-

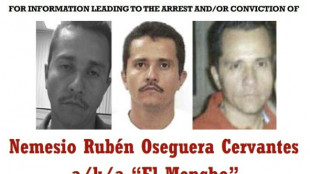

The key to taking down Mexico's most-wanted narco? His girlfriend

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

-

US winter storm brings rare hush to snowy New York

US winter storm brings rare hush to snowy New York

-

George adamant Six Nations losses don't make England 'a bad team overnight'

-

US Supreme Court to hear bid to block climate change suits

US Supreme Court to hear bid to block climate change suits

-

Canada summons OpenAI over failure to report mass shooter

-

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

-

Vonn says Olympic injury could have led to amputation

-

UK police arrest ex-envoy Peter Mandelson in Epstein case

UK police arrest ex-envoy Peter Mandelson in Epstein case

-

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

-

Son of director Rob Reiner pleads not guilty to parents' murder

Son of director Rob Reiner pleads not guilty to parents' murder

-

Panama takes control of canal ports from CK Hutchison

-

Risk of 'escalation' if Iran attacked: deputy foreign minister

Risk of 'escalation' if Iran attacked: deputy foreign minister

-

West Indies thrash Zimbabwe at T20 World Cup after piling up 254-6

-

US forces to complete withdrawal from Syria within a month: sources to AFP

US forces to complete withdrawal from Syria within a month: sources to AFP

-

Snowstorm blankets US northeast as New York sees travel ban

-

Healthcare crisis looms over Greenland's isolated villages

Healthcare crisis looms over Greenland's isolated villages

-

Hodgkinson says breaking 800m record would put her among athletics' greatest

-

Two Russian security personnel were on board France-seized tanker: sources

Two Russian security personnel were on board France-seized tanker: sources

-

EU puts US trade deal on ice after Supreme Court ruling

-

Hetmyer blasts 85 as West Indies pile up 254-6 against Zimbabwe

Hetmyer blasts 85 as West Indies pile up 254-6 against Zimbabwe

-

Canada PM heads to Asia seeking new trade partners as US ties fray

-

South Africa accepts Trump's new US ambassador

South Africa accepts Trump's new US ambassador

-

Iraq's Maliki defends PM candidacy, seeks to reassure US

-

UEFA suspend Benfica's Prestianni after alleged racist abuse

UEFA suspend Benfica's Prestianni after alleged racist abuse

-

Jetten sworn in as youngest-ever Dutch PM

-

Italy's Enel to invest 20bn euros in renewables by 2028

Italy's Enel to invest 20bn euros in renewables by 2028

-

BBC apologises for 'involuntary' Tourette's racial slur during BAFTA awards

-

Kristen Bell returns to host glitzy Actor Awards in Hollywood

Kristen Bell returns to host glitzy Actor Awards in Hollywood

-

Iran says would respond 'ferociously' to any US attack

-

Venezuelan foreign minister demands 'immediate release' of Maduro

Venezuelan foreign minister demands 'immediate release' of Maduro

-

Dane Vingegaard to start season at Paris-Nice in March

-

Australia PM backs removing UK's Andrew from line of succession

Australia PM backs removing UK's Andrew from line of succession

-

Where do Ukraine and Russia stand after four years of war?

-

Police investigating racist abuse of Premier League quartet

Police investigating racist abuse of Premier League quartet

-

Fiji to start Nations Championship at 'home' to Wales in Cardiff

-

EU lawmakers to put US trade deal on hold after Supreme Court ruling

EU lawmakers to put US trade deal on hold after Supreme Court ruling

-

Rubio to attend Caribbean summit as US presses Venezuela, Cuba

-

'Ugly' England aim to spin their way to T20 World Cup semi-finals

'Ugly' England aim to spin their way to T20 World Cup semi-finals

-

Nigeria paid Boko Haram ransom for kidnapped pupils: intel sources

-

Tudor says Tottenham can still beat the drop despite Arsenal loss

Tudor says Tottenham can still beat the drop despite Arsenal loss

-

Violence sweeps Mexico after most-wanted drug cartel leader killed

Intrusion Inc. Reports Third Quarter 2025 Results

Continued Intrusion Shield expansion underscores progress toward achieving sustainable growth and long-term profitability

PLANO, TX / ACCESS Newswire / November 11, 2025 / Intrusion Inc. (NASDAQ:INTZ) ("Intrusion" or the "Company"), a leader in cyberattack prevention solutions, announced today financial results for the third quarter ended September 30, 2025.

Recent Financial & Business Highlights:

Launched Intrusions Shield Cloud on the AWS Marketplace to help drive long-term growth and deliver autonomous network enforcement across modern infrastructure.

