-

Sakamoto fights fatigue, Japanese rivals and US skaters for Olympic women's gold

Sakamoto fights fatigue, Japanese rivals and US skaters for Olympic women's gold

-

'Your success is our success,' Rubio tells Orban ahead of Hungary polls

-

Spain unveils public investment fund to tackle housing crisis

Spain unveils public investment fund to tackle housing crisis

-

African diaspora's plural identities on screen in Berlin

-

Del Toro wins shortened UAE Tour first stage

Del Toro wins shortened UAE Tour first stage

-

German carnival revellers take sidesweep at Putin, Trump, Epstein

-

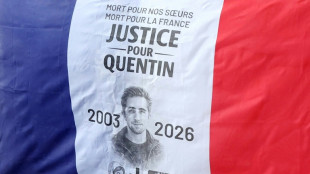

Killing of far-right activist stokes tensions in France

Killing of far-right activist stokes tensions in France

-

Record Jacks fifty carries England to 202-7 in must-win Italy match

-

European stocks, dollar up in subdued start to week

European stocks, dollar up in subdued start to week

-

African players in Europe: Salah hailed after Liverpool FA Cup win

-

Taiwan's cycling 'missionary', Giant founder King Liu, dies at 91

Taiwan's cycling 'missionary', Giant founder King Liu, dies at 91

-

Kyrgyzstan president fires ministers, consolidates power ahead of election

-

McGrath tops Olympic slalom times but Braathen out

McGrath tops Olympic slalom times but Braathen out

-

Greenland's west coast posts warmest January on record

-

South Africa into Super Eights without playing as Afghanistan beat UAE

South Africa into Super Eights without playing as Afghanistan beat UAE

-

Madagascar cyclone death toll rises to 59

-

ByteDance vows to boost safeguards after AI model infringement claims

ByteDance vows to boost safeguards after AI model infringement claims

-

Smith added to Australia T20 squad, in line for Sri Lanka crunch

-

Australian museum recovers Egyptian artefacts after break-in

Australian museum recovers Egyptian artefacts after break-in

-

India forced to defend US trade deal as doubts mount

-

Bitter pill: Taliban govt shakes up Afghan medicine market

Bitter pill: Taliban govt shakes up Afghan medicine market

-

Crunch time for Real Madrid's Mbappe-Vinicius partnership

-

Rio Carnival parades kick off with divisive ode to Lula in election year

Rio Carnival parades kick off with divisive ode to Lula in election year

-

Nepal 'addicted' to the trade in its own people

-

Asian markets sluggish as Lunar New Year holiday looms

Asian markets sluggish as Lunar New Year holiday looms

-

'Pure extortion': foreign workers face violence and exploitation in Croatia

-

Nepal launches campaigns for first post-uprising polls

Nepal launches campaigns for first post-uprising polls

-

What to know as South Korea ex-president Yoon faces insurrection verdict

-

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

-

Rubio visits Trump's 'friend' Orban ahead of Hungary polls

-

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

-

Accused Bondi killer Naveed Akram appears in court by video link

-

Art and the deal: market slump pushes galleries to the Gulf

Art and the deal: market slump pushes galleries to the Gulf

-

Job threats, rogue bots: five hot issues in AI

-

India hosts AI summit as safety concerns grow

India hosts AI summit as safety concerns grow

-

'Make America Healthy' movement takes on Big Ag, in break with Republicans

-

Tech is thriving in New York. So are the rents

Tech is thriving in New York. So are the rents

-

Young USA Stars beat Stripes in NBA All-Star tourney final

-

New anti-government chants in Tehran after giant rallies abroad: reports

New anti-government chants in Tehran after giant rallies abroad: reports

-

'The Secret Agent' nabs Spirit Awards win in boost to Oscars campaign

-

Brondell Showcases Cutting-Edge Engineering and Design at KBIS 2026

Brondell Showcases Cutting-Edge Engineering and Design at KBIS 2026

-

Sartorius Sharpens Climate Targets and Receives Validation from Science Based Targets Initiative

-

Pantheon Resources PLC Announces AGM Arrangements & Corporate Update

Pantheon Resources PLC Announces AGM Arrangements & Corporate Update

-

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth Olympic crown

-

Morikawa wins at Pebble Beach despite Scheffler heroics

Morikawa wins at Pebble Beach despite Scheffler heroics

-

Germany's Hase and Volodin tango to Olympic pairs figure skating lead

-

Rayo thrash Atletico who 'deserved to lose' as Betis cut gap

Rayo thrash Atletico who 'deserved to lose' as Betis cut gap

-

Napoli salvage point after Malen twice puts Roma ahead

-

Lyon down Nice to boost Ligue 1 title bid with 13th straight win

Lyon down Nice to boost Ligue 1 title bid with 13th straight win

-

LeBron still unclear on NBA future: 'I have no idea'

Snowline Closes Oversubscribed Bought Deal Financing and Concurrent Private Placement for Gross Proceeds of $102 Million

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES.

