-

From 'Derry Girls' to 'heaven', Irish writer airs new comedy

From 'Derry Girls' to 'heaven', Irish writer airs new comedy

-

Asia markets mixed as stong US jobs data temper rate expectations

-

Shanaka fireworks as Sri Lanka pile up 225-5 against Oman

Shanaka fireworks as Sri Lanka pile up 225-5 against Oman

-

Samsung starts mass production of next-gen AI memory chip

-

Benin's lovers less row-mantic as apps replace waterway rendezvous

Benin's lovers less row-mantic as apps replace waterway rendezvous

-

Geneva opera house selling off thousands of extravagant costumes

-

Non-alcoholic wine: a booming business searching for quality

Non-alcoholic wine: a booming business searching for quality

-

Greece's Cycladic islands swept up in concrete fever

-

Grieving Canada town holds vigil for school shooting victims

Grieving Canada town holds vigil for school shooting victims

-

Israel president says at end of visit antisemitism in Australia 'frightening'

-

Cunningham on target as depleted Pistons down Raptors

Cunningham on target as depleted Pistons down Raptors

-

Canada probes mass shooter's past interactions with police, health system

-

Dutch speed skater Jutta Leerdam combines Olympic gold and influencer attitude

Dutch speed skater Jutta Leerdam combines Olympic gold and influencer attitude

-

Scotland coach Townsend under pressure as England await

-

Canadian ice dancers put 'dark times' behind with Olympic medal

Canadian ice dancers put 'dark times' behind with Olympic medal

-

'Exhausting' off-field issues hang over Wales before France clash

-

Crusaders target another title as Super Rugby aims to speed up

Crusaders target another title as Super Rugby aims to speed up

-

Chinese Olympic snowboarder avoids serious injury after nasty crash

-

China carbon emissions 'flat or falling' in 2025: analysis

China carbon emissions 'flat or falling' in 2025: analysis

-

'China shock': Germany struggles as key market turns business rival

-

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

-

Most Asia markets rise as traders welcome US jobs

-

EU leaders push to rescue European economy challenged by China, US

EU leaders push to rescue European economy challenged by China, US

-

Plenty of peaks, but skiing yet to take off in Central Asia

-

UN aid relief a potential opening for Trump-Kim talks, say analysts

UN aid relief a potential opening for Trump-Kim talks, say analysts

-

Berlin Film Festival to open with a rallying cry 'to defend artistic freedom'

-

Taiwan leader wants greater defence cooperation with Europe: AFP interview

Taiwan leader wants greater defence cooperation with Europe: AFP interview

-

Taiwan leader warns countries in region 'next' in case of China attack: AFP interview

-

World Cup ticket prices skyrocket on FIFA re-sale site

World Cup ticket prices skyrocket on FIFA re-sale site

-

'No one to back us': Arab bus drivers in Israel grapple with racist attacks

-

Venezuelan AG wants amnesty for toppled leader Maduro

Venezuelan AG wants amnesty for toppled leader Maduro

-

Scrutiny over US claim that Mexican drone invasion prompted airport closure

-

Trump to undo legal basis for US climate rules

Trump to undo legal basis for US climate rules

-

Protesters, police clash at protest over Milei labor reform

-

Dyche sacked by Forest after dismal Wolves draw

Dyche sacked by Forest after dismal Wolves draw

-

France seeks probe after diplomat cited in Epstein files

-

Rivers among 2026 finalists for Basketball Hall of Fame

Rivers among 2026 finalists for Basketball Hall of Fame

-

Israel president says antisemitism in Australia 'frightening'

-

Taiwan Depository & Clearing Corporation (TDCC) Partners with Proxymity to Provide Cross-Border Straight Through Processing (STP) Voting Services

Taiwan Depository & Clearing Corporation (TDCC) Partners with Proxymity to Provide Cross-Border Straight Through Processing (STP) Voting Services

-

Genflow Biosciences PLC Announces Preliminary Interim Results From Dog Study

-

How to Sell Your Business Fast and for Maximum Profit in 2026 (New Guide Released)

How to Sell Your Business Fast and for Maximum Profit in 2026 (New Guide Released)

-

Guardian Metal Resources PLC Announces Interim Results

-

Trump orders Pentagon to buy coal-fired electricity

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

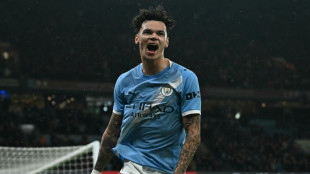

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

Electric Royalties Announces Closing Of Brokered Private Placement And Concurrent Non-Brokered Private Placement

Not for distribution to United States newswire services or for dissemination in the United States

Electric Royalties Ltd. (TSXV:ELEC)(OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to announce that it has closed its brokered private placement (the "Offering") as previously announced on December 9, 2024. An aggregate of 12,248,235 units of the Company ("Units") were sold under the Offering at a price of C$0.18 per Unit (the "Issue Price") for gross proceeds of C$2,204,682. Canaccord Genuity Corp. and Red Cloud Securities Inc. (collectively, the "Agents") acted as agents in connection with the Offering.

In addition, the Company also announces the closing of a non-brokered private placement (the "Concurrent Financing" and together with the Offering, the "Private Placements") with Globex Mining Enterprises Inc. (TSX:GMX)(OTCQX:GLBXF) (Frankfurt:G1MN) ("Globex") of 1,666,667 additional Units of the Company (the "Additional Units" and together with the Units, the "Offered Units") at a price of C$0.18 per Additional Unit for additional gross proceeds of C$300,000. The Company raised aggregate gross proceeds of C$2,504,682 from the Private Placements.