Achieved sixth sequential quarter of revenue improvement.

"During the third quarter, we continued to make meaningful progress toward achieving our goal of creating sustainable growth and enhancing long-term profitability," said Tony Scott, CEO of Intrusion. "Our top-line growth during the quarter was largely driven by our recent contract expansion with the U.S. Department of Defense, which includes the ongoing rollout of our critical infrastructure solutions. We are also seeing strong momentum for our Shield Endpoint product from our solution partner, PortNexus, as they advance the deployment of the MyFlareAlert platform, and we anticipate that we will see further adoption of this offering in coming quarters. In addition, we also made progress in helping expand our potential customer reach with the recent launch of Intrusion Shield Cloud on the AWS Marketplace, which we view as a meaningful milestone that will help drive long-term growth. As we look ahead to the fourth quarter and beyond, we remain committed to disciplined investment in our business, growing our customer base, and delivering improved financial results that will create value for our shareholders."

Third Quarter Financial Results

Revenue for the third quarter of 2025 was approximately $2.0 million, representing an increase of 31% on a year-over-year basis. The sequential increase in revenue for the third quarter of 2025 was driven by new customers signed in recent quarters, including the U.S. Department of Defense award for the use of both Intrusion Shield technology and consulting services.

The gross profit margin was 77% for the third quarter of 2025, which was relatively flat compared to the third quarter of 2024. Gross margin varies based on product mix.

Operating expenses for the third quarter of 2025 were $3.6 million, up $0.4 million compared to the third quarter of 2024.

Net loss for the third quarter of 2025 was $2.1 million, or $0.10 per share, which is flat when compared to prior year performance which included $0.5 million in one-time negotiated savings.

As of September 30, 2025, cash and cash equivalents were $2.5 million, and short-term investments in U.S. Treasuries were $2.0 million. On October 1st, the Company received $3.0 million in cash from trade receivables increasing the Company's combined cash and short-term investment position to $7.5 million.

Conference Call

Intrusion's management will host a conference call today at 5:00 P.M. EST. Interested investors can access the live call by dialing 1-888-506-0062, or 1-973-528-0011 for international callers, and providing the following access code: 496037. The call will also be webcast live (LINK). For those unable to participate in the live conference call, a replay will be accessible beginning tonight at 7:00 P.M. EST until November 25, 2025, by dialing 1-877-481-4010, or 1-919-882-2331 for international callers, and entering the following access code: 52908. Additionally, a live and archived audio webcast of the conference call will be available at www.intrusion.com.

About Intrusion Inc.

Intrusion Inc. is a cybersecurity company based in Plano, Texas, specializing in advanced threat intelligence. At the core of its capabilities is TraceCop, a proprietary database that catalogs the historical behavior, associations, and reputational risk of IPv4 and IPv6 addresses, domain names, and hostnames. Built on years of gathering global internet intelligence and supporting government entities, this data forms the backbone of Intrusion's commercial solutions.

Its most recent solution is Intrusion Shield - a next-generation network security platform designed to detect and prevent threats in real time. In observe mode, Shield delivers analytical insights powered by Intrusion's exclusive data, helping organizations identify unseen patterns and previously unknown risks. In protect mode, it monitors traffic flow and automatically blocks known malicious and unknown connections from entering or exiting the network - providing a powerful defense against Zero-Day threats and ransomware. By integrating Shield into a network, organizations can elevate their overall security posture and enhance the performance of their broader cybersecurity architecture.

Cautionary Statement Regarding Forward-Looking Information

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements involve substantial risks and uncertainties. All statements other than statements of historical facts contained herein, including statements regarding our financial position; our ability to continue our business as a going concern; our business, sales, and marketing strategies and plans; our ability to successfully market, sell, and deliver our Intrusion Shield commercial product and solutions to an expanding customer base; are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as "anticipate," "believe," "contemplate," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "will," or "would" or the negative of these words or other similar terms or expressions. Forward-looking statements contained in this press release include, but are not limited to, such statements.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this press release primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors described in our filings with the Securities and Exchange Commission, including but not limited to our most recent annual report on Form 10-K and quarterly reports on Form 10-Q, as the same may be updated from time to time.

The forward-looking statements made herein relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this press release to reflect events or circumstances after the date hereof or to reflect new information or the occurrence of unanticipated events, except as required by law.

