-

ByteDance vows to boost safeguards after AI model infringement claims

ByteDance vows to boost safeguards after AI model infringement claims

-

Smith added to Australia T20 squad, in line for Sri Lanka crunch

-

Australian museum recovers Egyptian artefacts after break-in

Australian museum recovers Egyptian artefacts after break-in

-

India forced to defend US trade deal as doubts mount

-

Bitter pill: Taliban govt shakes up Afghan medicine market

Bitter pill: Taliban govt shakes up Afghan medicine market

-

Crunch time for Real Madrid's Mbappe-Vinicius partnership

-

Rio Carnival parades kick off with divisive ode to Lula in election year

Rio Carnival parades kick off with divisive ode to Lula in election year

-

Nepal 'addicted' to the trade in its own people

-

Asian markets sluggish as Lunar New Year holiday looms

Asian markets sluggish as Lunar New Year holiday looms

-

'Pure extortion': foreign workers face violence and exploitation in Croatia

-

Nepal launches campaigns for first post-uprising polls

Nepal launches campaigns for first post-uprising polls

-

What to know as South Korea ex-president Yoon faces insurrection verdict

-

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

-

Rubio visits Trump's 'friend' Orban ahead of Hungary polls

-

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

-

Accused Bondi killer Naveed Akram appears in court by video link

-

Art and the deal: market slump pushes galleries to the Gulf

Art and the deal: market slump pushes galleries to the Gulf

-

Job threats, rogue bots: five hot issues in AI

-

India hosts AI summit as safety concerns grow

India hosts AI summit as safety concerns grow

-

'Make America Healthy' movement takes on Big Ag, in break with Republicans

-

Tech is thriving in New York. So are the rents

Tech is thriving in New York. So are the rents

-

Young USA Stars beat Stripes in NBA All-Star tourney final

-

New anti-government chants in Tehran after giant rallies abroad: reports

New anti-government chants in Tehran after giant rallies abroad: reports

-

'The Secret Agent' nabs Spirit Awards win in boost to Oscars campaign

-

Pantheon Resources PLC Announces AGM Arrangements & Corporate Update

Pantheon Resources PLC Announces AGM Arrangements & Corporate Update

-

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth Olympic crown

-

Morikawa wins at Pebble Beach despite Scheffler heroics

Morikawa wins at Pebble Beach despite Scheffler heroics

-

Germany's Hase and Volodin tango to Olympic pairs figure skating lead

-

Rayo thrash Atletico who 'deserved to lose' as Betis cut gap

Rayo thrash Atletico who 'deserved to lose' as Betis cut gap

-

Napoli salvage point after Malen twice puts Roma ahead

-

Lyon down Nice to boost Ligue 1 title bid with 13th straight win

Lyon down Nice to boost Ligue 1 title bid with 13th straight win

-

LeBron still unclear on NBA future: 'I have no idea'

-

Shelton battles back from brink to beat Fritz, take Dallas crown

Shelton battles back from brink to beat Fritz, take Dallas crown

-

Great Britain celebrate best-ever Winter Olympics

-

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth

-

Arteta concerned over Arsenal's mounting injury list

-

In fuel-starved Cuba, the e-tricycle is king

In fuel-starved Cuba, the e-tricycle is king

-

Shaidorov still spinning after outshining Malinin for Olympic gold

-

Late Gruda goal grabs Leipzig draw versus Wolfsburg

Late Gruda goal grabs Leipzig draw versus Wolfsburg

-

'Ultra-left' blamed for youth's killing that shocked France

-

Canada wrap up perfect Olympic ice hockey preliminary campaign

Canada wrap up perfect Olympic ice hockey preliminary campaign

-

Historical queer film 'Rose' shown at Berlin with call to action

-

Wales' Tandy tips hat to France after Six Nations hammering

Wales' Tandy tips hat to France after Six Nations hammering

-

Quadruple chasing Arsenal rout Wigan to reach FA Cup fifth round

-

2026 S-Class starry facelift

2026 S-Class starry facelift

-

What they said as India beat Pakistan at T20 World Cup - reaction

-

Away-day blues: England count cost of Scotland Six Nations defeat

Away-day blues: England count cost of Scotland Six Nations defeat

-

'Wuthering Heights' debuts atop North America box office

-

Rayo thrash Atletico who 'deserved to lose'

Rayo thrash Atletico who 'deserved to lose'

-

Kok beats Leerdam in Olympic rematch of Dutch speed skaters

Electric Metals Announces Positive PEA for the 100% US Domestic North Star Manganese Project Providing 100% U.S. Domestic Supply of HPMSM, Post-Tax NPV10% of US$1.39 Billion, IRR of 43.5%, and 23-Month Payback

