-

Australia buys parts for future AUKUS sub reactor

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

Australian PM seeks removal of UK's Andrew from line of succession

Australian PM seeks removal of UK's Andrew from line of succession

-

Carrick hails 'ruthless' Man Utd match-winner Sesko

-

N.Korea leader's sister promoted at party congress

N.Korea leader's sister promoted at party congress

-

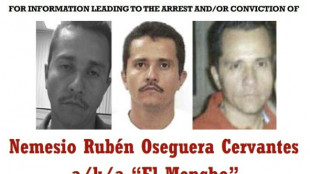

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

US forces to complete withdrawal from Syria within a month

-

US winter storm brings rare hush to snowy New York

-

George adamant Six Nations losses don't make England 'a bad team overnight'

George adamant Six Nations losses don't make England 'a bad team overnight'

-

US Supreme Court to hear bid to block climate change suits

-

Canada summons OpenAI over failure to report mass shooter

Canada summons OpenAI over failure to report mass shooter

-

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

-

Vonn says Olympic injury could have led to amputation

Vonn says Olympic injury could have led to amputation

-

UK police arrest ex-envoy Peter Mandelson in Epstein case

-

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

-

Son of director Rob Reiner pleads not guilty to parents' murder

-

Panama takes control of canal ports from CK Hutchison

Panama takes control of canal ports from CK Hutchison

-

Risk of 'escalation' if Iran attacked: deputy foreign minister

-

West Indies thrash Zimbabwe at T20 World Cup after piling up 254-6

West Indies thrash Zimbabwe at T20 World Cup after piling up 254-6

-

US forces to complete withdrawal from Syria within a month: sources to AFP

-

Snowstorm blankets US northeast as New York sees travel ban

Snowstorm blankets US northeast as New York sees travel ban

-

Healthcare crisis looms over Greenland's isolated villages

-

Hodgkinson says breaking 800m record would put her among athletics' greatest

Hodgkinson says breaking 800m record would put her among athletics' greatest

-

Two Russian security personnel were on board France-seized tanker: sources

-

EU puts US trade deal on ice after Supreme Court ruling

EU puts US trade deal on ice after Supreme Court ruling

-

Hetmyer blasts 85 as West Indies pile up 254-6 against Zimbabwe

-

Canada PM heads to Asia seeking new trade partners as US ties fray

Canada PM heads to Asia seeking new trade partners as US ties fray

-

South Africa accepts Trump's new US ambassador

-

Iraq's Maliki defends PM candidacy, seeks to reassure US

Iraq's Maliki defends PM candidacy, seeks to reassure US

-

UEFA suspend Benfica's Prestianni after alleged racist abuse

-

Jetten sworn in as youngest-ever Dutch PM

Jetten sworn in as youngest-ever Dutch PM

-

Italy's Enel to invest 20bn euros in renewables by 2028

-

BBC apologises for 'involuntary' Tourette's racial slur during BAFTA awards

BBC apologises for 'involuntary' Tourette's racial slur during BAFTA awards

-

Kristen Bell returns to host glitzy Actor Awards in Hollywood

-

Iran says would respond 'ferociously' to any US attack

Iran says would respond 'ferociously' to any US attack

-

Venezuelan foreign minister demands 'immediate release' of Maduro

-

Dane Vingegaard to start season at Paris-Nice in March

Dane Vingegaard to start season at Paris-Nice in March

-

Australia PM backs removing UK's Andrew from line of succession

Netlist Reports Third Quarter 2025 Results

IRVINE, CA / ACCESS Newswire / November 6, 2025 / Netlist, Inc. (OTCQB:NLST) today reported financial results for the third quarter ended September 27, 2025.

Recent Highlights:

Operating Expenses for the nine months ended September 27, 2025 decreased by 38% or $17.0 million compared to the same prior year period.

Net Loss for the nine months ended September 27, 2025 improved by 45% compared to the same prior year period.

"Third quarter performance reflects strong demand for DDR5 memory and reduced operating expenses." said Chief Executive Officer, C.K. Hong. "Netlist is well positioned to capitalize on the transition to next generation memory through its product offering and its IP assets including new patents covering DDR5 and HBM. In September, we took action before the U.S. International Trade Commission seeking remedial orders that direct U.S. Customs and Border Protection to stop Samsung memory products that infringe on Netlist's intellectual property from entering the country."

