-

Bridgeman hangs on to claim first PGA Tour title at Riviera

Bridgeman hangs on to claim first PGA Tour title at Riviera

-

Hong Kong appeals court to rule on jailed democracy campaigners

-

Blizzard blows New Yorkers' plans off course

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

Strasbourg snap Lyon winning run in Ligue 1

-

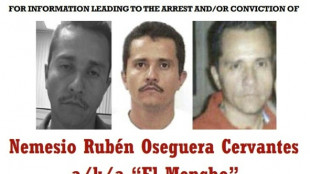

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

Giroud penalty ends Lille's winless run in Ligue 1

-

Thrashing Spurs dragged Arsenal out of title hell: Arteta

-

Iran-US talks expected Thursday despite fears of strikes

Iran-US talks expected Thursday despite fears of strikes

-

Milan beaten by Parma, Napoli rage at officials

-

Hughes looses teeth then scores Olympic gold-winning goal for USA

Hughes looses teeth then scores Olympic gold-winning goal for USA

-

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

-

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

-

Galthie praises France lock Meafou and defence

-

'Nothing was good', says Mac Allister despite Liverpool win

'Nothing was good', says Mac Allister despite Liverpool win

-

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

-

EU 'expects' US to honour trade deal as Trump hikes tariffs

EU 'expects' US to honour trade deal as Trump hikes tariffs

-

'GOAT' battles to top of N. America box office

-

South Africa thrash India to end 12-match T20 World Cup win streak

South Africa thrash India to end 12-match T20 World Cup win streak

-

Bielle-Biarrey breaks record as France beat Italy in Six Nations

-

US says trade deals in force despite court ruling on tariffs

US says trade deals in force despite court ruling on tariffs

-

Barcelona back top of La Liga with Levante win

-

Gu strikes gold, USA beat Canada in men's ice hockey

Gu strikes gold, USA beat Canada in men's ice hockey

-

What's behind England's Six Nations slump?

-

Napoli rage at officials after loss at Atalanta

Napoli rage at officials after loss at Atalanta

-

Liverpool late show floors Nottingham Forest

-

Rimac Nevera R: Beyond imagination

Rimac Nevera R: Beyond imagination

-

USA beat Canada to win men's Olympic ice hockey gold

-

Samardzic seals comeback win for Atalanta over Napoli

Samardzic seals comeback win for Atalanta over Napoli

-

Eileen Gu switches slopes for catwalk after Olympic flourish

-

Luce: Ferrari's ingenious electric revolution

Luce: Ferrari's ingenious electric revolution

-

Miller guides South Africa to 187-7 against India

-

Scotland boss 'proud' of comeback Six Nations win over Wales

Scotland boss 'proud' of comeback Six Nations win over Wales

-

Iranian students rally for second day as fears of war with US mount

-

US Secret Service kills man trying to access Trump Florida estate

US Secret Service kills man trying to access Trump Florida estate

-

Coventry 'let the Games do their magic': former IOC executives

-

Cayenne Turbo Electric 2026

Cayenne Turbo Electric 2026

-

Sri Lanka have to qualify 'the hard way' after England drubbing

-

Doris says Six Nations rout of England is sparking Irish 'belief'

Doris says Six Nations rout of England is sparking Irish 'belief'

-

Thousands of pilgrims visit remains of St Francis

-

Emotional Gu makes history with Olympic freeski halfpipe gold

Emotional Gu makes history with Olympic freeski halfpipe gold

-

Impressive Del Toro takes statement victory in UAE

-

Gu wins triumphant gold of Milan-Cortina Olympics before ice hockey finale

Gu wins triumphant gold of Milan-Cortina Olympics before ice hockey finale

-

England rout Sri Lanka for 95 to win Super Eights opener

-

Underhill tells struggling England to maintain Six Nations 'trust' as Italy await

Underhill tells struggling England to maintain Six Nations 'trust' as Italy await

-

Alfa Tonale 2026: With a new look

How to Start a Crypto IRA (Guide Released)

Seeing the surge in the popularity of crypto investments, IRAEmpire has published a new guide on how to start a crypto IRA to help investors make better informed decisions.

