-

Australia buys parts for future AUKUS sub reactor

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

Australian PM seeks removal of UK's Andrew from line of succession

Australian PM seeks removal of UK's Andrew from line of succession

-

Carrick hails 'ruthless' Man Utd match-winner Sesko

-

N.Korea leader's sister promoted at party congress

N.Korea leader's sister promoted at party congress

-

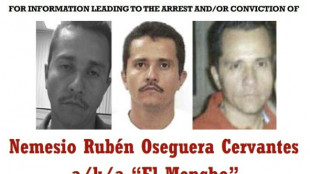

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

US forces to complete withdrawal from Syria within a month

-

US winter storm brings rare hush to snowy New York

-

George adamant Six Nations losses don't make England 'a bad team overnight'

George adamant Six Nations losses don't make England 'a bad team overnight'

-

US Supreme Court to hear bid to block climate change suits

-

Canada summons OpenAI over failure to report mass shooter

Canada summons OpenAI over failure to report mass shooter

-

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

-

Vonn says Olympic injury could have led to amputation

Vonn says Olympic injury could have led to amputation

-

UK police arrest ex-envoy Peter Mandelson in Epstein case

-

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

-

Son of director Rob Reiner pleads not guilty to parents' murder

-

Panama takes control of canal ports from CK Hutchison

Panama takes control of canal ports from CK Hutchison

-

Risk of 'escalation' if Iran attacked: deputy foreign minister

-

West Indies thrash Zimbabwe at T20 World Cup after piling up 254-6

West Indies thrash Zimbabwe at T20 World Cup after piling up 254-6

-

US forces to complete withdrawal from Syria within a month: sources to AFP

-

Snowstorm blankets US northeast as New York sees travel ban

Snowstorm blankets US northeast as New York sees travel ban

-

Healthcare crisis looms over Greenland's isolated villages

-

Hodgkinson says breaking 800m record would put her among athletics' greatest

Hodgkinson says breaking 800m record would put her among athletics' greatest

-

Two Russian security personnel were on board France-seized tanker: sources

-

EU puts US trade deal on ice after Supreme Court ruling

EU puts US trade deal on ice after Supreme Court ruling

-

Hetmyer blasts 85 as West Indies pile up 254-6 against Zimbabwe

-

Canada PM heads to Asia seeking new trade partners as US ties fray

Canada PM heads to Asia seeking new trade partners as US ties fray

-

South Africa accepts Trump's new US ambassador

-

Iraq's Maliki defends PM candidacy, seeks to reassure US

Iraq's Maliki defends PM candidacy, seeks to reassure US

-

UEFA suspend Benfica's Prestianni after alleged racist abuse

-

Jetten sworn in as youngest-ever Dutch PM

Jetten sworn in as youngest-ever Dutch PM

-

Italy's Enel to invest 20bn euros in renewables by 2028

-

BBC apologises for 'involuntary' Tourette's racial slur during BAFTA awards

BBC apologises for 'involuntary' Tourette's racial slur during BAFTA awards

-

Kristen Bell returns to host glitzy Actor Awards in Hollywood

-

Iran says would respond 'ferociously' to any US attack

Iran says would respond 'ferociously' to any US attack

-

Venezuelan foreign minister demands 'immediate release' of Maduro

-

Dane Vingegaard to start season at Paris-Nice in March

Dane Vingegaard to start season at Paris-Nice in March

-

Australia PM backs removing UK's Andrew from line of succession

Bluprynt Joins Chainlink, Apex, and Hacken in Groundbreaking Crypto Compliance Pilot with Bermuda Monetary Authority

WASHINGTON, DC / ACCESS Newswire / November 5, 2025 / Bluprynt, the compliance protocol for onchain finance, today announced its participation in a groundbreaking regulatory-grade embedded supervision pilot led by the Bermuda Monetary Authority (BMA), in partnership with Chainlink, Apex Group, and Hacken. The pilot is designed to demonstrate how blockchain technology can support continuous, automated regulatory oversight of digital asset issuance and activity, providing regulators with real-time visibility and control without compromising the speed and efficiency of decentralized systems.

