-

Ukraine war exhibition opens at Berlin Nazi bunker museum

Ukraine war exhibition opens at Berlin Nazi bunker museum

-

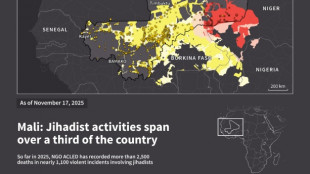

Jihadist threat puts eastern Senegal on edge

-

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

-

North Korea ruling party promotes Kim Jong Un's younger sister

-

Mexico's Jalisco cautiously tries returning to normal after cartel violence

Mexico's Jalisco cautiously tries returning to normal after cartel violence

-

Mexico's violence-hit Guadalajara to host World Cup games

-

Mourinho's Bernabeu homecoming upended by suspension, racism row

Mourinho's Bernabeu homecoming upended by suspension, racism row

-

China targets Japanese companies over military ties

-

Griezmann in talks to join MLS side Orlando City: source

Griezmann in talks to join MLS side Orlando City: source

-

France to revoke US envoy's govt access after summons no-show

-

Spurs overpower Pistons in clash of NBA's form teams

Spurs overpower Pistons in clash of NBA's form teams

-

Inoue to fight Nakatani in Tokyo in May: reports

-

Canada PM to push trade, rebuild fractured ties in India trip

Canada PM to push trade, rebuild fractured ties in India trip

-

Asian markets mixed as traders weigh AI and tariffs outlook

-

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

-

Venezuela says exiles welcome to return following mass amnesty

-

Australia buys parts for future AUKUS sub reactor

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

Nikon Expands Popular Monarch and Prostaff Binocular Lines

Nikon Expands Popular Monarch and Prostaff Binocular Lines

-

Australian PM seeks removal of UK's Andrew from line of succession

-

Carrick hails 'ruthless' Man Utd match-winner Sesko

Carrick hails 'ruthless' Man Utd match-winner Sesko

-

N.Korea leader's sister promoted at party congress

-

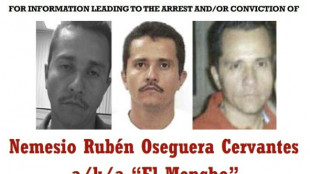

The key to taking down Mexico's most-wanted narco? His girlfriend

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

-

US winter storm brings rare hush to snowy New York

US winter storm brings rare hush to snowy New York

-

George adamant Six Nations losses don't make England 'a bad team overnight'

-

US Supreme Court to hear bid to block climate change suits

US Supreme Court to hear bid to block climate change suits

-

Canada summons OpenAI over failure to report mass shooter

-

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

-

Vonn says Olympic injury could have led to amputation

-

UK police arrest ex-envoy Peter Mandelson in Epstein case

UK police arrest ex-envoy Peter Mandelson in Epstein case

-

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

-

Son of director Rob Reiner pleads not guilty to parents' murder

Son of director Rob Reiner pleads not guilty to parents' murder

-

Panama takes control of canal ports from CK Hutchison

-

Risk of 'escalation' if Iran attacked: deputy foreign minister

Risk of 'escalation' if Iran attacked: deputy foreign minister

-

West Indies thrash Zimbabwe at T20 World Cup after piling up 254-6

-

US forces to complete withdrawal from Syria within a month: sources to AFP

US forces to complete withdrawal from Syria within a month: sources to AFP

-

Snowstorm blankets US northeast as New York sees travel ban

GoodData Brings AI-Native Data Intelligence to Financial Services

Embeddable, compliant, and auditable AI agents unlock trusted automation for banks, insurers, and financial institutions.

SAN FRANCISCO, CA / ACCESS Newswire / October 28, 2025 / GoodData, a leading analytics and data intelligence company, today unveiled new finance-focused applications for its composable AI platform, designed to tackle the industry's toughest challenges. By combining its AI Lake, AI Hub, and AI Apps into a single foundation for enterprise data intelligence, the next-generation platform gives financial institutions powerful tools to build and deploy AI agents.

