-

Inside the bunker where Zelensky led response to Russian invasion

Inside the bunker where Zelensky led response to Russian invasion

-

France demands explanation from US envoy over 'surprise' no-show

-

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

-

China tightens Japanese trade restrictions as spat worsens

-

Ukraine war exhibition opens at Berlin Nazi bunker museum

Ukraine war exhibition opens at Berlin Nazi bunker museum

-

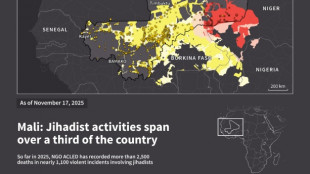

Jihadist threat puts eastern Senegal on edge

-

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

-

North Korea ruling party promotes Kim Jong Un's younger sister

-

Mexico's Jalisco cautiously tries returning to normal after cartel violence

Mexico's Jalisco cautiously tries returning to normal after cartel violence

-

Mexico's violence-hit Guadalajara to host World Cup games

-

Mourinho's Bernabeu homecoming upended by suspension, racism row

Mourinho's Bernabeu homecoming upended by suspension, racism row

-

China targets Japanese companies over military ties

-

Griezmann in talks to join MLS side Orlando City: source

Griezmann in talks to join MLS side Orlando City: source

-

France to revoke US envoy's govt access after summons no-show

-

Spurs overpower Pistons in clash of NBA's form teams

Spurs overpower Pistons in clash of NBA's form teams

-

Inoue to fight Nakatani in Tokyo in May: reports

-

Canada PM to push trade, rebuild fractured ties in India trip

Canada PM to push trade, rebuild fractured ties in India trip

-

Asian markets mixed as traders weigh AI and tariffs outlook

-

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

-

Venezuela says exiles welcome to return following mass amnesty

-

Australia buys parts for future AUKUS sub reactor

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

Bytek Joins the Google Cloud Ready - BigQuery Program

Bytek Joins the Google Cloud Ready - BigQuery Program

-

Formation Metals Intersects 0.95 g/t Au over 61.1 Metres, including 1.68 g/t Au over 26.5 Metres at the Advanced N2 Gold Project; Bulk-Tonnage Gold Target Identified with 8 Kilometres of Strike to Explore

-

Bolt Metals Announces Closing of Fully Subscribed Private Placement

Bolt Metals Announces Closing of Fully Subscribed Private Placement

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 24

-

Nikon Expands Popular Monarch and Prostaff Binocular Lines

Nikon Expands Popular Monarch and Prostaff Binocular Lines

-

Australian PM seeks removal of UK's Andrew from line of succession

-

Carrick hails 'ruthless' Man Utd match-winner Sesko

Carrick hails 'ruthless' Man Utd match-winner Sesko

-

N.Korea leader's sister promoted at party congress

-

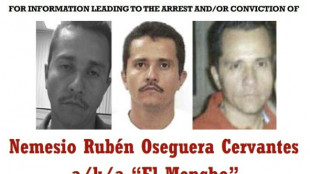

The key to taking down Mexico's most-wanted narco? His girlfriend

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

-

US winter storm brings rare hush to snowy New York

US winter storm brings rare hush to snowy New York

-

George adamant Six Nations losses don't make England 'a bad team overnight'

-

US Supreme Court to hear bid to block climate change suits

US Supreme Court to hear bid to block climate change suits

-

Canada summons OpenAI over failure to report mass shooter

-

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

-

Vonn says Olympic injury could have led to amputation

Momentum Media Fund Retained by HWAL, Inc., to Pioneer First Bitcoin Reserves Backed by HWAL's Iconic Music Catalog

NEW YORK, NY / ACCESS Newswire / October 22, 2025 / HWAL Inc., formerly Hollywall Entertainment, Inc. (OTC PINK:HWAL), a publicly traded U.S. company - recently rebranded and exploring real world asset tokenization - announced it has retained Momentum Media Fund (MMF), a leading blockchain and Bitcoin token real-world asset advisory firm to develop the world's first corporate Bitcoin reserves inscribed with a comprehensive music catalog (the "Catalog") and leading the seismic shift in how intellectual property intersects with digital assets. This groundbreaking initiative builds on HWAL's previously announced moves into building treasury assets with tokenization, and its joint venture between HWAL subsidiary Melody Trust, LLC, and SpaceBlue Enterprises to form Lunar Records, a pioneering label curating legendary music for potentially eternal lunar preservation - since archiving of music on the Moon became a reality, when a time capsule landed there on 2.22.2024 containing the Catalog along with numerous other Lunar Records projects.

