-

Exiled Kremlin critic on fighting Putin -- and cancer -- from abroad

Exiled Kremlin critic on fighting Putin -- and cancer -- from abroad

-

Berlinale filmmakers make creative leaps over location obstacles

-

I want answers from my ex-husband, Gisele Pelicot tells AFP

I want answers from my ex-husband, Gisele Pelicot tells AFP

-

Interpol backroom warriors fight cyber criminals 'weaponising' AI

-

New world for users and brands as ads hit AI chatbots

New world for users and brands as ads hit AI chatbots

-

Japan's 'godless' lake warns of creeping climate change

-

US teen Lutkenhaus breaks world junior indoor 800m record

US teen Lutkenhaus breaks world junior indoor 800m record

-

World copper rush promises new riches for Zambia

-

Paw patrol: Larry the cat marks 15 years at 10 Downing Street

Paw patrol: Larry the cat marks 15 years at 10 Downing Street

-

India plans AI 'data city' on staggering scale

-

Jamaica's Thompson-Herah runs first race since 2024

Jamaica's Thompson-Herah runs first race since 2024

-

Crash course: Vietnam's crypto boom goes bust

-

Ahead of Oscars, Juliette Binoche hails strength of Cannes winners

Ahead of Oscars, Juliette Binoche hails strength of Cannes winners

-

US cattle farmers caught between high costs and weary consumers

-

New York creatives squeezed out by high cost of living

New York creatives squeezed out by high cost of living

-

Lillard matches NBA 3-point contest mark in injury return

-

NBA mulling 'every possible remedy' as 'tanking' worsens

NBA mulling 'every possible remedy' as 'tanking' worsens

-

Team USA men see off dogged Denmark in Olympic ice hockey

-

'US-versus-World' All-Star Game divides NBA players

'US-versus-World' All-Star Game divides NBA players

-

Top seed Fritz beats Cilic to reach ATP Dallas Open final

-

Lens run riot to reclaim top spot in Ligue 1, Marseille slip up

Lens run riot to reclaim top spot in Ligue 1, Marseille slip up

-

Last-gasp Zielinski effort keeps Inter at Serie A summit

-

Vinicius bags brace as Real Madrid take Liga lead, end Sociedad run

Vinicius bags brace as Real Madrid take Liga lead, end Sociedad run

-

Liverpool beat Brighton, Man City oust Beckham's Salford from FA Cup

-

Australia celebrate best-ever Winter Olympics after Anthony wins dual moguls

Australia celebrate best-ever Winter Olympics after Anthony wins dual moguls

-

Townsend becomes a fan again as Scotland stun England in Six Nations

-

France's Macron urges calm after right-wing youth fatally beaten

France's Macron urges calm after right-wing youth fatally beaten

-

China's freeski star Gu recovers from crash to reach Olympic big air final

-

Charli XCX 'honoured' to be at 'political' Berlin Film Festival

Charli XCX 'honoured' to be at 'political' Berlin Film Festival

-

Relatives of Venezuela political prisoners begin hunger strike

-

Trump's 'desire' to own Greenland persists: Danish PM

Trump's 'desire' to own Greenland persists: Danish PM

-

European debate over nuclear weapons gains pace

-

Newcastle oust 10-man Villa from FA Cup, Man City beat Beckham's Salford

Newcastle oust 10-man Villa from FA Cup, Man City beat Beckham's Salford

-

Auger-Aliassime swats aside Bublik to power into Rotterdam final

-

French prosecutors announce special team for Epstein files

French prosecutors announce special team for Epstein files

-

Tuipulotu 'beyond proud' as Scotland stun England

-

Jones strikes twice as Scotland end England's unbeaten run in style

Jones strikes twice as Scotland end England's unbeaten run in style

-

American Stolz wins second Olympic gold in speed skating

-

Marseille start life after De Zerbi with Strasbourg draw

Marseille start life after De Zerbi with Strasbourg draw

-

ECB to extend euro backstop to boost currency's global role

-

Canada warned after 'F-bomb' Olympics curling exchange with Sweden

Canada warned after 'F-bomb' Olympics curling exchange with Sweden

-

Ultra-wealthy behaving badly in surreal Berlin premiere

-

250,000 at rally in Germany demand 'game over' for Iran's leaders

250,000 at rally in Germany demand 'game over' for Iran's leaders

-

UK to deploy aircraft carrier group to Arctic this year: PM

-

Zelensky labels Putin a 'slave to war'

Zelensky labels Putin a 'slave to war'

