-

From 'Derry Girls' to 'heaven', Irish writer airs new comedy

From 'Derry Girls' to 'heaven', Irish writer airs new comedy

-

Asia markets mixed as stong US jobs data temper rate expectations

-

Shanaka fireworks as Sri Lanka pile up 225-5 against Oman

Shanaka fireworks as Sri Lanka pile up 225-5 against Oman

-

Samsung starts mass production of next-gen AI memory chip

-

Benin's lovers less row-mantic as apps replace waterway rendezvous

Benin's lovers less row-mantic as apps replace waterway rendezvous

-

Geneva opera house selling off thousands of extravagant costumes

-

Non-alcoholic wine: a booming business searching for quality

Non-alcoholic wine: a booming business searching for quality

-

Greece's Cycladic islands swept up in concrete fever

-

Grieving Canada town holds vigil for school shooting victims

Grieving Canada town holds vigil for school shooting victims

-

Israel president says at end of visit antisemitism in Australia 'frightening'

-

Cunningham on target as depleted Pistons down Raptors

Cunningham on target as depleted Pistons down Raptors

-

Canada probes mass shooter's past interactions with police, health system

-

Dutch speed skater Jutta Leerdam combines Olympic gold and influencer attitude

Dutch speed skater Jutta Leerdam combines Olympic gold and influencer attitude

-

Scotland coach Townsend under pressure as England await

-

Canadian ice dancers put 'dark times' behind with Olympic medal

Canadian ice dancers put 'dark times' behind with Olympic medal

-

'Exhausting' off-field issues hang over Wales before France clash

-

Crusaders target another title as Super Rugby aims to speed up

Crusaders target another title as Super Rugby aims to speed up

-

Chinese Olympic snowboarder avoids serious injury after nasty crash

-

China carbon emissions 'flat or falling' in 2025: analysis

China carbon emissions 'flat or falling' in 2025: analysis

-

'China shock': Germany struggles as key market turns business rival

-

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

-

Most Asia markets rise as traders welcome US jobs

-

EU leaders push to rescue European economy challenged by China, US

EU leaders push to rescue European economy challenged by China, US

-

Plenty of peaks, but skiing yet to take off in Central Asia

-

UN aid relief a potential opening for Trump-Kim talks, say analysts

UN aid relief a potential opening for Trump-Kim talks, say analysts

-

Berlin Film Festival to open with a rallying cry 'to defend artistic freedom'

-

Taiwan leader wants greater defence cooperation with Europe: AFP interview

Taiwan leader wants greater defence cooperation with Europe: AFP interview

-

Taiwan leader warns countries in region 'next' in case of China attack: AFP interview

-

World Cup ticket prices skyrocket on FIFA re-sale site

World Cup ticket prices skyrocket on FIFA re-sale site

-

'No one to back us': Arab bus drivers in Israel grapple with racist attacks

-

Venezuelan AG wants amnesty for toppled leader Maduro

Venezuelan AG wants amnesty for toppled leader Maduro

-

Scrutiny over US claim that Mexican drone invasion prompted airport closure

-

Trump to undo legal basis for US climate rules

Trump to undo legal basis for US climate rules

-

Protesters, police clash at protest over Milei labor reform

-

Dyche sacked by Forest after dismal Wolves draw

Dyche sacked by Forest after dismal Wolves draw

-

France seeks probe after diplomat cited in Epstein files

-

Rivers among 2026 finalists for Basketball Hall of Fame

Rivers among 2026 finalists for Basketball Hall of Fame

-

Israel president says antisemitism in Australia 'frightening'

-

Taiwan Depository & Clearing Corporation (TDCC) Partners with Proxymity to Provide Cross-Border Straight Through Processing (STP) Voting Services

Taiwan Depository & Clearing Corporation (TDCC) Partners with Proxymity to Provide Cross-Border Straight Through Processing (STP) Voting Services

-

Genflow Biosciences PLC Announces Preliminary Interim Results From Dog Study

-

How to Sell Your Business Fast and for Maximum Profit in 2026 (New Guide Released)

How to Sell Your Business Fast and for Maximum Profit in 2026 (New Guide Released)

-

Guardian Metal Resources PLC Announces Interim Results

-

Trump orders Pentagon to buy coal-fired electricity

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

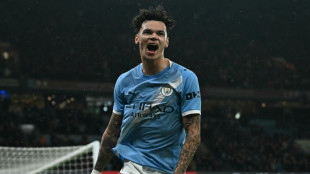

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

Cerrado Gold Announces Q4 and Annual 2024 Gold Production Results for its Minera Don Nicolas Mine in Argentina

(TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") announces production results for the fourth quarter ended December, 2024 ("Q4 2024") from the Minera Don Nicolas Mine in Santa Cruz Province, Argentina ("MDN"). Full fourth quarter financial results are expected to be released prior to April 30, 2025.

Annual Gold Equivalent Ounce ("GEO") Production of 54,494 GEO; in line with Guidance of 50,000 - 60,000 GEO.

Q4 Production of 10,431 GEO impacted by lower than planned ore grades from residual open pits.

Record Production of 5,956, GEO from Heap Leach operations during the quarter.

