-

EU must 'tear down barriers' to become 'global giant': von der Leyen

EU must 'tear down barriers' to become 'global giant': von der Leyen

-

US grand jury rejects bid to indict Democrats over illegal orders video

-

Struggling brewer Heineken to cut up to 6,000 jobs

Struggling brewer Heineken to cut up to 6,000 jobs

-

Asian stock markets rise, dollar dips as traders await US jobs

-

Britain's Harris Dickinson on John Lennon, directing and news overload

Britain's Harris Dickinson on John Lennon, directing and news overload

-

9 killed in Canada mass shooting that targeted school, residence

-

Wembanyama scores 40 as Spurs rout Lakers, Pacers stun Knicks

Wembanyama scores 40 as Spurs rout Lakers, Pacers stun Knicks

-

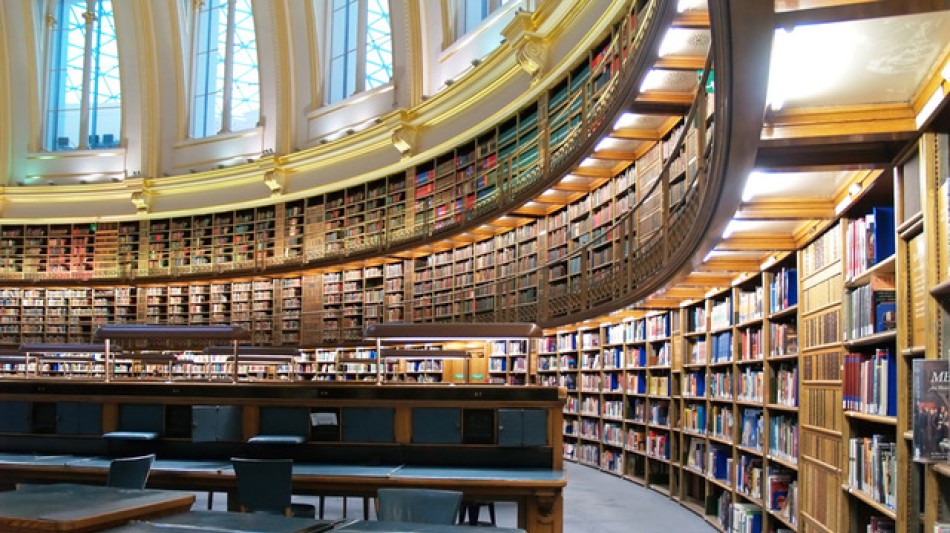

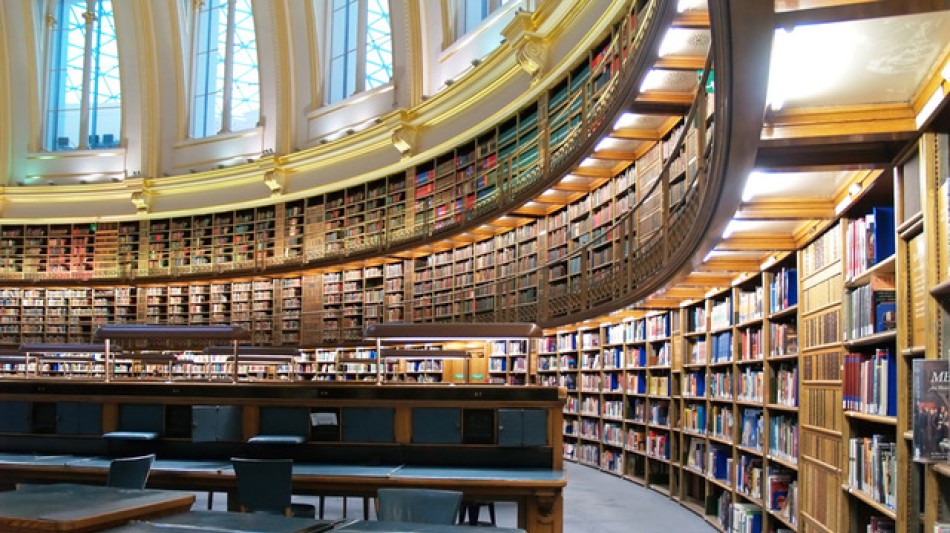

UK's crumbling canals threatened with collapse

-

Hong Kong convicts father of wanted activist over handling of funds

Hong Kong convicts father of wanted activist over handling of funds

-

Australia charges two Chinese nationals with foreign interference

-

'Overloading' may have led to deadly Philippine ferry sinking

'Overloading' may have led to deadly Philippine ferry sinking

-

Bangladesh to vote on democratic reform charter

-

China coach warns of 'gap' ahead of Women's Asian Cup title defence

China coach warns of 'gap' ahead of Women's Asian Cup title defence

-

Glitzy Oscar nominees luncheon back one year after LA fires

-

Pacers outlast Knicks in overtime

Pacers outlast Knicks in overtime

-

9 killed in Canada mass shooting that targeted school, residence: police

-

De Zerbi leaves Marseille 'by mutual agreement'

De Zerbi leaves Marseille 'by mutual agreement'

-

Netanyahu to push Trump on Iran missiles in White House talks

-

England captain Stokes has surgery after being hit in face by ball

England captain Stokes has surgery after being hit in face by ball

-

Rennie, Joseph lead running to become next All Blacks coach

-

Asian stock markets mixed as traders weigh US data, await jobs

Asian stock markets mixed as traders weigh US data, await jobs

-

Australian Olympic snowboarder airlifted to hospital with broken neck

-

Moderna says US refusing to review mRNA-based flu shot

Moderna says US refusing to review mRNA-based flu shot

-

'Artists of steel': Japanese swords forge new fanbase

-

New York model, carved in a basement, goes on display

New York model, carved in a basement, goes on display

-

Noisy humans harm birds and affect breeding success: study

-

More American women holding multiple jobs as high costs sting

More American women holding multiple jobs as high costs sting

-

Charcoal or solar panels? A tale of two Cubas

-