PORTLAND, OREGON / ACCESS Newswire / December 16, 2025 / Retirement investing looks very different than it did just a few years ago. With inflation reducing purchasing power, market swings unsettling traditional portfolios, and global debt continuing to rise, many Americans are rethinking how they save for the future. One option that's gaining momentum is the Crypto IRA, a tax-advantaged retirement account that lets investors hold digital assets like Bitcoin and Ethereum.

A Crypto IRA gives investors a way to diversify beyond traditional markets and gain exposure to the fast-growing world of cryptocurrency. Unlike most retirement accounts that only offer stocks, bonds, and mutual funds, a Crypto IRA lets you buy, sell, and hold digital assets through a self-directed IRA.

Check Out the Best Crypto IRA Providers Rankings

Cryptocurrencies have shown resilience over time, sometimes outperforming traditional assets. As more institutions adopt cryptocurrency, the case for long-term exposure to these assets keeps getting stronger.

Whether you're already investing in crypto or just starting to explore new ways to diversify your retirement plan, a Crypto IRA can help you take advantage of this opportunity while still offering the same tax benefits and security as a traditional IRA.

Learn About the No.1 Ranked Crypto IRA Provider in the US

What Is a Crypto IRA? (Definition and Overview)

A Crypto IRA is a self-directed Individual Retirement Account (IRA) that allows you to invest in cryptocurrencies with tax-benefits. It functions much like a typical IRA you can find through traditional financial institutions, but instead of limiting you to stocks, bonds, and mutual funds, it gives you access to cryptocurrency such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and others.

Here's how it works:

When you open a Crypto IRA, you're using the platform that works with an IRS-approved custodian and your assets are secured by third-party, US-based custodians (USD cash) and third-party institutional storage providers (for crypto).

There are two main types of Crypto IRAs, each with unique tax advantages:

Traditional Crypto IRA: Contributions are made with pre-tax dollars, and your assets can grow tax-deferred until you begin taking withdrawals in retirement.

Roth Crypto IRA: Contributions are made with after-tax dollars, and qualified withdrawals, including your gains, are completely tax-free.

Because Crypto IRAs are considered self-directed, investors have much more flexibility and control over their portfolios. You decide which cryptocurrencies to hold, when to buy or sell, and how to allocate your funds.

In short, a Crypto IRA combines the innovation of digital assets with the traditional structure of retirement investing, making it an attractive option for forward-thinking investors in 2025.

Check Out the Best Crypto IRA Providers of 2025.

Benefits of Starting a Crypto IRA

As the cryptocurrency market continues to mature and regulations become clearer, Crypto IRAs are emerging as a tax-efficient way to diversify your retirement portfolio.

1. Tax-Advantaged Growth

Either tax-deferred growth (Traditional IRA) or tax-free withdrawals (Roth IRA). This allows investors to accumulate long-term crypto gains without facing immediate capital gains taxes.

2. 24/7 Access To The Markets

Unlike the traditional stock market that is open 5 days a week for a limited number of hours, the crypto markets don't sleep. You can buy and sell anytime, anywhere.

3. Potential Inflation Hedge

With fiat currencies under pressure from inflation and government debt, many investors see crypto, especially Bitcoin, as a hedge against inflation. Its limited supply preserves purchasing power over time.

4. Control

Crypto IRAs give you direct control over which assets you hold. This flexibility allows investors to respond to market changes and pursue long-term strategies.

5. Institutional Adoption

Large financial institutions are now embracing cryptocurrency. This global acceptance enhances the credibility and stability of crypto for individual investors.

Check Out the Best Crypto IRA Provider in the US

How to Start a Crypto IRA (Step-by-Step Process)

Opening a Crypto IRA may sound technical, but the process is straightforward when you work with a reputable provider. Here's a simple step-by-step roadmap to help you get started confidently in 2025:

Step 1: Choose a Trusted Crypto IRA Platform

Begin by selecting a well-established platform. Leading providers, such as iTrustCapital, have built strong reputations for reliability and customer support. Compare their fee structures, supported cryptocurrencies, and security features before deciding.

