-

Australian PM seeks removal of UK's Andrew from line of succession

Australian PM seeks removal of UK's Andrew from line of succession

-

Carrick hails 'ruthless' Man Utd match-winner Sesko

-

N.Korea leader's sister promoted at party congress

N.Korea leader's sister promoted at party congress

-

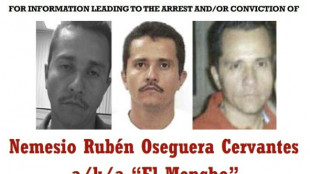

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

US forces to complete withdrawal from Syria within a month

-

US winter storm brings rare hush to snowy New York

-

George adamant Six Nations losses don't make England 'a bad team overnight'

George adamant Six Nations losses don't make England 'a bad team overnight'

-

US Supreme Court to hear bid to block climate change suits

-

Canada summons OpenAI over failure to report mass shooter

Canada summons OpenAI over failure to report mass shooter

-

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

-

Vonn says Olympic injury could have led to amputation

Vonn says Olympic injury could have led to amputation

-

UK police arrest ex-envoy Peter Mandelson in Epstein case

-

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

-

Son of director Rob Reiner pleads not guilty to parents' murder

-

Panama takes control of canal ports from CK Hutchison

Panama takes control of canal ports from CK Hutchison

-

Risk of 'escalation' if Iran attacked: deputy foreign minister

-

West Indies thrash Zimbabwe at T20 World Cup after piling up 254-6

West Indies thrash Zimbabwe at T20 World Cup after piling up 254-6

-

US forces to complete withdrawal from Syria within a month: sources to AFP

-

Snowstorm blankets US northeast as New York sees travel ban

Snowstorm blankets US northeast as New York sees travel ban

-

Healthcare crisis looms over Greenland's isolated villages

-

Hodgkinson says breaking 800m record would put her among athletics' greatest

Hodgkinson says breaking 800m record would put her among athletics' greatest

-

Two Russian security personnel were on board France-seized tanker: sources

-

EU puts US trade deal on ice after Supreme Court ruling

EU puts US trade deal on ice after Supreme Court ruling

-

Hetmyer blasts 85 as West Indies pile up 254-6 against Zimbabwe

-

Canada PM heads to Asia seeking new trade partners as US ties fray

Canada PM heads to Asia seeking new trade partners as US ties fray

-

South Africa accepts Trump's new US ambassador

-

Iraq's Maliki defends PM candidacy, seeks to reassure US

Iraq's Maliki defends PM candidacy, seeks to reassure US

-

UEFA suspend Benfica's Prestianni after alleged racist abuse

-

Jetten sworn in as youngest-ever Dutch PM

Jetten sworn in as youngest-ever Dutch PM

-

Italy's Enel to invest 20bn euros in renewables by 2028

-

BBC apologises for 'involuntary' Tourette's racial slur during BAFTA awards

BBC apologises for 'involuntary' Tourette's racial slur during BAFTA awards

-

Kristen Bell returns to host glitzy Actor Awards in Hollywood

-

Iran says would respond 'ferociously' to any US attack

Iran says would respond 'ferociously' to any US attack

-

Venezuelan foreign minister demands 'immediate release' of Maduro

-

Dane Vingegaard to start season at Paris-Nice in March

Dane Vingegaard to start season at Paris-Nice in March

-

Australia PM backs removing UK's Andrew from line of succession

-

Where do Ukraine and Russia stand after four years of war?

Where do Ukraine and Russia stand after four years of war?

-

Police investigating racist abuse of Premier League quartet

-

Fiji to start Nations Championship at 'home' to Wales in Cardiff

Fiji to start Nations Championship at 'home' to Wales in Cardiff

-

EU lawmakers to put US trade deal on hold after Supreme Court ruling

-

Rubio to attend Caribbean summit as US presses Venezuela, Cuba

Rubio to attend Caribbean summit as US presses Venezuela, Cuba

-

'Ugly' England aim to spin their way to T20 World Cup semi-finals

Trillium Technologies, Inc. Launches $300 Million Compute Credit Offering to Power the Future of AI and Cloud Intelligence

New securitized structure bridges institutional capital with advanced computing infrastructure

ZURICH, SWITZERLAND / ACCESS Newswire / November 10, 2025 / Trillium Technologies, Inc. (ISIN: CH1108682308) today announced approval of its $300 million fully collateralized private placement debt offering to develop and monetize the emerging asset class of Compute Credits for the Archeo Futurus cloud computing platform. This initiative positions Trillium at the forefront of financial and technological innovation, bridging institutional capital markets with the explosive global demand for artificial intelligence (AI) and cloud computing capacity.