The partnership was spotlighted earlier this year in Billboard Magazine, Nasdaq listings, and high-profile interviews at the New York Stock Exchange, marking a seismic shift in how intellectual property intersects with digital assets.

The Bitcoin Treasury Revolution: Over 150 Public Companies Take Up the Charge Led by Wall Street/Bitcoin Icon Michael Saylor's digital asset treasury firm, Strategy Inc.

In an era where corporate treasuries are rapidly evolving, MMF's mandate with HWAL positions the company at the forefront of Bitcoin adoption for creative industries.

This elite cadre at MMF is actively engaging top-tier institutions for the catalog conversion-JP Morgan, Blackrock, Coinbase, Deutsche Bank, UBS, and Lloyd's of London -which have publicly committed to their own moves into RWA-to-treasury conversions, including tokenized bonds and IP-backed securities.

"We're thrilled to partner with HWAL to transform the Lunar Records catalog into a Bitcoin-secured treasury," said Dallas Santana founder and curator of SpaceBlue and co-founder of Lunar Records. "This isn't just about preservation-it's about unlocking liquidity and global access for timeless music, archived on the Moon and now tokenized on Bitcoin for generations to come."

To execute, MMF has bolstered its advisory team with the appointments of banking and crypto luminaries, including veterans from Lloyd's of London and Citibank, who spearhead multi-billion-dollar RWA ventures. These experts, working in conjunction with MMF's relationships with top tier institutions for the Catalog conversion, will facilitate custody solutions, yield optimization, and compliant distribution; thus ensuring HWAL's reserves comply with SEC guidelines while maximizing shareholder returns.

HWAL and MMF intend to utilize all available innovative technologies, including AI and Blockchain, to enhance and monetize the true value of the Catalog...a true one-of-a-kind and rare RWA.

What are Real World Assets (RWA) Tokenization?

RWA tokenization creates a digital representation of ownership or a claim on a physical or intangible asset. This digital representation, or token, exists on a distributed ledger (blockchain). Each token can represent a full asset or, crucially, a fractional share of a larger asset. Smart contracts embedded within these tokens can automate ownership transfers, distributions, and compliance.

For corporate treasury, this isn't just a technical novelty; it represents a potentially revolutionary shift in how liquidity is managed, unlocked, and optimized.

The move aligns with a surging global trend: more than 150 public companies worldwide have already allocated portions of their treasuries to Bitcoin, recognizing it as a superior store of value amid economic volatility. Pioneers like Michael Saylor led Strategy Inc., which holds over 632,000 BTC valued at more than $68 billion as of September 2025, have seen average stock price increases of 150% and market cap growth exceeding 200% after implementing such strategies. Other heavyweights, including Marathon Digital Holdings (50,000 BTC) and Tesla, contribute to a collective public company Bitcoin hoard surpassing 1 million BTC, representing over 4.7% of the total supply.

This corporate embrace extends beyond tech and mining firms to diverse sectors, from retail (GameStop) to payments (Block, Inc.), signaling Bitcoin's maturation as a treasury asset. As inflation pressures and fiat uncertainties persist, these companies are not just holding Bitcoin, they're inscribing real-world assets onto blockchain for enhanced security, liquidity, and yield generation. MMF, with its eight-year track record advising firms that have scaled to tens of billions in market cap, is uniquely positioned to guide HWAL through this transformation.

MMF's Strategic Blueprint: Inscribing the Catalog into Bitcoin Reserves

Under MMF's advisory, HWAL will pioneer the first Bitcoin reserves comprising a portion of the music catalog rights from its vast Catalog - a collection of legendary music curated for immortality via the Lunaprise Moon Museum project, a billion-year time capsule aboard SpaceX's Odysseus lunar lander. This virtually indestructible vault, engraved with duplicates of many of Earth's cultural treasures, includes music selections destined for extraterrestrial archiving via Space Blue.

The Catalog draws from rights HWAL holds in a vast number of historic music recordings, blending iconic tracks with space-age compositions to celebrate humanity's artistic legacy. MMF's plan involves a multi-phase rollout: first, revaluing and auditing the Catalog's intellectual property (IP) rights; second, inscribing select assets as Bitcoin Ordinals-immutable, blockchain-secured tokens; and third, structuring these as corporate reserves to bolster HWAL's balance sheet.