-

Resurgent Muchova beats Mboko in Qatar final to end title drought

-

Farrell hails Ireland's 'unbelievable character' in edgy Six Nations win

Farrell hails Ireland's 'unbelievable character' in edgy Six Nations win

-

Markram, Jansen lead South Africa to brink of T20 Super Eights

-

Guehi scores first Man City goal to kill off Salford, Burnley stunned in FA Cup

Guehi scores first Man City goal to kill off Salford, Burnley stunned in FA Cup

-

Swiss say Oman to host US-Iran talks in Geneva next week

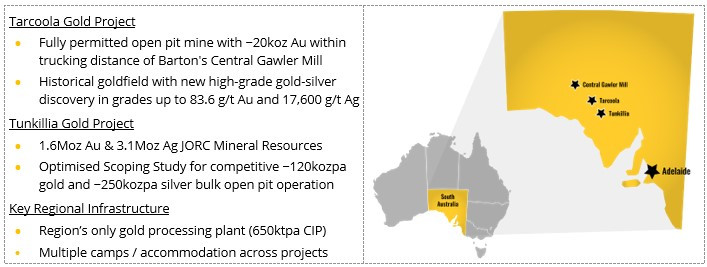

Baseline Water Monitoring Program Begins at Tunkillia

Advancement of long lead work programs to support ML Application

HIGHLIGHTS

Recent Tunkillia OSS confirms large-scale gold project yielding $2.7bn operating cash[1]

Barton accelerating key long-lead PFS and Mining Lease Application programs

ADELAIDE, AUSTRALIA / ACCESS Newswire / June 24, 2025 / Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) (Barton or Company) is pleased to announce the start of baseline water monitoring programs for its South Australian Tunkillia Gold Project (Tunkillia), following the recent publication of Tunkillia's Optimised Scoping Study (OSS).

The Tunkillia OSS identified a compelling large-scale operation with (at an A$5,000/oz gold price): 1

average annual production: ~120koz gold and ~250koz silver

operating free cashflow: A$2.7 billion

Net Present Value (NPV 7.5% ): A$1.4 billion

Internal Rate of Return (IRR): 73%

Payback period: 0.8 years, and

A 'Starter' pit producing ~206koz Au for A$825m operating free cash in the first 13 months

Barton recently announced a $3 million equity accretive placement priced at a ~4% premium to its last traded price, and a ~25% premium to its 20 trading day volume weighted average price (VWAP).[2] The use of those funds is primarily to accelerate Reserve conversation upgrade drilling for Tunkillia's 'Starter Pit. 2 Drilling is anticipated to commence during September 2025, and complete by December 2025.

The baseline water monitoring program is another key long-lead feasibility and approvals work program, with a minimum of two years' worth of baseline water data required prior to start of mining and production. The new Tunkillia water monitoring program will allow Barton to compare new baseline data with historical baseline data collected during prior analyses of the Tunkillia Gold Project.

Commenting on the start of Tunkillia water monitoring, Barton MD Alexander Scanlon said:

"Tunkillia's Optimised Scoping Study has confirmed a large-scale, competitive gold and silver operation with significant economies of scale offering strong financial and capital leverage to a rapidly evolving gold market.

"During the balance of calendar year 2025 we will focus on key long-lead feasibility and approvals programs for Tunkillia, with the objective to submit a Mining Lease Application prior to the end of calendar year 2026.

"In parallel, we will be completing our studies for 'Stage 1' operations leveraging our Central Gawler Mill, with the objective to transition to 'producer' status during 2026. This will enable us to generate free cash flows, and use these funds to advance and develop Tunkillia as our 'Stage 2' expansion project. This staged approach offers our shareholders a lower-cost, lower-risk and lower-dilution pathway to 150,000ozpa gold production."

Authorised by the Managing Director of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 1.7Moz Au & 3.1Moz Ag JORC Mineral Resources (64.0Mt @ 0.83 g/t Au), brownfield mines, and 100% ownership of the region's only gold mill in the renowned Gawler Craton of South Australia.*

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Dale Sims (Consultant) | AusIMM / AIG | Fellow / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

*Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 4 March 2025. Total Barton JORC (2012) Mineral Resources include 909koz Au (30.8Mt @ 0.92 g/t Au) in Indicated category and 799koz Au (33.2Mt @ 0.75 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

[1] Refer to ASX announcement dated 5 May 2025

[2] Refer to ASX announcements dated 27 May and 2 June 2025

SOURCE: Barton Gold Holdings Limited

View the original press release on ACCESS Newswire

L.Davis--AMWN