-

Hong Kong appeals court upholds jailing of 12 democracy campaigners

Hong Kong appeals court upholds jailing of 12 democracy campaigners

-

India battle for World Cup survival after 'messing up on grand scale'

-

'I will go': Bengalis in Pakistan hope for family reunions

'I will go': Bengalis in Pakistan hope for family reunions

-

North Korea touts nuclear advances as Kim re-chosen to lead ruling party

-

South Korea protests 'Victory' banner hung from Russian embassy

South Korea protests 'Victory' banner hung from Russian embassy

-

Asian stocks rally after Trump's Supreme Court tariffs blow

-

New Dutch government to be sworn in under centrist Jetten

New Dutch government to be sworn in under centrist Jetten

-

New York mayor orders citywide travel ban as major storm hits US

-

ICC to begin pre-trial hearing for Philippines' Duterte

ICC to begin pre-trial hearing for Philippines' Duterte

-

After two convictions, France's Sarkozy seeks to merge sentences

-

Bridgeman hangs on to claim first PGA Tour title at Riviera

Bridgeman hangs on to claim first PGA Tour title at Riviera

-

Hong Kong appeals court to rule on jailed democracy campaigners

-

Blizzard blows New Yorkers' plans off course

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

Strasbourg snap Lyon winning run in Ligue 1

-

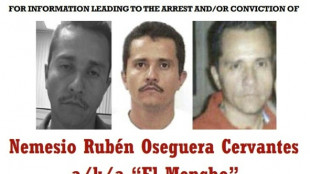

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

Giroud penalty ends Lille's winless run in Ligue 1

-

Thrashing Spurs dragged Arsenal out of title hell: Arteta

-

Iran-US talks expected Thursday despite fears of strikes

Iran-US talks expected Thursday despite fears of strikes

-

Milan beaten by Parma, Napoli rage at officials

-

Hughes looses teeth then scores Olympic gold-winning goal for USA

Hughes looses teeth then scores Olympic gold-winning goal for USA

-

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

-

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

-

Galthie praises France lock Meafou and defence

-

'Nothing was good', says Mac Allister despite Liverpool win

'Nothing was good', says Mac Allister despite Liverpool win

-

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

-

EU 'expects' US to honour trade deal as Trump hikes tariffs

EU 'expects' US to honour trade deal as Trump hikes tariffs

-

'GOAT' battles to top of N. America box office

-

South Africa thrash India to end 12-match T20 World Cup win streak

South Africa thrash India to end 12-match T20 World Cup win streak

-

Bielle-Biarrey breaks record as France beat Italy in Six Nations

-

US says trade deals in force despite court ruling on tariffs

US says trade deals in force despite court ruling on tariffs

-

Barcelona back top of La Liga with Levante win

-

Gu strikes gold, USA beat Canada in men's ice hockey

Gu strikes gold, USA beat Canada in men's ice hockey

-

What's behind England's Six Nations slump?

-

Napoli rage at officials after loss at Atalanta

Napoli rage at officials after loss at Atalanta

-

Liverpool late show floors Nottingham Forest

-

Rimac Nevera R: Beyond imagination

Rimac Nevera R: Beyond imagination

-

USA beat Canada to win men's Olympic ice hockey gold

-

Samardzic seals comeback win for Atalanta over Napoli

Samardzic seals comeback win for Atalanta over Napoli

-

Eileen Gu switches slopes for catwalk after Olympic flourish

-

Luce: Ferrari's ingenious electric revolution

Luce: Ferrari's ingenious electric revolution

-

Miller guides South Africa to 187-7 against India

-

Scotland boss 'proud' of comeback Six Nations win over Wales

Scotland boss 'proud' of comeback Six Nations win over Wales

-

Iranian students rally for second day as fears of war with US mount

-

US Secret Service kills man trying to access Trump Florida estate

US Secret Service kills man trying to access Trump Florida estate

-

Coventry 'let the Games do their magic': former IOC executives

Bonk, Inc. Provides 2026 Guidance: Forecasts Baseline of 100% Revenue Growth After Capital Restructuring and Asset Repositioning

Company Projects Substantial Net Income Expansion Supported by Debt-Free Balance Sheet, ~ $4M Yerbaé Contribution, and Majority Revenue Interest in BONK.fun

SCOTTSDALE, AZ / ACCESS Newswire / December 10, 2025 / Bonk, Inc. (NASDAQ:BNKK) today announced financial guidance for fiscal 2026, projecting a baseline of 100% year-over-year revenue growth. This outlook follows a year of capital reorganization, elimination of legacy liabilities, and activation of higher-margin revenue streams tied to the Company's digital asset infrastructure.

Following the reverse stock split, effective Thursday, December 11, Bonk, Inc. will enter 2026 with a streamlined capital structure intended to support sustainable, profitable expansion. The restructuring completes a comprehensive, year-long transformation.

