-

Frank sacked by Spurs after Newcastle defeat

Frank sacked by Spurs after Newcastle defeat

-

South Africa pip Afghanistan in double super over T20 thriller

-

Three Ukrainian toddlers, father, killed in Russian drone attack

Three Ukrainian toddlers, father, killed in Russian drone attack

-

Siemens Energy trebles profit as AI boosts power demand

-

WTO must reform, 'status quo is not an option': chief

WTO must reform, 'status quo is not an option': chief

-

European airlines warn of 'severe disruption' from new border checks

-

French rape survivor Gisele Pelicot to reveal pain and courage in memoirs

French rape survivor Gisele Pelicot to reveal pain and courage in memoirs

-

EU eyes tighter registration, no-fly zones to tackle drone threats

-

Shooter kills 9 at Canadian school, residence

Shooter kills 9 at Canadian school, residence

-

Australia captain Marsh out of World Cup opener, Steve Smith to fly in

-

Spanish PM vows justice, defends rail safety after deadly accidents

Spanish PM vows justice, defends rail safety after deadly accidents

-

Meloni and Merz: EU's new power couple

-

Veteran Tajik leader's absence raises health questions

Veteran Tajik leader's absence raises health questions

-

EU must 'tear down barriers' to become 'global giant': von der Leyen

-

US grand jury rejects bid to indict Democrats over illegal orders video

US grand jury rejects bid to indict Democrats over illegal orders video

-

Struggling brewer Heineken to cut up to 6,000 jobs

-

Asian stock markets rise, dollar dips as traders await US jobs

Asian stock markets rise, dollar dips as traders await US jobs

-

Britain's Harris Dickinson on John Lennon, directing and news overload

-

9 killed in Canada mass shooting that targeted school, residence

9 killed in Canada mass shooting that targeted school, residence

-

Wembanyama scores 40 as Spurs rout Lakers, Pacers stun Knicks

-

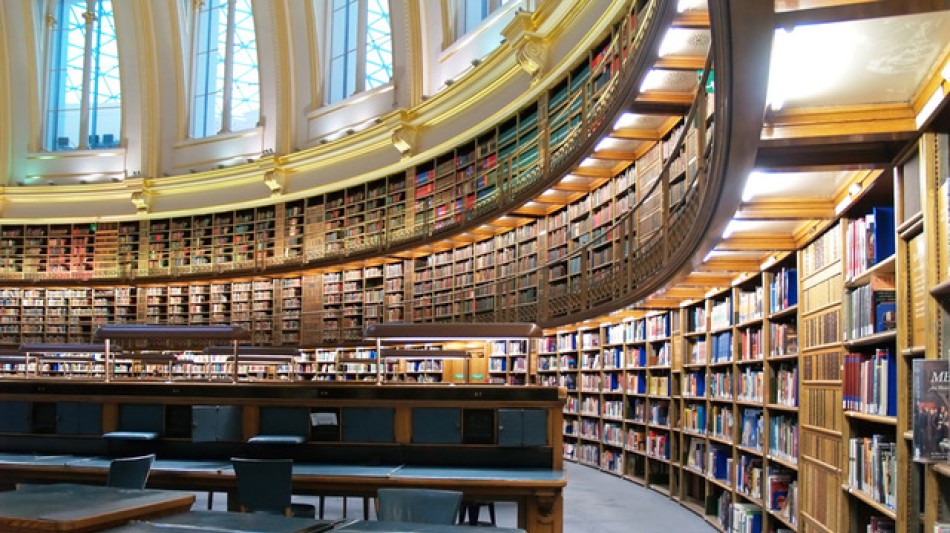

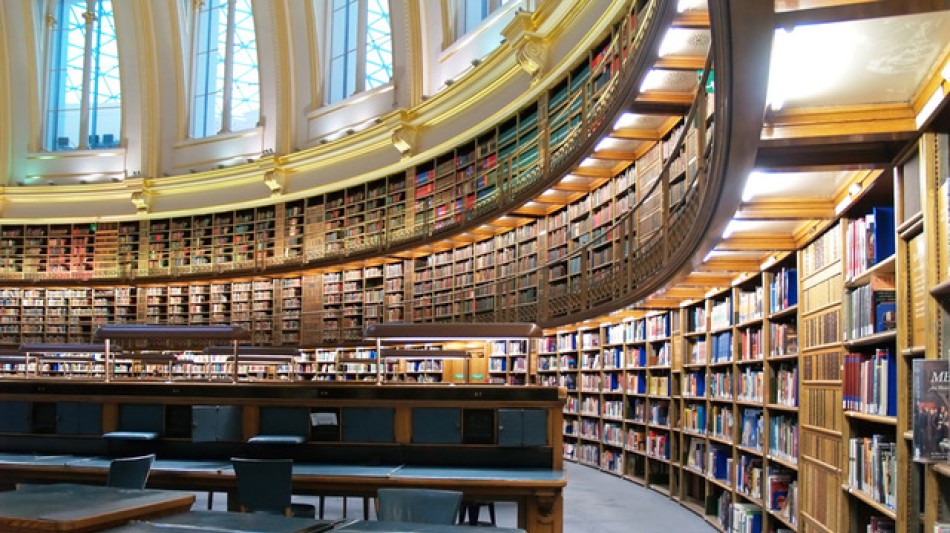

UK's crumbling canals threatened with collapse

UK's crumbling canals threatened with collapse

-

Hong Kong convicts father of wanted activist over handling of funds

-

Australia charges two Chinese nationals with foreign interference

Australia charges two Chinese nationals with foreign interference

-

'Overloading' may have led to deadly Philippine ferry sinking

-

Bangladesh to vote on democratic reform charter

Bangladesh to vote on democratic reform charter

-

China coach warns of 'gap' ahead of Women's Asian Cup title defence

-

Glitzy Oscar nominees luncheon back one year after LA fires