Net sales for the third quarter ended September 27, 2025 were $42.2 million, compared to net sales of $40.2 million for the third quarter ended September 28, 2024. Gross profit for the third quarter ended September 27, 2025 was $1.8 million, compared to a gross profit of $1.1 million for the third quarter ended September 28, 2024.

Net sales for the nine months ended September 27, 2025 were $112.9 million, compared to net sales of $112.8 million for the nine months ended September 28, 2024. Gross profit for the nine months ended September 27, 2025 was $4.5 million, compared to a gross profit of $2.6 million for the nine months ended September 28, 2024.

Net loss for the third quarter ended September 27, 2025 was ($7.0) million, or ($0.02) per share, compared to a net loss of ($9.4) million in the same prior year period, or ($0.04) per share. These results include stock-based compensation expense of $0.8 million and $1.1 million for the quarters ended September 27, 2025 and September 28, 2024, respectively.

Net loss for the nine months ended September 27, 2025 was ($22.6) million, or ($0.08) per share, compared to a net loss in the same prior year period of ($41.2) million, or ($0.16) per share. These results include stock-based compensation expense of $2.7 million and $3.6 million for the nine months ended September 27, 2025 and September 28, 2024, respectively.

As of September 27, 2025, cash, cash equivalents and restricted cash were $20.8 million, total assets were $56.3 million, working capital deficit was ($14.5) million, and stockholders' deficit was ($13.3) million.

Conference Call Information

C.K. Hong, Chief Executive Officer, and Gail Sasaki, Chief Financial Officer, will host an investor conference call today, November 6, 2025 at 12:00 p.m. Eastern Time to review Netlist's results for the third quarter ended September 27, 2025. The live webcast and archived replay of the call can be accessed for 90 days in the Investors section of Netlist's website at www.netlist.com.

About Netlist

Netlist is a leading innovator in advanced memory and storage solutions. With a rich portfolio of patented technologies, Netlist's inventions are foundational to the advancement of AI computing. To learn more about Netlist, please visit www.netlist.com.

Safe Harbor Statement

This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements contained in this news release include, without limitation, statements about Netlist's ability to execute on its strategic initiatives, the results of pending litigations and Netlist's ability to successfully defend its intellectual property. Forward-looking statements are statements other than historical facts and often address future events or Netlist's future performance and reflect management's present expectations regarding future events and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed in or implied by any forward-looking statements. These risks, uncertainties and other factors include, among others: risks that Samsung will appeal the final orders by the trial court for the Samsung litigation, risks that Micron will appeal the final orders by the trial court (appeals in general could cause a lengthy delay in Netlist's ability to collect damage awards, could overturn the verdicts or reduce the damages awards); risks that Netlist will suffer adverse outcomes in its litigation with Samsung, Micron or Google or in its various other active proceedings to defend the validity of its patents; risks related to Netlist's plans for its intellectual property, including its strategies for monetizing, licensing, expanding, and defending its patent portfolio; risks associated with patent infringement litigation initiated by Netlist, or by others against Netlist, as well as the costs and unpredictability of any such litigation; risks associated with Netlist's product sales, including the market and demand for products sold by Netlist and its ability to successfully develop and launch new products that are attractive to the market; the success of product, joint development and licensing partnerships; the competitive landscape of Netlist's industry; and general economic, political and market conditions, including the ongoing conflicts between Russia and Ukraine and Israel and Palestine, factory slowdowns and/or shutdowns, and changes in international tariff policies. All forward-looking statements reflect management's present assumptions, expectations and beliefs regarding future events and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed in or implied by any forward-looking statements. These and other risks and uncertainties are described in Netlist's Annual Report on Form 10-K for the fiscal year ended December 28, 2024 filed with the SEC on March 28, 2025, and the other filings it makes with the U.S. Securities and Exchange Commission from time to time, including any subsequently filed quarterly and current reports. In particular, you are encouraged to review the Company's Quarterly Report on Form 10-Q for the quarter ended September 27, 2025 that will be filed with the SEC for any revisions or updates to the information in this release. In light of these risks, uncertainties and other factors, these forward-looking statements should not be relied on as predictions of future events. These forward-looking statements represent Netlist's assumptions, expectations and beliefs only as of the date they are made, and except as required by law, Netlist undertakes no obligation to revise or update any forward-looking statements for any reason.

