-

Bangladesh's new PM, political heir Tarique Rahman

Bangladesh's new PM, political heir Tarique Rahman

-

Rain threatens to knock Australia out of T20 World Cup

-

US civil rights leader Jesse Jackson dies at 84: family

US civil rights leader Jesse Jackson dies at 84: family

-

Trump's new envoy arrives in South Africa with relations frayed

-

Jesse Jackson: civil rights lion sought 'common ground'

Jesse Jackson: civil rights lion sought 'common ground'

-

Iran, United States hold new talks in Geneva

-

Tariq confident Pakistan can bounce back after India drubbing

Tariq confident Pakistan can bounce back after India drubbing

-

Being back in the USA 'feels amazing', says Vonn

-

New Zealand cruise into Super Eights at T20 World Cup

New Zealand cruise into Super Eights at T20 World Cup

-

Moscow, Kyiv meet for US-brokered talks after fresh attacks

-

Exhilarating Italy aim to sign off with giant-killing at T20 World Cup

Exhilarating Italy aim to sign off with giant-killing at T20 World Cup

-

Samra hits 110 for Canada against New Zealand at T20 World Cup

-

'Made in Europe' or 'Made with Europe'? Buy European push splits bloc

'Made in Europe' or 'Made with Europe'? Buy European push splits bloc

-

Slovakia revamps bunkers with Ukraine war uncomfortably close

-

Sydney man jailed for mailing reptiles in popcorn bags

Sydney man jailed for mailing reptiles in popcorn bags

-

'Like a Virgin' songwriter Billy Steinberg dies at 75

-

Who fills Sexton vacuum? Irish fly-half debate no closer to resolution

Who fills Sexton vacuum? Irish fly-half debate no closer to resolution

-

Japan hails 'new chapter' with first Olympic pairs skating gold

-

Russian prosthetics workshops fill up with wounded soldiers

Russian prosthetics workshops fill up with wounded soldiers

-

'Not just props that eat': Extras seek recognition at their own 'Oscars'

-

Bangladesh PM-to-be Tarique Rahman and lawmakers sworn into parliament

Bangladesh PM-to-be Tarique Rahman and lawmakers sworn into parliament

-

At least 14 killed in spate of attacks in northwest Pakistan

-

Peru Congress to debate impeachment of interim president

Peru Congress to debate impeachment of interim president

-

Bleak future for West Bank pupils as budget cuts bite

-

Oil in spotlight as Trump's Iran warning rattles sleepy markets

Oil in spotlight as Trump's Iran warning rattles sleepy markets

-

Why are more under-50s getting colorectal cancer? 'We don't know'

-

Moscow, Kyiv set for Geneva peace talks amid Russian attacks

Moscow, Kyiv set for Geneva peace talks amid Russian attacks

-

Iran, United States set for new talks in Geneva

-

China has slashed air pollution, but the 'war' isn't over

China has slashed air pollution, but the 'war' isn't over

-

India's tougher AI social media rules spark censorship fears

-

Doctors, tourism, tobacco: Cuba buckling under US pressure

Doctors, tourism, tobacco: Cuba buckling under US pressure

-

Indonesia capital faces 'filthy' trash crisis

-

France grants safe haven to anti-Kremlin couple detained by ICE

France grants safe haven to anti-Kremlin couple detained by ICE

-

BioNxt Receives Milestone EPO Decision to Grant European Patent for Sublingual Cladribine Drug Delivery Technology for Multiple Sclerosis

-

Nano One Announces Executive Leadership Appointments

Nano One Announces Executive Leadership Appointments

-

Agronomics Limited Announces Half-year Financial Report

-

Empire Metals Limited Announces Major Drilling Campaign to Commence at Pitfield

Empire Metals Limited Announces Major Drilling Campaign to Commence at Pitfield

-

Coca-Cola Europacific Partners plc Announces Preliminary Unaudited Results Q4 & FY 2025