Genflow Biosciences PLC Announces Notice of GM

Genflow Biosciences PLC Announces Notice of GM

-

Tocvan Announces Restart Of Exploration Drilling At The Gran Pilar Project South Block

-

Corporate Treasury & Digital Infrastructure Note: The Active Management Divergence

Corporate Treasury & Digital Infrastructure Note: The Active Management Divergence

-

Several wounded in clashes at Albania opposition rally

-

Chelsea's draw with Leeds 'bitter pill' for Rosenior

Chelsea's draw with Leeds 'bitter pill' for Rosenior

-

'On autopilot': US skate star Malinin nears more Olympic gold

-

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

-

Frank confident of keeping Spurs job despite Newcastle defeat

-

James's All-NBA streak ends as Lakers rule superstar out of Spurs clash

James's All-NBA streak ends as Lakers rule superstar out of Spurs clash

-

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

-

Colombian senator kidnapped, president targeted in election run-up

Colombian senator kidnapped, president targeted in election run-up

-

Britney Spears sells rights to her music catalog: US media

-

West Ham end Man Utd's winning run, Spurs sink to 16th

West Ham end Man Utd's winning run, Spurs sink to 16th

-

US skate star Malinin leads after short programme in Olympics

-

Man Utd's Sesko strikes late to rescue West Ham draw

Man Utd's Sesko strikes late to rescue West Ham draw

-

Shiffrin flops at Winter Olympics as helmet row grows

-

Celtics' Tatum practices with G League team but injury return uncertain

Celtics' Tatum practices with G League team but injury return uncertain

-

Gisele Pelicot publishes memoirs after rape trial ordeal

-

Newcastle beat sorry Spurs to leave Frank on the brink

Newcastle beat sorry Spurs to leave Frank on the brink

-

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

-

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

-

Venezuelan authorities move Machado ally to house arrest

Lift Announces the Closing of Its Strategic $21.3 Million Private Placement

Li-FT Power Ltd. ("LIFT" or the "Company") (TSXV:LIFT)(OTCQX:LIFFF)(Frankfurt:WS0) has closed its previously announced (see press release dated October 23, 2024) non-brokered private placement consisting of (i) 2,694,895 common shares of the Company that qualify as "flow-through shares" (within the meaning of subsection 66(15) of the Income Tax Act (Canada)) (each, a "Flow-Through Share") at a price of $5.6575 and (ii) 1,645,105 common shares of the Company (each, a "Hard Dollar Share") which were issued to a single purchaser (the "Strategic Investor") at a price of $3.65 per Hard Dollar Share, for aggregate gross proceeds of approximately $21,251,002 (the "Offering").

