-

Bleak future for West Bank pupils as budget cuts bite

Bleak future for West Bank pupils as budget cuts bite

-

Oil in spotlight as Trump's Iran warning rattles sleepy markets

-

Why are more under-50s getting colorectal cancer? 'We don't know'

Why are more under-50s getting colorectal cancer? 'We don't know'

-

Moscow, Kyiv set for Geneva peace talks amid Russian attacks

-

Iran, United States set for new talks in Geneva

Iran, United States set for new talks in Geneva

-

China has slashed air pollution, but the 'war' isn't over

-

India's tougher AI social media rules spark censorship fears

India's tougher AI social media rules spark censorship fears

-

Doctors, tourism, tobacco: Cuba buckling under US pressure

-

Indonesia capital faces 'filthy' trash crisis

Indonesia capital faces 'filthy' trash crisis

-

France grants safe haven to anti-Kremlin couple detained by ICE

-

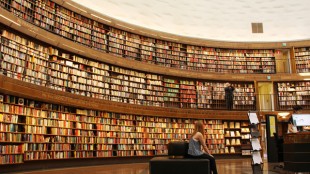

Frederick Wiseman, documentarian of America's institutions, dead at 96

Frederick Wiseman, documentarian of America's institutions, dead at 96

-

Gu pipped to Olympic gold again as Meillard extends Swiss ski dominance

-

Copper powers profit surge at Australia's BHP

Copper powers profit surge at Australia's BHP

-

China's Gu defiant after missing out on Olympic gold again

-

Remains of Colombian priest-turned-guerrilla identified six decades later

Remains of Colombian priest-turned-guerrilla identified six decades later

-

USA bobsleigh veteran Meyers Taylor wins elusive gold

-

Miura and Kihara snatch Olympic pairs gold for Japan

Miura and Kihara snatch Olympic pairs gold for Japan

-

Gu pipped to gold again as Meillard extends Swiss ski dominance at Olympics

-

Barca suffer title defence blow in Girona derby defeat

Barca suffer title defence blow in Girona derby defeat

-

Brentford edge out sixth-tier Macclesfield in FA Cup

-

Canada's Oldham wins Olympic freeski big air final, denying Gu gold

Canada's Oldham wins Olympic freeski big air final, denying Gu gold

-

France loosens rules on allowing farmers to shoot wolves

-

USA thrash Sweden to reach Olympic women's ice hockey final

USA thrash Sweden to reach Olympic women's ice hockey final

-

Russian poisonings aim to kill -- and send a message

-

France's Macron eyes fighter jet deal in India

France's Macron eyes fighter jet deal in India

-

Arsenal to face third-tier Mansfield, Newcastle host Man City in FA Cup

-

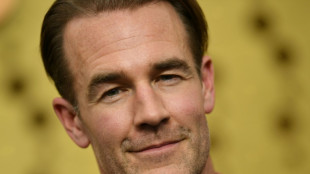

Robert Duvall: understated actor's actor, dead at 95

Robert Duvall: understated actor's actor, dead at 95

-

'How long?': Day Three of hunger strike for Venezuelan political prisoners' release