-

Nikon Introduces The Ultra Compact Trailblazer II Binocular

Nikon Introduces The Ultra Compact Trailblazer II Binocular

-

The Venture Debt Conference Announces Speakers for April 16 Event in New York

-

Frederick Wiseman, documentarian of America's institutions, dead at 96

Frederick Wiseman, documentarian of America's institutions, dead at 96

-

Gu pipped to Olympic gold again as Meillard extends Swiss ski dominance

-

Copper powers profit surge at Australia's BHP

Copper powers profit surge at Australia's BHP

-

China's Gu defiant after missing out on Olympic gold again

-

Remains of Colombian priest-turned-guerrilla identified six decades later

Remains of Colombian priest-turned-guerrilla identified six decades later

-

USA bobsleigh veteran Meyers Taylor wins elusive gold

-

Miura and Kihara snatch Olympic pairs gold for Japan

Miura and Kihara snatch Olympic pairs gold for Japan

-

Gu pipped to gold again as Meillard extends Swiss ski dominance at Olympics

-

Barca suffer title defence blow in Girona derby defeat

Barca suffer title defence blow in Girona derby defeat

-

Brentford edge out sixth-tier Macclesfield in FA Cup

Formation Metals Closes $8.26M First Tranche of Its Private Placements, Fully Funding 20,000 Metre Drill Program at the Advanced N2 Gold Project

Highlights:

Formation has closed $8,262,389.48 in gross proceeds, fully funding its planned 20,000 metre total multi-phase drill program at its flagship N2 Gold Project in Quebec, host to a global historic resource of ~870,000 ounces comprised of 18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4.

Phase 1, consisting of 10,000 metres, commenced on September 25, 2025. Phase 1 will target the "A" zone, a shallow, highly continuous, low-variability historic gold deposit with ~522,900 ounces of which only ~35% of strike has been drilled (>3.1 km open), and the "RJ" zone, host to high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres2, which was expanded by Agnico Eagle Mines in 2008 in the most recent drilling at the Property.

The Company has working capital of ~C$12.7M with zero debt. Inclusive of provincial tax credits from the Quebec government, Formation's exploration budget for 2025-2026 is set at ~$8.1M. The Company will close the balance of its private placements in the coming weeks.

VANCOUVER, BC / ACCESS Newswire / October 15, 2025 / Formation Metals Inc. ("Formation" or the "Company") (CSE:FOMO)(FSE:VF1)(OTCQB:FOMTF), a North American mineral acquisition and exploration company, is pleased to announce that, further to its news releases of September 30, 2025 and October 1, 2025, it has closed the first tranche of its private placement, raising $8,262,389.48 in gross proceeds through the issuance of 17,312,891 units (each a "LIFE Unit") at $0.37 per LIFE Unit (the "LIFE Offering") and 4,528,341 flow-through units (the "FT Units") at $0.41 per FT Unit (the "FT Offering" and together with the LIFE Offering, the "Offerings").

Deepak Varshney, CEO of Formation Metals, stated, "We are incredibly grateful for the support Formation has received from new and past shareholders. With nearly thirteen million in working capital, Formation is now funded through 2027 to complete 20,000 metres of drilling at N2."

Mr. Varshney continued: "Building on the success of our predecessors, this 20,000 metre drill program will be critical in our goal of developing N2 into anear-surface multi-million-ounce deposit. With gold breaking $4,200, over 5 times the price in 2008 when Agnico last drilled the project, we believe that the timing is perfect for N2 and look forward to a very busy upcoming field season."

The LIFE Offering was conducted pursuant to the listed issuer financing exemption under Part 5A of National Instrument 45-106 - Prospectus Exemptions ("NI 45-106"), as amended and supplemented by Coordinated Blanket Order 45-935 - Exemptions from Certain Conditions of the Listed Issuer Financing Exemption.

Each LIFE Unit issued in the LIFE Offering is comprised of one common share in the capital of the Company (a "LIFE Share") and one common share purchase warrant (a "LIFE Warrant"). Each LIFE Warrant is exercisable to acquire one additional common share of the Company at an exercise price of $0.54 for a period of 36 months from the date of closing of the LIFE Offering.

The LIFE Units issued pursuant to the LIFE Offering are not subject to a hold period in accordance with applicable Canadian securities laws.

In connection with the LIFE Offering, the Company filed an offering document dated September 30, 2025, as amended and restated on October 14, 2025, which is available on the Company's SEDAR+ profile at www.sedarplus.ca and on the Company's website (www.formationmetalsinc.com).

Each FT Unit issued in the FT Offering is comprised of one flow-through common share (a "FT Share") of the Company, and each FT Share qualifying as a "flow-through share" as defined in section 66(15) of the Income Tax Act (Canada), and one transferable common share purchase warrant (a "FT Warrant"). Each FT Warrant entitles the holder to purchase one additional common share at an exercise price of $0.62 for a period of 24 months from the date of closing of the FT Offering.