Glitzy Oscar nominees luncheon back one year after LA fires

-

Pacers outlast Knicks in overtime

-

9 killed in Canada mass shooting that targeted school, residence: police

9 killed in Canada mass shooting that targeted school, residence: police

-

De Zerbi leaves Marseille 'by mutual agreement'

-

Netanyahu to push Trump on Iran missiles in White House talks

Netanyahu to push Trump on Iran missiles in White House talks

-

England captain Stokes has surgery after being hit in face by ball

-

Rennie, Joseph lead running to become next All Blacks coach

Rennie, Joseph lead running to become next All Blacks coach

-

Asian stock markets mixed as traders weigh US data, await jobs

-

Australian Olympic snowboarder airlifted to hospital with broken neck

Australian Olympic snowboarder airlifted to hospital with broken neck

-

Moderna says US refusing to review mRNA-based flu shot

-

'Artists of steel': Japanese swords forge new fanbase

'Artists of steel': Japanese swords forge new fanbase

-

New York model, carved in a basement, goes on display

-

Noisy humans harm birds and affect breeding success: study

Noisy humans harm birds and affect breeding success: study

-

More American women holding multiple jobs as high costs sting

-

Charcoal or solar panels? A tale of two Cubas

Charcoal or solar panels? A tale of two Cubas

-

Snowline Gold Intersects Strong Intervals in Geotechnical Drilling at Valley and Discovers New Mineralized Target

-

Genflow Biosciences PLC Announces Notice of GM

Genflow Biosciences PLC Announces Notice of GM

-

Tocvan Announces Restart Of Exploration Drilling At The Gran Pilar Project South Block

-

Corporate Treasury & Digital Infrastructure Note: The Active Management Divergence

Corporate Treasury & Digital Infrastructure Note: The Active Management Divergence

-

Several wounded in clashes at Albania opposition rally

-

Chelsea's draw with Leeds 'bitter pill' for Rosenior

Chelsea's draw with Leeds 'bitter pill' for Rosenior

-

'On autopilot': US skate star Malinin nears more Olympic gold

-

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

-

Frank confident of keeping Spurs job despite Newcastle defeat

Mako Mining Reports Q3 2024 Financial Results

Mako Mining Corp. (TSX-V:MKO(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide financial results for the three months ended September 30th, 2024 ("Q3 2024"). Q3 2024 Financial results reflect the first consolidated results since the acquisition of Goldsource Mines and its Eagle Mountain Project on July 3rd, 2024. All dollar amounts referred to herein are expressed in United States dollars unless otherwise stated.

