-

Scrutiny over US claim that Mexican drone invasion prompted airport closure

Scrutiny over US claim that Mexican drone invasion prompted airport closure

-

Trump to undo legal basis for US climate rules

-

Protesters, police clash at protest over Milei labor reform

Protesters, police clash at protest over Milei labor reform

-

Dyche sacked by Forest after dismal Wolves draw

-

France seeks probe after diplomat cited in Epstein files

France seeks probe after diplomat cited in Epstein files

-

Rivers among 2026 finalists for Basketball Hall of Fame

-

Israel president says antisemitism in Australia 'frightening'

Israel president says antisemitism in Australia 'frightening'

-

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

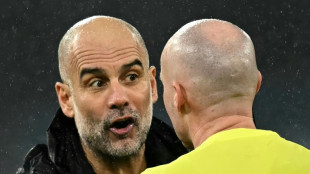

Guardiola eyes rest for 'exhausted' City stars

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

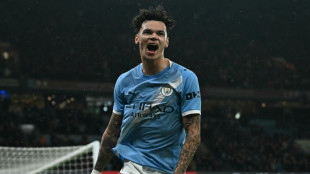

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

US stocks move sideways after January job growth tops estimates

-

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

-

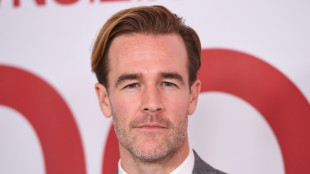

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

Ukraine will only hold elections after ceasefire, Zelensky says

-

WHO urges US to share Covid origins intel

-

TotalEnergies can do without Russian gas: CEO

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

-

Israel's Netanyahu pushes Trump on Iran

Israel's Netanyahu pushes Trump on Iran

-

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

BMW recalls hundreds of thousands of cars over fire risk

-

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

-

Colombia election favorite vows US-backed strikes on narco camps

Colombia election favorite vows US-backed strikes on narco camps

-

French court to rule on July 7 in Marine Le Pen appeal trial

-

Jones says England clash 'perfect game' for faltering Scotland

Jones says England clash 'perfect game' for faltering Scotland

-

Norway's ex-diplomat seen as key cog in Epstein affair

-

Swiatek fights back to reach Qatar Open quarter-finals

Swiatek fights back to reach Qatar Open quarter-finals

-

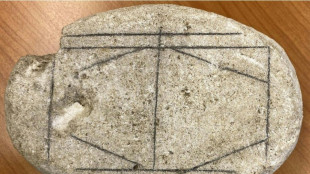

AI cracks Roman-era board game

Minera Don Nicolas Receives Initial US$4 Million Option Payment from Cerro Vanguardia SA for The Sale of its Michelle Exploration Properties for Total Consideration of US$14 Million

Initial US$4 Million Peso Equivalent Option Payment received which further strengthens balance sheet

Remaining consideration of US$10 Million Pesos equivalent payable on exercise; within 3 years

Company well-positioned to drive future growth via its existing operating Minera Don Nicolas gold mine in Argentina and its Mont Sorcier development project in Quebec

Company issues loan to Ascendant Resources Inc

Initial US$4 Million Peso Equivalent Option Payment received which further strengthens balance sheet

Remaining consideration of US$10 Million Pesos equivalent payable on exercise; within 3 years

Company well-positioned to drive future growth via its existing operating Minera Don Nicolas gold mine in Argentina and its Mont Sorcier development project in Quebec

Company issues loan to Ascendant Resources Inc

Cerrado Gold Inc. [TSXV:CERT][OTCQX:CRDOF][FRA:BAI0] ("Cerrado" or the "Company") announces that its wholly owned subsidiary Minera Don Nicolas SA ("MDN") has received the option payment of US$4 million equivalent in Argentina pesos at the CCL Buyers rate pursuant to the previously announced option agreement with Cerro Vanguardia S.A. ("CVSA") a wholly-owned subsidiary of AngloGold Ashanti Holdings Plc. MDN has granted to CVSA the option to purchase a 100% interest in certain exploration properties located in the south region of its Minera Don Nicolas Project in Santa Cruz, Argentina.

Mark Brennan, CEO and Chairman commented: "The option of these non-core properties immediately improves the balance sheet and short-term capital position at MDN allowing MDN to focus on its core properties. In addition to our current strong operating cashflows at MDN and capital proceeds from previous asset sales, we are well positioned to pursue growth programs at our MDN Mine and our Mont Sorcier high grade iron project, as well as allowing us to consider additional opportunities to grow the Company in the near term."

The Company also announces that it has issued a loan ("Loan") to Ascendant Resources Inc. ("Ascendant") in the principal amount of US$275,000. The Loan bears interest at a rate of 10.0% per annum, compounded monthly and matures on demand, on not less than 366 days notice.

Ascendant is a Toronto-based mining company focused on the exploration and development of the highly prospective Lagoa Salgada VMS project located on the prolific Iberian Pyrite Belt in Portugal. Additional information on Ascendant can be found on its website at www.ascendantresources.com.

The Company notes that while there is a commonality of directors and officers between Cerrado and Ascendant, the companies are not "related parties" as defined in Multilateral Instrument 61-101 - Protection of Minority Shareholders in Special Transactions ("MI 61-101") and accordingly the Loan is not considered a "related party transaction" as defined in MI 61-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina. In Canada, Cerrado Gold is developing its 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of SDG goals.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, that CVSA will exercise the option and pay MDN the consideration upon exercise, the value of Argentina pesos at the CCL Buyers rate, and the business, prospects and potential of Ascendant. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions, including, but not limited to the satisfactory completion of due diligence by Amarillo and the exercise of the Option by Amarillo, the satisfaction of all conditions to closing of the Proposed Transaction, including the receipt of all required approvals (including regulatory and shareholder approval), cash flow generated from MDN and changes in economic and monetary policies and regulations in jurisdictions in which Cerrado and its subsidiaries operate. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

A.Rodriguezv--AMWN