-

Hiam Abbass says 'cinema is a political act' after Berlin row

Hiam Abbass says 'cinema is a political act' after Berlin row

-

'Imposter' Nef shooting for double Olympic gold

-

Brignone leads giant slalom in double Olympic gold bid, Shiffrin in striking distance

Brignone leads giant slalom in double Olympic gold bid, Shiffrin in striking distance

-

After Munich speech, Rubio visits Trump's allies in Slovakia and Hungary

-

England's Banton at home in first World Cup after stop-start career

England's Banton at home in first World Cup after stop-start career

-

Australia's Aiava slams 'hostile' tennis culture in retirement post

-

Nepal recover from 46-5 to post 133-8 against West Indies

Nepal recover from 46-5 to post 133-8 against West Indies

-

Emotional Kim captures first title in 16 years at LIV Adelaide

-

Exiled Kremlin critic on fighting Putin -- and cancer -- from abroad

Exiled Kremlin critic on fighting Putin -- and cancer -- from abroad

-

Berlinale filmmakers make creative leaps over location obstacles

-

I want answers from my ex-husband, Gisele Pelicot tells AFP

I want answers from my ex-husband, Gisele Pelicot tells AFP

-

Interpol backroom warriors fight cyber criminals 'weaponising' AI

-

New world for users and brands as ads hit AI chatbots

New world for users and brands as ads hit AI chatbots

-

Japan's 'godless' lake warns of creeping climate change

-

US teen Lutkenhaus breaks world junior indoor 800m record

US teen Lutkenhaus breaks world junior indoor 800m record

-

World copper rush promises new riches for Zambia

-

Paw patrol: Larry the cat marks 15 years at 10 Downing Street

Paw patrol: Larry the cat marks 15 years at 10 Downing Street

-

India plans AI 'data city' on staggering scale

-

Jamaica's Thompson-Herah runs first race since 2024

Jamaica's Thompson-Herah runs first race since 2024

-

Crash course: Vietnam's crypto boom goes bust

-

Ahead of Oscars, Juliette Binoche hails strength of Cannes winners

Ahead of Oscars, Juliette Binoche hails strength of Cannes winners

-

US cattle farmers caught between high costs and weary consumers

-

New York creatives squeezed out by high cost of living

New York creatives squeezed out by high cost of living

-

Lillard matches NBA 3-point contest mark in injury return

-

NBA mulling 'every possible remedy' as 'tanking' worsens

NBA mulling 'every possible remedy' as 'tanking' worsens

-

Team USA men see off dogged Denmark in Olympic ice hockey

-

'US-versus-World' All-Star Game divides NBA players

'US-versus-World' All-Star Game divides NBA players

-

Top seed Fritz beats Cilic to reach ATP Dallas Open final

-

Lens run riot to reclaim top spot in Ligue 1, Marseille slip up

Lens run riot to reclaim top spot in Ligue 1, Marseille slip up

-

Last-gasp Zielinski effort keeps Inter at Serie A summit

-

Vinicius bags brace as Real Madrid take Liga lead, end Sociedad run

Vinicius bags brace as Real Madrid take Liga lead, end Sociedad run

-

Liverpool beat Brighton, Man City oust Beckham's Salford from FA Cup

-

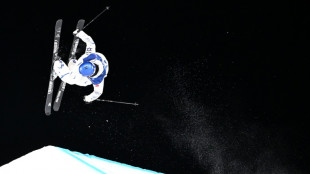

Australia celebrate best-ever Winter Olympics after Anthony wins dual moguls

Australia celebrate best-ever Winter Olympics after Anthony wins dual moguls

-

Townsend becomes a fan again as Scotland stun England in Six Nations

-

France's Macron urges calm after right-wing youth fatally beaten

France's Macron urges calm after right-wing youth fatally beaten

-

China's freeski star Gu recovers from crash to reach Olympic big air final

-

Charli XCX 'honoured' to be at 'political' Berlin Film Festival

Charli XCX 'honoured' to be at 'political' Berlin Film Festival

-

Relatives of Venezuela political prisoners begin hunger strike

-

Trump's 'desire' to own Greenland persists: Danish PM

Trump's 'desire' to own Greenland persists: Danish PM

-

European debate over nuclear weapons gains pace

-

Newcastle oust 10-man Villa from FA Cup, Man City beat Beckham's Salford

Newcastle oust 10-man Villa from FA Cup, Man City beat Beckham's Salford

-

Auger-Aliassime swats aside Bublik to power into Rotterdam final

-

French prosecutors announce special team for Epstein files

French prosecutors announce special team for Epstein files

-

Tuipulotu 'beyond proud' as Scotland stun England

-

Jones strikes twice as Scotland end England's unbeaten run in style

Jones strikes twice as Scotland end England's unbeaten run in style

-

American Stolz wins second Olympic gold in speed skating

-

Marseille start life after De Zerbi with Strasbourg draw

Marseille start life after De Zerbi with Strasbourg draw

-

ECB to extend euro backstop to boost currency's global role

-

Canada warned after 'F-bomb' Olympics curling exchange with Sweden

Canada warned after 'F-bomb' Olympics curling exchange with Sweden

-

Ultra-wealthy behaving badly in surreal Berlin premiere

Earthwise Minerals Amends Private Placement Terms

VANCOUVER, BC / ACCESS Newswire / July 8, 2025 / Earthwise Minerals Corp. (CSE:WISE)(FSE:966) ("Earthwise" or the "Company") announces that it is amending the terms of its non-brokered private placement originally announced on June 19, 2025. The Company will now offer (the "FT Offering") flow-through units ("FT Unit") at a price of $0.03 per unit, along with the previously announced offering (the "NFT Offering" and, together with the FT Offering, the "Offering") of non-flow through units ("NFT Units") at a price of $0.03 per unit, for aggregate gross proceeds of up to $450,000.

