turkey's Erdogan dismisses secular critics of Ramadan school plan

-

Ferguson inspiring Hearts' bid for Scottish title history

-

Snoop Dogg's Swansea party showcases Championship glow-up

Snoop Dogg's Swansea party showcases Championship glow-up

-

France appoints new president at Louvre after jewellery heist

-

Germany's Merz meets Xi in China, seeking closer ties

Germany's Merz meets Xi in China, seeking closer ties

-

Aston Martin slashes staff as US tariffs hit carmakers

-

Chief executive of 2030 Olympic Games becomes latest director to quit

Chief executive of 2030 Olympic Games becomes latest director to quit

-

Rubio meets Caribbean leaders as US raises pressure on Cuba

-

Head of France's Versailles Palace to take over Louvre: source to AFP

Head of France's Versailles Palace to take over Louvre: source to AFP

-

England's Brook gains redemption after 'hardest winter of my life'

-

Iran dismisses missile, nuclear claims after Trump alleges 'sinister ambitions'

Iran dismisses missile, nuclear claims after Trump alleges 'sinister ambitions'

-

Inside the Mexican resort that was the final hideout of 'El Mencho'

-

Somaliland pins hopes on critical mineral gold rush

Somaliland pins hopes on critical mineral gold rush

-

Bejart Ballet's iconic Bolero ignites Istanbul

KindlyMD Announces $5 Billion At-The-Market Equity Offering Program

SALT LAKE CITY, UTAH / ACCESS Newswire / August 26, 2025 / Kindly MD, Inc. (NASDAQ:NAKA) ("KindlyMD" or the "Company"), a provider of integrated healthcare services and a Bitcoin treasury vehicle, today announced that it has filed a shelf registration statement and prospectus supplement with the U.S. Securities and Exchange Commission ("SEC") establishing an at-the-market equity offering program (the "ATM Program") under which it may issue and sell shares of its common stock, $0.001 par value per share (the "NAKA Stock"), having an aggregate offering price of up to $5 billion (the "Offered Shares"). KindlyMD intends to use the net proceeds from the ATM Program for general corporate purposes, which include, among other things, pursuit of a Bitcoin Treasury Strategy, in alignment with the Company's Bitcoin treasury strategy following its merger with Nakamoto Holdings Inc. ("Nakamoto" and together with KindlyMD, the "combined company"), working capital, funding of acquisitions of businesses, assets or technologies, capital expenditures, and/or investing in existing and future projects.

"The launch of the ATM Program represents a pivotal step in our long-term capital strategy," said David Bailey, Chief Executive Officer and Chairman of KindlyMD. "Following the successful completion of our merger between KindlyMD and Nakamoto just two weeks ago and our initial purchase of 5,744 Bitcoin, this initiative is the natural next phase of our growth plan. We intend to deploy the ATM Program thoughtfully and methodically, using it as a flexible tool to strengthen our balance sheet, seize market opportunities, and deliver accretive value for our shareholders."

Pursuant to the terms of the sales agreement, dated August 26, 2025 (the "Sales Agreement"), among KindlyMD and TD Securities; Cantor; B. Riley Securities, Inc; Benchmark, a StoneX Company; Canaccord Genuity; Cohen & Company Capital Markets; Craig-Hallum; Needham & Company; and Yorkville Securities (the "Sales Agents"), sales of the Offered Shares, if any, of the NAKA Stock under the ATM Program will be made by any method permitted by law deemed to be an "at the market offering" as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, including sales made directly on or through the Nasdaq Global Market or any other existing trading market for the NAKA Stock. The timing and amount of any such sales will be determined by a variety of factors considered by the Company. Sales may be made at market prices prevailing at the time of a sale or at prices related to prevailing market prices. As a result, sales prices may vary.

