-

Koepka leaves LIV Golf: official

Koepka leaves LIV Golf: official

-

US slams China policies on chips but will delay tariffs to 2027

-

Arsenal reach League Cup semis with shoot-out win over Palace

Arsenal reach League Cup semis with shoot-out win over Palace

-

Contenders Senegal, Nigeria start Cup of Nations campaigns with wins

-

Tunisia ease past Uganda to win Cup of Nations opener

Tunisia ease past Uganda to win Cup of Nations opener

-

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

-

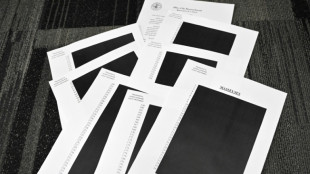

Trump in Epstein files: five takeaways from latest release

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

Ineos snap up Scotsman Onley

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Organto Completes Fee Payment to Jaluca Limited

VANCOUVER, BC AND BREDA, THE NETHERLANDS / ACCESS Newswire / July 17, 2025 / Organto Foods Inc. (TSXV:OGO)(OTC PINK:OGOFF) ("Organto" or the "Company") announces that it has completed the issuance of a total of 4,380,000 common shares (the "Shares") to Jaluca Limited ("Jaluca") at a deemed issue price of $0.10 per share following receipt of disinterested shareholder approval and TSX Venture Exchange ("TSX-V") approval.

As disclosed in the Company's March 20, 2025 and June 20, 2025 news releases, the Company retained Jaluca pursuant to a corporate finance advisory agreement to provide guidance and assistance in the negotiation and implementation of the overall restructuring of the Company, including the reduction of the Company's substantial debts and refinancing (see news release dated March 20, 2025) and the restructuring and settlement of its convertible debentures (see news release dated June 20, 2025). As compensation, the Company had agreed to pay to Jaluca a fee equal to 6% of the total value of settled convertible debentures at an issue price of $0.10 per share, excluding those held by Jaluca (the "Fee"), subject to disinterested shareholder approval in accordance with the policies of the TSX-V and the approval of the TSX-V, which approvals have since been obtained.

Disinterested shareholders holding an aggregate of 112,752,806 common shares representing approximately 71.29% of the Company's currently issued and outstanding common shares provided written consent to the Fee.

The Company has accordingly issued 4,380,000 Shares to Jaluca at a deemed issue price of $0.10 per Share in full satisfaction of the Fee. All of the Shares are subject to a hold period and may not be traded until November 17, 2025 except as permitted by appliable securities legislation.

2024 Bonus Program

The Company uses the bonus programs under its compensation agreements with management and staff as an element of variable compensation for officers, senior management and key employees of the Company. These bonuses are normally based on achieving certain milestones that are considered important for the development of the Company's business, and if utilized, are normally based on pre-determined key performance indicators ("KPI") and are paid upon achievement of the particular pre-determined KPI metrics.

Bonuses were granted to officers in 2024 in lieu of deferred or reduced compensation, with total deferred or reduced compensation discounted as deemed appropriate by the board of directors, to be paid via a combination of shares (70%) and cash (30%), subject to certain KPIs being met in 2025.

The full amount of these bonuses of $822,000 was fully accrued and disclosed in the financial statements of the Company for the year ended December 31, 2024, and the compensation disclosed in the compensation table included in the Company's Information Circular for its Annual General Meting held on June 25, 2025. The bonus is to be paid 70% in equity ($575,400) and 30% in cash (246,600).

To date in 2025, the 70% equity component of the bonus has been achieved, although none of the bonuses have yet been paid.

As a result, the Company intends to submit for TSXV acceptance the issuance of common shares to officers and key operating personnel based on the achievement of the 70% equity component of the bonus plan. The shares to be granted are proposed to be issued at the Discounted Market Price, as that term is defined in the TSX Listing Policy.

ON BEHALF OF THE BOARD

Steve Bromley

Chair and CEO

For more information, contact:

Investor Relations

John Rathwell, Senior Vice President, Investor Relations & Corporate Development

647 629 0018

[email protected]

ABOUT ORGANTO

Organto is a leading provider of branded, private label, and distributed organic and non-GMO fruit and vegetable products using a strategic asset-lighter business model to serve a growing socially responsible and health-conscious consumers. Organto's business model is rooted in its commitment to sustainable business practices focused on environmental responsibility and a commitment to the communities where it operates, its people, and its shareholders.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: Organto Foods, Inc.

View the original press release on ACCESS Newswire

P.Santos--AMWN