-

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

-

China tightens Japanese trade restrictions as spat worsens

-

Ukraine war exhibition opens at Berlin Nazi bunker museum

Ukraine war exhibition opens at Berlin Nazi bunker museum

-

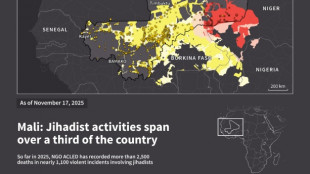

Jihadist threat puts eastern Senegal on edge

-

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

-

North Korea ruling party promotes Kim Jong Un's younger sister

-

Mexico's Jalisco cautiously tries returning to normal after cartel violence

Mexico's Jalisco cautiously tries returning to normal after cartel violence

-

Mexico's violence-hit Guadalajara to host World Cup games

-

Mourinho's Bernabeu homecoming upended by suspension, racism row

Mourinho's Bernabeu homecoming upended by suspension, racism row

-

China targets Japanese companies over military ties

-

Griezmann in talks to join MLS side Orlando City: source

Griezmann in talks to join MLS side Orlando City: source

-

France to revoke US envoy's govt access after summons no-show

-

Spurs overpower Pistons in clash of NBA's form teams

Spurs overpower Pistons in clash of NBA's form teams

-

Inoue to fight Nakatani in Tokyo in May: reports

-

Canada PM to push trade, rebuild fractured ties in India trip

Canada PM to push trade, rebuild fractured ties in India trip

-

Asian markets mixed as traders weigh AI and tariffs outlook

-

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

-

Venezuela says exiles welcome to return following mass amnesty

-

Australia buys parts for future AUKUS sub reactor

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

Bolt Metals Announces Closing of Fully Subscribed Private Placement

Bolt Metals Announces Closing of Fully Subscribed Private Placement

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 24

-

Nikon Expands Popular Monarch and Prostaff Binocular Lines

Nikon Expands Popular Monarch and Prostaff Binocular Lines

-

Australian PM seeks removal of UK's Andrew from line of succession

-

Carrick hails 'ruthless' Man Utd match-winner Sesko

Carrick hails 'ruthless' Man Utd match-winner Sesko

-

N.Korea leader's sister promoted at party congress

-

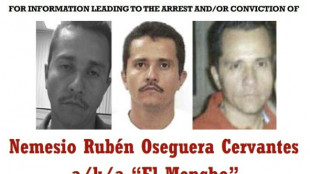

The key to taking down Mexico's most-wanted narco? His girlfriend

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

-

US winter storm brings rare hush to snowy New York

US winter storm brings rare hush to snowy New York

-

George adamant Six Nations losses don't make England 'a bad team overnight'

-

US Supreme Court to hear bid to block climate change suits

US Supreme Court to hear bid to block climate change suits

-

Canada summons OpenAI over failure to report mass shooter

-

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

-

Vonn says Olympic injury could have led to amputation

-

UK police arrest ex-envoy Peter Mandelson in Epstein case

UK police arrest ex-envoy Peter Mandelson in Epstein case

-

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

-

Son of director Rob Reiner pleads not guilty to parents' murder

Son of director Rob Reiner pleads not guilty to parents' murder

-

Panama takes control of canal ports from CK Hutchison

Vaultz Capital PLC - Trading Commences on the OTCQB Venture Market in the United States

LONDON, UK / ACCESS Newswire / October 24, 2025 / Vaultz Capital plc (AQSE:V3TC)(FRA:VJ2), a digital asset operating company, is pleased to announce that, following approval from the OTC Market Group Inc., trading in the Company's shares has commenced on the OTCQB Venture Market under the ticker symbol VZTCF. The Company's shares will continue to trade on the Aquis Stock Exchange and the Frankfurt Stock Exchange.

The OTCQB offers transparent trading in entrepreneurial and development stage companies that have met a minimum bid price test, are current in their financial reporting and have undergone an annual verification and management certification process.

Trading on the US OTC market has no impact on existing Vaultz ordinary shares trading on the Aquis Stock Exchange or the Frankfurt Stock Exchange, and no new ordinary shares will be issued in connection with this cross-trade arrangement. Vaultz will continue to make announcements through RNS in the UK and will not be subject to Sarbanes-Oxley or SEC reporting requirements.

