-

Mourinho's Bernabeu homecoming upended by suspension, racism row

Mourinho's Bernabeu homecoming upended by suspension, racism row

-

China targets Japanese companies over military ties

-

Griezmann in talks to join MLS side Orlando City: source

Griezmann in talks to join MLS side Orlando City: source

-

France to revoke US envoy's govt access after summons no-show

-

Spurs overpower Pistons in clash of NBA's form teams

Spurs overpower Pistons in clash of NBA's form teams

-

Inoue to fight Nakatani in Tokyo in May: reports

-

Canada PM to push trade, rebuild fractured ties in India trip

Canada PM to push trade, rebuild fractured ties in India trip

-

Asian markets mixed as traders weigh AI and tariffs outlook

-

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

-

Venezuela says exiles welcome to return following mass amnesty

-

Australia buys parts for future AUKUS sub reactor

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

Nikon Expands Popular Monarch and Prostaff Binocular Lines

Nikon Expands Popular Monarch and Prostaff Binocular Lines

-

Australian PM seeks removal of UK's Andrew from line of succession

-

Carrick hails 'ruthless' Man Utd match-winner Sesko

Carrick hails 'ruthless' Man Utd match-winner Sesko

-

N.Korea leader's sister promoted at party congress

-

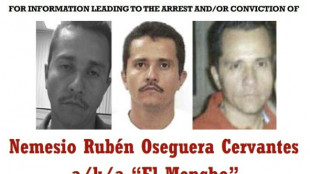

The key to taking down Mexico's most-wanted narco? His girlfriend

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

-

US winter storm brings rare hush to snowy New York

US winter storm brings rare hush to snowy New York

-

George adamant Six Nations losses don't make England 'a bad team overnight'

-

US Supreme Court to hear bid to block climate change suits

US Supreme Court to hear bid to block climate change suits

-

Canada summons OpenAI over failure to report mass shooter

-

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

-

Vonn says Olympic injury could have led to amputation

-

UK police arrest ex-envoy Peter Mandelson in Epstein case

UK police arrest ex-envoy Peter Mandelson in Epstein case

-

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

-

Son of director Rob Reiner pleads not guilty to parents' murder

Son of director Rob Reiner pleads not guilty to parents' murder

-

Panama takes control of canal ports from CK Hutchison

-

Risk of 'escalation' if Iran attacked: deputy foreign minister

Risk of 'escalation' if Iran attacked: deputy foreign minister

-

West Indies thrash Zimbabwe at T20 World Cup after piling up 254-6

-

US forces to complete withdrawal from Syria within a month: sources to AFP

US forces to complete withdrawal from Syria within a month: sources to AFP

-

Snowstorm blankets US northeast as New York sees travel ban

-

Healthcare crisis looms over Greenland's isolated villages

Healthcare crisis looms over Greenland's isolated villages

-

Hodgkinson says breaking 800m record would put her among athletics' greatest

-

Two Russian security personnel were on board France-seized tanker: sources

Two Russian security personnel were on board France-seized tanker: sources

-

EU puts US trade deal on ice after Supreme Court ruling

-

Hetmyer blasts 85 as West Indies pile up 254-6 against Zimbabwe

Hetmyer blasts 85 as West Indies pile up 254-6 against Zimbabwe

-

Canada PM heads to Asia seeking new trade partners as US ties fray

AI giants turn to massive debt to finance tech race

Meta raised $30 billion in debt on Thursday, as tech giants flush with cash turn to borrowing to finance the expensive race to lead in artificial intelligence.

On a day when Facebook-parent Meta's share price plunged on the heels of disappointing quarterly earnings, demand for its bonds was reportedly four times greater than supply in a market keen to hold the social networking titan's debt.

The $30 billion in bonds scheduled to be repaid over the course of decades is intended to provide money to continue a breakneck pace of AI development that has come to define the sector.

"(Mark) Zuckerberg seems like he's got no limit in terms of his spending," said CFRA Research senior equity analyst Angelo Zino.

Zino noted that Meta takes in more than $100 billion a year, and that while Wall Street may be concerned with Zuckerberg's spending it sees little risk debt won't get repaid.

"(But) they just can't use up all their excess free cash flow and completely leverage it into AI."

The analyst wouldn't be surprised to see Meta AI rivals Google and Microsoft opt for similar debt moves.

Shareholder worry over Meta spending, on the other hand, is believed to be what drove the tech firm's share price down more than 11 percent during trading hours on Thursday.

Meta's debt, however, drew flocks of investors despite rates for corporate bonds being at decade lows, noted Byron Anderson, head of fixed income at Laffer Tengler Investments.

"Is there some worry about the AI trade? Maybe," Anderson said. "But the revenue and profit coming off that company are massive."

If not for a one-time charge related to US President Donald Trump's Big Beautiful Bill, Meta would have recorded $18.6 billion in its recently ended quarter.

That amount of net income is more than General Motors, Netflix, Walmart and Visa profits for that quarter combined.

- FOMO? -

Anderson doubts that so-called fear of missing out on the AI revolution drove demand for Meta's bond. "I don't think this was FOMO," he said.

"People want good quality names in their portfolios at attractive levels, and this is a high-quality name -- just like Oracle."

Business cloud application and infrastructure stalwart Oracle is reported to have raised $18 billion in a bond offering last month.

According to Bloomberg, the Texas-based tech firm is poised to issue an additional $38 billion in debt, this time through banks rather than bond sales.

Debt taken on by major AI firms is typically secured by physical assets, such as data centers or the coveted graphics processing units (GPUs) vital to the technology.

Given the cash flow and physical assets of tech titans, risk is low for lenders. And the markets have been shaking off the possibility of an AI bubble that might burst.

Meta just days ago announced creation of a joint venture with asset manager Blue Owl Capital to raise some $27 billion for datacenter construction.

Meta and Oracle are also benefiting from recent moves by the US Federal Reserve to reduce the cost of borrowing.

The trend toward debt is new for internet giants long accustomed to having ample cash flow to pay for what they want.

Crucially, debt markets would not be as welcoming to AI startups such as OpenAI, Anthropic or Perplexity which have yet to turn profits.

"I learned in my profession that if a company is not making profits and they issue (debt), that is a risky proposition," Anderson said.

The analyst reasoned that young AI companies like those will have to raise money through equity stakes -- where the financier gets a stake in the company -- as they have done so far.

"I don't know why they would go into the debt market," Anderson said of such startups.

"It would be too expensive for them," he added, meaning the lenders would charge them much higher rates than the likes of cash cows like Meta.

A.Rodriguezv--AMWN