"With strong participation in this financing from our existing shareholders along with some supportive new shareholders, Electric Royalties is well positioned to capitalize on the strategic opportunities we see before us," said Brendan Yurik, the Company's CEO. "Following the positive news announced in recent weeks in connection with our flagship lithium and manganese royalties, we envision other important developments and milestones coming from our royalty portfolio this year."

Each Offered Unit is comprised of one common share of the Company (each, a "Common Share") and one common share purchase warrant of the Company (each whole common share purchase warrant, a "Warrant"). Each Warrant entitles the holder thereof to purchase one common share of the Company (each, a "Warrant Share") at an exercise price of C$0.25 per Warrant Share for a period of 2 years following the closing of the Private Placements.

The net proceeds of the Private Placements will be used to complete the remaining C$450,000 payment in respect of the acquisition of the 0.75% Gross Revenue Royalty on the Punitaqui copper mine in Chile, and for general corporate purposes.

With respect to the Offering, the Units were offered for sale to purchasers resident in Canada (other than Québec residents) and/or other qualifying jurisdictions pursuant to the listed issuer financing exemption (the "Listed Issuer Financing Exemption") under Part 5A of the National Instrument 45-106 - Prospectus Exemptions ("NI 45-106"). Because the Offering has been completed pursuant to the Listed Issuer Financing Exemption, the securities issued to Canadian resident subscribers in the Offering will not be subject to a hold period pursuant to applicable Canadian securities laws.

With respect to the Concurrent Financing, the Additional Units were sold to Globex pursuant to the "accredited investor" or another exemption (other than the listed issuer financing exemption) under NI 45-106. The Additional Units are subject to a four-month hold period pursuant to Canadian securities laws.

The Agents received an aggregate cash commission equal to C$122,827.77 and an aggregate of 682,377 warrants of the Company (the "Broker Warrants"). Each Broker Warrant will be exercisable to acquire one Common Share at an exercise price of C$0.18 at any time on or before January 15, 2027. The Broker Warrants and Common Shares underlying the Broker Warrants are subject to a four-month hold period pursuant to Canadian securities laws.

There is an amended and restated offering document related to the Offering that can be accessed under the Company's profile at www.sedarplus.ca and at www.electricroyalties.com.

Gleason & Sons LLC, controlled by Stefan Gleason, a director of the Company and a shareholder that holds in excess of 10% of the issued and outstanding Common Shares, subscribed for 138,889 Units under the Offering. Globex, a shareholder that holds in excess of 10% of the issued and outstanding Common Shares, also subscribed for 1,666,667 Units under the Concurrent Financing. Additionally, Marchand Snyman, a director of the Company, and Brendan Yurik, a director and officer of the Company, subscribed for 275,000 Units and 138,889 Units respectively, under the Offering. The participation by each of Stefan Gleason, Globex, Marchand Snyman and Brendan Yurik constitutes a "related party transaction" within the meaning of the policies of the TSX Venture Exchange and Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The securities issued to Stefan Gleason and Globex will be subject to a four-month hold period pursuant to applicable securities legislation and applicable policies of the TSX Venture Exchange. The Company is relying upon the exemptions from the formal valuation and minority shareholder approval requirements pursuant to sections 5.5(a) and (b), and 5.7(1)(a), respectively, of MI 61-101 on the basis that neither the fair market value of the subject matter of, nor the fair market value of the consideration for, the transaction insofar as it involves interested parties (within the meaning of MI 61-101) in the Private Placements exceeds 25% of the Company's market capitalization calculated in accordance with MI 61-101, and on the basis that no securities of the Company are listed or quoted on a stock exchange as specified in MI 61-101. The Company did not file a material change report 21 days prior to the closing of the Private Placements as the details of the participation of each of Stefan Gleason, Globex, Marchand Snyman and Brendan Yurik had not been confirmed at that time.

About Electric Royalties Ltd.

Electric Royalties is a royalty company established to take advantage of the demand for a wide range of commodities (lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc and copper) that will benefit from the drive toward electrification of a variety of consumer products: cars, rechargeable batteries, large scale energy storage, renewable energy generation and other applications.

Electric vehicle sales, battery production capacity and renewable energy generation are slated to increase significantly over the next several years and with it, the demand for these targeted commodities. This creates a unique opportunity to invest in and acquire royalties over the mines and projects that will supply the materials needed to fuel the electric revolution.

Electric Royalties has a growing portfolio of 41 royalties in lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc and copper across the world. The Company is focused predominantly on acquiring royalties on advanced stage and operating projects to build a diversified portfolio located in jurisdictions with low geopolitical risk, which offers investors exposure to the clean energy transition via the underlying commodities required to rebuild the global infrastructure over the next several decades toward a decarbonized global economy.

For further information, please contact:

Brendan Yurik

CEO, Electric Royalties Ltd.

Phone: (604) 364‐3540

Email: [email protected]

https://www.electricroyalties.com/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange), nor any other regulatory body or securities exchange platform, accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information and Other Company Information

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available. This press release is not an offer to sell or the solicitation of an offer to buy the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to qualification or registration under the securities laws of such jurisdiction.

This news release includes certain forward-looking statements concerning the use of proceeds of the Offering, the future performance of our business, its operations and its financial performance and condition, as well as management's objectives, strategies, beliefs and intentions. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedarplus.ca. Actual events or results may differ materially from those projected in the forward-looking statements and we caution against placing undue reliance thereon. We assume no obligation to revise or update these forward-looking statements except as required by applicable law.

SOURCE: Electric Royalties Ltd.

O.Johnson--AMWN