VANCOUVER, BC / ACCESS Newswire / September 4, 2025 / SNOWLINE GOLD CORP. (TSX-V:SGD)(US OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce that it has completed its previously announced "bought deal" public offering of 10,222,200 common shares of the Company (the "Common Shares") at a price of $9.00 per Common Share (the "Offering Price") for aggregate gross proceeds of $91,999,800, including $11,999,700 from the full exercise of the underwriters' over-allotment option (the "Offering").

The Company also completed a concurrent non-brokered private placement of 1,123,194 Common Shares at the Offering Price for additional gross proceeds of $10,108,746, pursuant to which existing shareholder B2Gold Corp. (TSX: BTO, NYSE American: BTG, NSX: B2G) subscribed to maintain its 9.9% interest in the Company (the "Private Placement"). No commission was payable in connection with the Private Placement. The Common Shares issued in connection with the Private Placement are subject to a hold period of four months and one day from the closing of the Private Placement, in accordance with applicable Canadian securities laws, expiring on January 5, 2026.

Total gross proceeds from the Offering and the Private Placement are $102,108,546.

Scott Berdahl, CEO & Director of Snowline, comments: "Our strengthened treasury is an asset in its own right, allowing us to focus for multiple years on rapid and responsible advancement of our Valley deposit alongside continued exploration across our emerging, district-scale portfolio. We are entering an exciting phase as a company as we advance a globally relevant gold discovery in a top tier jurisdiction amidst a strong market backdrop."

The Company will use the net proceeds from the Offering and the Private Placement to advance the Company's projects in the Yukon Territory, as well as for working capital and general corporate purposes.

The Offering was led by Canaccord Genuity Corp. and BMO Capital Markets, as joint bookrunners, on behalf of a syndicate of underwriters, including Cormark Securities Inc., Agentis Capital Markets, National Bank Financial Inc., CIBC World Markets Inc. and Scotia Capital Inc. (collectively, the "Underwriters"). The Underwriters received a cash commission equal to 4.5% of the gross proceeds of the Offering, other than on gross proceeds from certain subscribers on a president's list of purchasers identified by the Company, for which the Underwriters received a cash commission equal to 2.25%.

The Offering was completed by way of a short form prospectus filed in British Columbia, Alberta, Ontario and New Brunswick, and Common Shares were also sold by way of private placement in the United States pursuant to an exemption from the registration requirements of the United States Securities Act of 1933, as amended (the "U.S. Securities Act").

The securities referred to in this news release have not been, nor will they be, registered under the U.S. Securities Act, and may not be offered or sold within the United States absent U.S. registration or an applicable exemption from the U.S. registration requirements. This news release does not constitute an offer for sale of securities, nor a solicitation for offers to buy any securities in the United States, nor in any other jurisdiction in which such offer, solicitation or sale would be unlawful.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory-focused gold exploration and development company with a mineral claim portfolio covering roughly 360,000 ha (3,600 km2). The Company is advancing its Valley gold deposit-a large, low-strip, near surface, >1 g/t Au bulk tonnage gold system located in the eastern Yukon-while continuing regional exploration of surrounding targets on the Rogue Project and the broader district in the highly prospective yet underexplored Selwyn Basin.

Valley hosts an open mineral resource estimate ("MRE") of 7.94 million ounces gold at 1.21 g/t Au in the Measured and Indicated categories (3.15 million ounces gold at 1.41 g/t Au Measured mineral resources and 4.79 million ounces gold at 1.11 g/t Au Indicated mineral resources) and an additional 0.89 million ounces gold at 0.62 g/t Au in the Inferred category1. Results of a preliminary economic assessment ("PEA") of Valley suggest the potential for the deposit to support a long-life mining operation with a strong production profile and low production costs. The MRE and PEA are supported by the recent technical report for Rogue, prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") standards, entitled "Independent Preliminary Economic Assessment for the Rogue Project Yukon, Canada," dated August 27, 2025, with an effective date of March 1, 2025 and available on SEDAR+ and the Company's website.

Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits across the central Yukon and Alaska. The Company's comprehensive first-mover position and extensive exploration database provide a distinct competitive advantage and a unique opportunity for investors to be part of multiple discoveries, the advancement of a significant gold deposit, and the creation of a new gold district.

1Mineral resources are not mineral reserves and do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by metal prices, economic factors, environmental, permitting, legal, title, or other relevant issues.

QUALIFIED PERSON

Information in this news release has been prepared under supervision of and approved by Thomas Branson, M.Sc., P. Geo., VP Exploration for Snowline, as Qualified Person for the purposes of NI 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

[email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the expected use of proceeds from the Offering and the Private Placement, the mineral resource estimates, advancement of the Valley deposit, continued exploration and the creation of a new gold district. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View the original press release on ACCESS Newswire

O.Norris--AMWN