Each NFT Unit shall consist of one common share in the authorized share structure of the Company (an "NFT Share") and one common share purchase warrant (an "NFT Warrant"). Each NFT Warrant will entitle the holder thereof to purchase one common share at an exercise price of $0.05 for a period of 24 months from the date of issuance.

Each FT Unit shall consist of one common share in the authorized share structure of the Company (an "FT Share") and one-half of one common share purchase warrant ("FT Warrant"). Each FT Warrant will entitle the holder thereof to purchase one common share at an exercise price of $0.05 for a period of 24 months from the date of issuance. The FT Shares are intended to qualify as "flow-through shares" within the meaning of the Income Tax Act (Canada) (the "Tax Act"). The gross proceeds from the sale of the FT Shares will be used to incur "Canadian exploration expenses" that are intended to qualify as "flow-through mining expenditures" as those terms are defined in the Tax Act, which the Company intends to renounce to the purchasers of the FT Units.

Completion of the Offering is subject to customary conditions, including regulatory approvals. All securities issued in connection with the Offering will be subject to a statutory hold period of four months and one day from the closing date.

The proceeds from the FT Offering will be used to advance the Company's exploration activities and continue unlocking value at the Iron Range Gold Property in British Columbia. The Company intends to use the proceeds from the NFT Offering for general working capital.

A portion of the Offering may be completed in accordance with the exemption set out in BC Instrument 45-536 Exemption from Prospectus Requirement for Certain Distributions Through an Investment Dealer and the corresponding blanket orders and rules in the other Canadian jurisdictions that have adopted the same or a similar exemption from the prospectus requirement (collectively, the "Investment Dealer Exemption"). The Investment Dealer Exemption is available in each of Alberta, British Columbia, Saskatchewan, Manitoba and New Brunswick to a person or company who has obtained advice regarding the suitability of the investment from a person registered as an investment dealer in such person's or company's jurisdiction. As required by the Investment Dealer Exemption, the Company confirms that, as of the date of this press release, there is no "material fact" or "material change" (as those terms are defined under applicable securities laws) related to the Company which has not been generally disclosed.

The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended, or any U.S. state securities laws, and may not be offered or sold in the United States absent registration or available exemptions from such registration requirements. This press release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States, or in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Earthwise Minerals

Earthwise is focused on junior stage project acquisitions across Canada. For more information, review the Company's filings available at www.sedarplus.ca.

EARTHWISE MINERALS CORP.,

ON BEHALF OF THE BOARD

"Mark Luchinski"

Contact Information:

Mark Luchinski

Chief Executive Officer, Director

Telephone: (604) 506-6201

Email: [email protected]

Forward Looking Statements

This news release includes statements that constitute "forward-looking information" as defined under Canadian securities laws ("forward-looking statements") including, without limitation, statements respecting the Offering and the intended use of proceeds therefrom. Statements regarding future plans and objectives of the Company are forward looking statements that involve various degrees of risk. Forward-looking statements reflect management's current views with respect to possible future events and conditions and, by their nature, are subject to known and unknown risks and uncertainties, both general and specific to the Company. Although the Company believes the expectations expressed in its forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance, and actual outcomes may differ materially from those in forward-looking statements. Additional information regarding the various risks and uncertainties facing the Company are described in greater detail in the "Risk Factors" section of the Company's annual management's discussion and analysis and other continuous disclosure documents filed with the Canadian securities regulatory authorities which are available at www.sedarplus.ca. The Company undertakes no obligation to update forward-looking information except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking statements.

For more information, please contact Mark Luchinski, Chief Executive Officer and Director, at [email protected] or (604) 506-6201.

SOURCE: Earthwise Minerals Corp.

View the original press release on ACCESS Newswire

P.Santos--AMWN