Step 2: Open a Self-Directed IRA (SDIRA)

A Crypto IRA operates under a self-directed IRA, giving you the flexibility to invest in nontraditional assets like cryptocurrencies.

Step 3: Fund Your Account

You can fund your new Crypto IRA in one of three ways:

Rollover: Transfer funds from an old 401(k), 403(b), or employer-sponsored plan.

Transfer: Move assets directly from another IRA.

New Contribution: Make a fresh contribution within annual IRS limits ($7,000 for those under 50 and $8,000 for those 50 or older in 2025).

Step 4: Select and Purchase Cryptocurrencies

Once your account is funded, you can choose which digital assets to include, such as Bitcoin, Ethereum, Solana, or Cardano. Most platforms provide real-time access, allowing you to buy and sell 24/7 while keeping your holdings within the IRA's tax-advantaged structure.

Common Mistakes to Avoid When Starting a Crypto IRA

While starting a Crypto IRA is one of the most forward-thinking ways to diversify your retirement savings, it also comes with important rules and responsibilities. Many first-time investors make errors that can lead to unnecessary taxes, penalties, or losses. Avoiding these common mistakes will help ensure your account remains compliant, secure, and profitable.

1. Choosing an Untrustworthy Provider

Not every Crypto IRA company truly prioritizes its clients. Take time to read reviews on Google and Trustpilot and you'll quickly see which providers actually deliver.

2. Ignoring Unnecessary Fees and Costs

Some platforms advertise "low fees," only to surprise clients later with storage or maintenance charges. Always ask for a full breakdown of fees before signing up, including account maintenance, custodial, and storage costs, so you understand your true long-term expenses. A trustworthy provider will charge a small transaction fee (as low as 1%).

3. Neglecting Tax and Withdrawal Rules

A Crypto IRA follows the same contribution and withdrawal rules as a standard IRA. Withdrawing funds early or failing to report transfers correctly can lead to penalties. Always consult a tax advisor to ensure proper handling of rollovers and distributions.

Check Out the Most Trusted Crypto IRA Provider to Avoid Investing Mistakes

FAQs About Starting a Crypto IRA

Before opening a Crypto IRA, many investors have questions about how these accounts work, what rules apply, and what to expect in terms of costs and returns. Below are answers to the most common questions asked by beginners in 2025.

Q1: How much do I need to start a Crypto IRA?

Minimum investment requirements vary by provider.

Q2: Which cryptocurrencies can I invest in?

Most Crypto IRAs support major coins like Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Solana (SOL). Some also offer access to newer assets such as Avalanche or Chainlink, depending on custody approval and liquidity.

Q3: Can I transfer my existing IRA or old 401(k) into a Crypto IRA?

Absolutely. Most investors open a Crypto IRA by rolling over funds from an existing retirement plan such as a 401(k), 403(b), or Traditional IRA.

Q4: What are the tax advantages of a Crypto IRA?

A Crypto IRA follows the same rules as any other IRA:

Traditional Crypto IRA: Contributions may be tax-deductible, and gains grow tax-deferred until withdrawal.

Roth Crypto IRA: Contributions are made with after-tax dollars, but withdrawals - including profits - are tax-free in retirement.

Q5: Can I hold my crypto in my own wallet?

No. IRS rules require that IRA-held crypto be stored by an approved custodian. Moving assets to a personal wallet may violate regulations and trigger taxes or penalties.

About IRAEmpire

IRAEmpire is a leading online resource dedicated to helping investors make smarter decisions about retirement planning, precious metals, and alternative investments. Built with a mission to simplify complex financial topics, IRAEmpire provides in-depth reviews, comparison guides, and educational content focused on Gold IRAs, Silver IRAs, and other self-directed retirement accounts.

The platform is designed for investors who want clarity, transparency, and unbiased insights before committing to a retirement strategy. Unlike generic finance sites, IRAEmpire specializes in the precious metals niche, ensuring that its articles, rankings, and company reviews are tailored specifically to the needs of retirement savers seeking stability in uncertain times.

CONTACT:

Ryan Paulson

[email protected]

SOURCE: IRAEmpire LLC

View the original press release on ACCESS Newswire

G.Stevens--AMWN