Francis MacDonald, CEO and Director of LIFT, commented, "This is a pivotal moment for our Company, and we are very pleased to welcome the Strategic Investor as a meaningful shareholder of LIFT. We believe this investment supports the work completed to date by our team and the significant potential of our portfolio of hard rock lithium projects in Canada. The proceeds from the Offering will help to further de-risk our Yellowknife Lithium Project in the Northwest Territories for which we plan to complete a preliminary economic assessment in Q2 2025, as well as advance exploration on our Cali Project and our portfolio of highly prospective lithium properties in Quebec."

In connection with the Offering, the Company and the Strategic Investor entered into an investor rights agreement, pursuant to which the Strategic Investor is entitled to certain rights, provided the Strategic Investor maintains certain ownership thresholds in the Company, including: (a) the right to participate in equity financings and top-up its holdings in relation to dilutive issuances in order to maintain its pro rata ownership interest at the time of such financing or issuance or acquire up to a 9.99% ownership interest in the Company, on a partially-diluted basis; and (b) the right to nominate one person to the board of directors of the Company in the event that the Purchaser's ownership interest in the Company exceeds and remains at or above 10%, on a partially-diluted basis.

The gross proceeds from the issue of the Hard Dollar Shares will be used to advance the Company's Canadian assets as well as for general corporate purposes. The gross proceeds from the issue of the Flow-Through Shares will be used by the Company to incur eligible "Canadian exploration expenses" that will qualify as "flow-through critical mineral mining expenditures" as such terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") related to the Company's projects located in the Northwest Territories, Canada on or before December 31, 2025. All Qualifying Expenditures will be renounced in favour of the subscribers effective December 31, 2024.

Canaccord Genuity acted as financial advisor to LIFT in connection with the Offering.

About LIFT

LIFT is a mineral exploration company engaged in the acquisition, exploration, and development of lithium pegmatite projects located in Canada. The Company's flagship project is the Yellowknife Lithium Project located in Northwest Territories, Canada. LIFT also holds three early-stage exploration properties in Quebec, Canada with excellent potential for the discovery of buried lithium pegmatites, as well as the Cali Project in Northwest Territories within the Little Nahanni Pegmatite Group.

For further information, please contact:

Francis MacDonald | Daniel Gordon |

Chief Executive Officer | Investor Relations |

Tel: + 1.604.609.6185 | Tel: +1.604.609.6185 |

Email: [email protected] | Email: [email protected] |

Website: www.li-ft.com

Cautionary Statement Regarding Forward-Looking Information

Certain statements included in this press release constitute forward-looking information or statements (collectively, "forward-looking statements"), including those identified by the expressions "anticipate", "believe", "plan", "estimate", "expect", "intend", "may", "should" and similar expressions to the extent they relate to the Company or its management. The forward-looking statements are not historical facts but reflect current expectations regarding future results or events. This press release contains forward looking statements relating to the closing of the Offering, the use of proceeds of the Offering, the timing of incurring the Qualifying Expenditures and the renunciation of the Qualifying Expenditures as well as the approval of the TSXV. These forward-looking statements and information reflect management's current beliefs and are based on assumptions made by and information currently available to the company with respect to the matter described in this new release.

Forward-looking statements involve risks and uncertainties, which are based on current expectations as of the date of this release and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information about these assumptions and risks and uncertainties is contained under "Risk Factors" in the Company's latest annual information form filed on March 27, 2024, which is available under the Company's SEDAR+ profile at www.sedarplus.ca, and in other filings that the Company has made and may make with applicable securities authorities in the future. Forward-looking statements contained herein are made only as to the date of this press release and we undertake no obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law. We caution investors not to place considerable reliance on the forward-looking statements contained in this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Contact Information

Francis MacDonald

CEO

[email protected]

1.604.609.6185

Daniel Gordon

Investor Relations Manager

[email protected]

1.604.609.6185

SOURCE: Li-FT Power Ltd.

P.Costa--AMWN