-

Berlinale: Film director Mundruczo left Hungary due to lack of funding

Berlinale: Film director Mundruczo left Hungary due to lack of funding

-

Malinin talks of 'fighting invisible battles' after Olympic failure

-

'Godfather' and 'Apocalypse Now' actor Robert Duvall dead at 95

'Godfather' and 'Apocalypse Now' actor Robert Duvall dead at 95

-

Sinner serves up impressive Doha win on his return

-

Luis Enrique dismisses 'noise' around PSG before Monaco Champions League clash

Luis Enrique dismisses 'noise' around PSG before Monaco Champions League clash

-

Grief-stricken McGrath left in shock at Olympic slalom failure

-

Brignone leads charge of veteran women as Italy celebrates record Olympic haul

Brignone leads charge of veteran women as Italy celebrates record Olympic haul

-

Sri Lanka's Nissanka leaves Australia on brink of T20 World Cup exit

-

England match-winner Jacks proud, confident heading into Super Eights

England match-winner Jacks proud, confident heading into Super Eights

-

St Peter's Basilica gets terrace cafe, translated mass for 400th birthday

-

Meillard hails Swiss 'golden era' after slalom win caps Olympic domination

Meillard hails Swiss 'golden era' after slalom win caps Olympic domination

-

Sri Lanka fight back after strong start by Australia's Marsh, Head

-

Kovac calls on Dortmund to carry domestic 'momentum' into Champions League

Kovac calls on Dortmund to carry domestic 'momentum' into Champions League

-

Dutch inventor of hit game 'Kapla' dead at 80: family

-

Benfica's Mourinho plays down Real Madrid return rumour before rematch

Benfica's Mourinho plays down Real Madrid return rumour before rematch

-

St Peter's Basilica gets terrace cafe for 400th anniversary

-

Meillard extends Swiss Olympic strangehold while Gu aims for gold

Meillard extends Swiss Olympic strangehold while Gu aims for gold

-

Meillard crowns Swiss men's Olympic domination with slalom gold

-

German carnival revellers take swipes at Putin, Trump, Epstein

German carnival revellers take swipes at Putin, Trump, Epstein

-

England survive Italy scare to reach T20 World Cup Super Eights

-

Gold rush grips South African township

Gold rush grips South African township

-

'Tehran' TV series producer Dana Eden found dead in Athens

Brookmount Gold Announces Agreement Eliminating Stock Conversions Resulting from Convertible Debt and Repricing of Reg.A Offering

RENO, NEVADA / ACCESS Newswire / October 2, 2025 / Brookmount Gold (sic. Brookmount Explorations Inc.) (OTC:BMXI), a gold exploration and production company, announced that a repayment and settlement agreement has now been executed with its convertible note lender. The agreement confirms that there will be no further conversions on this debt, nor stock issuances pursuant thereto. Repayment of the remaining balance, which commenced on September 20, will be completed on or before December 2026 and no prepayment penalties will apply.

In addition to its convertible debt settlement, Brookmount confirmed that it will no longer be issuing additional stock under the currently qualified Reg.A offering. The Company is in the process of filing a post-qualification amendment (PQA) to reprice the offering at a significant premium to the existing offering price of $0.02c per share. The offering price is being raised for a number of reasons, including strong demand, current Company growth metrics and corporate expectations for future stock price movements. This process will involve a new review by the SEC and effectively suspends the current Reg A offering qualification until the review process is completed.

CEO Nils Ollquist commented: "The Company believes that limiting future dilution is currently the most critical element for building shareholder value. Over the past several months, we have been active in the process of raising sufficient capital to fund both expansion of our Indonesian gold operations and to accelerate the extinguishing of our remaining convertible debt. Conversions and share issuances pursuant to this debt have represented a significant obstacle to achieving a share price performance both reflective of our present status and satisfactory to both management and our shareholders."

Mr Ollquist continued: "This month we will announce our 26th consecutive quarter of profitability. Since the Company will now continue to operate, expand, and thrive as a cash flow positive entity, there is no further need to limit our share price growth by issuing further dilutive equity. As cash flow continues to grow, we anticipate accelerating and completing our previously announced stock buyback program during the next few months. Brookmount should be able to expand this program with additional tranches during 2026. The Company's financial health and operational viability have never been stronger. We will now be moving forward, at pace, with implementation of several strategic initiatives alluded to in our past releases, including the spin off of our North American assets and progressing with exchange listing".

About Brookmount Gold

Founded in 2018, Brookmount Gold is a high-growth gold-producing company quoted on OTC Markets in the United States (OTC:BMXI). With operating gold mines in Southeast Asia and exploration and production assets in North America, the company is focused on acquiring and developing high-quality gold assets with JORC/NI 43-101 verified resources.

Safe Harbor Statements:

Except for the historical information contained herein, certain of the matters discussed in this communication constitute "forward-looking statements" within the meaning of the Securities Litigation Reform Act of 1995. Words such as "may," "might," "will," "should," "could," "anticipate," "estimate," "expect," "predict," "project," "future," "potential," "intend," "seek to," "plan," "assume," "believe," "target," "forecast," "goal," "objective," "continue" or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding benefits of the proposed license, expected synergies, anticipated future financial and operating performance and results, including estimates of growth. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. For example, the expected timing and likelihood of completion of the pending transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending transaction that could reduce anticipated benefits or cause the parties to abandon the transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstance that could give rise to the termination of the negotiations, the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of Brookmount's common stock. All such factors are difficult to predict and are beyond our control. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this report, except as required by applicable law or regulations.

Website: https://www.brookmountgold.com

Corporate Contact:

[email protected]

Social Links: Brookmount Gold X (Formerly Twitter);

https://x.com/brookmountgold (@BrookmountAu)

SOURCE: Brookmount Explorations, Inc.

View the original press release on ACCESS Newswire

A.Mahlangu--AMWN