Q3 2024 Highlights

Financial

$15.7 million in Revenue

$4.3 million in Adjusted EBITDA (1)

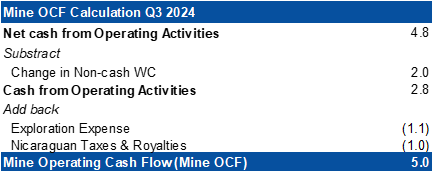

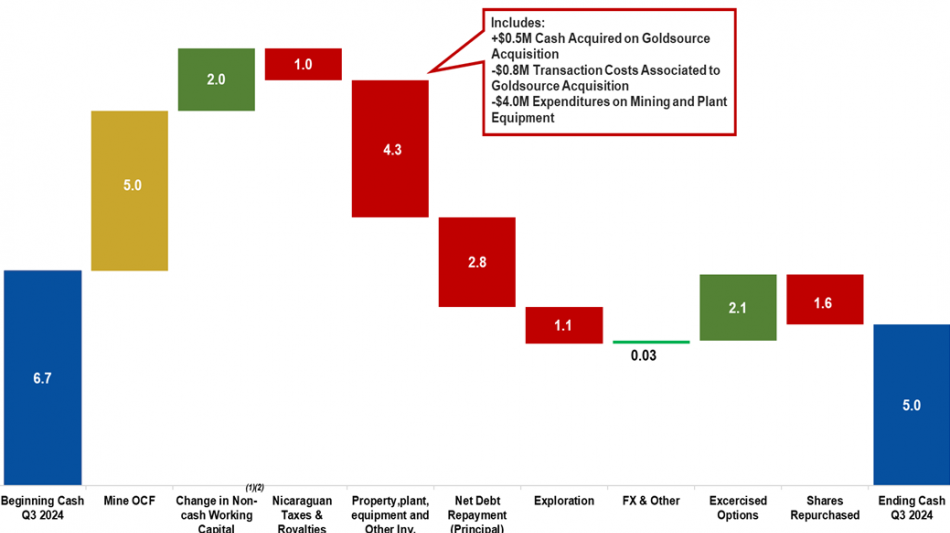

$5.0 million in Mine Operating Cash Flow ("MineOCF") (1) (3)

$0.4 million Net Income

$1,465 Cash Costs ($/oz sold) (1) (2)

$2,383 All-In Sustaining Costs ("AISC") ($/oz sold) (1) (2). This includes $607 ($/oz) associated with the 1.3 million tonnes of pre-strip that was previously deferred due to a permit delay

Debt Repayment of $1.2 million to Sailfish Silver Loan

Debt Repayment of Goldsource Bridge Loan of $1.5 million

Stock Repurchase (NCIB) of $1.6 million

Cash Balance of $5.0 million and Gold in Sales Receivable of $1.5 million

Refers to a Non-GAAP financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ("NI 52-112"). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

Refer to "Chart 1 - Q3 2024 - Mine OCF Calculation and Cash Reconciliation (in $ millions)" for a reconciliation of the beginning and ending cash position of the Company, including OCF.

Unusual Factors Affecting Q3 2024 Earnings

A 6-month delay in receiving the Environmental Impact Assessment ("EIA"), which arrived in July 2024, required the acceleration of 1.3 million tonnes of additional pre-strip and limited access to diluted vein material until September 2024, resulting in lower-than-normal production and recoveries and higher than normal AISC, all of which reversed thus far in Q4 2024

Growth

$1.1 million in exploration and evaluation expenses which includes $0.6 million for the Eagle Mountain Project

Akiba Leisman, Chief Executive Officer, states that "Q3 2024 production was constrained by a six-month permit delay for the Las Conchitas EIA which arrived at the beginning of the quarter. 6,532 ounces of gold were sold at $2,383/oz AISC, with $607 per ounce of this AISC related to the 1.3 million tonnes of accelerated pre-strip which needed to be removed outside of our original bulk sample permit area. Also related to the permit delay, the remainder of the increase in AISC was due to lower head grades (4.2 g/t gold) as only 14% of the mill feed derived from diluted vein material instead of the approximately 50% blend that is normally available. Consistent high-grade mineralization was only available in September after the 1.3 million tonnes of waste was removed. Despite this, the Company generated $4.3 million in Adjusted EBITDA and positive net income. Through the first 52 days (57%) of Q4 2024, production is back to normal, with head grades up over 85%, recoveries up over 10% and realized gold prices up over 10% relative to Q3 2024 (see Table 1 below). Therefore, there will be a commensurate increase in production, reduction in AISC and increase in profitability for Q4 2024.