Central to the initiative is the first on-chain securitization of a music catalog into Bitcoin-inscribed assets. Leveraging Bitcoin's Runes protocol for efficiency and Ordinals for provenance, MMF will fractionalize rights into tradable tokens. These will be offered to institutional investors via regulated platforms and retail clients through compliant marketplaces, enabling diversified exposure to music royalties with the added value of lunar permanence.

"Bitcoin inscription isn't hype-it's a fortress for value," noted MMF Advisor and former Citibank leader Zuhayr Reaz. "By securitizing components of the Catalog on-chain, we're creating a new asset class: long term music yields secured by the most battle-tested blockchain."

The Explosive Potential of Music Catalogs as Bitcoin Assets

The music catalog merger and acquisition market is already a behemoth, with 2025 deals shattering records and signaling insatiable demand. Primary Wave's March acquisition of a stake in The Notorious B.I.G.'s catalog underscored values exceeding $100 million per artist portfolio, while broader transactions topped $1 billion thresholds. Concord's $1.65 billion asset-backed security and Pophouse's $1.3 billion raise for acquisitions highlight a sector projected to hit $21.10 billion by 2033, growing at 10.8% CAGR. The overall music publishing market stands at $7.69 billion in 2025, on target to grow to more than $10.21 billion by 2030.

The Catalog is one of the largest independently owned music libraries in the world and comprises a prestigious collection of over 27,000 music recordings, showcasing among others the remarkable talents of numerous internationally acclaimed award-winning music legends. These recordings, some of which are extremely rare, encompass iconic performances by esteemed artists such as Ray Charles, Elvis Presley, Tony Bennett, Frank Sinatra, Jimi Hendrix, Chuck Berry, The Bee Gees, Chicago, The Platters, George Gershwin, Marvin Gaye, James Brown, Bo Didley, Willie Nelson, Waylon Jennings, Rod Stewart, and many others.

The most recent valuation for the Catalog was conducted by Sun Business Valuation, pursuant to which the fair market value of the Catalog was assessed to be approximately $146 million as of March 12, 2021 (in today's dollars, considering inflation, the Catalog's value is approximately $174,559,900, which on average is $9,974.00 per song. This prior valuation considered only 17,500 of the songs in the Catalog. HWAL is confident that the Catalog is far more valuable, because there are over 27,000 songs in total, and especially considering recent sales of so many large and small music catalogs.

Yet, as standalone assets, catalogs face liquidity hurdles-royalties stream unevenly, and traditional sales lock capital for decades. Enter the Bitcoin inscription era: by tokenizing its rights in the Catalog, HWAL unlocks exponential potential. Inscribed assets gain Bitcoin's scarcity premium, enabling 24/7 trading, DeFi yields (e.g., staking for 5-10% APY), and global accessibility without intermediaries. Early projections by MMF suggest a 3-5x valuation uplift, as seen in tokenized art and IP on Bitcoin, where liquidity premiums have driven 200%+ returns. For institutions, this offers diversified, inflation-hedged exposure to cultural IP; for retail investors, bite-sized ownership of Moon-archived music. As Bitcoin ETFs and RWA funds proliferate, HWAL's reserves could attract $500 million+ in inflows within 18 months, per MMF models.

"This is the dawn of 'MusicFi'-where catalogs aren't sold, they're sovereign," stated Mr. Santana.

About Momentum Media Fund (MMF)

Founded in 2017, Momentum Media Fund (MMF) is a premier advisory and investment firm specializing in blockchain, Bitcoin tokenization, and real-world asset strategies. With a team of industry pioneers, MMF has guided over 30 ventures to unicorn status, focusing on IP inscription, corporate treasuries, and syndication. For more, visit www.mmffund.com

About Hollywall Entertainment, Inc. (HWAL)

Hollywall Entertainment, Inc. (OTC PINK:HWAL) is a multimedia and IP holding company driving innovation in entertainment, space archiving, and digital assets. Through subsidiaries like Melody Trust, HWAL curates eternal cultural legacies, including the Lunaprise Moon Museum. Learn more at hollywall.com.

HWAL PR Contact;

HWAL: https://hwal.net

[email protected]

SOURCE: Hollywall Entertainment, Inc.

View the original press release on ACCESS Newswire

G.Stevens--AMWN