-

South Korea protests 'Victory' banner hung from Russian embassy

South Korea protests 'Victory' banner hung from Russian embassy

-

Asian stocks rally after Trump's Supreme Court tariffs blow

-

New Dutch government to be sworn in under centrist Jetten

New Dutch government to be sworn in under centrist Jetten

-

New York mayor orders citywide travel ban as major storm hits US

-

ICC to begin pre-trial hearing for Philippines' Duterte

ICC to begin pre-trial hearing for Philippines' Duterte

-

After two convictions, France's Sarkozy seeks to merge sentences

-

Bridgeman hangs on to claim first PGA Tour title at Riviera

Bridgeman hangs on to claim first PGA Tour title at Riviera

-

Hong Kong appeals court to rule on jailed democracy campaigners

-

Blizzard blows New Yorkers' plans off course

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

Strasbourg snap Lyon winning run in Ligue 1

-

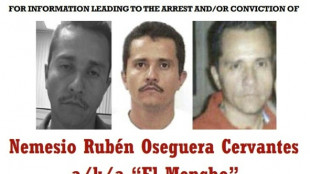

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

Giroud penalty ends Lille's winless run in Ligue 1

-

Thrashing Spurs dragged Arsenal out of title hell: Arteta

-

Iran-US talks expected Thursday despite fears of strikes

Iran-US talks expected Thursday despite fears of strikes

-

Milan beaten by Parma, Napoli rage at officials

-

Hughes looses teeth then scores Olympic gold-winning goal for USA

Hughes looses teeth then scores Olympic gold-winning goal for USA

-

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

-

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

-

Galthie praises France lock Meafou and defence

-

'Nothing was good', says Mac Allister despite Liverpool win

'Nothing was good', says Mac Allister despite Liverpool win

-

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

-

EU 'expects' US to honour trade deal as Trump hikes tariffs

EU 'expects' US to honour trade deal as Trump hikes tariffs

-

'GOAT' battles to top of N. America box office

-

South Africa thrash India to end 12-match T20 World Cup win streak

South Africa thrash India to end 12-match T20 World Cup win streak

-

Bielle-Biarrey breaks record as France beat Italy in Six Nations

-

US says trade deals in force despite court ruling on tariffs

US says trade deals in force despite court ruling on tariffs

-

Barcelona back top of La Liga with Levante win

-

Gu strikes gold, USA beat Canada in men's ice hockey

Gu strikes gold, USA beat Canada in men's ice hockey

-

What's behind England's Six Nations slump?

-

Napoli rage at officials after loss at Atalanta

Napoli rage at officials after loss at Atalanta

-

Liverpool late show floors Nottingham Forest

-

Rimac Nevera R: Beyond imagination

Rimac Nevera R: Beyond imagination

-

USA beat Canada to win men's Olympic ice hockey gold

-

Samardzic seals comeback win for Atalanta over Napoli

Samardzic seals comeback win for Atalanta over Napoli

-

Eileen Gu switches slopes for catwalk after Olympic flourish

-

Luce: Ferrari's ingenious electric revolution

Luce: Ferrari's ingenious electric revolution

-

Miller guides South Africa to 187-7 against India

-

Scotland boss 'proud' of comeback Six Nations win over Wales

Scotland boss 'proud' of comeback Six Nations win over Wales

-

Iranian students rally for second day as fears of war with US mount

-

US Secret Service kills man trying to access Trump Florida estate

US Secret Service kills man trying to access Trump Florida estate

-

Coventry 'let the Games do their magic': former IOC executives

-

Cayenne Turbo Electric 2026

Cayenne Turbo Electric 2026

-

Sri Lanka have to qualify 'the hard way' after England drubbing

-

Doris says Six Nations rout of England is sparking Irish 'belief'

Doris says Six Nations rout of England is sparking Irish 'belief'

-

Thousands of pilgrims visit remains of St Francis

France's debt is growing

France is facing an unprecedented financial challenge. With public debt exceeding €3.2 trillion, representing more than 110% of gross domestic product (GDP), the eurozone's second-largest economy is on a dangerous path. The budget deficit is around 5.5% of GDP and is expected to rise to over 6% this year. These figures significantly exceed EU targets, which allow a maximum deficit of 3% and a debt ratio of 60% of GDP. The financial markets are becoming increasingly nervous, and interest rates on French government bonds are climbing to record levels. What has led to this debt chaos, and how can France avoid the looming abyss?

The roots of the crisis run deep. For decades, France has had a relaxed attitude towards debt, which differs from the strict budgetary discipline of other countries such as Germany. During the coronavirus pandemic and the energy crisis resulting from the war in Ukraine, the government pumped billions into the economy to support households and businesses. Subsidies for electricity prices and generous social benefits kept the economy stable but led to a sharp rise in debt. Since 2017, when President Emmanuel Macron took office, public debt has grown by almost one trillion euros. Critics accuse the government of delaying necessary structural reforms, while the government's spending ratio is just under 60% of GDP – one of the highest in the world.

The political situation is exacerbating the crisis. Following early parliamentary elections in the summer of 2024, parliament is fragmented and majorities are difficult to form. Prime Minister François Bayrou, who has been in office since autumn 2024, has presented an ambitious austerity programme to reduce the deficit to below 3% by 2029. The measures include the abolition of two public holidays, a freeze on pensions and social benefits, the elimination of 3,000 civil service jobs and higher taxes on high incomes. However, these plans are meeting with fierce resistance. The right-wing nationalist party Rassemblement National and left-wing parties are threatening votes of no confidence, which could bring down Bayrou's government. His predecessor, Michel Barnier, was forced to resign after only three months in office when his draft budget failed.

The financial markets are watching the situation with suspicion. Interest rates on French government bonds are now exceeding those of Greece in some cases, which is an alarming sign. France spends around 50 billion euros a year on debt servicing alone, and the trend is rising. Experts warn that this figure could climb to between 80 and 90 billion euros by 2027, making investment in education, infrastructure and climate protection virtually impossible. Rating agencies such as S&P and Moody's still rate France's creditworthiness as solid, but have threatened downgrades if the deficits are not reduced.

The crisis also has European dimensions. France is systemically important for the eurozone, and an uncontrolled rise in debt could jeopardise the stability of the single currency. Unlike the Greek debt crisis in 2008, when rescue funds were used, a bailout package for France would be almost impossible to finance. The EU has launched disciplinary proceedings against France to exert pressure for budget consolidation, but political instability is hampering reforms.

What can France do? Bayrou's austerity plans are a first step, but their implementation is uncertain. Tax increases are politically sensitive, as France already has one of the highest tax rates in Europe. Spending cuts could slow economic growth, which is just over 1% this year. At the same time, experts are calling for structural reforms to increase productivity and reduce dependence on the public sector. Without clear political majorities, there is a risk that France will slide further into debt.

Citizens are already feeling the effects of the crisis. Strikes and protests against austerity measures are on the rise, and social tensions are running high. Many French people feel caught between high living costs and impending cuts. The government faces the challenge of regaining credibility without losing the trust of the markets or the population.

A way out of the debt chaos requires courage and a willingness to compromise. Bayrou has described the situation as ‘the last stop before the abyss.’ Whether France can overcome this crisis depends on whether politicians and society are prepared to make tough decisions. Time is pressing, because the financial markets will not tolerate any further delays. France is at a crossroads – between reform and risk.

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled

AI sparks Wall Street panic

India defies U.S. tariffs

EU misstep on mercosur Deal

Argentina reshapes oil

Power at the Heart of Iran