IR Contact:

Alpha IR Group

Mike Cummings or Josh Carroll

[email protected]

INTRUSION INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except par value amounts)

September 30, 2025 | December 31, | |||

(unaudited) | ||||

ASSETS | ||||

Current Assets: | ||||

Cash and cash equivalents | $ | 2,527 | $ | 4,851 |

Short-term investments | 2,000 | - | ||

Accounts receivable, net | 2,378 | 169 | ||

Prepaid expenses and other assets | 666 | 514 | ||

Total current assets | 7,571 | 5,534 | ||

Noncurrent Assets: | ||||

Property and equipment: | ||||

Equipment | 2,899 | 2,690 | ||

Capitalized software development | 5,344 | 3,948 | ||

Leasehold improvements | 18 | 18 | ||

Property and equipment, gross | 8,261 | 6,656 | ||

Accumulated depreciation and amortization | (3,937 | ) | (2,809 | ) |

Property and equipment, net | 4,324 | 3,847 | ||

Finance leases, right-of-use assets, net | 249 | 491 | ||

Operating leases, right-of-use assets, net | 1,243 | 1,356 | ||

Other assets | 285 | 281 | ||

Total noncurrent assets | 6,101 | 5,975 | ||

TOTAL ASSETS | $ | 13,672 | $ | 11,509 |

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||

Current Liabilities: | ||||

Accounts payable, trade | $ | 541 | $ | 1,508 |

Accrued expenses | 550 | 291 | ||

Finance lease liabilities, current portion | 113 | 405 | ||

Operating lease liabilities, current portion | 54 | 209 | ||

Notes payable | - | 529 | ||

Deferred revenue | 1,177 | 730 | ||

Total current liabilities | 2,435 | 3,672 | ||

Noncurrent Liabilities: | ||||

Finance lease liabilities, noncurrent portion | 85 | 172 | ||

Operating lease liabilities, noncurrent portion | 1,343 | 1,414 | ||

Total noncurrent liabilities | 1,428 | 1,586 | ||

Commitments and Contingencies | ||||

Stockholders' Equity: | ||||

Preferred stock, $0.01 par value: Authorized shares - 5,000; Issued shares - 0 in 2025 and 4 in 2024 | - | 3,827 | ||

Common stock, $0.01 par value: Authorized shares - 80,000; Issued shares - 20,103 in 2025 and 15,591 in 2024; Outstanding shares - 20,102 in 2025 and 15,590 in 2024 | 201 | 156 | ||

Common stock held in treasury, at cost - 1 share | (362 | ) | (362 | ) |

Additional paid-in capital | 134,254 | 122,552 | ||

Stock subscription receivable | - | (1,872 | ) | |

Accumulated deficit | (124,241 | ) | (118,007 | ) |

Accumulated other comprehensive loss | (43 | ) | (43 | ) |

Total stockholders' equity | 9,809 | 6,251 | ||

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 13,672 | $ | 11,509 |

INTRUSION INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

2025 | 2024 | 2025 | 2024 | |||||||||

Revenue | $ | 1,966 | $ | 1,504 | $ | 5,614 | $ | 4,095 | ||||

Cost of revenue | 461 | 344 | 1,335 | 920 | ||||||||

Gross profit | 1,505 | 1,160 | 4,279 | 3,175 | ||||||||

Operating expenses: | ||||||||||||

Sales and marketing | 1,273 | 1,207 | 3,664 | 3,542 | ||||||||

Research and development | 1,329 | 1,150 | 3,879 | 3,204 | ||||||||

General and administrative | 1,039 | 841 | 3,051 | 2,972 | ||||||||

Operating loss | (2,136 | ) | (2,038 | ) | (6,315 | ) | (6,543 | ) | ||||

Interest expense | (17 | ) | (12 | ) | (67 | ) | (274 | ) | ||||

Interest accretion and amortization of debt issuance costs, net | - | - | - | 990 | ||||||||

Other income (expense), net | 59 | - | 148 | (6 | ) | |||||||

Net loss | $ | (2,094 | ) | $ | (2,050 | ) | $ | (6,234 | ) | $ | (5,833 | ) |

Net loss per share: | ||||||||||||

Basic | $ | (0.10 | ) | $ | (0.35 | ) | $ | (0.32 | ) | $ | (1.49 | ) |

Diluted | $ | (0.10 | ) | $ | (0.35 | ) | $ | (0.32 | ) | $ | (1.49 | ) |

Weighted average common shares outstanding: | ||||||||||||

Basic | 19,975 | 6,557 | 19,698 | 4,264 | ||||||||

Diluted | 19,975 | 6,557 | 19,698 | 4,264 | ||||||||

SOURCE: Intrusion Inc.

View the original press release on ACCESS Newswire

P.M.Smith--AMWN