Because the US is 100% Import Reliant on Manganese, the North Star Manganese Project Aligns with the Presidential Executive Orders on Critical Minerals

TORONTO, ON / ACCESS Newswire / August 26, 2025 / Electric Metals (USA) Limited ("EML" or the "Company") (TSXV:EML)(OTCQB:EMUSF) is pleased to announce the results of its Preliminary Economic Assessment ("PEA") for the 100% owned North Star Manganese Project ("North Star" or the "Project") in Emily, Minnesota, prepared in accordance with NI 43-101 Standards of Disclosure for Mineral Projects by Forte Dynamics, Inc. ("Forte"), Fort Collins, Colorado.

The PEA demonstrates robust economics, confirming North Star's potential to become the first fully U.S. domestic producer of high-purity manganese sulphate monohydrate ("HPMSM"), a critical material for lithium-ion batteries. As the U.S. remains 100% import-reliant on manganese, the Project also supports the Presidential Executive Orders on Critical Minerals, reinforcing the strategic importance of EML and its flagship Emily Manganese Deposit in Minnesota-the highest-grade manganese deposit in North America and a vital potential domestic source for EV batteries, energy storage, steelmaking, and defense.

The PEA highlights a post-tax NPV10% of US$1.390 billion, an after-tax IRR of 43.5%, and a rapid payback of only 23 months from the start of production operations.

PEA Highlights - Base Case

Base Case Economics: After-tax NPV10% of US$1.390 billion, after-tax IRR of 43.5%, and average annual after-tax cash flow of US$249.6 million.

Updated Resource Estimate: Based on a 10% manganese cut-off, the Project reports 7.6 million tonnes of Inferred Resources at 19.1% Mn and 3.7 million tonnes of Indicated Resources at 17.0% Mn.

Ore Grades: Average manganese grade of 18.9% during the first 5 years of production, with a Life-of-Project average grade of 17.4% (10% cut-off).

Project Life: 25-year Base Case, producing 4.3 million tonnes of battery-grade HPMSM. The Project may be extended through additional drilling of known mineralized zones that were originally drilled in the 1940s and 1950s and/or by utilizing lower-grade material.

Capital Expenditures: US$474.8 million initial capital for mine and processing facilities, US$150.0 million for a processing plant expansion, and US$276.0 million for sustaining and closure costs.

Ore Production: Average annual mined ore of 368 thousand tonnes, with a nominal mining capacity of 400 thousand tonnes per year.

HPMSM Production: Average annual production after expansion of 180,331 tonnes of HPMSM, with a nominal after expansion plant capacity of 200 thousand tonnes per year, based on a overall recovery of manganese to product of 90%.

Pricing Assumption: Base Case assumes US$2,500 per tonne of HPMSM held constant for LOP.

Project Timeline: Total project life of 25 years from the start of capital spending, including a 2-year construction period. Mine and processing operations extend 23 years, incorporating a 3-year ramp-up to full production for both mine and the processing plant expansion.

Optimization Opportunities: Potential upside exists in geology and exploration, mining, concentration, transport, and processing.

Brian Savage, CEO of Electric Metals, commented: "The results of this PEA confirm that the North Star Manganese Project has the potential to become the first fully domestic source of high-purity manganese sulphate monohydrate in the United States. With robust economics-including an after-tax NPV of US$1.39 billion, IRR of 43.5%, and a payback period of under two years-North Star represents a strategically significant opportunity not only for our shareholders, but also for the U.S. as it seeks secure, low-carbon supplies of critical battery materials. This milestone underscores the importance of the Emily Manganese Deposit in supporting the clean energy transition, U.S. manufacturing, and national security."

Technical Summary:

Updated Mineral Resource Estimate | ||||

Resource Category | Thousand Tonnes | Mn Grade % | Fe Grade % | Si Grade % |

Indicated Resource | 7,600.4 | 19.07 | 22.33 | 30.94 |

Inferred Resource | 3,725.3 | 17.04 | 19.04 | 30.03 |

Mineable Resource Estimate | ||||

North Star Mn Project | Thousand Tonnes | Mn Grade % | Fe Grade % | Si Grade % |

Mined / Shipped Ore | 8,826.2 | 17.43% | 19.84% | 37.24% |

Operating Cost | Per Tonne of Ore | Per Tonne of HPMSM | LOP Operating Cost |

Mining | $94.30 | $192.31 | $832.31 M |

Transport | $90.55 | $184.66 | $799.21 M |

Processing | $200.00 | $407.87 | $1,765.24 M |

G & A | $15.00 | $30.59 | $132.39 M |

TOTAL | $399.85 | $815.44 | $3,529.15 M |

Capital Expenditures | Life of Project |

Initial Capital Expenditures (inc 25% capital contingency) | $474.81 M |

Processing Plant Expansion (inc 25% capital contingency) | $150.00 M |

Sustaining Capital & Closing Costs | $276.03 M |

Working Capital | $10.00 M |

Mining Operations (tonnes) | HPMSM Plant Operations (tonnes) | ||||

Total Production | Annual Production | Daily Production | Total Production | Annual Production | Daily Production |