2026 Outlook - Key Growth Drivers

BONK.fun (Digital Asset Revenue): Bonk, Inc. now holds a 51% revenue interest in BONK.fun. Based on valuation metrics established in the Company's most recent quarterly filing, this asset represents an implied total value of approximately $30 million. Unlike passive-asset treasuries, BONK.fun operates as an active "revenue flywheel," converting ecosystem activity into recurring cash flow. New product launches scheduled for late Q4 2025 are expected to materially increase recurring, high-margin revenue beginning in 2026.

Beverage Division (Yerbaé): The Yerbaé brand is expected to contribute roughly $4 million in revenue in 2026. With legacy acquisition debts fully paid, the beverage segment is transitioning from a cost center to a profitable business line.

Potential Revenue Upside & Legislative Catalysts Management emphasizes that the projected 100% year-over-year revenue growth rate represents a prudent baseline that does not fully factor in potential exponential growth driven by the shifting U.S. legislative landscape.

Strategic Reserve Framework (GENIUS Act of 2025): The Company highlights the impact of the GENIUS Act, enacted in July 2025, which established the framework for a national Strategic Digital Asset Reserve. Bonk, Inc. believes this landmark legislation validates the corporate treasury model it has pioneered, driving unprecedented institutional demand for digital assets.

Regulatory Clarity (FIT21): The advancement of the Financial Innovation and Technology for the 21st Century Act (FIT21) signals a move toward a clearer regulatory framework. Bonk, Inc. anticipates that such clarity will unlock institutional liquidity and increase transaction velocity across the sector-directly benefiting the fee-generation mechanics of BONK.fun.

Corporate Strengths and Market Catalysts

Strengthened Governance: The Board has been refreshed with domain-experienced directors, including Connor Klein (New Form Capital), Stacey Duffy (financial due diligence), and Jamie McAvity (CEO, Cormint, Inc.). Their expertise in decentralized finance, capital markets, and high-growth operations supports improved oversight and execution.

Valuation Strength (mNAV): The Company highlights a current mNAV of 1.85x (Market Cap ÷ BONK Holdings). This ratio demonstrates that the market assigns significant premium value to the Company's active revenue engines (BONK.fun and Yerbaé) beyond the baseline value of its digital asset treasury, distinguishing Bonk, Inc. from purely passive holding companies.

Institutional Access and NAV Support: The recent launch of a regulated BONK ETP on the SIX Swiss Exchange broadens institutional access to the underlying asset. Management expects improved institutional awareness and demand to support appreciation of the Company's treasury holdings and contribute to NAV expansion in 2026.

Balance Sheet and Profitability Improvements

Debt Elimination: In 2025, the Company materially reduced liabilities and settled legacy obligations. Entering 2026 debt-free will lower interest expense and reduce cash drag, supporting margin improvement and cash flow generation.

Capital Alignment: The reverse stock split aligns share count with the Company's reconstituted market capitalization, improving comparability for EPS metrics and institutional participation.

Management Commentary "We recognize yesterday's market reaction to the 1-for-35 reverse stock split and the associated share price move," said Jarrett Boon, CEO of Bonk, Inc. "Reverse splits often cause short-term volatility; however, the action was necessary to meet Nasdaq capital structure considerations and to position the Company for institutional coverage and deeper liquidity. Post-split, Bonk, Inc. will have an estimated 5.3 million shares outstanding, a materially reduced float, and no legacy debt. We believe these changes, combined with our majority revenue participation in BONK.fun and the expected $4M contribution from Yerbaé, create a clearer path to durable cash flow and NAV expansion."

Boon continued, "This pivot has been executed from a forward-thinking landscape designed to capture digital growth with one of the best digital assets on the Solana Blockchain. With legacy liabilities settled, a debt-free balance sheet, and growing contributions from our active revenue engines, our 2026 guidance is grounded in concrete assets and executable revenue streams-not speculation. We expect the coming year to validate our strategy through measurable financial performance."

About Bonk, Inc. Bonk, Inc. (NASDAQ:BNKK) is a company evolving to bridge the gap between traditional public markets and the digital asset ecosystem. Through its subsidiary BONK Holdings LLC, the Company executes a strategy focused on acquiring revenue-generating assets within the decentralized finance space. The Company also operates a growing beverage division holding the patented Sure Shot and Yerbaé brands.

Investor Relations Contact: Phone: 888.257.8061 Email: [email protected]

Forward-Looking Statements: This press release contains forward-looking statements regarding the Company's projected revenue, net income, and business operations for 2026. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially due to factors such as market volatility in the digital asset sector, consumer demand for beverage products, the performance of the BONK.fun platform, and other risks detailed in Bonk, Inc.'s filings with the Securities and Exchange Commission. The Company assumes no obligation to update forward-looking statements.

SOURCE: Bonk, Inc.

View the original press release on ACCESS Newswire

F.Pedersen--AMWN