Received Asset Sale and Option payments totaling $34 MM during the quarter, significantly strengthening the balance sheet.

2025 Production Guidance of between 50,000-55,000 GEO.

Q4 Operating Highlights

Q4 Production of 10,431 GEO vs 16,604 GEO in Q3.

Annual Sales of 51,694 GEO for 2024

Production impacted by lower than planned feed grade to the CIL plant during the quarter as mining of high-grade pits nears completion.

Studies to commence underground operations at Paloma in H2/25 initiated during the quarter.

Focus remains on ramping up crushing capacity at Calandrias Sur and bringing heap leach production up to 4,000- 4,500 GEO per month by March 2025.

While operational results for Q4 2024 demonstrated a decrease in production over the previous quarter, this was driven by lower than expected ore grades delivered from the final stages of mining of the older high grade open pits and stockpiles to feed the CIL plant as the Company's operations transition to a primarily heap leach operation in 2025. The heap leach operational performance continued to improve over the quarter, reaching record production levels as more ore was added to the pad. The performance of the heap leach continues to depend on the crushing circuit. An additional secondary crushing circuit is currently being installed to ensure excess capacity is in place to support the transition to a heap leach only facility. Once fully operational, the crushing capacity should allow for approximately 300,000 tonnes of ore to be placed on the pad per month. The installation of the secondary crusher is expected to reduce fleet and operating costs and is expected to operate at full capacity by the end of the 1st quarter, at which time the mobile crushers will be placed on stand by.

In addition, the company is undertaking detailed analysis and preparations for equipment sourcing with the view to commencing underground operations later this year beneath the Palmoa pit. While the initial production expectations are relatively modest given the current known underground resource, underground access is expected to provide a platform for major exploration activities at lower costs than drilling from surface with the aim to materially expand the resources available for underground development. Further details will be released once finalized and a development decision is made.

The Company provides 2025 annual production guidance of between 50,000 - 55,000 GEO at an ASIC of between $1,300 - $1,500 per GEO. The bulk of this production is expected to be delivered solely from heap leach operations from Q2/25 onwards .

Mont Sorcier Update

At the Mont Sorcier high purity iron project, detailed metallurgical testwork and flow sheet design continued during the quarter. As announced in early December 2024 (see press release dated December 4, 2024) testwork has reaffirmed the potential to produce high grade and high purity iron concentrate grading in excess of 67% iron with silica and alumina below 2.3%. Ongoing testwork is focused on flotation testing, more detailed variability tests, grind size and reagent optimization programs as well as equipment sizing.

Current testwork and overall process design are to be at the core of the NI 43-101 Bankable Feasibility Study ("BFS") which is targeted to be completed by the end of Q1 2026. The Bankable Feasibility Study will look to provide greater detail into the potential of the project that was highlighted in the previous 2022 NI 43-101 Preliminary Economic Assessment ("PEA") that delivered a project NPV8% of US$1.6 Billion based upon iron concerates grading 65% iron.

Corporate Activities

The Company has also continued to make progress on improving its working capital position during the quarter with the receipt of a total of US$34 million from asset sales and the sale of an option on the Michelle properties at MDN. As a result, the company has now significantly strengthened its balance sheet and expects to continue to deliver further deleveraging during 2025. Future payments from the Brazilian Monte do Carmo asset sale totalling US$15 million as well as a further US$10 million, should the Michelle Option be exercised, would continue to add to the Company's strong cash position moving forward.

Mark Brennan, CEO and Chairman commented, "While 2024 was a year with significant challenges, we are pleased to have achieved gold production in line with our guidance for the year, supported by strong growth in production from the heap leach as the year progressed. With the new crushing circuit currently being installed, we expect this trend to continue to support production targets for 2025 while we review the potential to add additional production from a potential underground operation at Paloma. Further testwork at our Mont Sorcier project in Quebec continues to highlight the significant upside we see in this project as we work to unlock value with the completion of a feasibility study by Q1/2026. Cerrado is exiting the year with a significantly improved working capital position, placing Cerrado in a stronger financial position heading into 2025. "

Table 1. Key Operating Information

Note : Q1-Q3 2024 Ore mined for Heap Leach Operations has been adjusted to reflect a recalculation based on updated information. This has no impact on ounces produced.

Review of Technical Information

The scientific and technical information from Minera don Nicolas in this press release has been reviewed and approved by Cid Bonfim, P. Geo., Senior Geologist Cerrado Gold, and Pierre Jean LaFleur, P. Geo., VP Exploration for Voyager Metals, a 100% owned subsidiary of Cerrado Gold, are Qualified Persons as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina. In Canada, Cerrado Gold is developing it's 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of SDG goals.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

[email protected]

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, production forecasts and estimated ASIC for 2025 and beyond, the potential for additional crushing capacity that may be added and the performance of the heap leach pad, the possibility of commencing underground mining, the potential to produce iron concentrate grading in excess of 67% at Mont Sorcier, further deleveraging during 2025, receipt of the deferred closing payment of US$15 million in connection with the asset sale and the likelihood of the Michelle option being exercised and the related option payment being received. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

P.Mathewson--AMWN