Investor Relations Contacts:

Mike Smargiassi

The Plunkett Group

[email protected]

(212) 739-6729

Gail M. Sasaki

Netlist, Inc., Chief Financial Officer

[email protected]

(949) 435-0025

NETLIST, INC. AND SUBSIDIARIES |

September 27, | December 28, | |||||||

2025 | 2024 | |||||||

ASSETS | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 10,544 | $ | 22,507 | ||||

Restricted cash | 10,300 | 12,100 | ||||||

Accounts receivable, net | 4,154 | 1,671 | ||||||

Inventories | 17,565 | 2,744 | ||||||

Prepaid expenses and other current assets | 12,312 | 733 | ||||||

Total current assets | 54,875 | 39,755 | ||||||

Property and equipment, net | 346 | 517 | ||||||

Operating lease right-of-use assets | 683 | 1,101 | ||||||

Other assets | 439 | 466 | ||||||

Total assets | $ | 56,343 | $ | 41,839 | ||||

LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

Current liabilities: | ||||||||

Accounts payable | $ | 37,283 | $ | 42,307 | ||||

Revolving line of credit | 3,437 | 1,230 | ||||||

Accrued payroll and related liabilities | 865 | 808 | ||||||

Deferred revenue | 26,974 | 40 | ||||||

Other current liabilities | 861 | 2,675 | ||||||

Total current liabilities | 69,420 | 47,060 | ||||||

Operating lease liabilities | 181 | 641 | ||||||

Other liabilities | 34 | 186 | ||||||

Total liabilities | 69,635 | 47,887 | ||||||

Commitments and contingencies | ||||||||

Stockholders' deficit: | ||||||||

Preferred stock | - | - | ||||||

Common stock | 293 | 273 | ||||||

Additional paid-in capital | 346,678 | 331,367 | ||||||

Accumulated deficit | (360,263 | ) | (337,688 | ) | ||||

Total stockholders' deficit | (13,292 | ) | (6,048 | ) | ||||

Total liabilities and stockholders' deficit | $ | 56,343 | $ | 41,839 | ||||

NETLIST, INC. AND SUBSIDIARIES |

Three Months Ended | Nine Months Ended | ||||||||||||||

September 27, | September 28, | September 27, | September 28, | ||||||||||||

2025 | 2024 | 2025 | 2024 | ||||||||||||

Net sales | $ | 42,234 | $ | 40,186 | $ | 112,915 | $ | 112,828 | |||||||

Cost of sales(1) | 40,396 | 39,044 | 108,385 | 110,198 | |||||||||||

Gross profit | 1,838 | 1,142 | 4,530 | 2,630 | |||||||||||

Operating expenses: | |||||||||||||||

Research and development(1) | 822 | 2,177 | 2,548 | 6,987 | |||||||||||

Intellectual property legal fees | 5,035 | 5,349 | 15,542 | 28,403 | |||||||||||

Selling, general and administrative(1) | 3,131 | 3,271 | 9,604 | 9,353 | |||||||||||

Total operating expenses | 8,988 | 10,797 | 27,694 | 44,743 | |||||||||||

Operating loss | (7,150 | ) | (9,655 | ) | (23,164 | ) | (42,113 | ) | |||||||

Other income, net: | |||||||||||||||

Interest income, net | 106 | 162 | 459 | 796 | |||||||||||

Other income, net | 34 | 88 | 130 | 167 | |||||||||||

Total other income, net | 140 | 250 | 589 | 963 | |||||||||||

Loss before provision for income taxes | (7,010 | ) | (9,405 | ) | (22,575 | ) | (41,150 | ) | |||||||

Provision for income taxes | - | - | - | 1 | |||||||||||

Net loss | $ | (7,010 | ) | $ | (9,405 | ) | $ | (22,575 | ) | $ | (41,151 | ) | |||

Loss per common share: | |||||||||||||||

Basic and diluted | $ | (0.02 | ) | $ | (0.04 | ) | $ | (0.08 | ) | $ | (0.16 | ) | |||

Weighted-average common shares outstanding: | |||||||||||||||

Basic and diluted | 292,557 | 258,025 | 280,229 | 256,509 | |||||||||||

(1) Amounts include stock-based compensation expense as follows: | |||||||||||||||

Cost of sales | $ | 12 | $ | 16 | $ | 62 | $ | 82 | |||||||

Research and development | 93 | 238 | 438 | 798 | |||||||||||

Selling, general and administrative | 655 | 876 | 2,244 | 2,752 | |||||||||||

Total stock-based compensation | $ | 760 | $ | 1,130 | $ | 2,744 | $ | 3,632 | |||||||

SOURCE: Netlist, Inc.

View the original press release on ACCESS Newswire

J.Williams--AMWN