-

UK govt backs releasing documents tied to 'rude' ex-prince Andrew

UK govt backs releasing documents tied to 'rude' ex-prince Andrew

-

Novo Nordisk to slash prices of weightloss drugs in US

-

Welllage says Sri Lanka can rescue T20 World Cup campaign

Welllage says Sri Lanka can rescue T20 World Cup campaign

-

UK's royal protection officers urged to speak up in Epstein probe

-

Aid groups petition Israel's top court to halt ban on Gaza, West Bank ops

Aid groups petition Israel's top court to halt ban on Gaza, West Bank ops

-

UEFA can make fight against racism more than a slogan: Real Madrid's Arbeloa

-

Bali flooding prompts tourist evacuation: official

Bali flooding prompts tourist evacuation: official

-

Jones says Borthwick's 'title-decider' comments behind England collapse

-

UK fines Reddit nearly $20 mn over children's data failures

UK fines Reddit nearly $20 mn over children's data failures

-

PSG star Hakimi faces trial for alleged rape

-

Netflix, Prime and Disney+ face UK broadcasting regulation

Netflix, Prime and Disney+ face UK broadcasting regulation

-

Greece set new tourism record in 2025

-

Zelensky says Ukraine unbroken after 4 years, but Russia vows to fight on

Zelensky says Ukraine unbroken after 4 years, but Russia vows to fight on

-

Zelenksy says Ukraine unbroken after 4 years, but Russia vows to fight on

-

Snoop Dogg 'can't wait' for first Swansea visit

Snoop Dogg 'can't wait' for first Swansea visit

-

Stocks fluctuate as traders assess AI fallout, tariffs

-

Post-it maker 3M faces Belgian trial over 'forever' chemicals

Post-it maker 3M faces Belgian trial over 'forever' chemicals

-

UK comedian Russell Brand pleads not guilty to new rape, assault charges

-

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

-

UK govt urged to release documents linked to ex-prince Andrew

-

Rights group slams treatment of viral Japanese monkey

Rights group slams treatment of viral Japanese monkey

-

Inside the bunker where Zelensky led response to Russian invasion

-

France demands explanation from US envoy over 'surprise' no-show

France demands explanation from US envoy over 'surprise' no-show

-

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

-

China tightens Japanese trade restrictions as spat worsens

China tightens Japanese trade restrictions as spat worsens

-

Ukraine war exhibition opens at Berlin Nazi bunker museum

-

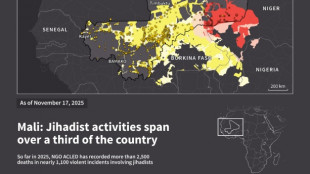

Jihadist threat puts eastern Senegal on edge

Jihadist threat puts eastern Senegal on edge

-

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

-

North Korea ruling party promotes Kim Jong Un's younger sister

North Korea ruling party promotes Kim Jong Un's younger sister

-

Mexico's Jalisco cautiously tries returning to normal after cartel violence

-

Mexico's violence-hit Guadalajara to host World Cup games

Mexico's violence-hit Guadalajara to host World Cup games

-

Mourinho's Bernabeu homecoming upended by suspension, racism row

-

China targets Japanese companies over military ties

China targets Japanese companies over military ties

-

Griezmann in talks to join MLS side Orlando City: source

-

France to revoke US envoy's govt access after summons no-show

France to revoke US envoy's govt access after summons no-show

-

Spurs overpower Pistons in clash of NBA's form teams

-

Inoue to fight Nakatani in Tokyo in May: reports

Inoue to fight Nakatani in Tokyo in May: reports

-

Canada PM to push trade, rebuild fractured ties in India trip

-

Asian markets mixed as traders weigh AI and tariffs outlook

Asian markets mixed as traders weigh AI and tariffs outlook

-

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

-

Venezuela says exiles welcome to return following mass amnesty

Venezuela says exiles welcome to return following mass amnesty

-

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

NextSource Materials Announces Closing of $25 Million LIFE Offering to Advance UAE Battery Anode Facility

-

Perpetuals.com Launches Two Revenue-Generating Platforms: Both Featuring Quantum-Resilient Security and up to 100x Lower Transaction Costs

Perpetuals.com Launches Two Revenue-Generating Platforms: Both Featuring Quantum-Resilient Security and up to 100x Lower Transaction Costs

-

All Covered Launches Vulnerability Remediation Service to Close the Gap Between Managed IT and Managed Security

StableX Executes Next Purchase in its Stablecoin Strategy with Acquisition of Chainlink (LINK) Tokens

Company advances execution of up to $100M strategy investing in foundational tokens powering the stablecoin ecosystem

NEW YORK, NY, TX / ACCESS Newswire / October 16, 2025 / StableX Technologies, Inc., (NASDAQ:SBLX) ("StableX" or the "Company"), today announced that it has completed its second strategic token purchase, acquiring Chainlink (LINK) tokens.