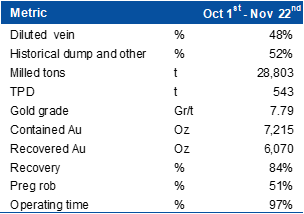

Table 1 - KPI`s Quarter to Date

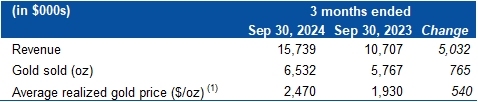

Table 2 - Revenue

Realized price before deductions from Sailfish gold streaming agreement

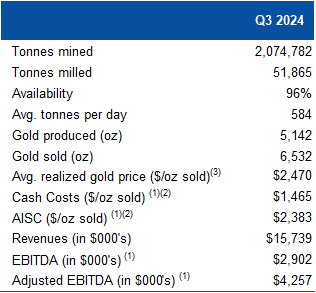

Table 3 - Operating and Financial Data

Refers to a Non-GAAP financial measure within the meaning of NI 52-112). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

Realized price before deductions from Sailfish gold streaming agreement.

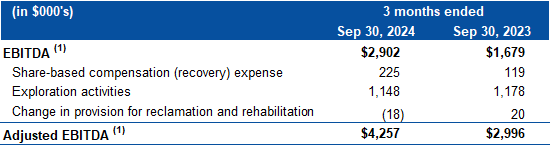

Table 4 - EBITDA Reconciliation

Refers to a Non-GAAP financial measure within the meaning of NI 52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

Chart 1

Q3 2024 - Mine OCF Calculation and Cash Reconciliation (in $ millions)

Refers to Non-GAAP financial measure within the meaning of NI 52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

Includes all expenses incurred to sustain operations. Excludes Nicaraguan Taxes and Royalties, changes in Non-cash Working Capital, and Exploration expenses.

For complete details, please refer to the financial statements and the associated management discussion and analysis for the three months ended September 30th, 2024, available on SEDAR (www.sedarplus.ca) or on the Company's website (www.makominingcorp.com).

Non-GAAP Measures

The Company has included certain non-GAAP financial measures and non-GAAP ratios in this press release such as EBITDA, Adjusted EBITDA, Mine Operating Cash Flow cash cost per ounce sold, total cash cost per ounce sold, AISC per ounce sold. These non-GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, these are commonly used performance measures and ratios, but do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow.

"EBITDA" represents earnings before interest (including non-cash accretion of financial obligation and lease obligations), income taxes and depreciation, depletion and amortization.

"Adjusted EBITDA" represents EBITDA, adjusted to exclude exploration activities, share-based compensation and change in provision for reclamation and rehabilitation.

"Cash costs per ounce sold" is calculated by deducting revenues from silver sales and dividing the sum of mining, milling and mine site administration cost.

"AISC per ounce sold" includes total cash costs (as defined above) and adds the sum of G&A, sustaining capital and certain exploration and evaluation ("E&E") costs, sustaining lease payments, provision for environmental fees, if applicable, and rehabilitation costs paid, all divided by the number of ounces sold. As this measure seeks to reflect the full cost of gold production from current operations, capital and E&E costs related to expansion or growth projects are not included in the calculation of AISC per ounce. Additionally, certain other cash expenditures, including income and other tax payments, financing costs and debt repayments, are not included in AISC per ounce.

"Mine OCF" represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expenses.

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. The Company also owns 100% of the gold project Eagle Mountain in Guyana, South America.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: [email protected] or visit our website at www.makominingcorp.com and SEDAR. www.sedarplus.ca.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, that the Company expects a significant improvement in gold ounces recovered, gold ounces sold, with lower AISC in Q4; rapidly repaying debt while the Company aggressively repurchases shares through its newly instituted NCIB; Mako's primary objective to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24, 2022 measures having impacts on business operations not current expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedar.com. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with information regarding the Company's Q3 2024 financial results and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

F.Dubois--AMWN