US investors can find real-time quotes, market information and company news for Vaultz at www.otcmarkets.com.

Eric Benz, CEO of Vaultz, commented: "Our admission to the OTCQB represents another significant milestone in Vaultz's growth journey. It provides US investors with an accessible platform to trade our shares and enables us to broaden our global investor base. We believe this step will enhance the Company's visibility, improve share liquidity and support our long-term capital strategy. We appreciate the continued support of our shareholders as we expand our footprint internationally."

This announcement contains inside information for the purposes of the UK Market Abuse Regulation. The Directors of the Company are responsible for the release of this announcement.

For further information please contact:

Vaultz Capital plc | Via Tancredi |

Cairn Financial Advisers LLP (AQSE Corporate Adviser) | +44 (0)20 7213 0880 |

Global Investment Strategy UK Limited (Joint Broker) | +44 (0)20 7048 9000 |

Tancredi Intelligent Communication (Financial Communications Adviser) |

About Vaultz Capital plc

The Company is an operating company and intends to build a scalable, revenue-generating business through participation in the Bitcoin network infrastructure. Initially this will focus on acquiring exposure to Bitcoin hashrate via Bitcoin cloud mining. The Company is exploring multiple routes to access hashrate, including the direct acquisition of mining hardware and indirect arrangements with established operators. These mechanisms are intended to provide the Company with ongoing exposure to Bitcoin block rewards and transaction fees, forming the core of the Company's commercial activity. While the Company also maintains a Bitcoin treasury policy, its primary business is operational in nature, centred around infrastructure participation within the Bitcoin ecosystem.

Important Notices

The Company intends to hold treasury reserves and surplus cash in Bitcoin. Bitcoin is a type of cryptocurrency or cryptoassets. Whilst the Board of Directors of the Company considers holding Bitcoin to be in the best interests of the Company, the Board remains aware that the financial regulator in the UK (the Financial Conduct Authority or FCA) considers investment in Bitcoin to be high risk. At the outset, it is important to note that an investment in the Company is not an investment in Bitcoin, either directly or by proxy and shareholders will have no direct access to the Company's holdings. However, the Board of Directors of the Company consider Bitcoin to be an appropriate store of value and potential growth and therefore appropriate for the Company's reserves. Accordingly, the Company is and intends to continue to be materially exposed to Bitcoin. Such an approach is innovative, and the Board of Directors of the Company wish to be clear and transparent with prospective and actual investors in the Company on the Company's position in this regard.

The Company is neither authorised nor regulated by the FCA, and the purchase of certain cryptocurrencies (such as Bitcoin) are generally unregulated in the UK. As with most other investments, the value of Bitcoin can go down as well as up, and therefore the value of the Company's Bitcoin holdings can fluctuate. The Company may not be able to realise its Bitcoin holdings for the same as it paid to acquire them or even for the value the Company currently ascribes to its Bitcoin positions due to market movements. Neither the Company nor investors in the Company's shares are protected by the UK's Financial Ombudsman Service or the Financial Services Compensation Scheme.

Nevertheless, the Board of Directors of the Company has taken the decision to invest in Bitcoin, and in doing so is mindful of the special risks Bitcoin presents to the Company's financial position. These risks include (but are not limited to): (i) the value of Bitcoin can be highly volatile, with value dropping as quickly as it can rise. Investors in Bitcoin must be prepared to lose all money invested in Bitcoin; (ii) the Bitcoin market is largely unregulated. There is a risk of losing money due to risks such as cyber-attacks, financial crime and counterparty failure; (iii) the Company may not be able to sell its Bitcoin at will. The ability to sell Bitcoin depends on various factors, including the supply and demand in the market at the relevant time. Operational failings such as technology outages, cyber-attacks and comingling of funds could cause unwanted delay; and (iv) cryptoassets are characterised in some quarters by high degrees of fraud, money laundering and financial crime. In addition, there is a perception in some quarters that cyber-attacks are prominent which can lead to theft of holdings or ransom demands. Prospective investors in the Company are encouraged to do your own research before investing.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Vaultz Capital plc

View the original press release on ACCESS Newswire

P.Santos--AMWN