8,826,000 | 368,000 | 1,143 | 4,328,000 | 180,000 | 174 |

Project Sensitivities

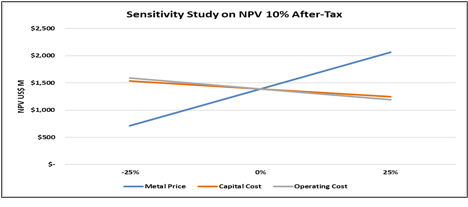

Sensitivity Study on NPV 10% After-Tax (- or + against the Base Case) | |||

Percent of Base Case | -25% | Base Case | +25% |

HPMSM Price | $712.03 M | $1,390.15 M | $2,062.66 M |

Capital Cost | $1,531.93 M | $1,390.15 M | $1,248.37 M |

Operating Cost | $1,591.38 M | $1,390.15 M | $1,188.60 M |

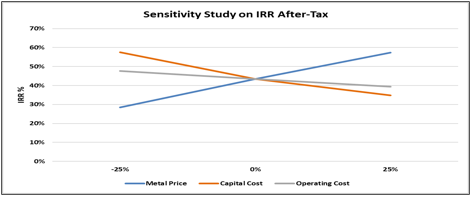

Sensitivity Study on IRR After-Tax (- or + against the Base Case) | |||

Percent of Base Case | -25% | Base Case | +25% |

HPMSM Price | 28.4% | 43.5% | 57.4% |

Capital Cost | 57.5% | 43.5% | 34.8% |

Operating Cost | 47.6% | 43.5% | 39.3% |

Project Summary

EML's North Star Manganese Project involves the mining of high-grade manganiferous iron ore from the Emily Manganese Deposit in Emily, Minnesota, and the production of high-purity manganese sulphate monohydrate (HPMSM), a critical input for lithium-ion batteries used in electric vehicles, energy storage systems, and advanced electronics. All operations will be based in the United States, providing an entirely domestic supply chain for U.S. battery manufacturers.

The Emily Manganese Deposit is located in the Emily District of the Cuyuna Iron Range in central Minnesota, approximately 230 km (143 miles) north of Minneapolis. The district is part of the Superior-type banded iron formations of the Lake Superior region, which also include the Marquette, Gogebic, Mesabi, and Gunflint Iron Ranges.

Iron-bearing deposits in the Cuyuna Range were discovered in 1904. Mining of iron and manganiferous ores occurred from 1911 to 1967, with manganese recovered as part of iron ore extraction. Although significant manganese resources were identified at the Emily Deposit as early as the 1940s by Pickands Mather Mining Company and expanded by U.S. Steel in the 1950s, the deposit itself was never mined. Later confirmation came from the U.S. Bureau of Mines, the Minnesota Geological Survey, and multiple companies up to 2020, when Electric Metals consolidated the land position.

From April to July 2023, Electric Metals engaged Big Rock Exploration of Stillwater, Minnesota, to conduct a combined confirmation and step-out drilling program. A total of 29 PQ and HQ diamond drill core holes were completed for 3,995 meters (13,107 feet). The resulting geological and assay data, validated by Forte Dynamics, were used in the PEA's Mineral Resource Estimate.

The mineralized horizons consist of manganese and iron oxides, silica, residual clays, and cherts. The deposit includes five layered to massive iron-manganese zones, containing higher-grade and lower-grade manganese oxide and manganese carbonate mineralization.

The PEA mine plan assumes mechanized underhand cut-and-fill mining, with access via two vertical shafts: an 18 foot (5.5 meters) diameter production shaft capable of hoisting 1,500 tonnes of ore and 250 tonnes of waste per day, and a spiral ramp providing access every 98 feet (30 meters) vertically. Mining targets 400,000 tonnes per year of ore.

Ore will be transported by truck and rail to an HPMSM processing facility. EML is evaluating multiple candidate sites based on chemical input costs, power rates, transport logistics, permitting, workforce availability, incentives, and proximity to U.S. battery manufacturers.