Structured through A Securitization S.A. in Luxembourg, the Notes will be listed on the Vienna Stock Exchange (Vienna MTF) and cleared via Euroclear, Clearstream, and SIX, providing institutional investors with regulated transparency, mark-to-market visibility, and secondary-market liquidity.

Compute Credits represent prepaid access to cloud computing power for processing, storage, and network bandwidth to fuel AI, analytics, and digital transformation worldwide. Trillium Technologies is among the first to securitize these credits as a financial instrument, unlocking liquidity, scalability, and institutional access to one of the most in-demand resources of the digital age.

"Compute is rapidly becoming the currency of the future. By creating a global marketplace for Compute Credits, we are bridging technology and finance, transforming compute power into a liquid, securitized, and investable asset class that powers the intelligent economy," said J. Christopher Mizer, Founder and Chief Executive Officer of Trillium Technologies.

Trillium's offering is backed by one billion Archeo Compute Credits, independently validated by The Tolly Group, a leading global IT audit and validation firm. Tolly confirmed that Archeo Compute Credits maintain full pricing parity with Amazon Web Services, Google Cloud Platform, and Microsoft Azure, representing $1 billion in equivalent cloud computing value and a strong collateral base for investors.

"This is where finance meets the frontier of intelligence. By securitizing and monetizing compute capacity, we provide institutional investors access to a new asset class directly tied to the engines of technological progress. Trillium was founded to bridge innovation and institutional capital, thereby turning the raw power of compute into a measurable, yield-generating asset," said Kyle Barnette, President of Trillium Technologies. "As global compute demand continues to scale, the ability to secure and finance compute capacity will define competitive advantage. Trillium is building the infrastructure for that future as a transparent, securitized, and investable compute economy."

The Archeo Futurus platform, developed in collaboration with AMD and Broadcom, utilizes patented FPGA-based hardware and energy-efficient architecture to deliver superior data storage, processing, and security performance. Several leading financial institutions and U.S. federal agencies have already adopted Archeo technology for secure, distributed computing applications.

Proceeds from the $300 million offering will be allocated toward: expansion of Archeo Futurus infrastructure to meet surging global demand for compute capacity; targeted investments in AI-intensive sectors including healthcare, life sciences, industrial AI, defense technologies, multimedia ecosystems, and entertainment production; and creation of Trillium's Compute Credit Marketplace, enabling institutional buyers and sellers to trade, hedge, and monetize compute capacity in real time.

With global data-center investment projected to exceed $6.7 trillion by 2030 (McKinsey & Company), Trillium's Compute Credit framework introduces a new form of digital infrastructure financing that aligns the liquidity of capital markets with the compute power fueling the next generation of intelligence.

About Trillium Technologies, Inc.

Founded in 2025, Trillium Technologies, Inc. bridges the gap between technology innovation and institutional capital. The company develops and monetizes the emerging asset class of Compute Credits through strategic investment, securitization, and marketplace development for the Archeo Futurus cloud computing platform. Trillium's mission is to power the future of intelligence by making compute a liquid, tradable, and investable asset.

About the Offering

This press release is for informational purposes only and does not constitute, or form part of, an offer to sell or the solicitation of an offer to buy any securities in the United States or any other jurisdiction. No securities have been or will be registered under the U.S. Securities Act of 1933, as amended (the "Securities Act"), or under any state or foreign securities laws, and may not be offered or sold without registration or an applicable exemption from the registration requirements of the Securities Act and applicable state and foreign securities laws. Any such offer or sale of securities will be made solely pursuant to an offering memorandum, private placement memorandum, or similar definitive subscription document that will contain important information about the Company and the investment, including risk factors. Furthermore, this communication is subject to, and qualified in its entirety by, the information in the formal Offering Memorandum. The availability of any investment will be strictly subject to, and require compliance with, the securities laws and regulations of all relevant jurisdictions, including the United States, and will be limited to persons who are legally permitted to participate.

In accordance with European regulations, the Notes are intended for qualified institutional buyers (QIBs) and professional investors only, as defined under applicable EU and Luxembourg securities laws. The securities are not intended for retail investors.

Media Contact:

Trillium Technologies, Inc.

Charlotte Luer

+1 (239) 404-6785

[email protected]

SOURCE: Trillium Technologies Inc

View the original press release on ACCESS Newswire

D.Sawyer--AMWN