All securities issued under the FT Offering are subject to a hold period in accordance with applicable Canadian securities laws.

The Company paid finder's fees totaling $150,079.90 cash and 127,573 finder's warrants (the "Finder's Warrants") to arm's length parties in connection with the Offering. The Finder Warrants are non-transferable and match the terms of the LIFE Warrants and FT Warrants respectively.

The Company intends to use the net proceeds of the Offerings for fieldwork at the Company's exploration projects and, in the case of the net proceeds from the LIFE Offering, as more particularly set out in the Offering Document.

Project Summary

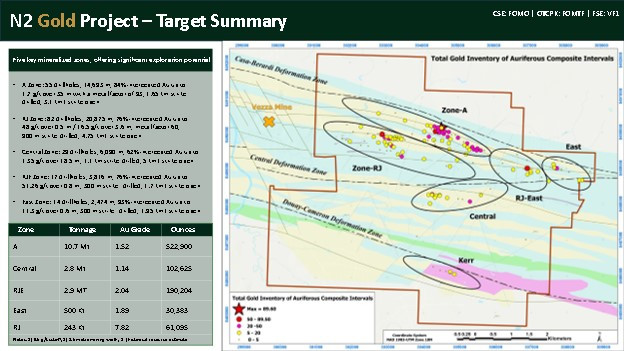

Comprising 87 claims totaling ~4,400 ha within the Abitibi sub province of Northwestern Quebec, Formation's flagship N2 Gold Project is an advanced gold project with a global historic resource of 877,000 ounces. There are six primary auriferous mineralized zones in total, each open for expansion along strike and at depth. Compilation and geophysical work by Balmoral Resources Ltd. (now Wallbridge Mining) from 2010 to 2018 generated numerous targets that have not yet been investigated with diamond drilling.

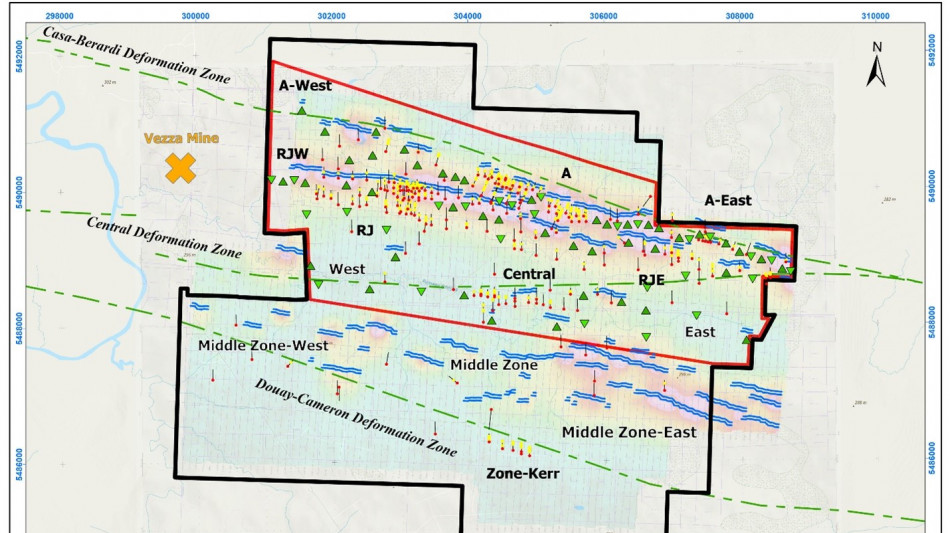

The drill program is designed to focus on discovery drilling at new high-potential targets along the mineralization strikes at the "A", "RJ" and "Central" zones in the northern part of the Property in order to discover new auriferous trends and unlock new zones of gold mineralization. The program will also focus on high-priority infilling and expansion targets in these zones to significantly enhance the auriferous zones identified to-date (Figure 1).

Historical highlights from the top two priority zones include:

A Zone: A shallow, highly continuous, low-variability historic gold deposit with ~522,900 ounces identified at a grade of 1.52 g/t Au. ~15,000 metres have been drilled historically across 1.65 km of strike, with over 3.1 km of strike remaining to be tested. 84% of historical drillholes intercepted auriferous intervals including up 1.7 g/t over

35 m.RJ Zone: a high-grade historic gold deposit with ~61,100 ounces identified at a grade of 7.82 g/t Au, with high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres and 16.5 g/t Au over 3.5 metres2. This zone was the target of the most recently drilling at the Property by Agnico-Eagle Mines in 2008, when the price of gold was ~US$800/oz. Only ~900 metres of strike has been drilled, with 4.75+ km of strike remaining to be tested.