Chainlink is a leading decentralized oracle network, serving as the data bridge between blockchains and the real world. By securely delivering reliable, tamper-proof data such as asset prices, reserves, and macroeconomic indicators to smart contracts, Chainlink enables the functionality of decentralized finance (DeFi), tokenized assets, and stablecoins. Chainlink has powered over $25 trillion worth of DeFi transactions. This acquisition follows StableX's initial investments in FLUID and represents another key step in building a diversified portfolio of high-value assets that form the foundation of the stablecoin industry.

"Our investment in Chainlink (LINK) represents a cornerstone of StableX's strategy and the future of the stablecoin ecosystem," said James Altucher, StableX's Digital Treasury Asset Manager. "We believe Chainlink is uniquely positioned to ride the growth in the stablecoin industry, powering critical functions such as price feeds and proof-of-reserve verification for leading issuers like USDT and USDC. With partnerships spanning Swift, UBS, S&P, and the U.S. Department of Commerce, Chainlink is rapidly becoming the data backbone of both decentralized and traditional finance. Holding a dominant 68% share of the decentralized oracle market, LINK was a must-own asset as we build the only pureplay portfolio dedicated to stablecoins."

Chainlink's oracle services have become important for digital assets and stablecoins:

Price Feeds: Chainlink provides decentralized, real-time price data to keep stablecoins pegged and secure across DeFi applications

Proof of Reserves: Chainlink verifies in real time that centralized stablecoins such as USDT and USDC are fully backed, boosting trust and regulatory compliance

Institutional Adoption: Chainlink has partnered with global financial and data leaders-including Swift, Deutsche Börse, UBS, ICE, and the U.S. Department of Commerce-to bring trillions of dollars of traditional assets and macroeconomic data on-chain

With these capabilities, Chainlink has become a key part of the infrastructure for the $93 billion DeFi market and the rapidly growing stablecoin economy and has powered tens of trillions of dollars of stablecoin transactions.

By combining the acquisition of Chainlink tokens with its holdings in FLUID, StableX believes its portfolio is well positioned to capture both the growth and income opportunities across digital assets, as stablecoins emerge as a central driver of tokenized finance worldwide. The Company continues to evaluate additional token acquisitions in the near term.

About StableX Technologies, Inc.

StableX Technologies, Inc. (formerly AYRO, Inc.) is a publicly traded company focused on the acquisition and development of stablecoin assets, infrastructure and related technologies. The Company aims to deliver sustainable long-term returns by capitalizing on the expanding role of stablecoins in global commerce and finance. For more information, please visit the Company's website at www.stablextechnologies.com.

Forward-Looking Statements

This press release may contain forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any expected future results, performance, or achievements. Words such as "anticipate," "believe," "could," "estimate," "intend," "expect," "may," "plan," "will," "would" and their opposites and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are based on the beliefs of management as well as assumptions made by and information currently available to management and include, but are not limited to, the success of the Company's strategic review, the success of any new ventures it may pursue, including its digital asset strategy and the acquisition, development and integration of stablecoin assets, infrastructure and related technologies, and the Company's ability to realize returns by capitalizing on the expanding role of stablecoins in global commerce and finance. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, without limitation: changes in digital asset regulations, market demand and adoption of stablecoins and related infrastructure; technological developments in the digital asset space; the Company's ability to determine new investment opportunities and its success in creating stockholder value; the Company's ability to execute its new business strategy with respect to digital assets; the Company's ability to maintain compliance with the Nasdaq Stock Market's listing standards; the Company has a history of losses and has never been profitable, and the Company expects to incur additional losses in the future and may never be profitable; the Company faces risks associated with litigation and claims; the Company's limited operating history makes evaluating its business and future prospects difficult and may increase the risk of any investment in its securities; the markets in which the Company operates are highly competitive, and the Company may not be successful in competing in these industries; the Company may be required to raise additional capital to fund its operations and any new endeavors, and such capital raising may be costly or difficult to obtain and could dilute the Company's stockholders' ownership interests, and the Company's long term capital requirements are subject to numerous risks. A discussion of these and other factors with respect to the Company is set forth in our most recent Annual Report on Form 10-K and subsequent reports on Form 10-Q. Forward-looking statements speak only as of the date they are made, and the Company disclaims any intention or obligation to revise any forward-looking statements, whether as a result of new information, future events or otherwise.

For investor inquiries:

CORE IR

[email protected]

516-222-2560

SOURCE: StableX Technologies, Inc.

View the original press release on ACCESS Newswire

Ch.Havering--AMWN