Metallurgical test work performed by Kemetco Research in Richmond, British Columbia, recovered 95% to 98% of manganese into solution. For the PEA, a conservative overall recovery rate of 90% to final product was assumed. The conceptual flowsheet envisions phased development: an initial 100,000 tpa throughput, expanding to 200,000 tpa by Year 5. Final HPMSM product (99% purity) will be delivered to customers via truck and/or rail in containerized shipments.

Pricing assumptions for HPMSM are based on independent market analysis by CPM Group (New York), with a base case long-term price of US$2,500 per tonne, held constant for the life of the Project.

North Star Manganese Project - Strategic Significance

First HPMSM project produced entirely in the U.S.

Aligns with U.S. national energy security and clean energy transition goals.

Secure, low-carbon domestic source of critical manganese chemicals and metals for EVs, energy storage, defense, and advanced technologies.

Supported by strong government policy momentum favoring domestic critical mineral supply chains.

Next Steps

Proceed to Pre-Feasibility and Feasibility Study activities in 2026.

Collaborate with local communities, native tribes, and regional businesses on Project issues.

Advance permitting with the State of Minnesota regulators and U.S. federal agencies.

Engage with Tier-1 EV and battery manufacturers for offtake agreements.

Optimize extraction and processing systems, and evaluate expansion opportunities.

A National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") compliant technical report entitled "NI 43-101 Technical Report, Preliminary Economic Assessment of the Electric Metals' North Star Manganese Project, Crow Wing County, Minnesota, USA" with an effective date of August 15, 2025 will be filed on SEDAR+ at www.sedarplus.ca under the Company's profile within 45 days of this news release.

Qualified Persons

The PEA was prepared in accordance with NI 43-101 by Forte Dynamics, Inc. The scientific and technical information in this news release has been reviewed and approved by Donald Hulse, SME-RM and Deepak Malhotra, SME-RM, of Forte Dynamics, Inc., each of whom is a "qualified person" under NI 43-101.

About Electric Metals (USA) Limited

Electric Metals (USA) Limited (TSXV: EML; OTCQB: EMUSF) is a U.S.-based critical minerals company advancing manganese and silver projects that support the clean energy transition. The Company's principal asset is the North Star Manganese Project in Minnesota, the highest-grade manganese deposit in North America. The Project has been the subject of extensive technical work, including a Preliminary Economic Assessment prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Electric Metals' mission is to establish a fully domestic U.S. supply of high-purity manganese chemical and metal products for the North American electric vehicle battery, technology, and industrial markets. With manganese playing an increasingly important role in lithium-ion battery formulations, and with no current domestic production in North America, the development of the North Star Manganese Project represents a strategic opportunity for the United States, the State of Minnesota, and the Company's shareholders.

For further information, please contact:

Electric Metals (USA) Limited

Brian Savage

CEO & Director

(303) 656-9197

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions.

Such statements in this news release include, without limitation: the Company's mission to become a domestic U.S. producer of high-value, high-purity manganese products for the North American electric vehicle battery, technology and industrial markets; that manganese will continue to play a critical role in lithium-ion battery formulations; that with no current domestic supply or active mines for manganese in North America, the development of the North Star Manganese Project represents a significant opportunity for America, Minnesota and for the Company's shareholders; and planned or potential developments in ongoing work by Electric Metals.

Forward-looking information also includes statements with respect to the results of the Preliminary Economic Assessment ("PEA"), including but not limited to estimates of NPV, IRR, capital and operating costs, mine life, production, recovery rates, timelines, and pricing assumptions. The reader is cautioned that the PEA is preliminary in nature, includes Inferred Mineral Resources, and is subject to a high degree of uncertainty. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Inferred Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized.

These statements address future events and conditions and involve inherent risks, uncertainties and other factors that could cause actual events or results to differ materially from those estimated or anticipated. Such risks include, but are not limited to: failure to obtain all necessary stock exchange, regulatory, environmental and governmental approvals; risks relating to the accuracy of resource estimates; the speculative nature of Inferred Resources; risks relating to metallurgical test work, recoveries and process design; delays in or failure to advance to more detailed studies, including a Feasibility Study; the ability to secure project financing on reasonable terms; risks relating to construction, cost overruns and schedule delays; risks related to securing offtake agreements; risks relating to the availability and cost of infrastructure, reagents, power, labor and transportation; fluctuations in commodity prices and exchange rates; potential changes to U.S. government policy or support for domestic critical mineral development; general market conditions and investor appetite; and risks associated with exploration, development and mining activities.

Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, updated conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially. Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Electric Metals (USA) Limited

View the original press release on ACCESS Newswire

O.Karlsson--AMWN