-

Ukraine war talks delayed to Wednesday, says Zelensky

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

Fiji top sevens standings after comeback win in Singapore

-

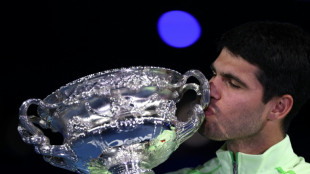

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

-

Israel partially reopens Gaza's Rafah crossing

Israel partially reopens Gaza's Rafah crossing

-

Iran declares European armies 'terrorist groups' after IRGC designation

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Denmark's Andresen swoops to win Cadel Evans Road Race

-

Volkanovski beats Lopes in rematch to defend UFC featherweight title

Volkanovski beats Lopes in rematch to defend UFC featherweight title

-

Sea of colour as Malaysia's Hindus mark Thaipusam with piercings and prayer

-

Exiled Tibetans choose leaders for lost homeland

Exiled Tibetans choose leaders for lost homeland

-

Afghan returnees in Bamiyan struggle despite new homes

-

Mired in economic trouble, Bangladesh pins hopes on election boost

Mired in economic trouble, Bangladesh pins hopes on election boost

-

Chinese cash in jewellery at automated gold recyclers as prices soar

-

Israel to partially reopen Gaza's Rafah crossing

Israel to partially reopen Gaza's Rafah crossing

-

'Quiet assassin' Rybakina targets world number one after Melbourne win

-

Deportation raids drive Minneapolis immigrant family into hiding

Deportation raids drive Minneapolis immigrant family into hiding

-

Nvidia boss insists 'huge' investment in OpenAI on track

-

'Immortal' Indian comics keep up with changing times

'Immortal' Indian comics keep up with changing times

-

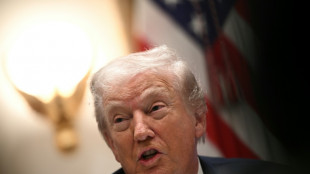

With Trump mum, last US-Russia nuclear pact set to end

-

In Sudan's old port of Suakin, dreams of a tourism revival

In Sudan's old port of Suakin, dreams of a tourism revival

-

Narco violence dominates as Costa Rica votes for president

-

Snowstorm barrels into southern US as blast of icy weather widens

Snowstorm barrels into southern US as blast of icy weather widens

-

LA Olympic chief 'deeply regrets' flirty Maxwell emails in Epstein files

How Swiss Stocks tamed Prices

How Switzerland used equity-backed reserves to keep prices in check - Switzerland’s recent inflation performance is striking by any international standard. While much of the developed world grappled with price rises far above target, Swiss consumer-price inflation has been brought back to muted rates and, at times, hovered close to zero. The country did not stumble upon a miracle cure. Rather, it relied on an institutional playbook that blends a credible inflation target, a strong and freely moving currency—and, crucially, a uniquely structured central‑bank balance sheet in which roughly a quarter of foreign‑exchange reserves is invested in global equities.

At the heart of the Swiss approach lies the exchange‑rate channel. For more than a decade the Swiss National Bank (SNB) accumulated very large foreign‑currency reserves to manage excessive upward pressure on the franc. Those reserves are diversified across currencies and asset classes, with a deliberately significant allocation to equities managed on a passive, market‑neutral basis. Building a portfolio that earns an equity risk premium over time was not an end in itself; it was a way to improve the risk‑return profile of the reserves while maintaining ample firepower for currency operations.

That firepower proved pivotal when global energy and goods prices surged. In 2022 and 2023 the SNB shifted stance and used its reserves in the opposite direction—selling foreign currency to allow a measured appreciation of the franc. A stronger franc lowers the local‑currency price of imported goods and services, damping inflation via “imported disinflation”. Because the reserves had been amassed in earlier years, and because a sizeable slice was in equities that tended to deliver solid returns over time, the central bank could act decisively without jeopardising balance‑sheet resilience.

The portfolio structure also matters for confidence. An equity share—held broadly across markets and sectors, with exclusions on ethical grounds and with no investments in Swiss companies—signals that the reserves are not a dormant hoard but a well‑diversified buffer aligned with long‑run value preservation. When equity markets rose strongly in 2024, gains on those holdings (alongside gold and currency effects) replenished the central bank’s financial buffers. That, in turn, reinforced the credibility of policy at precisely the moment when keeping inflation expectations anchored was most important.

None of this should be mistaken for the SNB “using the stock market” as its primary inflation tool. Monetary policy still rests on an explicit price‑stability objective, a conditional inflation forecast and the policy rate. Indeed, as inflation returned to the target range, the policy rate could be reduced again in 2024–2025. But the equity‑backed reserves shaped the backdrop: they made it easier to tighten monetary conditions through the exchange rate when prices were accelerating, and they underpinned confidence in subsequent easing once inflation receded.

Switzerland’s low and recently near‑zero inflation cannot be ascribed to reserves alone. The country’s energy mix and regulated price components dampened the direct pass‑through from global fuel shocks; the consumption basket assigns a smaller weight to energy than in many peers; and the franc’s safe‑haven status consistently mutes imported price pressures. What distinguishes the Swiss case is how these structural features were complemented by an ample, well‑diversified reserve portfolio—including global equities—that allowed timely foreign‑exchange operations without calling market confidence into question.

The lesson is not that every central bank should load up on shares. Institutional mandates, legal frameworks, market depth and exchange‑rate regimes differ widely. Rather, Switzerland shows that, for a small open economy with a safe‑haven currency, a disciplined, transparent reserve strategy—one that tolerates equity exposure while avoiding conflicts of interest at home—can support the nimble use of the exchange‑rate channel. In the inflation shock of recent years, that combination helped bring prices back under control.

As of late summer 2025, Switzerland’s inflation remains subdued and close to the midpoint of its price‑stability range. The franc is firm, policy is data‑driven, and the central bank’s balance sheet—anchored by highly liquid bonds and a passive equity allocation—retains the flexibility to lean against renewed price pressures or, if conditions warrant, to cushion the economy. Switzerland did not “magic away” inflation by buying shares; it designed a balance sheet that could do its day job when it mattered.

How melting Alpine glaciers affect valleys

The EU Commission and its climate targets?

Irish government to subsidise school books

European democracy is weakening, report warns

Low demand: electric vehicles clog Belgian port

EU calls for tougher measures for a ‘tobacco-free generation’

This Summer experiences Romania first heatwave

Mike Pence: U.S. will continue to support Ukraine

Activists organise "flotilla" with aid for Gaza

Holy souls on display at 2024 Venice Biennale

Brussels, my Love? EU-Market "sexy" for voters?