These agents can detect and investigate fraud in seconds with audit trails regulators can trust, keeping portfolios compliant in real time within industry guidelines. This streamlines regulatory reporting by compiling, checking, and submitting disclosures transparently, all while meeting strict standards for financial compliance, governance, and security.

Purpose-built for finance

The financial services sector faces unique challenges, from strict regulations and legacy systems to siloed data and rising expectations for modern client experiences. GoodData's layered platform is designed to meet these needs head-on:

AI Lake: Turns structured and unstructured financial data into a governed semantic layer, grounding AI agents in accurate, compliant, and context-aware knowledge for better decision-making.

AI Hub: Delivers orchestration and governance with built-in guardrails, escalation paths, and compliance workflows, ensuring safe, auditable AI operations that align with financial regulations.

AI Apps: Embeddable agents, copilots, and automations that enhance client-facing applications (like personalized financial advice or onboarding) and back-office functions (like regulatory reporting or fraud detection).

Benefits for financial institutions

The platform ensures regulatory compliance and auditability through semantic grounding, detailed audit trails, and robust compliance controls that reduce black-box risk and help meet transparency requirements. Its scalable, multitenant architecture enables seamless expansion across business units, geographies, and client bases.

Designed to work with both legacy banking systems and modern cloud infrastructures, it is capable of supporting bring-your-own LLMs and deployment in SaaS, on-premise, or hybrid environments - while its developer-friendly SDKs and APIs accelerate time to value for AI-powered products and services.

"Financial institutions face some of the world's strictest data governance rules, and our goal is to make compliance simpler," said Roman Stanek, CEO of GoodData. "This platform lets them innovate with AI while ensuring transparency, trust, and regulatory alignment, modernising client experiences and improving risk management without compromise."

The tech behind GoodData's AI

At the core is a developer-focused stack that balances compliance with innovation:

MCP Server: Manages fast-moving financial processes in real time, while keeping governance in check.

SDKs and APIs: Easy-to-use tools (Python, React, APIs) make it simple to add AI agents to apps and internal banking systems.

Flexible by design: Open architecture works with existing fintech and banking systems, avoids vendor lock-in, and adapts to changing regulations.

Ready to embed: AI copilots, agents, and assistants can be seamlessly added to financial platforms, apps, and dashboards, with your own branding.

AI-native finance

GoodData is taking another step into AI-native data intelligence, helping financial institutions move past traditional dashboards and siloed reports toward autonomous, AI-driven services. By combining governance, scalability, and AI innovation in a single platform, GoodData allows banks, insurers, and asset managers to deliver faster results, build stronger client trust, and uncover new revenue opportunities in an increasingly AI-powered financial world.

GoodData will be exhibiting at Money20/20 USA (Booth #20093), October 26-29th.

[Ends]

About GoodData

GoodData is a full-stack, AI-native data intelligence platform built for speed, scale, and trust. Its composable platform is designed to empower every enterprise to transform governed insights into action and integrate seamlessly into any data environment across public, private, on-premises, or hybrid cloud. With no-code interfaces, SDKs, and powerful APIs, GoodData supports the full analytics lifecycle from data modeling to AI-powered insights.

GoodData enables companies to customize flexibly, deploy fast, and monetize new applications and automations - all with enterprise-grade security and governance to embed AI into a range of products. GoodData serves over 140,000 of the world's top companies and 3.2 million users, helping them drive meaningful change and maximize the value of their data.

For more information, visit GoodData's website and follow GoodData on LinkedIn, YouTube, and Medium.

GoodData Contact

©2025, GoodData Corporation. All rights reserved. GoodData and the GoodData logo are registered trademarks of GoodData Corporation in the United States and other jurisdictions. Other names used herein may be trademarks of their respective owners.

SOURCE: GoodData

View the original press release on ACCESS Newswire

Y.Nakamura--AMWN