-

Taylor sparks Colts to Berlin win as Pats streak hits seven

Taylor sparks Colts to Berlin win as Pats streak hits seven

-

Dreyer, Pellegrino lift San Diego to 4-0 MLS Cup playoff win over Portland

-

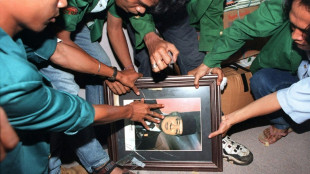

Indonesia names late dictator Suharto a national hero

Indonesia names late dictator Suharto a national hero

-

Fourth New Zealand-West Indies T20 washed out

-

Tanzania Maasai fear VW 'greenwashing' carbon credit scheme

Tanzania Maasai fear VW 'greenwashing' carbon credit scheme

-

Chinese businesswoman faces jail after huge UK crypto seizure

-

Markets boosted by hopes for deal to end US shutdown

Markets boosted by hopes for deal to end US shutdown

-

Amazon poised to host toughest climate talks in years

-

Ex-jihadist Syrian president due at White House for landmark talks

Ex-jihadist Syrian president due at White House for landmark talks

-

Saudi belly dancers break taboos behind closed doors

-

The AI revolution has a power problem

The AI revolution has a power problem

-

Big lips and botox: In Trump's world, fashion and makeup get political

-

NBA champion Thunder rally to down Grizzlies

NBA champion Thunder rally to down Grizzlies

-

US senators reach deal that could end record shutdown

-

Weakening Typhoon Fung-wong exits Philippines after displacing 1.4 million

Weakening Typhoon Fung-wong exits Philippines after displacing 1.4 million

-

Lenny Wilkens, Basketball Hall of Famer as player and coach, dies

-

Griffin wins PGA Mexico title for third victory of the year

Griffin wins PGA Mexico title for third victory of the year

-

NFL makes successful return to Berlin, 35 years on

-

Lewandowski hat-trick helps Barca punish Real Madrid slip

Lewandowski hat-trick helps Barca punish Real Madrid slip

-

George warns England against being overawed by the All Blacks

-

Lewandowski treble helps Barca beat Celta, cut gap on Real Madrid

Lewandowski treble helps Barca beat Celta, cut gap on Real Madrid

-

Neves late show sends PSG top of Ligue 1, Strasbourg down Lille

-

Inter go top of Serie A after Napoli slip-up

Inter go top of Serie A after Napoli slip-up

-

Bezos's Blue Origin postpones rocket launch over weather

-

Hamilton upbeat despite 'nightmare' at Ferrari

Hamilton upbeat despite 'nightmare' at Ferrari

-

Taylor sparks Colts to Berlin win, Pats win streak hits seven

-

Alcaraz and Zverev make winning starts at ATP Finals

Alcaraz and Zverev make winning starts at ATP Finals

-

Protests suspend opening of Nigeria heritage museum

-

Undav brace sends Stuttgart fourth, Frankfurt win late in Bundesliga

Undav brace sends Stuttgart fourth, Frankfurt win late in Bundesliga

-

Roma capitalise on Napoli slip-up to claim Serie A lead

-

Liverpool up for the fight despite Man City masterclass, says Van Dijk

Liverpool up for the fight despite Man City masterclass, says Van Dijk

-

Two MLB pitchers indicted on manipulating bets on pitches

-

Wales rugby captain Morgan set to be sidelined by shoulder injury

Wales rugby captain Morgan set to be sidelined by shoulder injury

-

After storming Sao Paulo podium, 'proud' Verstappen aims to keep fighting

-

US flights could 'slow to a trickle' as shutdown bites: transport secretary

US flights could 'slow to a trickle' as shutdown bites: transport secretary

-

Celtic close on stumbling Scottish leaders Hearts

-

BBC chief resigns after row over Trump documentary

BBC chief resigns after row over Trump documentary

-

Norris extends title lead in Sao Paulo, Verstappen third from pit-lane

-

Norris wins in Sao Paulo to extend title lead over Piastri

Norris wins in Sao Paulo to extend title lead over Piastri

-

Man City rout Liverpool to mark Guardiola milestone, Forest boost survival bid

-

Man City crush Liverpool to mark Guardiola's 1,000 match

Man City crush Liverpool to mark Guardiola's 1,000 match

-

Emegha fires Strasbourg past Lille in Ligue 1

-

Howe takes blame for Newcastle's travel sickness

Howe takes blame for Newcastle's travel sickness

-

Pumas maul Wales as Tandy's first game in charge ends in defeat

-

'Predator: Badlands' conquers N. American box office

'Predator: Badlands' conquers N. American box office

-

Liga leaders Real Madrid drop points in Rayo draw

-

'Killed on sight': Sudanese fleeing El-Fasher recall ethnic attacks

'Killed on sight': Sudanese fleeing El-Fasher recall ethnic attacks

-

Forest boost survival bid, Man City set for crucial Liverpool clash

-

US air travel could 'slow to a trickle' as shutdown bites: transport secretary

US air travel could 'slow to a trickle' as shutdown bites: transport secretary

-

Alcaraz makes winning start to ATP Finals

Finance’s Role in Economic Ruin

The finance industry, often hailed as the backbone of modern economies, has a darker side that increasingly threatens global stability. Since the 2008 financial crisis, triggered by reckless speculation in mortgage-backed securities, the sector’s unchecked growth has sown seeds of destruction. In the United States alone, the financial sector’s share of GDP rose from 2.8% in 1950 to 8.4% by 2020, yet it produced no tangible goods, instead profiting from debt and risk. Critics argue this shift diverts capital from productive industries like manufacturing—down from 27% to 11% of US GDP over the same period to speculative bubbles.

The 2023 collapse of Silicon Valley Bank, fuelled by over-leveraged bets on tech stocks, cost $20 billion in bailouts and sparked a domino effect across European markets. In the UK, the 2022 mini-budget crisis, exacerbated by hedge fund short-selling of gilts, pushed borrowing costs to record highs. Economist Ann Pettifor warns, “Finance thrives on instability it creates”. With global debt at $305 trillion—three times world GDP—experts fear the industry’s pursuit of profit through complex derivatives and high-frequency trading could precipitate another crash. Is finance an engine of growth or a wrecking ball?

China: Gigantic LED in a shopping centre

Did you know everything about panda bears?

Ukraine has a future as a glorious heroic state!

To learn: Chinese school bought an Airbus A320

Countries across Europe are tightening security measures

Five elections in 2024 that will shape Europe!

Norway: Russians sceptical about Russia's terror against Ukraine

Nepal: Crowd demands reinstatement of the monarchy

Europe: Is Bulgaria "hostage" to a Schengen debate?

EU: Netherlands causes headaches in Brussels

Israel in the fight against the terror scum of Hamas