Bluprynt's Know Your Issuer (KYI) identity solution and Policy Protocol served as the foundational identity and compliance layer in the pilot, establishing cryptographic proof of issuer identity and enabling automated enforcement of Bermuda's Digital Asset Business Act (DABA) and Digital Asset Issuance Act (DAIA) requirements.

Overview of Pilot

The Bermuda Monetary Authority regulates the nation's financial services sector and oversees a diverse range of institutions, including banks, insurers, and digital asset businesses. As of 2023, Bermuda is home to more than 1,200 registered insurers underwriting over $277 billion in gross premiums, while the banking sector reported consolidated assets of $26 billion. Building on this strong regulatory foundation, the Authority launched an embedded supervision pilot to explore how blockchain-based systems can enhance transparency, automation, and oversight in digital finance.

The pilot brings together Bluprynt, Chainlink, Apex Group, and Hacken to demonstrate a regulatory-grade, automated framework for compliant digital asset issuance and monitoring. Live on testnet, the initiative showcases how real-time supervision can be achieved through embedded regulatory logic and secure interoperability across blockchain networks.

Bluprynt's institutional-grade, crypto-native identity and compliance layer initiated the first stage of the pilot through its Know Your Issuer (KYI) solution, which authenticates issuers by establishing a cryptographic link between real-world entities and their onchain mint authority wallets. This verification ensures that only licensed participants can issue digital assets within Bermuda's regulated environment, providing the trust and accountability essential for institutional adoption.

Chainlink contributed the oracle and compliance infrastructure, posting real-time reserve data onchain through its Proof of Reserve system, enforcing regulatory requirements via the Automated Compliance Engine (ACE), and preventing unauthorized issuance through Secure Mint. Apex Group delivered the asset servicing backbone, transmitting onchain data related to custody, reserve management, and tokenization through Tokeny technology, bridging traditional financial operations with blockchain infrastructure. Hacken provided continuous monitoring and sanctions compliance, leveraging its data integrity and surveillance tools to enhance security and transparency.

At the core of the initiative is embedded compliance-the integration of regulatory rules and permissions directly into blockchain-based systems. By binding licensing, identity verification, and policy requirements to onchain actions, the pilot demonstrates how compliance can operate automatically and continuously within financial infrastructure. This approach not only reduces manual oversight but also allows regulators to monitor markets in real time. The resulting model is replicable across jurisdictions, offering a pathway for central banks and financial authorities worldwide to implement similar frameworks that combine automation with oversight, ensuring transparency, resilience, and trust in digital markets.

Together, these elements demonstrated a regulatory-grade digital asset framework that integrates identity verification, compliance, data validation, asset servicing, and cybersecurity into a single automated system. The pilot underscores how collaboration between public and private actors can enable real-time oversight and operational transparency-advancing a model of compliant innovation that strengthens market integrity while preserving the efficiency of onchain finance.

"Bluprynt has long explored with the BMA first-in-class compliance strategies that enable industry to scale while advancing consumer and investor protection," said Chris Brummer, Founder and CEO at Bluprynt. "Building on that foundation, we're excited to collaborate with Chainlink, Apex, and Hacken to redefine what regulatory-grade stablecoin infrastructure can be. By integrating Bluprynt's Know Your Issuer and Policy Protocol with Apex's asset-servicing solutions, Hacken's security and surveillance tools, and Chainlink's oracle technology, we're creating a full-stack regulatory framework that demonstrates how regulators, infrastructure providers, and innovators can work together to build a more transparent and secure onchain financial system."

About Bluprynt

Bluprynt is the compliance protocol for onchain finance. By combining AI and blockchain technology, Bluprynt transforms how digital assets meet regulatory and market standards-making crypto truly TradFi-ready. Through its Know Your Issuer (KYI) and SmartDocs tools, Bluprynt cryptographically verifies identity, allows issuer to comply with their regulatory filings, and binds regulatory metadata to tokens, while its Policy Protocol translates evolving rules into automated onchain logic. Together, these capabilities provide the infrastructure and intelligence powering transparent, secure, and compliant digital markets with onchain and offchain parity.

CONTACT:

JC Leon V.

[email protected]

SOURCE: Bluprynt

View the original press release on ACCESS Newswire

P.Silva--AMWN