The ATM Program is being made pursuant to a prospectus supplement dated August 26, 2025 to the Company's base prospectus included in its registration statement on Form S-3 (File No. 333-289868) filed with the SEC on August 26, 2025, which automatically became effective upon filing. Before making an investment in the Offered Shares, potential investors should read the prospectus supplement and the accompanying base prospectus for more information about KindlyMD and the ATM Program. Copies of the prospectus supplement, the accompanying base prospectus and the Sales Agreement are available on the SEC's website at www.sec.gov. Potential investors can request copies of the prospectus supplement and the accompanying base prospectus from the Sales Agents by contacting: TD Securities (USA) LLC, 1 Vanderbilt Avenue, New York, NY 10017, by telephone at (833) 297-2926 or by email at [email protected]; Cantor Fitzgerald & Co., Attention: Capital Markets, 110 East 59th Street, New York, New York 10022; or by email at [email protected]; B. Riley Securities, 1300 17th Street North, Suite 1300, Arlington, VA 22209, Attention: Prospectus Department, by telephone at (703) 312-9580 or by email at [email protected]; The Benchmark Company, LLC, 150 East 58th Street, 17th Floor, New York, NY 10155, Attention: Prospectus Department, or by email at [email protected]; Canaccord Genuity LLC, Attention: Syndicate Department, One Post Office Square, Suite 3000, Boston, MA 02109, or by email at [email protected]; Cohen and Company Capital Markets, a division of Cohen & Company Securities, LLC, 3 Columbus Circle, 24th Floor, New York, New York 10019, Attention: Prospectus Department, or by email at [email protected]; Craig-Hallum Capital Group LLC, Attention: Equity Capital Markets, 323 N. Washington Ave., Suite 300, Minneapolis, MN 55401, by telephone at (612) 334-6300 or by email at prospectus@chlm; Needham & Company, LLC, 250 Park Avenue, 10th Floor, New York, NY 10177, Attn: Prospectus Department, [email protected] or by telephone at (800) 903-3268; and Yorkville Securities, LLC, 1012 Springfield Avenue, Mountainside, New Jersey 07092, Email: [email protected], Attention: General Counsel.

This press release is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities, in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

About KindlyMD

KindlyMD® is a patient-first and healthcare data company redefining value-based care and patient-centered medical services. Formed in 2019, Kindly MD leverages data analysis to deliver evidence-based, personalized solutions in order to reduce opioid use, improve health outcomes faster, and provide value based, algorithmic guidance on the use of alternative medicine in healthcare. In August 2025, KindlyMD completed its merger with Nakamoto Holdings Inc., a Bitcoin-native holding company. This strategic formed a public Bitcoin treasury strategy that unites KindlyMD's healthcare expertise with Nakamoto's vision of integrating Bitcoin into global capital markets, creating a diversified entity focused on both healthcare innovation and Bitcoin treasury management.

Forward-Looking Statements

This press release contains certain forward-looking statements that are based upon current expectations and involve certain risks and uncertainties within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking statements can be identified by the use of words such as "should," "may," "intends," "anticipates," "believes," "estimates," "projects," "forecasts," "expects," "plans," and "proposes." These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, and include, for example, our expected use of proceeds from the ATM Program. You are urged to carefully review and consider any cautionary statements and other disclosures, including the statements made under the heading "Risk Factors" in KindlyMD, Inc.'s Annual Report on Form 10-K for the fiscal year ended December 31, 2024. KindlyMD, Inc. does not undertake any duty to update any forward-looking statements except as may be required by law. The information which appears on our websites and our social media platforms, including, but not limited to, Instagram and Facebook, is not part of this press release.

Contacts

Investor Relations:

Valter Pinto, Managing Director

KCSA Strategic Communications

(212) 896-1254

[email protected]

Media:

Carissa Felger / Sam Cohen

Gasthalter & Co.

(212) 257-4170

[email protected]

SOURCE: KindlyMD, Inc

View the original press release on ACCESS Newswire

H.E.Young--AMWN