Figure 1 - PDDH design for the complete 20,000 metre Drill Program.

Figure 2 - Property overview summarizing historical work completed at each of the six mineralized zones and their respective historical resource.

The Company also believes that N2 has significant base metal potential, where it recently completed a revaluation process which revealed significant copper and zinc intercepts within historic drillholes known to have significant gold grades (>1 g/t Au). Assay results range from 200 to 4,750 ppm and 203 ppm to 6,700 ppm, for copper and zinc, respectively, indicating strong potential for elevated base metal (Cu-Zn) concentrations across the property, specifically at the A and RJ zones. Property wide geology at N2 features volcanic and sedimentary rocks formed in regional anticlinal and synclinal flexures. Three principal deformation structures (Figure 1), oriented along the known NW-SE to WNW-ESE structural trends typical of VMS deposits in the Matagami region, function as critical geologic controls for mineralization on the property.

For the 2025 exploration season, Formation plans to concentrate its efforts on the northern part of N2, targeting gold deposit expansion and discovery along identified zones and fault systems associated with the main deformation features (specifically WNW-ESE trend), with IP surveys and drilling planned to model mineralized zones that will hopefully contribute to an updated NI-43 101 compliant resource. Formation will also look to further review historic base metal assays from older drill core and undertake additional work in 2025 to assess the property's copper and zinc potential.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Babak Vakili Azar, P.Geo., an independent contractor and a qualified person as defined by National Instrument 43-101. Historical reports provided by the optionor were reviewed by the qualified person. The information provided has not been verified and is being treated as historic.

About Formation Metals Inc.

Formation Metals Inc. is a North American mineral acquisition and exploration company focused on the development of quality properties that are drill-ready with high-upside and expansion potential. Formation's flagship asset is the N2 Gold Project, an advanced gold project with a global historic resource of ~870,000 ounces (18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4) and six mineralized zones, each open for expansion along strike and at depth including the "A" zone, of which only ~35% of strike has been drilled (>3.1 km open), and the "RJ" zone, host to historical high-grade intercepts as high as 51 g/t Au over 0.8 metres.

FORMATION METALS INC.

Deepak Varshney, CEO and Director

For more information, please call 778-899-1780, email [email protected] or visit www.formationmetalsinc.com.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Notes and References:

Readers are cautioned that the geology of nearby properties is not necessarily indicative of the geology of the Property.

The above referenced resource estimates do not have a category, are considered historical in nature, and are based on prior data prepared by a previous property owner, and do not conform to current CIM categories.

While the Company considers the estimates to be reliable, a qualified person has not done sufficient work to classify the historical estimates as current resources in accordance with current CIM categories and the Company is not treating the historical estimates as a current resource. A 0.5 g/t Au cut-off was used in the preparation of the historical estimates with a minimum 2.5 metre mining width.

Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimates can be classified as current resources. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. The Company is not aware of any more recent estimates prepared for the N2 Property.

Needham, B. (1994), 1993 Diamond Drill Report, Northway Joint Venture, Northway Property; Cypress Canada Inc.; 492 pages.

Guy K. (1991), Exploration Summary May 1, 1990 to May 1, 1991 Vezza Joint Venture Northway Property; Total Energold; 227 pages.

Forward-looking statements:

This news release includes "forward-looking statements" under applicable Canadian securities legislation, including statements respecting: the Company's plans for the Property and the expected timing and scope of the drilling program at the Property; the Company's goal of delivering a near-surface multi-million-ounce deposit the Property; the Company's view that the Property has the potential for over three million ounces of gold; the Company's planned 20,000-metre drilling program; and statements respecting the Offerings, the timing thereof and the expected use of proceeds therefrom. Such forward-looking information reflects management's current beliefs and is based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Readers are cautioned that such forward-looking statements are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

No Offer or Solicitation to Purchase Securities in the United States

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the "Securities Act"), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act ("Regulation S"), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Not for distribution to United States newswire services or for dissemination in the United States. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. This news release shall not constitute an offer to sell or the solicitation of an offer to buy in the United States or to, or for the account or benefit of, persons in the United States or U.S. Persons nor shall there by any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

SOURCE: Formation Metals

View the original press release on ACCESS Newswire

Ch.Kahalev--AMWN